Real estate tokenization introduces a new way to invest in property by enabling fractional ownership, high liquidity, and global accessibility.

Each token represents a share of a specific property and can be bought or sold through platforms like BinaryX, Republic, and HoneyBricks.

What Is Real Estate Tokenization and How Does It Work?

Tokenization refers to converting physical assets into tradable digital tokens on a blockchain.

In real estate, this process creates a digital version of a real-world property issued through smart contracts on blockchain-based platforms.

Pros and Cons of Real Estate Tokenization

Each token represents partial ownership in a given property, allowing investors to contribute small amounts to large-scale real estate projects.

This brings benefits like rental income, property appreciation, and liquidity. Here's a breakdown of the advantages and disadvantages:

Pros and Cons:

Pros | Cons |

Easy access to real estate investment | Token security risks |

Simplified portfolio management | Legal restrictions in certain countries |

Reduced costs and human error | Lack of centralized reporting |

High transparency and security via blockchain | Platform fees impacting final returns |

Fractional ownership with minimal capital | - |

Top Real Estate Tokenization Platforms

Here are some of the top platforms for real estate tokenization:

- BinaryX

- Republic

- HoneyBricks

- Figure

- Mogul

- Arrived

- Roofstock

- RealT

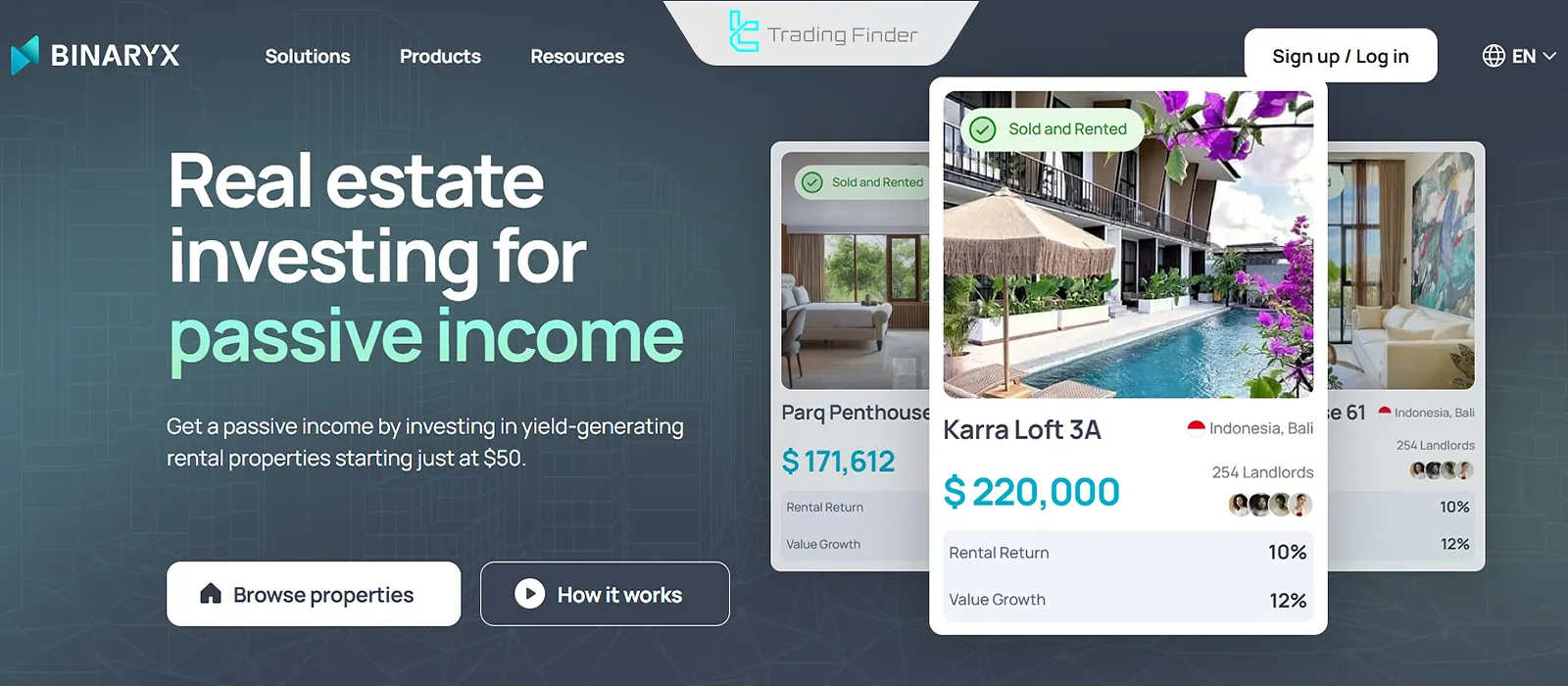

BinaryX

BinaryX offers a reliable experience for buying, selling, and holding digital assets; Ideal for those entering the tokenization space with

Minimum investment of $50. In this platform, Rental income is paid daily in USDT.

Republic

Based in New York, Republic allows investors and companies to join real estate, startup, and digital asset projects with a minimum investment of $50.

Features like Automated Investing and an Accredited Deal Room appeal to professional investors.

HoneyBricks

HoneyBricks aims to simplify commercial property investment in the U.S. via a secure blockchain-based platform.

It leverages blockchain to provide transparency, flexibility, and tax advantages tied to direct ownership.

Figure

Figure eliminates traditional complexities and costs using blockchain. Its Provenance platform supports financial services like lending, asset management, and financing.

Loan terms range from $15,000 to $400,000, with up to 30 years of repayment periods.

Mogul

Mogul uses data-driven analysis and a vetted partner network, selecting under 1% of proposed properties for investment. Properties are offered as fractional shares with monthly rental income distributions.

Mogul eliminates ownership responsibilities to ensures transparency and income flow via blockchain.

Arrived

Founded in 2019, Arrived is a real estate investment platform that enables low-entry investment and allows individuals to share in rental income. Key features include:

- Professional property management

- Asset diversification

- Transparent financial reporting

Arrived mission is to provide public access to real estate markets and passive income opportunities.

Roofstock

Roofstock, a fintech company based in Oakland, CA, was founded in 2015 by “Gary Beazley”, “Gregor Watson”, and “Rich Ford”.

It operates an online marketplace for rental property investment, allowing users to purchase and manage rental homes.

RealT

Founded in 2019, RealT enables real estate investment through the Ethereum blockchain.

The platform has tokenized over 400 properties in the U.S., valued at more than $83 million by 2025.

Conclusion

Real estate tokenization provides a modern model for both small and large investors to invest in property with minimal capital (as low as $50).

Through digital tokens, individuals can own fractional shares of real estate and benefit from rental income and appreciation.