SuperForex has partnered with some of the best liquidity providers like UBS and Citibank to provide commission-free trading and tight spreads from 0.5 pips through its 9 ECN/STP account types. As a result, the broker was titled the “Best ECN Broker in Africa 2021.”

SuperForex was titled the “Best ECN Broker in Africa 2021” and the “Best Cryptocurrency Broker LATAM 2022”

SuperForex was titled the “Best ECN Broker in Africa 2021” and the “Best Cryptocurrency Broker LATAM 2022”

SuperForex; Company Introduction and Regulation

The company is a globally operating broker that has been in the financial markets since 2013. The International Financial Services Commission (IFSC) oversees the company’s activities. Key features of SuperForex:

- Regulated by the International Financial Services Commission (IFSC)

- Member of the Investor Compensation Fund (ICF)

- Provides services in 150+ countries

- Operates as a No Dealing Desk (NDD) broker

- Works with multiple liquidity providers, such as BNB Paribas, Natixis, Citibank, and UBS

- Various bonus offerings, including no deposit and Energy+

SuperForex operates under regulatory oversight from the International Financial Services Commission (IFSC) of Belize, holding license number IFSC/60/292/TS/17.

While not a top-tier regulator, IFSC registration ensures the broker complies with basic operational and capital requirements. SuperForex also enforces:

- Segregation of client funds from company capital

- Negative balance protection to prevent losses beyond deposits

- Secure SSL encryption and firewalls for platform security

Despite its regulatory status with the IFSC, it's important to note that this regulatory body is not considered as stringent as top-tier regulators like the FCA or CySEC. Traders should exercise caution and conduct thorough due diligence before investing with SuperForex.

SuperForex Broker Specifications

The Forex broker offers diverse trading options and services, including Copy Trading, Mobile App, and Membership Club, to cater to various trader needs. Key specifics about SuperForex:

Broker | SuperForex |

Account Types | STP, ECN |

Regulating Authorities | IFSC |

Based Currencies | Variable based on the account type |

Minimum Deposit | $1 |

Deposit Methods | Credit/Debit Cards, Bank Transfer, E-Payments, SuperForex Money |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, E-Payments, SuperForex Money |

Minimum Order | N/A |

Maximum Leverage | 1:3000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, Mobile App |

Markets | Forex, Indices, Commodities, ETFs, Stocks, Crypto |

Spread | From 0.0 pips |

Commission | Variable based on the account type and instrument |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Mobile Trading, CopyTrading |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Phone, Telegram, WhatsApp, Skype, Mail |

Customer Support Hours | 24/7 |

SuperForex Account Types

The broker has three main account offerings, including STP, ECN, and Demo. Each of these types has various modes with different conditions.

SuperForex offers up to 1:3000 leverage, $1 minimum deposit, and 12+ base currencies

SuperForex offers up to 1:3000 leverage, $1 minimum deposit, and 12+ base currencies

SuperForex STP Accounts

An STP account routes client orders directly to the broker's liquidity providers (e.g. banks, hedge funds) without a dealing desk. The broker acts as a bridge.

Features | Standard | Swap-Free | No Spread | Micro Cent | Profi STP | Crypto |

Currency | USD, EUR, GBP, CNY, AED, MYR, IDR, RUB, ZAR, NGN, INR, THB, BRL, BDT, EGP, CHF, MXN, JPY, PHP, HKD, SGD, PEN, TZS, KES, GHS, UGX, ZMW, RWF, VND, XAF, PLN, AUD, CAD, JOD | USD, EUR, GBP, CNY, AED, MYR, IDR, RUB, ZAR, NGN, INR, PKR, BDT, EGP, CHF, JPY, TRY, PHP, HKD, SGD, ILS, TZS, KES, GHS, UGX, ZMW, RWF | USD, EUR | USD, EUR, ZAR | USD, EUR, GBP | USD |

Min Deposit | $5 | $5 | $50 | $1 | $500 | $50 |

Lot Size | $10,000 | $10,000 | $100,000 | 10,000 Cents | $100,000 | 10 BTC / LTC / ZEC / DASH / NEO / EOS / BCH / XMR |

Max Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:3000 | 1:10 |

Swaps | Yes | No | No | Yes | No | No |

Spreads | Fixed | Fixed | 0 | Fixed | From 0.01 pips | Fixed |

Copy Trade | Yes | Yes | No | No | No | No |

SuperForex ECN Accounts

An ECN account connects traders directly with other participants in the market (banks, other traders, hedge funds) in a centralized network.

Features | Standard | Standard-Mini | Swap-Free | Swap-Free Mini | Crypto |

Currency | USD, EUR, GBP, CNY, ZAR, NGN, INR, BRL, JPY, CLP, TZS, KES, GHS, UGX, ZMW, RWF, CZK, SEK, DKK, NOK, HUF, KZT, KRW, COP, TWD | USD, EUR, GBP, CNY, MYR, ZAR, NGN, BRL, TZS, KES, GHS, UGX, ZMW, NZD, KRW, COP, TWD | USD, EUR, GBP, CNY, MYR, IDR, EGP, TRY, CLP, CZK, SEK, DKK, NOK, HUF, KRW, COP, TWD | USD, EUR, GBP, CNY, MYR, IDR, NGN, TZS, GHS, UGX, ZMW, KZT, KRW, COP, TWD | TTR, DGE, LTC, BCH |

Min Deposit | $100 | $5 | $100 | $5 | $50 |

Lot Size | $100,000 | $10,000 | $100,000 | $10,000 | 10 BTC / LTC / ZEC / DASH / NEO / EOS / BCH / XMR |

Max Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1000 | 1:10 |

Swaps | Yes | Yes | No | No | No |

Spreads | Floating | Floating | Floating | Floating | Floating |

Copy Trade | No | No | No | No | No |

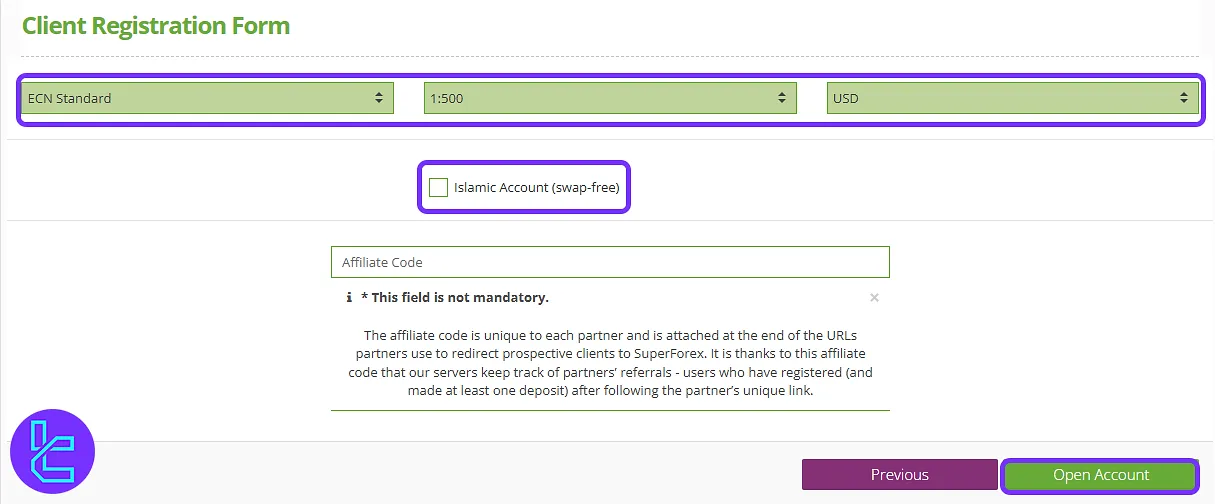

SuperForex Islamic Account

SuperForex offers Swap-Free Islamic accounts that align with Sharia law by eliminating overnight interest charges. These accounts are available upon request and are suitable for Muslim traders who wish to trade Forex without incurring riba (interest).

SuperForex Broker Advantage and Disadvantage

Mobile Trading, various payment methods, and vast educational resources are some of the company’s strengths.

By opening a SuperForex account in your local currency, skip additional conversion rates

By opening a SuperForex account in your local currency, skip additional conversion rates

However, to have a balanced view of SuperForex, let's look at its upsides and downsides.

Pros | Cons |

Low minimum deposit ($1) | Limited regulation (IFSC only) |

Wide range of trading instruments | Low trust scores |

Multiple account types for different traders | Lack of transparency in fee structure |

Competitive spreads from 0.5 pips | - |

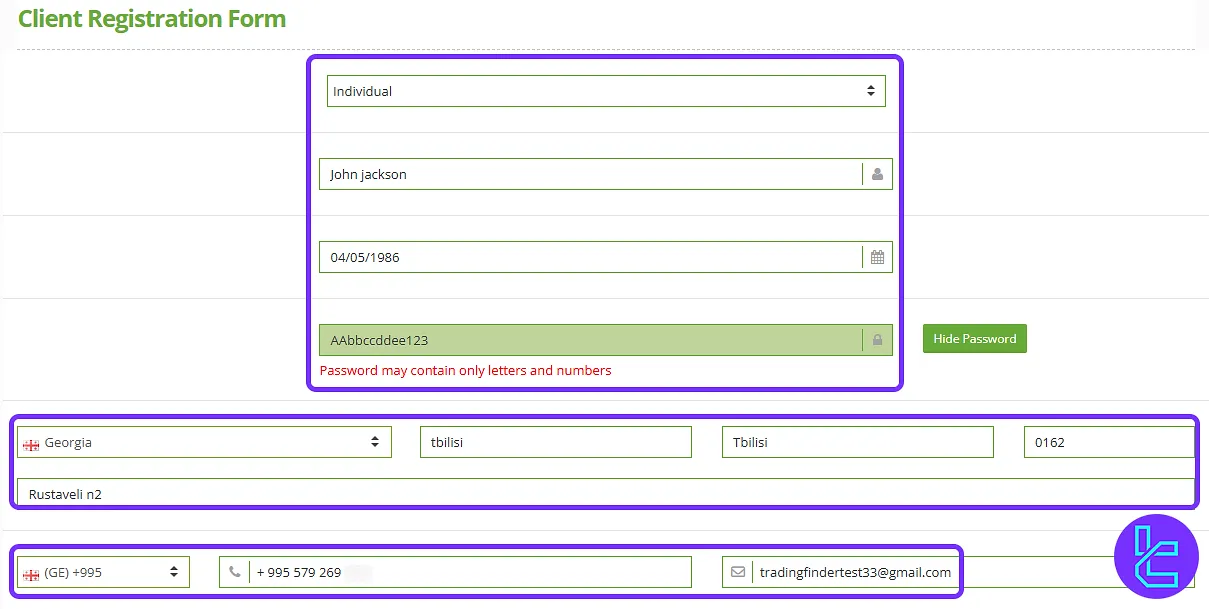

SuperForex Account Opening and Verification

SuperForex makes registration efficient and tailored to your trading needs. Whether you're opening an STP, ECN, or Islamic account, the process involves a few guided steps.

You'll submit personal and residential details, choose your account preferences, and complete email verification to complete the SuperForex registration process.

#1 Visit the Broker Website

Access the SuperForex homepage and click “Open Account” to reach the application form.

#2 Accept Terms and Start Sign-Up

Agree to the terms and conditions, then proceed by clicking “Open an Account”.

#3 Enter Personal and Residential Details

Fill out the sign up form with the following details:

- Full Name

- Date of Birth

- Country, City, Postal Code, and Address

- Phone Number

- Strong password

#4 Configure Your Account

Adjust your account settings and select your preferences:

- Account Type (STP, ECN, or Islamic)

- Base Currency

- Leverage (up to 1:3000)

#5 Verify Your Email

Click the “Verify Now” button and confirm your registration through the verification link sent to your inbox.

#6 SuperForex KYC

Note that KYC verification is not mandatory on SuperForex, and unverified clients experience some limits only when using bonus programs.

However, if you decide to complete the KYC procedure, you'll need the following documents:

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

What Trading Platforms Are Available on SuperForex?

We must mention the trading platforms in this SuperForex review. The company provides traders with the industry-standard MetaTrader 4 (MT4) and a proprietary mobile app.

Operating System | MT4 | SuperForex Mobile App |

Desktop | Windows, macOS | - |

Android | ||

iOS | - |

SuperForex mobile trading app features real-time analytics, balance tracking, and order management. However, the broker does not currently offer MetaTrader 5 (MT5).

SuperForex Broker Fee Structure

The broker’s fee structure is not very persuasive compared to other competitors. In the table below, we’ll explore the commission and spreads for the EUR/USD pair in SuperForex’s various account types.

Type | Account | EUR/USD Spreads From (Pips) | EUR/USD Commission (USD) |

STP | Standard | 2.0 | 0 |

Swap Free | 2.0 | 0 | |

No Spread | 0.0 | 0.017 | |

Micro Cent | N/A | N/A | |

Profi | 0.1 | 0.013 | |

ECN | Standard | 2.0 | 9 |

Standard Mini | 2.0 | 9 | |

Swap Free | N/A | N/A | |

Swap Free Mini | N/A | N/A |

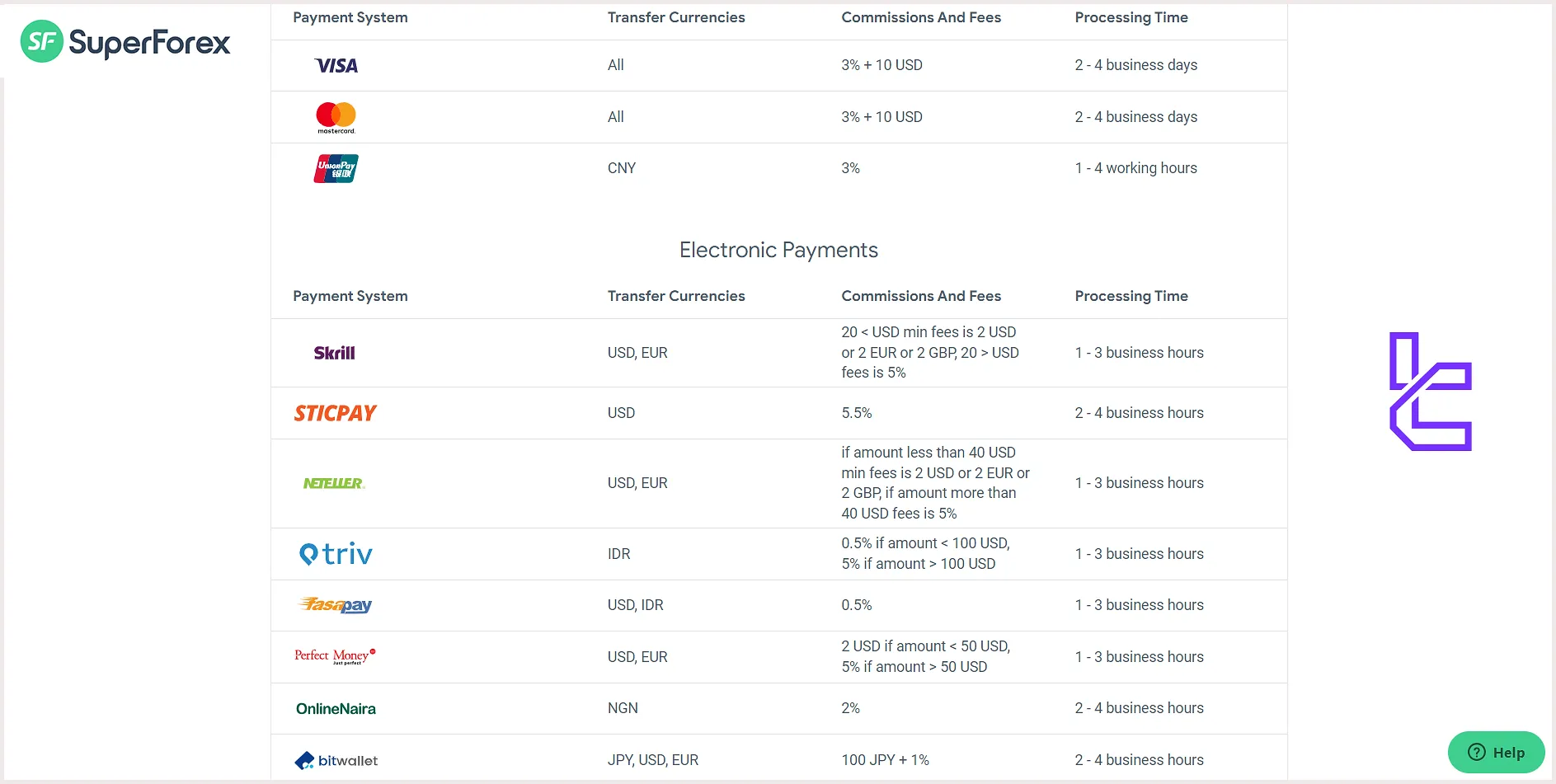

While the broker doesn’t charge any fees for deposits, it has an average fee of 3% for withdrawals. SuperForex also charges no inactivity commissions.

SuperForex Deposit and Withdrawal

One of the broker’s strengths that we must mention in this SuperForex review is the payment option. Traders can start with SuperForex by depositing as little as $1, making it one of the most beginner-friendly brokers in terms of capital requirements.

The platform supports a wide variety of funding methods, including:

- Bank Wire Transfer

- E-Payments (Skrill, Neteller, Perfect Money, FasaPay)

- Credit/Debit Cards (Visa, MasterCard, UnionPay)

- Cryptocurrencies (BTC, LTC, DOGE, PPC, DASH, RDD, ZEC, BLK, USDT)

- Local Payment Methods (Malaysia, Indonesia, Nigeria, Kenya, Zimbabwe, Namibia, Iran)

- SuperForex Money (USD, MYR, IDR)

Copy Trading and Investment Plans on SuperForex Broker

The company offers a copy trading service called "Forex Copy" for those interested in earning passive income on their assets. Key features of SuperForex copy trade:

- Automatic copying trades of experienced traders

- minimum deposit of 10$

- Comprehensive performance metrics

- Option to copy multiple traders simultaneously

- Two commission systems, Daily and Profit Share

- Available on STP Standard and Swap Free accounts

SuperForex Financial Markets

The broker provides access to 300+ instruments across 6 asset classes, from the Forex market and ETFs to the Futures market, swhich enable traders to diversify their portfolios and exploit market opportunities.

- Currency Pairs: Major, minor, and exotic forex pairs

- Cryptocurrencies: Bitcoin, Ethereum, Litecoin, and more

- Stocks: CFDs on shares of international companies

- Indices: Major global stock indices

- Commodities: Gold, silver, oil, and other raw materials

- ETFs: More than 20 Exchange-Traded Funds

SuperForex Bonus and Promotions

One of the most attractive topics in this SuperForex review is promotion. The broker understands the importance of incentivizing new and existing clients and offers multiple bonuses, including:

Features | Easy Deposit | Welcome | Energy+ | Hot |

Deposit Increase | 3000% (up to $750) | 100% | 75% | 750% |

Min Deposit | $1 | $1 | $1 | $1 |

Max Leverage | 1:100 | 1:100 | 1:1000 | 1:1000 |

Profit Withdrawable | Yes | Yes | Yes | Yes |

Mandatory Verification | Yes | No | No | No |

Crediting | Once | Each deposit | Each deposit | Each deposit |

SuperForex Broker Support Channels

The company provides 24/7 support through various channels, from hotline to WhatsApp chat.

support@superforex.com | |

Hotline | +442045771579 |

WhatsApp (Text Only) | +3728-16-730-16 |

Telegram (Text Only) | +3728-16-730-16 |

Skype | client-support.superforex |

GOTSE DELCHEV / EMIL MARKOV/ 47E, OFFICE 1, SOFIA, BULGARIA, 1404 |

SuperForex Red Flag Countries

While the broker does not explicitly list restricted countries on its website, due to its lack of regulations, some local authorities have banned its services in their regions, including:

- United States

- Ukraine

- North Korea

- Haiti

- Suriname

SuperForex User Satisfaction

Trust score is one of the most important topics in this SuperForex review. The company has received mixed reviews from users on reputable rating websites.

No rating due to breach of guidelines (fake reviews) | |

Forex Peace Army | 1.5 out of 5.0 based on 109 reviews |

Reviews.io | 2.2 out of 5.0 based on 39 comments |

SuperForex Educational Materials

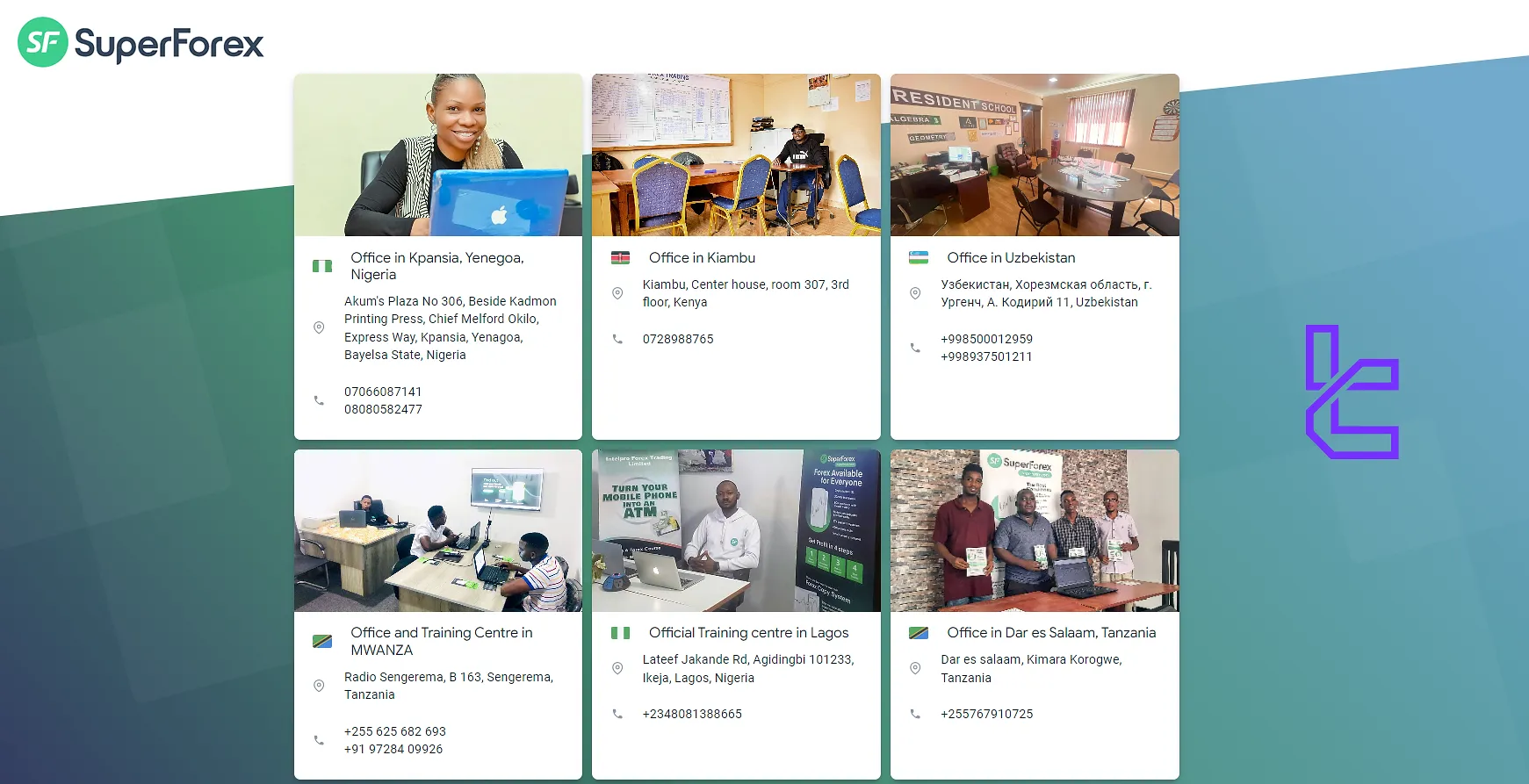

The broker provides a diverse range of educational resources, from Forex tutorials to physical training centers across the globe.

- Video tutorials on trading basics and platform use

- Webinars hosted by experienced traders

- Economic calendar for tracking market events

- Daily market analysis and trading signals

- Training centers across the world

You can also use TradingFinder's Forex education and Crypto tutorials sections to access additional learning materials.

SuperForex vs Top Forex Brokers

Let's see Swissquote's standing in the trading world compared to other industry players.

Parameter | SuperForex Broker | |||

Regulation | IFSC | FSA, FCA, CySEC, LFSA, FSCA | FSC, CySEC | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0..0 pips | From 0.0 pips | From 0.0 pips | From 0.6 Pips |

Commission | From $0.0 | From $0.0 | From $0.0 | From Zero |

Minimum Deposit | $1 | $100 | $5 | $5 |

Maximum Leverage | 1:3000 | 1:1000 | 1:3000 | 1:1000 |

Trading Platforms | MT4, Mobile App | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | MT4, MT5, Mobile App | MT4, MT5, Mobile App |

Account Types | STP, ECN, Demo | Classic, Raw | Standard | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 600+ | 550+ | 1,400+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Instant |

Conclusion and Final Words

SuperForex provides various financial services, such as copy trading (Forex Copy) with a minimum investment requirement of $10 and CFD trading on 6 asset classes, including Forex and Crypto, with leverage options of up to 1:3000.