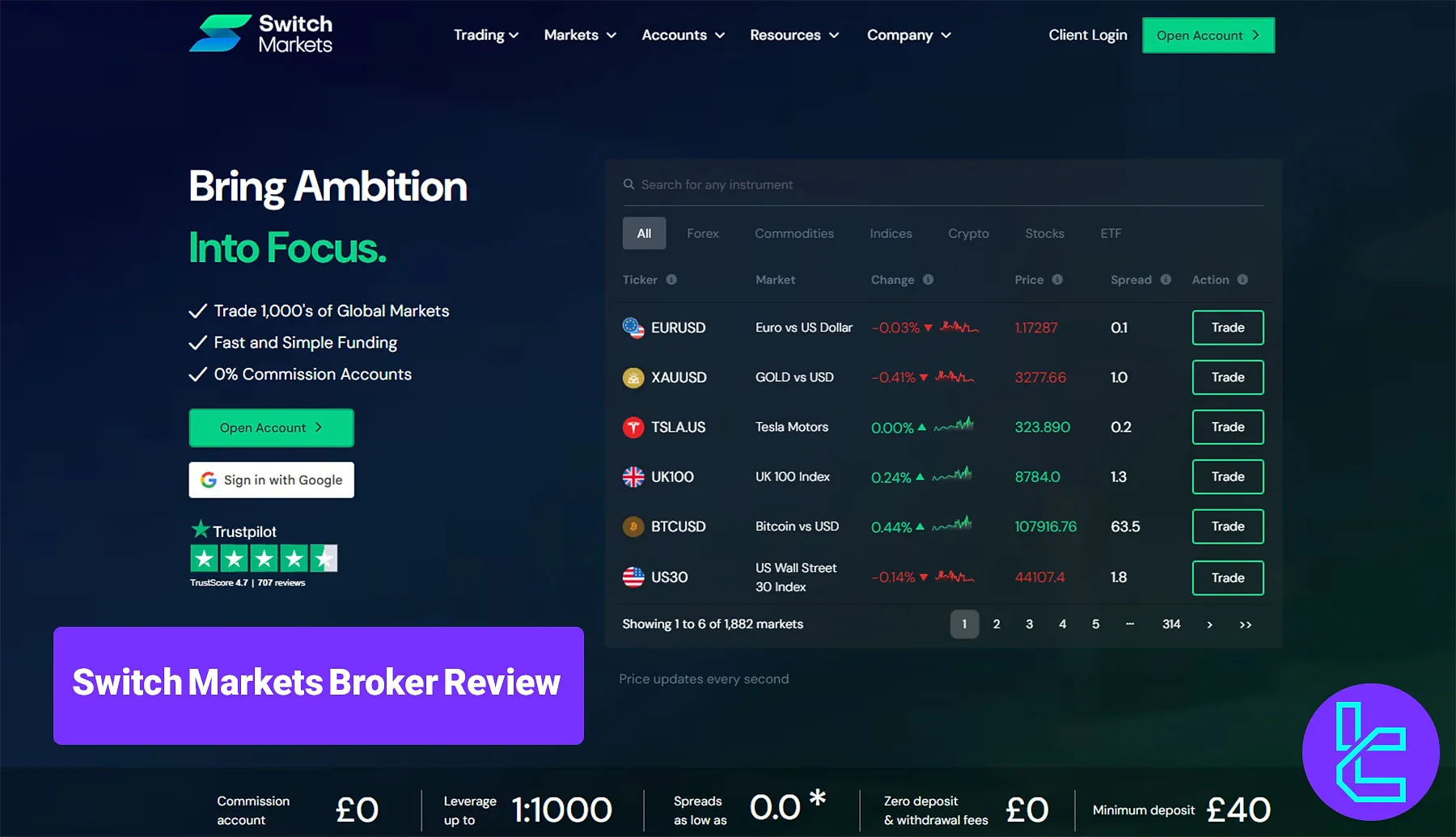

Switch Markets broker offers Forex and CFD trading services through its Standard and Pro accounts. These accounts provide a low-cost trading experience (0.0 spreads and $3.5 commission), a low minimum deposit of only €40, and up to 1:1000 leverage.

Switch Markets Company Information & Regulation Status

Switch Markets, established in 2019, has quickly become one of the fastest-growing brokers in the industry. With a global presence spanning 21 countries and a team of nearly 100 professionals, they've built a reputation for reliability and innovation. Here are some key points about Switch Markets:

- Regulated by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA)

- Client funds held in segregated bank accounts for enhanced protection

- Access to diverse liquidity providers, ensuring tight spreads

Switch Markets was originally regulated under the ASIC via a license held by SWITCH MARKETS PTY LTD, operating as an appointed representative. However, as of the latest data, this ASIC license has been revoked.

The entity now primarily operates globally through Switch Markets International PTE Ltd and its parent firm, Royal ETP LLC, which is incorporated in St. Vincent and the Grenadines, a jurisdiction that does not enforce strict broker oversight.

While the broker promotes fund segregation and compliance mechanisms, its regulatory footprint has diminished. Traders should be aware that regulatory protection is limited, and Switch Markets is no longer under active ASIC supervision.

Switch Markets Specifications

Let's take a closer look at what the Forex broker brings to the table:

Broker | Switch Markets |

Account Types | Standard, Pro |

Regulating Authorities | SVGFSA |

Based Currencies | USD, EUR, AUD, GBP, CAD, NZD, CHF |

Minimum Deposit | €40 |

Deposit Methods | Visa/MasterCard, Paypal, Bank wire, Neteller, Skrill, UnionPay, Globe pay, NganLuong, Fasapay, PayTrust, crypto |

Withdrawal Methods | Visa/MasterCard, Paypal, Bank wire, Neteller, Skrill, UnionPay, Globe pay, NganLuong, Fasapay, PayTrust, crypto |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | Algo Trading, Social Trading |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, indices, commodities, crypto, shares |

Spread | Floating from 0.0 pips |

Commission | From $3.5 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/20% |

Trading Features | Demo account, Forex calculator, Economic calendar |

Affiliate Program | Yes |

Bonus & Promotions | Free VPS, Risk management EA |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, live chat, WhatsApp |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, USA, Cyprus, and more |

Switch Markets Broker Account Types

Switch Markets offers 2 main account types to suit different trading styles and experience levels:

Account types | Standard | Pro |

Minimum deposit | €40 | €40 |

Minimum trading volume | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:1000 | 1:1000 |

Spreads | Floating from 1.4 pips | Floating from 0.0 pips |

Commission | No commission | $3.5 |

Trading platform | MT4, MT5 | MT4, MT5 |

Suitable for | Beginner to intermediate-level traders | Advanced and high-frequency traders |

The Standard account is perfect for traders who want to experience higher spreads but pay no commission, while the Pro account ensures the lowest possible spreads.

Switch Markets also offers a Demo account with key features and benefits, including:

- Practice in a risk-free environment

- Test trading strategies before going live

- Access to all features of live accounts

Muslim traders can also use Switch Markets trading services since this broker offers an Islamic account compliant with Sharia laws.

Pro and Standard accounts are also available on institutional grade with a minimum deposit requirement of $25,000.

- Institutional Standard: $25,000 minimum deposit, spreads from 0.6 pips, no commission

- Institutional Pro: $25,000 minimum deposit, raw spreads from 0.0 pips, $5.50 commission

Switch Markets Advantages and Disadvantages

Let's weigh the pros and cons of trading with Switch Markets:

Advantages | Disadvantages |

High leverage options (1:1000) | Relatively new broker |

Competitive spreads on Pro account from 0.0 pips | Not available to US citizens |

MT4 and MT5 trading platforms | Higher-than-average spreads on the Standard account |

Over 1000 tradable instruments | No tier-1 regulation |

Switch Markets Broker Registration and Verification

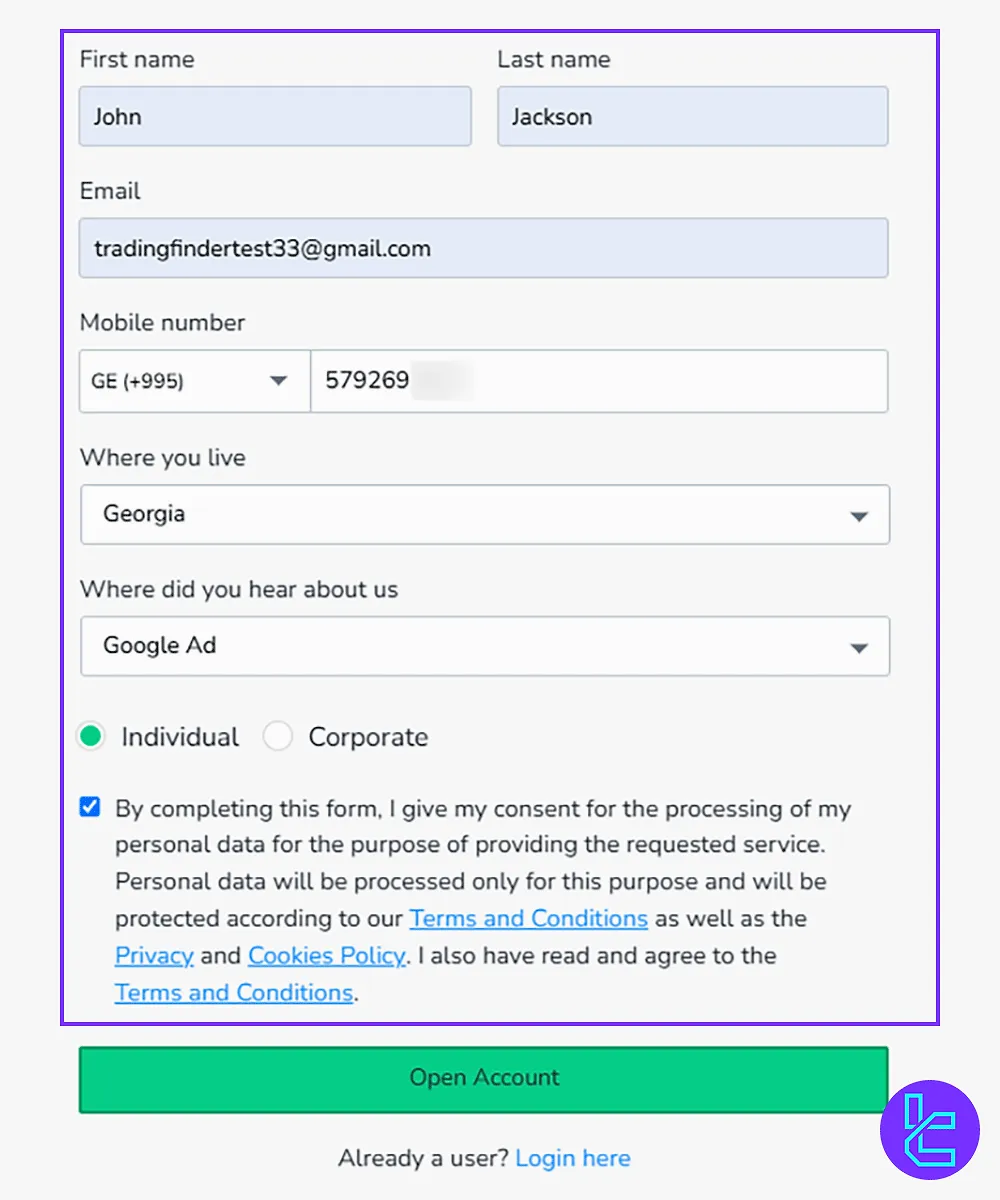

Switch Markets offers a structured onboarding process for individual and corporate traders, ensuring alignment with regulatory requirements through complete identity, residency, and financial disclosure. Steps to Switch Markets registration:

#1 Access the Signup Page

Click on "Create Live Account" on the Switch Markets website to begin the registration.

#2 Personal Information & Account Type

Fill out the application form with the following details:

- Name

- Phone number

- Country

Choose between an Individual or Corporate account and accept the terms.

#3 Birth & Citizenship Details

Enter your date of birth, nationality, tax residency, and indicate whether you're a US citizen.

#4 Residential Address

Provide your full physical address, including:

- City

- Postcode

- Street details

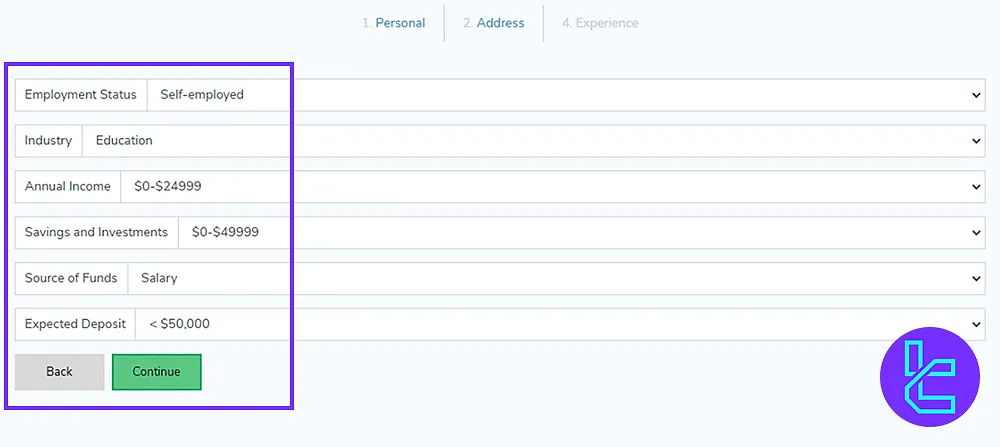

#5 Financial & Occupational Information

State your employment status, annual income, and planned deposit size to comply with risk profiling requirements.

#6 Investment Background

Detail your education level, trading purpose, and experience in financial markets.

#7 Email Verification

Choose the “Verify Now” option, click the confirmation link sent to your inbox, and complete your registration.

#8 Upload Supporting Documents

Navigate to the profile menu through the client dashboard, initiate the Switch Markets verification process, and provide supporting documents, including:

- Proof of Identity: Passport or Driver's license

- Proof of Residency: Utility bill or Bank statement

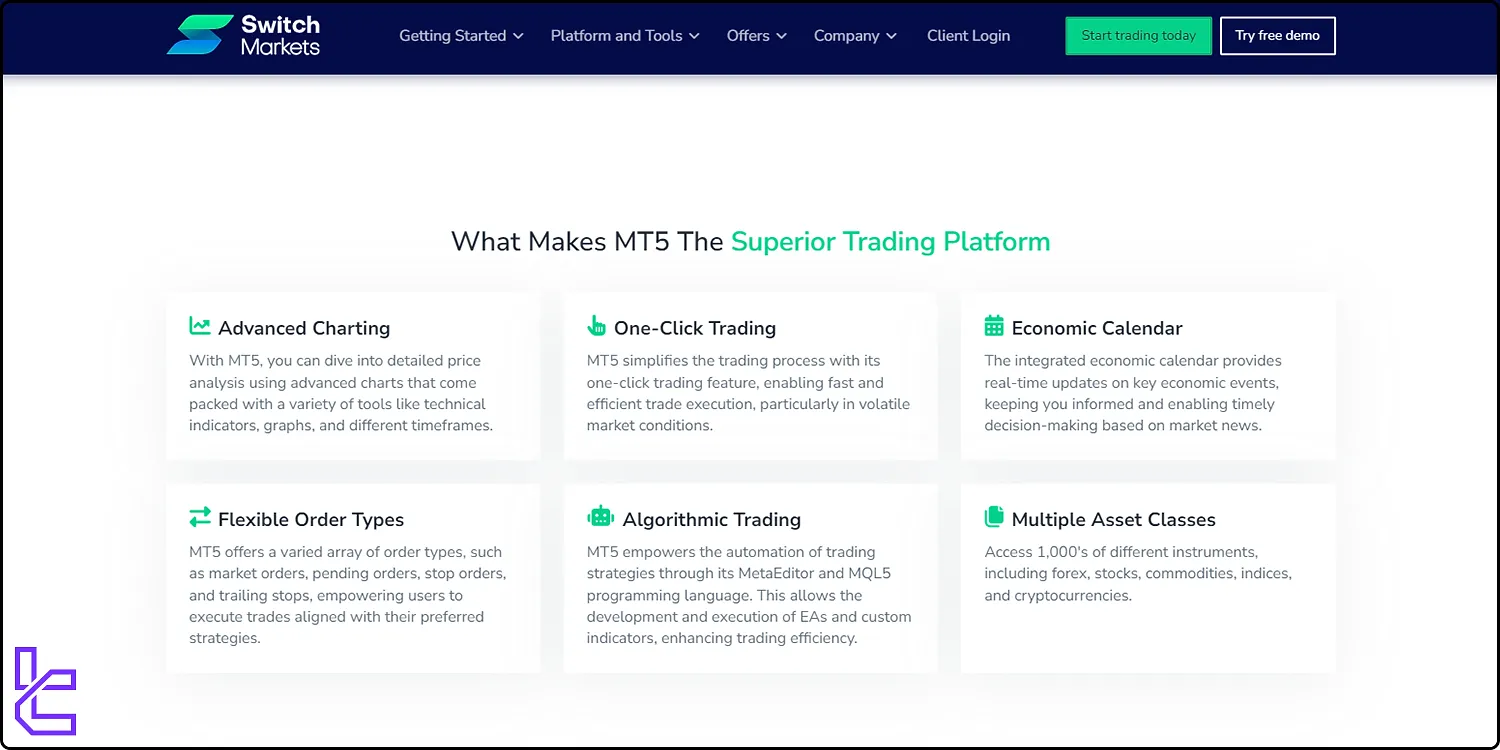

Switch Markets Supported Trading Platforms

Switch Markets provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, accessible via desktop, web, and mobile.

MT4 remains a trader favorite for its simplicity, reliability, and large support community, while MetaTrader 5 offers a more advanced interface with additional order types, economic calendar integration, and deeper analytical capabilities.

Mobile trading is fully supported on iOS and Android, allowing seamless access to full account functionality and real-time trading while on the move. Here are the download links:

Both platforms are also available on desktop and web browsers, ensuring you can trade on the go. TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

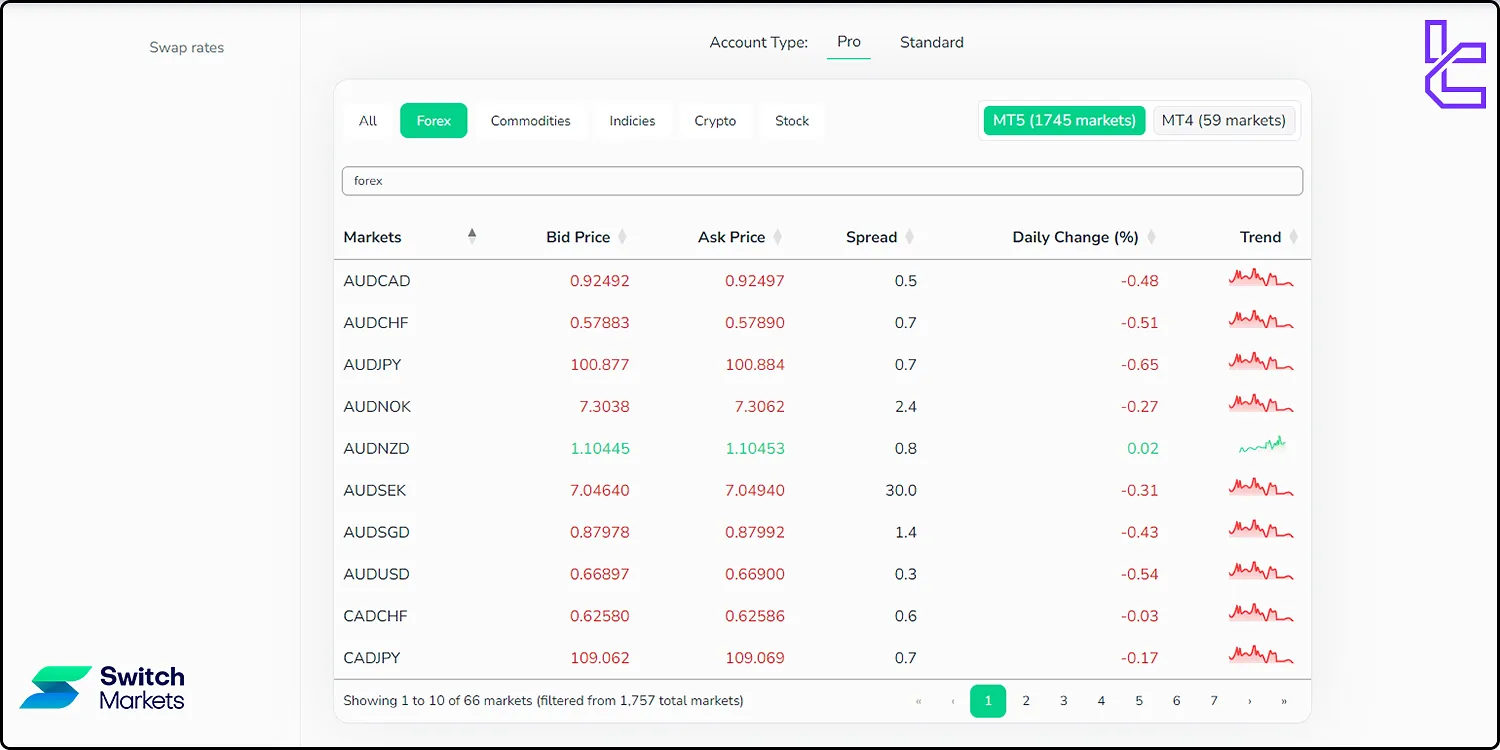

Switch Markets Broker Trading Fees (Spreads and Commissions)

Switch Markets offers competitive pricing across its account types:

- Standard Account: No commission, spreads from 1.4 pips

- Pro Account: Spreads from 0.0 pips, $3.5 commission per trade

Other fees in Switch Markets broker:

- Standard Swap/over-night fees

- No inactivity fee

- No deposit/withdrawal fees (except for cryptocurrencies)

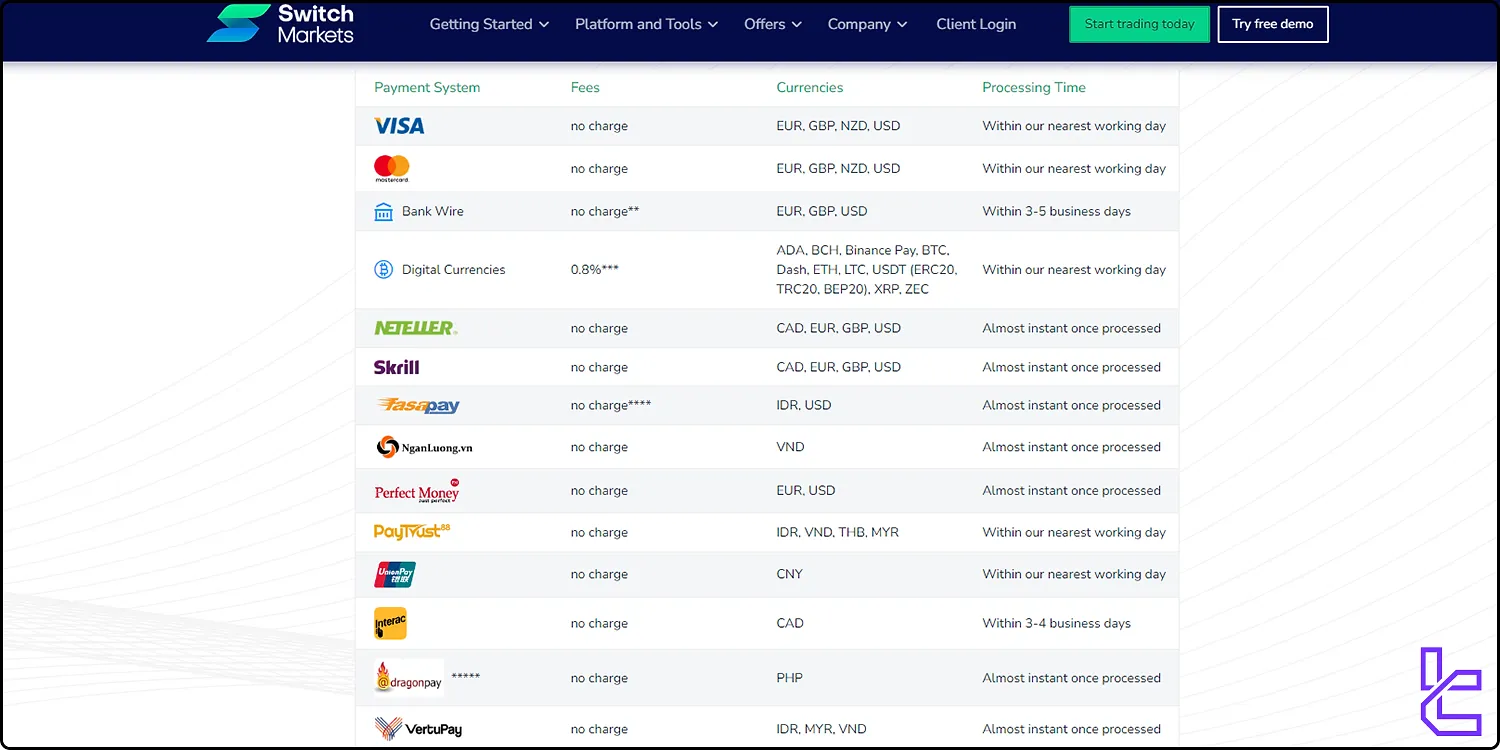

Switch Markets Deposit & Withdrawal Methods

The broker offers a variety of payment methods, from bank wires to crypto and e-wallets, to cater to a global client base. Switch Markets deposit & withdrawal options:

Payment method | Withdrawal processing time |

Visa and MasterCard | Within 1-5 business days |

Bank Wire Transfer | Within 3-5 business days |

Neteller | Nearest working day |

Skrill | Almost instant |

Fasapay | Almost instant |

Perfect Money | Almost instant |

Cryptocurrencies | Almost instant |

Union Pay | Nearest working day |

Key features of their payment system include:

- No fees charged by Switch Markets for deposits or withdrawals, except 0.08% for crypto deposits

- Fast processing times

- Minimum deposit of $50

- Multiple base currencies supported

Switch Markets Broker Copy Trading & Investment Options

Switch Markets Forex broker offers copy trading and algo trading options:

- Social Trading: Allows to follow and replicate the strategies of experienced and successful traders. Gain insights, minimize risk, and enhance your trading by copying their proven methods in real-time;

- Algo Trading: Enables you to execute automated trading strategies, removing the need for manual intervention. By utilizing pre-programmed algorithms, you can efficiently trade 24/7 and capitalize on market opportunities with precision and speed.

These features allow both novice and experienced traders to diversify their trading approach and potentially improve their results. Switch Markets also offers a PAMM account, but there is no information available about how it works or the associated fees.

Switch Markets Broker Instruments & Symbols

Switch Markets provides access to over 1,000 tradable instruments across five asset classes, from the Forex market to shares and indices.

- Forex: 60+ currency pairs, including majors, minors, and exotics

- Indices: 26 global indices, such as FTSE 100, Nasdaq 100, and Nikkei 225

- Stocks: 1,000+ share CFDs covering top names like Amazon, Facebook, and Twitter

- Commodities: 15 trading pairs on metals and energies like gold, silver, oil, and natural gas

- Cryptocurrencies: CFDs on 41 popular digital assets, such as BTC, ETH, LTC, and XRP

This wide array of markets empowers traders to broaden their portfolios and seize opportunities across various asset classes, maximizing potential and minimizing risk.

Bonuses and Promotions in Switch Markets

Switch Markets occasionally offers promotional bonuses to attract new clients and reward existing ones. These bonuses are currently available on the Switch Markets website:

- Free VPS: A special hosting server for Forex traders to run their algorithms and trading robots;

- Free Risk Management EA: Effectively manage your Forex trading risk with Switch Markets Risk Management Expert Advisor;

- Affiliate Program: Join the Switch Markets affiliate program to earn commissions by referring new traders to the platform.

Unfortunately, Switch Markets does not currently offer a deposit bonus, but it may be available soon.

Switch Markets Broker Support

Switch Markets offers responsive customer support through live chat, email, WhatsApp, and social media platforms. Support is available five days a week during business hours.

Clients can ask questions even before account registration, providing accessible help for prospective users. However, 24/7 support and direct phone lines are not available.

- Live Chat: Available 24/7 for quick queries

- Email Support: support@switchmarkets.com

- WhatsApp: Scan the QR code on the Contact Us page to connect with Switch Markets’ WhatsApp support

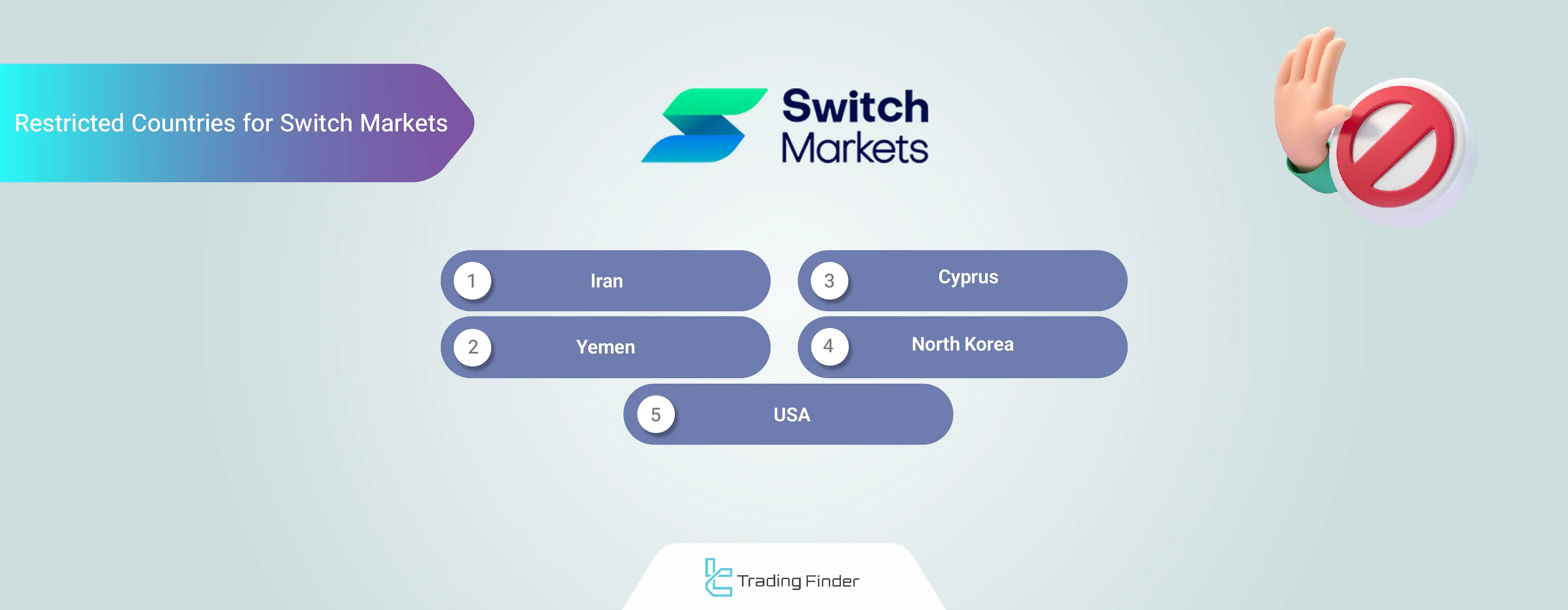

Switch Markets Restricted Countries

While Switch Markets serves global clients, they are unable to provide services to residents of certain countries due to regulatory restrictions. These include:

- United States of America

- Iran

- Yemen

- North Korea

- Cyprus

Traders from these countries should seek alternative brokers that are licensed to operate in their jurisdictions.

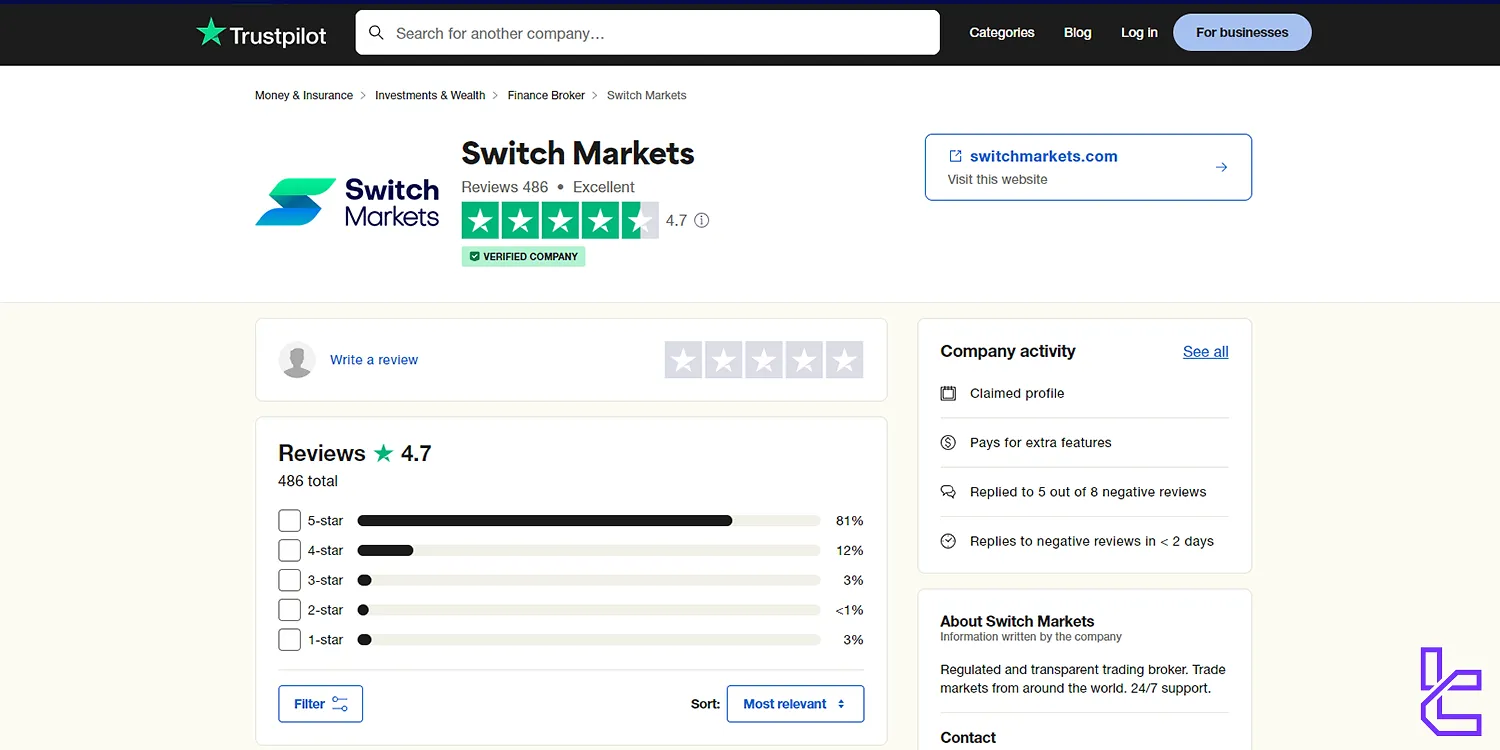

Switch Markets Trust Scores On Review Websites

The broker has garnered positive reviews from traders, evident in the high Switch Markets TrustPilot score:

- Trust score: 4.7 out of 5

- Total number of reviews: Over 480

Key points from user reviews:

- Fast and reliable trading platform

- Exceptional customer support

- Quick account setup process

- Appreciation for free VPS and risk management tools

The consistently high ratings and positive feedback suggest that Switch Markets is delivering on its promises to clients.

Switch Markets Educational Resources

Switch Markets offers a range of educational resources to support traders:

- Comprehensive trading guides

- Video tutorials on platform usage

- Regular market analysis and insights

- An economic calendar for tracking important events

- Risk management tools and calculators

- A free VPS with 1ms latency is offered to support algorithmic trading with minimal slippage

These resources cater to traders of all levels, from beginners learning the basics to experienced traders refining their strategies.

You can also check TradingFinder's Forex education and crypto tutorial sections for additional resources.

Switch Markets Comparison Table

The table below provides a detailed comparison between Switch Markets and the top forex brokers:

Parameter | Switch Markets Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | SVGFSA | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.0 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | From $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | €40 | $200 | $5 | $50 |

Maximum Leverage | 1:1000 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Standard, Pro | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 1,000+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

TF Expert Suggestion

Switch Markets has gained quite a reputation and received a 4.7/5 score on the Trustpilot website (from over 450 reviews).

Yet, the broker’s higher-than-average spreads on the Standard account (1.4 pips), low leverage options (maximum 1:30), and unavailability in various countries, such as the USA and Cyprus, prevent it from reaching its full potential.