Traders should note that the broker's website is not operational, as the latest investigation and the Nextmarkets Google profile indicate a permanent closure.

Nextmarkets, founded by Dominic Hayden and Manuel Hayden, is a German financial company with a minimum deposit of $1 and a maximum leverage of 1:100. The spreads in the trading pairs of this broker are variable, starting from 0.6 pips.

Company Information & Regulation

According to the available data on the company's profile on the Crunchbase website, Nextmarkets is a private corporation founded by Dominic Heyden and Manuel Hayden. Key Points:

- Established Date: 2014

- Legal Name: Nextmarkets AG

- Headquarters: Cologne, Nordrhein-Westfalen, Germany

- Other Offices: Lisbon & Malta

- Regulation: Malta Financial Services Authority (MFSA), C 77603

Nextmarkets is fully licensed and regulated by the Malta Financial Services Authority (MFSA) under license number IS/77603.

This regulation ensures compliance with MiFID II directives, offering a strong layer of investor protection through features like segregated client funds and participation in a recognized investor compensation scheme.

The broker’s regulatory structure aligns with EU standards, making it a trusted option for retail traders seeking secure and transparent financial services within the European Economic Area.

Summary of Features

There are several common parameters among Forex brokers. In this section, we will take a look at these parameters in Nextmarkets:

Broker | Nextmarkets |

Account Types | Standard, Pro |

Regulating Authorities | MFSA |

Based Currencies | EUR, USD, GBP |

Minimum Deposit | $1 |

Deposit Methods | Credit/Debit Cards, Bank Transfers, E-Payments |

Withdrawal Methods | Credit/Debit Cards, Bank Transfers, E-Payments |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:100 |

Investment Options | None |

Trading Platforms & Apps | MetaTrader 4, Proprietary Platform |

Markets | Shares, ETFs, CFDs on Stocks, Indices, Currency Pairs, Commodities, and Bonds |

Spread | From 0.6 Pips |

Commission | Withdrawal Fees |

Orders Execution | Market |

Margin Call/Stop Out | Not Specified |

Trading Features | Funds Held in Segregated Accounts |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | None |

PAMM Account | None |

Customer Support Ways | Email, Phone Call, Ticket |

Customer Support Hours | Monday to Friday, 9 Hours/Day |

Nextmarkets Account Types Specifics

This brokerage is not the best in terms of offering various account types. In fact, it only provides 2 trading accounts:

- Standard: Leverage up to 1:30

- Pro: Leverage up to 1:100 for qualified traders (under certain conditions)

Nextmarkets also provides a demo trading account with a virtual balance of $10,000.

Advantages and Disadvantages

Nextmarkets, similar to other brokers in the industry, comes with some significant pros and cons. We will mention some of them in the table below:

Advantages | Disadvantages |

Commission-Free Trading | Limited Educational Resources Compared To Larger Brokerages |

Regulated By a Reputable Authority (MFSA) | No 24/7 Customer Support |

Wide Range Of Tradable Assets | - |

Nextmarkets Broker Account Opening and Authorization

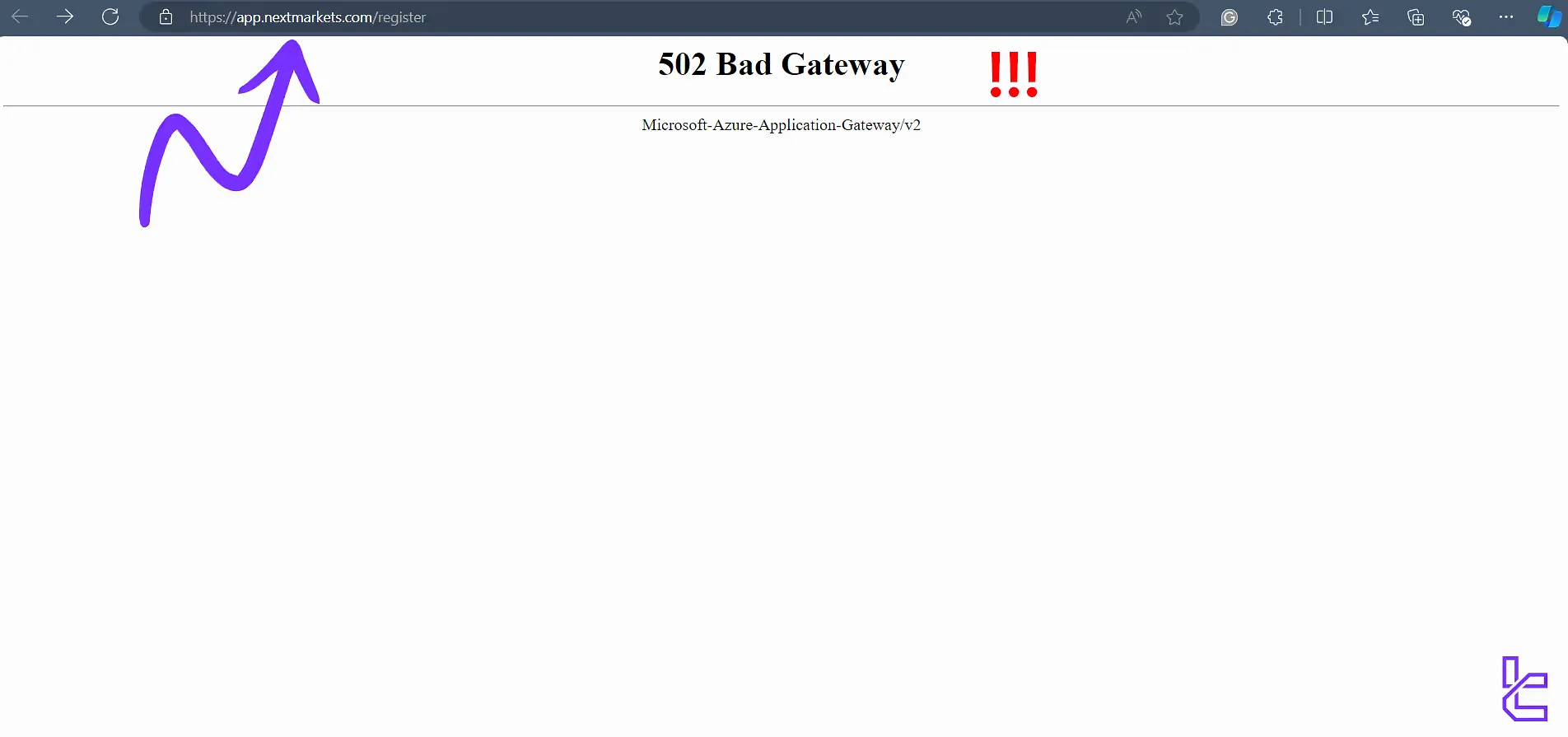

We attempted to create an account by clicking the "Open account now" button on the official website, but the related page didn't open. As you can see in the screenshot below, it prints a "502 Bad Gateway" error:

This issue is a big disappointment for the company, as it prevents new clients from registering.

Available Trading Platforms and Applications

Nextmarkets offers a proprietary trading platform designed to provide a seamless and intuitive trading experience, which is accessible on web and mobile devices. It also employs MetaTrader 4 as a third-party platform. Key Features:

- Real-time market data and quotes

- Access to charting tools and technical indicators

- One-click trading for quick execution

- Risk management tools (stop-loss, take-profit)

You can download the proprietary platform for your smartphones through these links:

If you decide to use the MetaTrader platform, you can check TradingFinder's list of MT4 indicators for additional analytical tools.

What is The Structure for Spreads and Commissions?

Nextmarkets performs average in spreads and fees. Unfortunately, the broker does not offer RAW or ECN accounts, and the spread for both accounts is the same, variable starting from 0.6 pips.

There are no additional commissions on trading with the broker; however, you should consider the withdrawal fees when working with it. Besides that, there are no inactivity or deposit costs.

Nextmarkets Deposit & Withdrawal Methods

The broker provides a limited range of common options for funding your account and withdrawing your profits. Nextmarkets Payment Methods:

- Credit/Debit Cards (Visa, Mastercard): Instant processing

- Bank Transfer (SEPA, IBAN): 1-3 business days processing time

- E-Payments: Trustly, iDeal, Giropay, etc.

Always check the most current information on the website or contact customer support for specific details about deposit and withdrawal processes, as these can change over time.

Copy Trading & Investment Options Offered on Nextmarkets

We examined the website for any information on the investment options for Forex traders and found nothing. As it appears, there are no ways to earn passive income on the FX market with this broker.

Nextmarkets Forex Broker Tradable Markets & Symbols

This company offers a very long list of over 7,000 tradable markets and instruments. It's the most significant benefit of trading with this brokerage. Financial instruments on Nextmarkets:

- Shares: Access to major global stock markets

- ETFs (Exchange-Traded Funds): A wide selection of ETFs covering various sectors and regions

- CFDs on Shares: Trade price movements without owning the underlying asset

- CFDs on Indices: Major global indices available

- CFDs on Currency Pairs: Forex trading with fair spreads

- CFDs on Commodities: Including gold, silver, oil, and more

- CFDs on Bonds: Government and corporate bonds

Are There Any Bonuses and Promotions?

As of our latest review, Nextmarkets does not offer traditional bonuses or promotions. While the absence of bonuses might seem disappointing to some traders, it's important to note that this policy ensures transparency and compliance with regulatory standards.

Always check the official website for the most up-to-date information on any special offers or changes to their promotional policies.

Support Contact Channels and Timing

Nextmarkets provides common channels and methods for contacting customer support. We will discuss these channels in this list:

- Email: support@nextmarkets.com

- Phone Call: +49 221 98259 007

- Ticket System: Access through the website

Unfortunately, there is no live chat option for getting help from the broker's team, which is found in many other companies. Customer support is available Monday to Friday, 9:00 AM to 6:00 PM CET (Central European Time).

NextMarkets List of Restricted Countries

Brokers and financial companies do not provide trading services to all countries and are restricted to some regions because of regulatory issues, sanctions, etc. While Nextmarkets does not offer a public list of banned countries, it mainly includes:

- United States

- Iraq

- Lebanon

- North Korea

- Cuba

- Afghanistan

- Japan

- Turkey

- Other countries sanctioned by international bodies

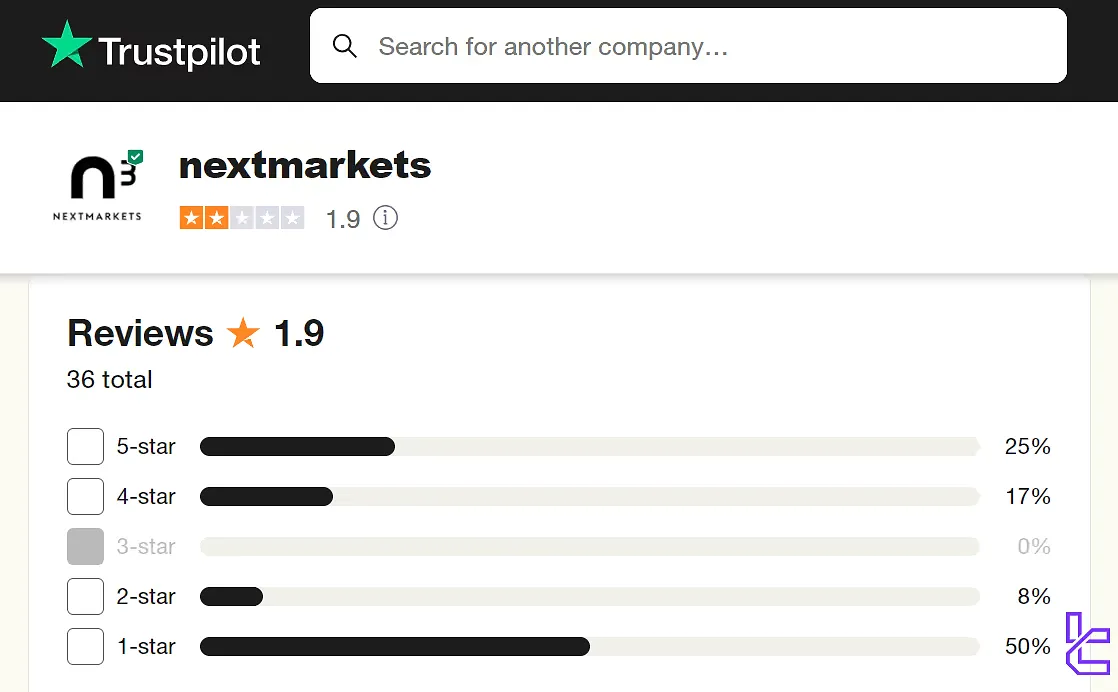

Trust Scores & Ratings

Trust scores and user reviews provide valuable insights into a broker's reliability and service quality. Actually, the only platform on which we found Nextmarkets' rating is the Trustpilot. Let's examine Nextmarkets TrustPilot profile in detail:

- 1.9 out of 5

- Based on +35 reviews

- Half of the ratings are 1-star

Overall, the broker has a low reputation on review websites. However, online reviews can be subjective and may not represent the overall experience of all users.

Education Resources on the Website

Nextmarkets does a poor job of providing educational resources for traders. The only education offered by the broker is found on the YouTube channel, which is not even in English, and has not been updated for a long time.

You can check TradingFinder's Forex education section to access a comprehensive list of tutorials.

Nextmarkets Compared to Other Brokers

Let's check Nextmarkets' standing in the forex trading world in comparison with the top brokerage companies:

Parameter | Nextmarkets Broker | FxGrow Broker | Errante Broker | FBS Broker |

Regulation | MFSA | CySEC, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC | CySEC, FSA | FSC, CySEC |

Minimum Spread | From 0.6 Pips | From 0.00001 pips | From 0.0 pips | From 0.0 Pips |

Commission | $0.0 | $8 | From $0.0 | From $0.0 |

Minimum Deposit | $1 | $100 | $50 | $5 |

Maximum Leverage | 1:100 | 1:300 | 1:1000 | 1:3000 |

Trading Platforms | MetaTrader 4, Proprietary Platform | MetaTrader 5 | Metatrader 4, Metatrader 5, cTrader, Mobile App | MT4, MT5, Mobile App |

Account Types | Standard, Pro | ECN, ECN Plus, ECN VIP, Demo | Standard, Premium, VIP, Tailor Made | Standard |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 7,000+ | 120+ | 150+ | 550+ |

Trade Execution | Market | Market | Market | Market |

Conclusion and final words

Nextmarkets offers 2 account types [Standard, Pro]. The former provides a leverage of up to 1:30, while the latter has a maximum leverage of 1:100. Furthermore, a demo account with $10,000 virtual funds is available.