MultiBank is known for features such as maximum leverage of 1:500, zero commission, and minimum deposits starting at $50.

Using platforms such as MetaTrader 4, MetaTrader 5, and its proprietary MultiBank-Plus, traders benefit from a streamlined, high-tech trading experience.

Restricted countries for services include North Korea, Ukraine, the UK, the USA, Iran, Russia, and Myanmar, highlighting its focus on compliant jurisdictions.

Company Information & Regulation Status

Established in 2005, MultiBank Group has rapidly ascended the ranks to become a formidable player in the global financial services industry.

With its headquarters nestled recently in the bustling financial hub of Dubai, the Forex broker has strategically expanded its operations across multiple continents, boasting offices in Australia, Germany, Austria, Germany, Cyprus, and the United Arab Emirates.

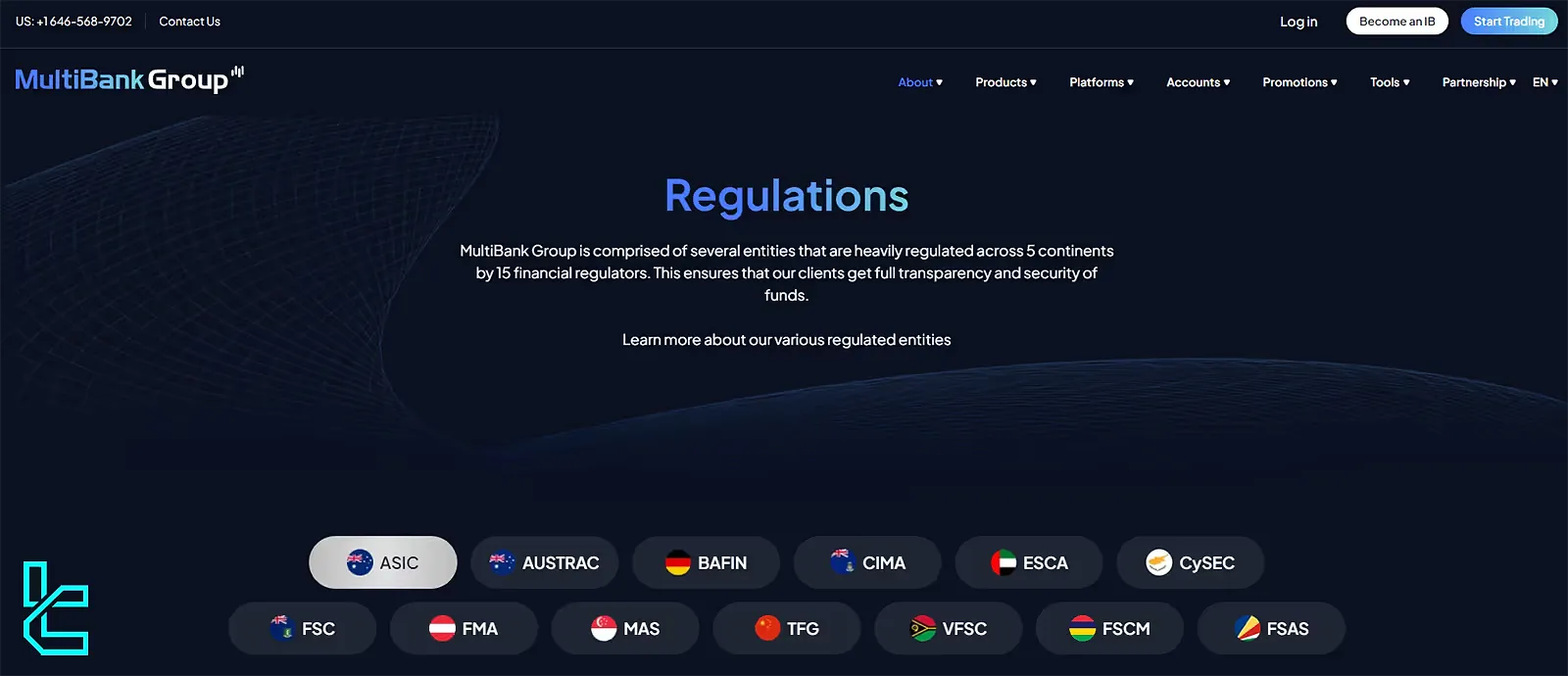

MultiBank's unwavering commitment to regulatory compliance and financial security sets it apart. The broker operates under the watchful eyes of several top-tier financial authorities, including:

- Australian Securities and Investments Commission (ASIC): Mex Australia Pty Ltd – License No. 416279

- Cyprus Securities and Exchange Commission (CySEC): MEX Europe Ltd – License No. 430/23

- UAE Securities and Commodities Authority (SCA): MEX GLOBAL FINANCIAL SERVICES – License No. 20200000045

- Monetary Authority of Singapore (MAS): MEX GLOBAL MARKETS PTE. LTD – License No. CMS101174

- Securities and Commodities Authority of the UAE (ESCA)

- German Federal Financial Supervisory Authority (BaFin)

- Tianjin Financial Government (TFG)

- Financial Markets Authority (FMA)

- Financial Services Commission of the British Virgin Islands (FSC)

- Cayman Islands Monetary Authority (CIMA)

- AUSTRAC

- FSAS

- FSCM

This multi-jurisdictional regulatory framework underscores MultiBank's dedication to transparency and client protection and provides traders with peace of mind when dealing with a globally recognized and regulated entity.

Client protection mechanisms include segregated accounts, negative balance protection, and a substantial $1 million excess loss insurance per user.

Funds are securely held with Tier 1 global banks, and the firm is rated “B” by Standard & Poor’s, signaling a strong capital structure and regulatory adherence.

MultiBank Broker Summary of Specifics

MultiBank isn't just another run-of-the-mill broker; it's a comprehensive financial ecosystem designed to cater to traders of all stripes.

From forex enthusiasts to commodity traders, MultiBank offers a smorgasbord of financial instruments to make even the most discerning trader's head spin.

But don't take our word for it – let's break it down in a neat little table that'll give you the lowdown on what MultiBank brings to the table:

Broker | MultiBank |

Account Types | Standard, Pro, ECN |

Regulating Authorities | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BAFIN, AUSTRAC, ASIC |

Base Currencies | AUD, NZD, CAD, USD, GBP, EUR, CHF |

Minimum Deposit | $50 |

Deposit Methods | credit or debit card, Bank Transfer, Crypto, SEPA |

Withdrawal Methods | bank wire, credit cards, Neteller |

Minimum Order | N/A |

Maximum Leverage | 1:500 |

Investment Options | N/A |

Trading Platforms & Apps | MultiBank-Plus, MT4 Platform, MT5 Platform, Web Trader MT4 |

Markets | Spot, Futures |

Spread | From 0.0 |

Commission | Zero |

Orders Execution | Market, Pending |

Margin Call/Stop Out | 50% |

Trading Features | ECN account, Copy Trading |

Affiliate Program | YES |

Bonus & Promotions | 20% Deposit Bonus, Win an iPhone (Trade 15 lots) |

Islamic Account | YES |

PAMM Account | YES |

Customer Support Ways | Live Chat, WhatsApp, Call back form, Call |

Customer Support Hours | 24/7 |

As you can see, MultiBank doesn't skimp on the goods. With a diverse range of tradable assets, competitive spreads, and leverage, MultiBank has become a go-to choice for traders worldwide.

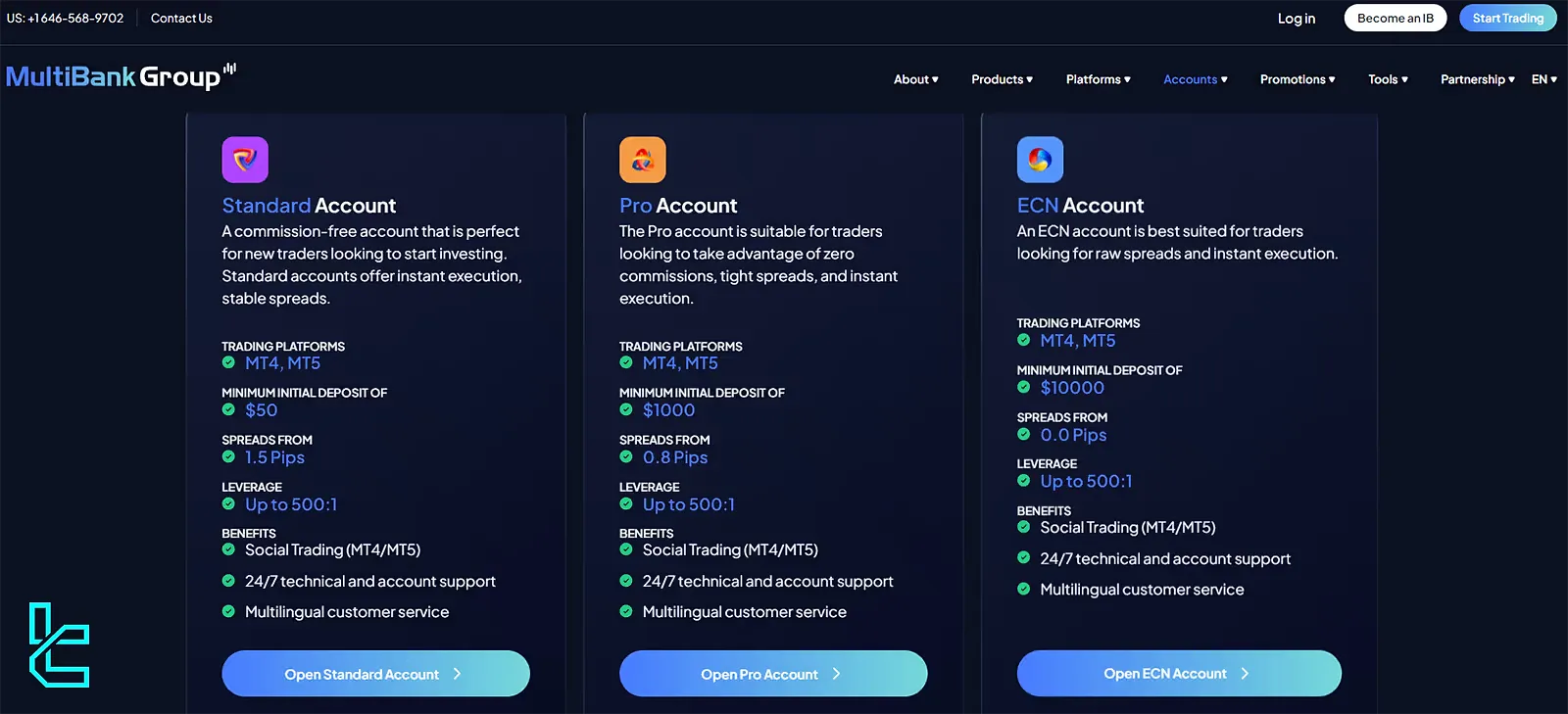

MultiBank Forex Broker Account Types

Regarding account types, MultiBank doesn't believe in a one-size-fits-all approach. Instead, they've crafted a suite of account options to cater to traders of all experience levels and trading strategies. Let's break down the main account types on offer:

- Standard Account: The entry-level option, perfect for beginners or those looking to test the waters. It offers wider spreads with leverage up to 1:500

- Pro Account: Designed for more experienced traders, this account type provides tighter spreads (from 0.08 pips), the same leverage (up to 1:500), and a social trading option

- ECN Account: For the pros who demand lightning-fast execution and spreads from 0.0 pips, featuring Social Trading and multilingual customer support

MultiBank Account Comparison

Features | Standard | Pro | ECN |

Min Deposit | $50 | $1,000 | $10,000 |

Spreads from (Pips) | 1.5 | 0.8 | 0.0 |

Max Leverage | 1:500 | 1:500 | 1:500 |

Commission | $0 | $0 | $0 |

Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 |

Each account type has its perks and features, allowing traders to choose the one that best aligns with their trading goals and risk appetite.

Islamic (swap-free) accounts are available for Standard and Pro users in eligible regions. MultiBank also supports demo accounts.

MultiBank Forex Broker Advantages and Disadvantages

Like any broker, MultiBank comes with its strengths and weaknesses. Let's take an honest look at what makes the company shine and where it might fall short:

Advantages | Disadvantages |

Robust regulatory framework | Limited educational resources |

Wide range of tradable instruments | No proprietary trading platform |

Competitive spreads and leverage | Lack of trading signals |

Multiple trading platforms | The high minimum deposit for some account types |

24/7 customer support | - |

While MultiBank excels in providing a secure and diverse trading environment, it may not be the ideal choice for absolute beginners or those seeking extensive educational resources.

However, for traders who prioritize regulatory compliance, competitive trading conditions, and a wide range of instruments, MultiBank stands out as a solid choice.

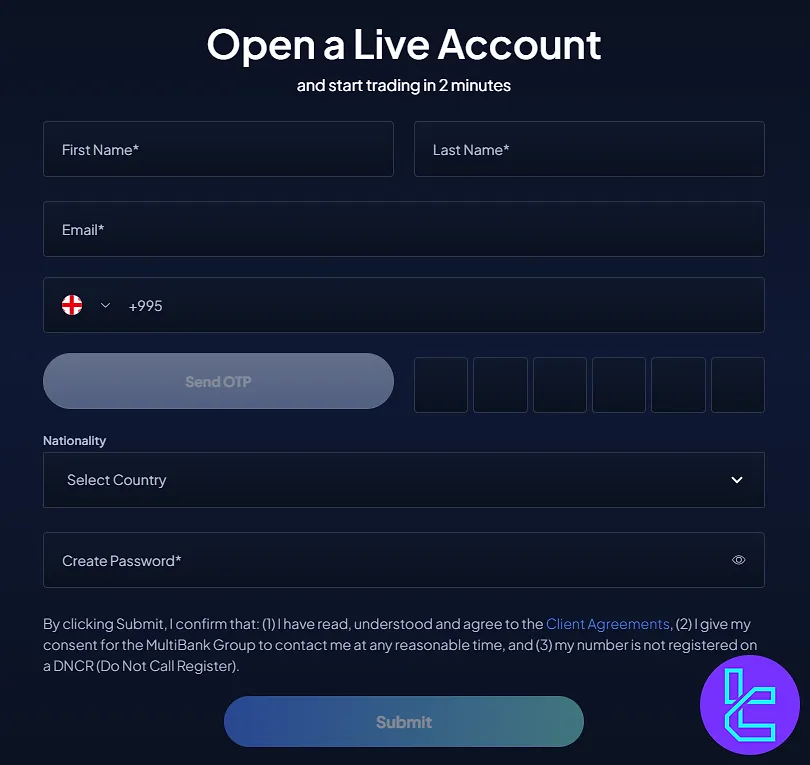

MultiBank Broker Signing Up & Verification: Complete Guide

MultiBank registration is a quick 2-step process that includes submitting your personal information and verifying your phone via OTP SMS. Users can choose from Standard, Pro, or ECN account types right from the start.

#1 Access the Website and Start Registration

Visit the official Multi Bank website and click on “Start Trading”. Fill out the sign-up form with the following details:

- Full name

- Email address

- Mobile number

Click “Send OTP” to receive your SMS verification code.

#2 Complete Details and Verify OTP

Enter the received OTP code, set a secure password, and select your nationality. Submit the form to finalize registration.

#3 Verify Your Identity

Log in to the MultiBank dashboard, click "Real Account", and proceed to complete your financial profile. You must upload supporting documents to complete the MultiBank verification procedure.

- Proof of Identity: Passport or Driving license

- Proof of Residency: Utility bill or Bank statement

The verification process usually takes 1 business day but may take longer during peak times. To avoid any delays, it's crucial to provide accurate information and clear, legible documents.

MultiBank Forex Broker Trading Platforms

When it comes to trading platforms, MultiBank offers a trifecta of powerful options designed to cater to traders of all skill levels and preferences, including MetaTrader 4, MT5, and a proprietary platform.

MetaTrader 4 (MT4)

The industry standard, MT4, is beloved for its user-friendly interface and powerful charting tools. It offers:

- Advanced charting capabilities

- Expert Advisors (EAs) for automated trading

- Customizable indicators

- One-click trading

MetaTrader 5 (MT5)

The next-generation platform MetaTrader 5 is built on MT4's success with additional features:

- More timeframes and charting tools

- Improved backtesting capabilities

- Access to a broader range of markets

- Economic calendar integration

MultiBank Plus

MultiBank's platform, designed for seamless trading across devices:

- Over 20,000 instruments

- Investment diversification opportunities

- Advanced trading tools and features for optimal trading

- Access to global financial markets

All platforms are available on desktop and mobile devices, ensuring you can trade on the go or from the comfort of your home office. Here are the download links:

The choice of platform often comes down to personal preference and trading style, so it's worth exploring each option to find the one that best suits your needs.

Traders can access tools such as free VPS hosting, economic calendars, and FIX API connectivity. While the MultiBank-Plus platform has a modern interface, some areas could benefit from UX improvements and deeper research tool integration.

MultiBank Forex Broker Spreads and Commissions

MultiBank’s fee structure varies by account type:

- Standard Account: Spreads from 1.5 pips, commission-free

- Pro Account: Spreads from 0.8 pips, also commission-free

- ECN Account: Raw spreads from 0.0 pips, commission-free

Swap-free trading is available on select accounts and regions. There are no internal fees for deposits or withdrawals, although external fees may apply.

Traders should note that a $60 monthly inactivity fee applies after 90 days of inactivity. Also, guaranteed stop-loss orders are not available, which means slippage may occur during fast-moving markets.

It's worth noting that spreads can widen during high market volatility or low liquidity periods. Always check the current trading conditions before placing trades, especially during major economic events or news releases.

MultiBank Broker Deposit & Withdrawal

MultiBank supports a broad range of global deposit and withdrawal methods:

- Deposit Options: Credit/Debit Cards (Visa, Mastercard), Bank Wire, and Cryptocurrency

- Withdrawal Methods: Credit/Debit Cards (Visa, Mastercard), Bank Wire, and E-Wallet (Neteller)

Key Points about MultiBank deposit & withdrawal:

- The minimum deposit varies by account type, starting from $50;

- No fees charged by MultiBank for deposits or withdrawals (third-party fees may apply);

- Withdrawal processing time is typically 1-5 business days, depending on the method;

- Strict AML and KYC policies are in place to ensure security.

To avoid any delays or complications, always ensure that your account is fully verified before attempting to make a withdrawal.

Copy Trading & Investment Options Offered on MultiBank Broker

For traders looking to diversify their strategies or those new to the game, MultiBank offers some interesting copy trading and investment options:

- MAM/PAMM Accounts: Allows professional money managers to manage investors' funds;

- Social Trading: Connect with and copy trades from successful traders within the MultiBank community;

- Automated Trading: This feature supports the use of Expert Advisors (EAs) for algorithmic trading on the MT4 and MT5 platforms.

These options provide flexibility for traders who want to leverage the expertise of others or automate their trading strategies.

However, always remember that past performance doesn't guarantee future results, and it's crucial to understand the risks involved in copy trading and managed accounts.

MultiBank Forex Broker Tradable Markets & Symbols Overview

Like many forex brokers, MultiBank offers a vast array of over 20,000 tradable instruments across six asset classes, ranging from the Forex market to Share CFDs.

- Forex: 55+ currency pairs, including majors, minors, and exotics

- Metals: Gold, Silver, Platinum, and Palladium

- Energies: Oil and Natural Gas

- Indices: Major global stock indices

- Shares: Over 20,000 equities from major exchanges

- Cryptocurrencies: CFDs on popular digital assets like BTC and ETH

With over 20,000 tradable symbols, MultiBank provides ample opportunities for diversification and exploring various market sectors.

Always check the specific trading conditions for each instrument, as they may vary in terms of spreads, leverage, and trading hours.

MultiBank Forex Broker Bonuses and Promotions

MultiBank occasionally offers bonuses and promotions to attract new clients and reward existing ones. However, it's important to note that these offers are subject to change and may vary by region due to regulatory restrictions. Some common types of promotions include:

- Deposit Bonus: You can receive up to a 20% bonus on your deposit, with a maximum bonus amount of $40,000;

- Cashback Program: This program rewards you with cashback based on the volume of your trades;

- Referral Bonus: Earn bonuses by referring friends who then open and fund their accounts.

These promotions are designed to help traders enhance their trading experience and benefits.

You can get an accurate estimate of your cashback earnings using TradingFinder's Forex Rebate Calculator.

MultiBank Broker Support team

Quality customer support is crucial in the fast-paced world of trading, and MultiBank strives to provide responsive and helpful assistance [24/7] to its clients. Here's what you can expect:

- Live Chat: Available on the home page of the website

- Email: Use for non-urgent questions or detailed requests

- Phone: Multiple regional numbers for direct support

- Multilingual Support: Assistance available in multiple languages to cater to a global clientele

The quality of customer support can make or break a trading experience, especially during critical moments.

MultiBank Broker List of Restricted Countries

Due to regulatory requirements and internal policies, MultiBank, like many international brokers, cannot offer its services to residents of certain countries. While the exact list may change over time, some typically restricted regions include:

- North Korea

- Ukraine

- UK

- USA

- Iran

- Russia

- Myanmar

It's important to note that this list is not exhaustive and may be subject to change. Always check the most up-to-date information on MultiBank's website or contact customer support for the latest details on country restrictions.

Additionally, even if your country is not on the restricted list, local regulations may impact your services.

MultiBank Broker Trust Scores & Reviews

Trust is paramount in online trading, and MultiBank has worked hard to establish a solid reputation. Let's take a look at how they stack up in terms of trust scores and user reviews:

Reviews.io | 4.1 out of 5 |

4.5 out of 5 |

While these scores paint a generally positive picture, it's important to note that individual experiences may vary. Common praises in user reviews include the broker's wide range of tradable instruments and competitive spreads.

Criticisms sometimes mention withdrawal processing times and the complexity of some account features for beginners.

Education on MultiBank Broker

MultiBank’s educational content is basic and better suited for beginners. Resources include:

- Introductory videos and eBooks

- Platform tutorials (MT4/MT5, MultiBank-Plus)

- Social trading walkthroughs

- Mobile app guidance

The research offering is similarly limited, primarily consisting of Dow Jones headlines within the platforms. MultiBank does not offer webinars, Autochartist, or deep fundamental/technical analysis.

While the foundation exists, significant expansion is needed to compete with research leaders. You can check TradingFinder's Forex education section for additional resources.

MultiBank Comparison Table

Here is a detailed comparison between MultiBank and the top forex brokers:

Parameter | MultiBank Broker | AMarkets Broker | FXTM Broker | Tickmill Broker |

Regulation | FSAS, FSCM, VFS, TFG, MAS, FMA, FSC, CySEC, ESCA, CIMA, BAFIN, AUSTRAC, ASIC | FSA, FSC, Misa, FinaCom | FSC | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Spread | From 0.0 Pips | From 0.0 pips | From 0.0 pips | From 0.0 Pips |

Commission | $0.0 | From $0.0 | Variable | From $0.0 |

Minimum Deposit | $50 | $100 | $200 | $100 |

Maximum Leverage | 1:500 | 1:3000 | 1:3000 | 1:1000 |

Trading Platforms | MultiBank-Plus, MT4, MT5, WebTrader | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Account Types | Standard, Pro, ECN | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | Classic, Raw |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 20,000+ | 550+ | 1000+ | 620+ |

Trade Execution | Market, Instant | Instant, Market | Market, Instant | Market |

Conclusion and final words

About MultiBank, the trust ratings of 4.5/5 on Trustpilot and 4.1/5 on Reviews.io underscore its reputation.

The firm’s offerings, such as copy trading and Islamic accounts, alongside promotions including a 20% deposit bonus (up to $40,000) and incentives like winning an iPhone for trading 15 lots, make it an attractive choice.

Deposits can be made through several methods, including credit/debit cards, bank transfers, cryptocurrency, and SEPA. Withdrawal processing times can be as quick as 1 day up to 5 business days.