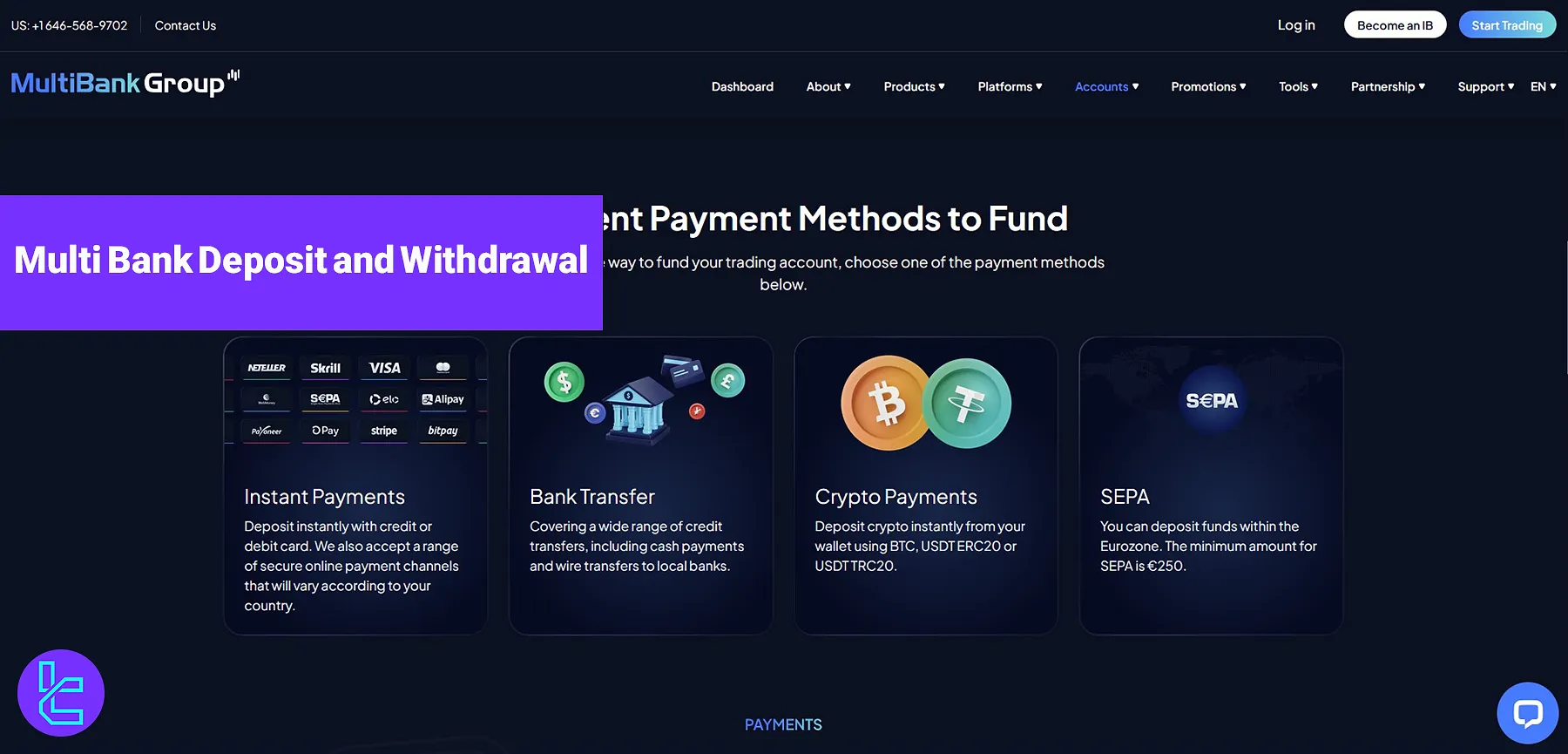

Multi Bank Deposit and Withdrawal include debit/credit cards, bank wire transfers, or cryptocurrencies. The broker ensures instant and fee-free transactions.

Traders can fund their accounts using VISA, Mastercard, SWIFT, Neteller, Skrill, and more.

List of Deposit and Withdrawal Methods in Multi Bank

A wide range of deposit and withdrawal methods are available in Multi Bank Broker; Multi Bank Payment Options:

- Debit/Credit Cards

- Bank Transfers

- E-Wallets

- Local Payment Methods

- Cryptocurrency

Multi Bank Deposit Methods

Multi Bank supports multiple deposit methods to ensure fast and secure funding; Multi Bank Available Funding Options:

- Credit/Debit Cards: VISA, Mastercard

- Bank Transfers: SWIFT, Bank Wire Transfers

- E-Wallets: Skrill, Neteller, Pagsmile, PayTrust88, Pay Retailers, Korapay, PaymentAsia

- Local Payment Solutions: Thai QR Payment, My Fatoorah, Plus Wallets, PIX, SPEI, Boleto

- Mobile Payment Systems: GCash, Dragonpay, Globepay

- Cryptocurrency: Bitcoin, Ethereum, USDT

Multi Bank Deposit Methods Fees

Multi Bank does not charge any fees for deposits. However, third-party payment providers or banks may apply transaction fees.

Multi Bank Deposit Methods Processing Time

Funding processing times depend on the payment method selected; Multi Bank Deposit Time:

- Credit/Debit Cards (VISA, Mastercard): Instant

- Bank Transfers (SWIFT, Wire Transfers): 1–3 business days

- E-Wallets (Skrill, Neteller, etc.): Instant

- Cryptocurrency: Instant (depending on blockchain confirmation time)

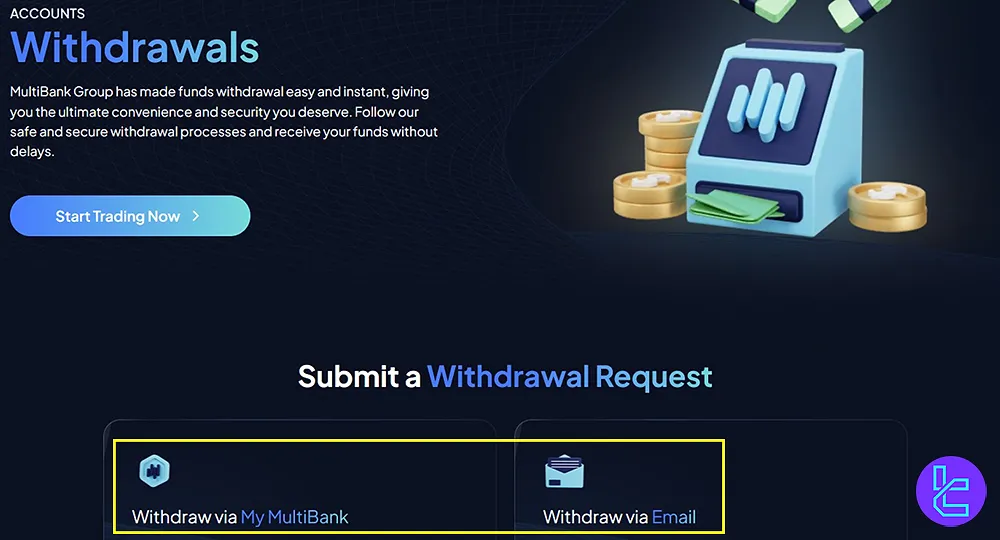

Multi Bank Withdrawal Methods

For withdrawals, Multi Bank follows a return-to-source policy, meaning funds must be withdrawn using the same method used for deposits.

This ensures transaction security and regulatory compliance while maintaining smooth fund withdrawals.

Multi Bank Withdrawal Methods Fees

Multi Bank does not charge any fees for withdrawals. However, external banking institutions or payment providers may impose transaction charges:

- Credit/Debit Cards: No withdrawal fees

- Bank Transfers: No withdrawal fees (bank charges may apply)

- E-Wallets: No withdrawal fees

- Crypto Withdrawals: No withdrawal fees (network fees may apply)

Multi Bank Withdrawal Methods Processing Time

Withdrawal processing depends on the payment method; Multi Bank Payouts Time:

- Credit/Debit Cards: 2–5 business days

- Bank Transfers: 3–7 business days

- E-Wallets: 1–2 business days

- Cryptocurrency: Within 24 hours (depending on blockchain network speed)

Multi Bank processes withdrawal requests within 24 working hours, but the final receipt time depends on the third-party provider handling the transaction.

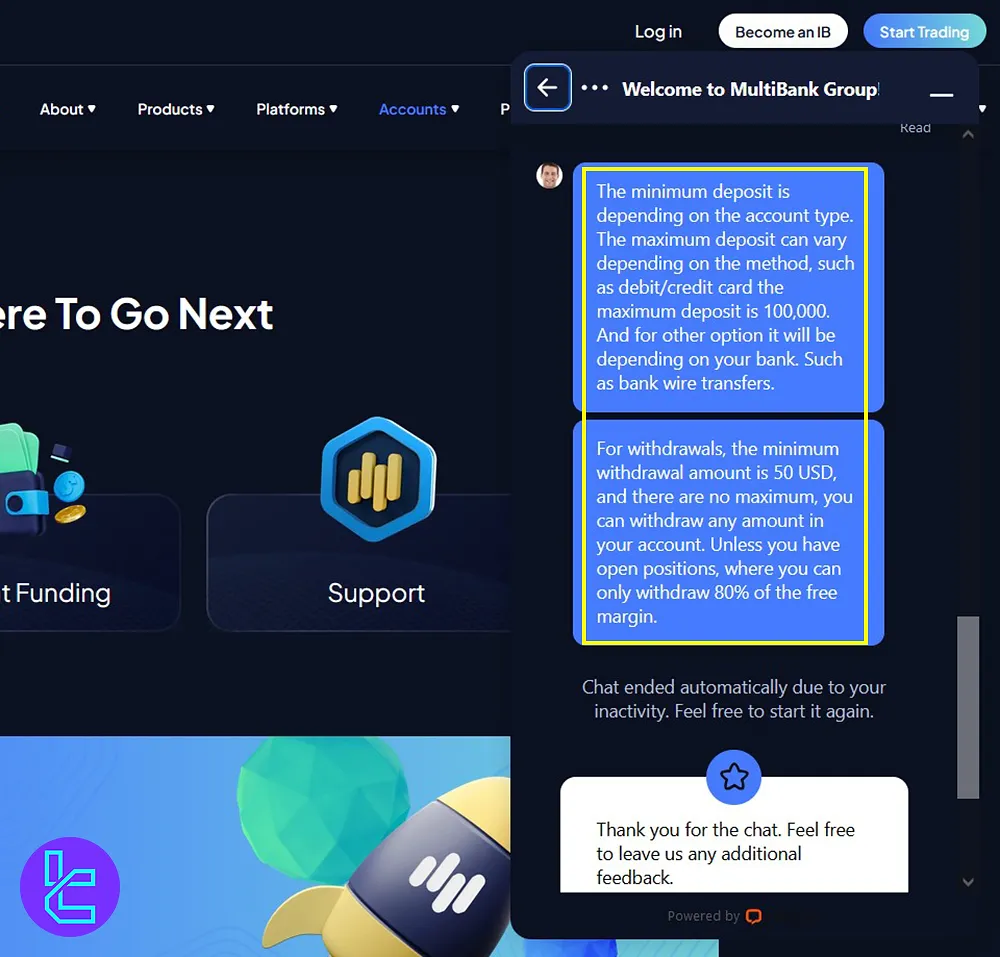

Multi Bank Payment Limits

Deposit and withdrawal limits vary based on the payment method used; Multi Bank Transaction Limits:

Payment Method | Minimum Deposit | Maximum Deposit | Minimum Withdrawal | Maximum Withdrawal |

Credit/Debit Cards | Depends on the account type | $100,000 | $50 | No limit |

Bank Transfers | Depends on bank | Varies | $50 | No limit |

E-Wallets | $10 | Varies | $50 | No limit |

Cryptocurrency | Depends on blockchain fees | Varies | $50 | No limit |

For withdrawals, traders can withdraw up to 80% of the free margin if they have open positions.

Writer’s Opinion and Conclusion

Multi Bank Deposit and Withdrawal with zero fees make it highly attractive for traders. With instant deposits via cards, e-wallets, and crypto, users can fund their accounts quickly, while withdrawal processing takes 24 hours.

For withdrawals, a return-to-source policy ensures that funds return to the original payment method. To learn more about the platform, check out Multi Bank Tutorials page.