Engaging in transactions and investments in NFTs Token's without sufficient knowledge of the project, the development team, and the smart contract canlead to investment losses.

Depending on the type and field of the NFT project (e.g., gaming or art-related), investors should pay attention to royalties, smart contract features, and whether the contract is editable.

This way, after the purchase, the buyer won’t face issues such as ownership changes, royalty removals, metadata alterations, or the addition of new tokens.

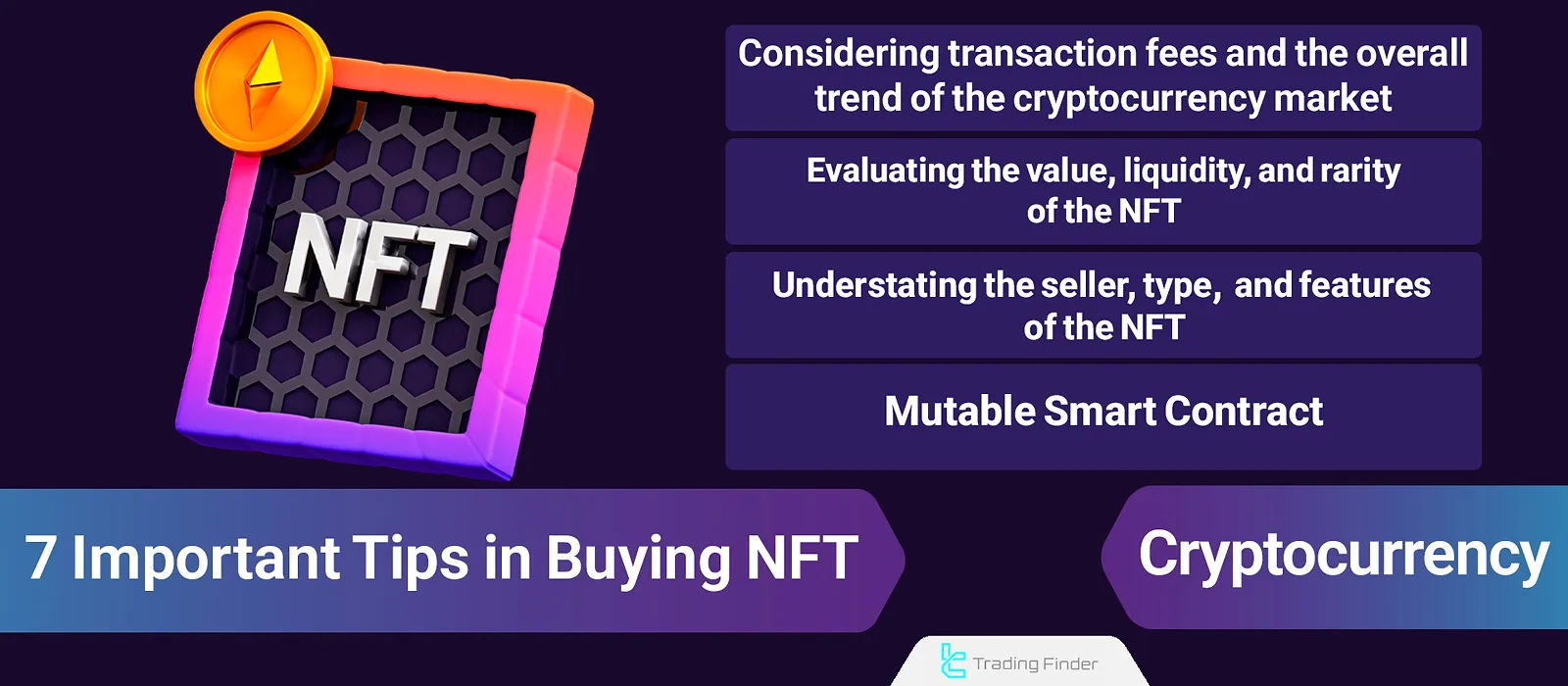

What should we consider when buying NFTs?

When buying NFTs with the intention of investing, having sufficient knowledge of the product or artwork, the seller, and the specific features of the NFT are among the important tips in buying NFT that must be considered.

Important tips in buying NFT:

- Knowing the product and the seller

- Understanding the types of NFTs and their features (e.g., royalties)

- The mutability of the smart contract

- Paying attention to the overall trend of the cryptocurrency market

- Examining the liquidity of the NFT token

- Evaluating the value and rarity of the token

- Considering transaction fees

1- Knowing the Product and the Seller

Some NFT projects are fake, created by anonymous opportunists or scammers. In such projects, the development team may disappear after the sale, offering no updates or further development.

Therefore, knowing the seller and the development team is an important point in buying NFT, as the development team still plays a role in the NFT’s credibility, price, development, and future updates even after ownership is transferred.

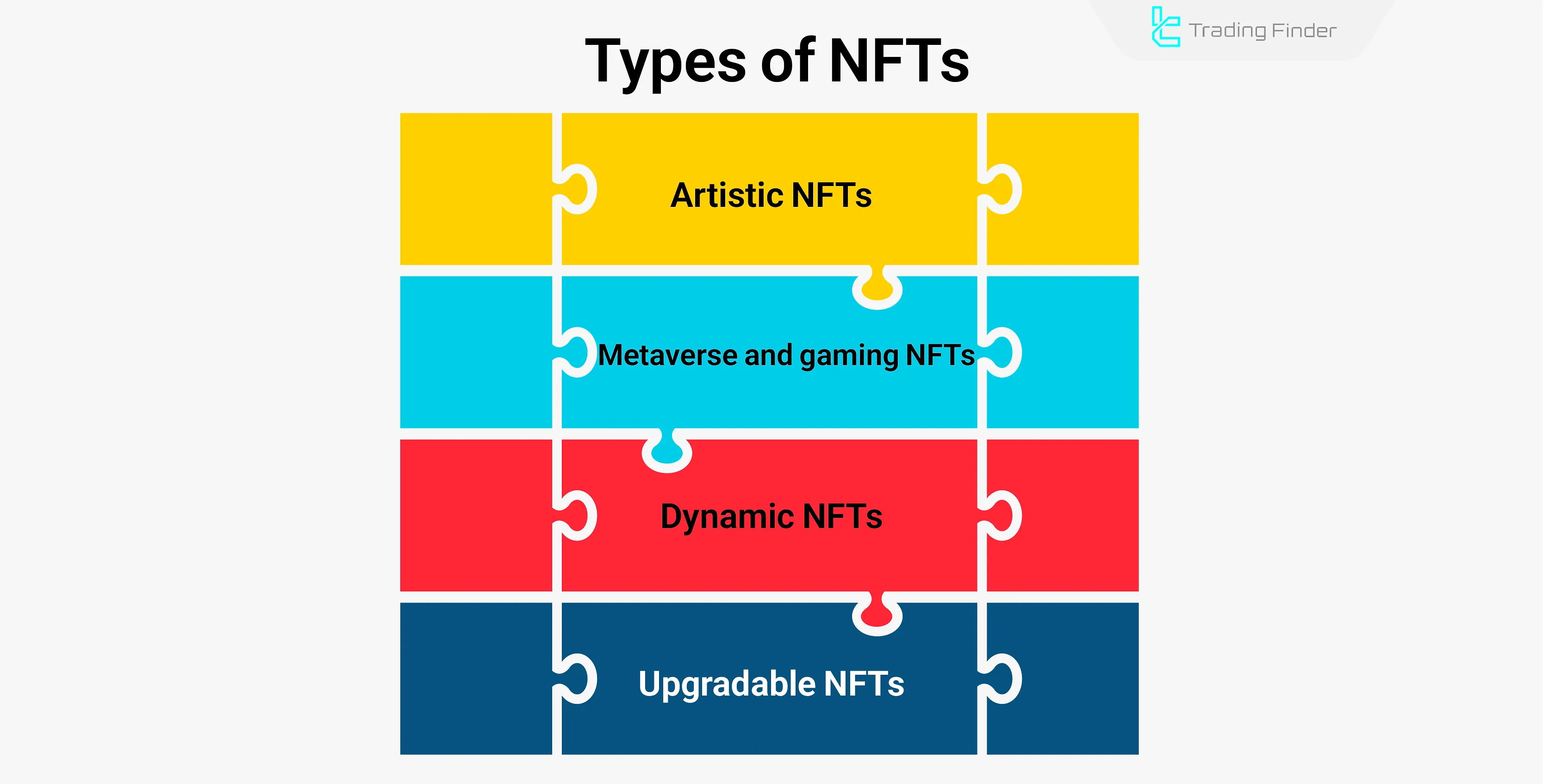

2- Knowing the Types and Features of the NFT

NFTs are categorized into different types, each with unique characteristics. Types of non-fungible tokens include:

- Artistic: Digital artworks created on blockchain (like musicians’ content) that support royalties for creators;

- Metaverse and Gaming NFTs: In-game items or assets used in virtual worlds that come in various forms;

- Dynamic NFTs: Their features and data change based on real-world events (like an athlete’s performance);

- Upgradable NFTs: Allow developers or owners to manually apply changes.

3- Mutability of the NFT Smart Contract

In some NFT smart contracts, changing features such as royalties is possible. This depends on how the contract was coded. Generally, smart contracts fall into two types:

- NFTs with mutable smart contracts: In these smart contracts, modifications can be made, but an important point in buying NFT is that the developer or contract owner usually makes these changes;

- NFTs with immutable smart contracts: All features like royalties are permanently recorded and cannot be changed.

Developers can alter smart contracts; however, if done without proper notice, it may affect the token’s price. Therefore, if any edits are intended, it’s best that this is clearly stated within the contract.

4- Paying Attention to the Overall Trend of the Crypto Market

NFTs are part of the blockchain ecosystem and closely tied to the cryptocurrency market. The overall market trend significantly impacts NFT prices. So, considering macroeconomic conditions and factors affecting the fundamental analysis of cryptocurrencies is also an important point in buying NFT.

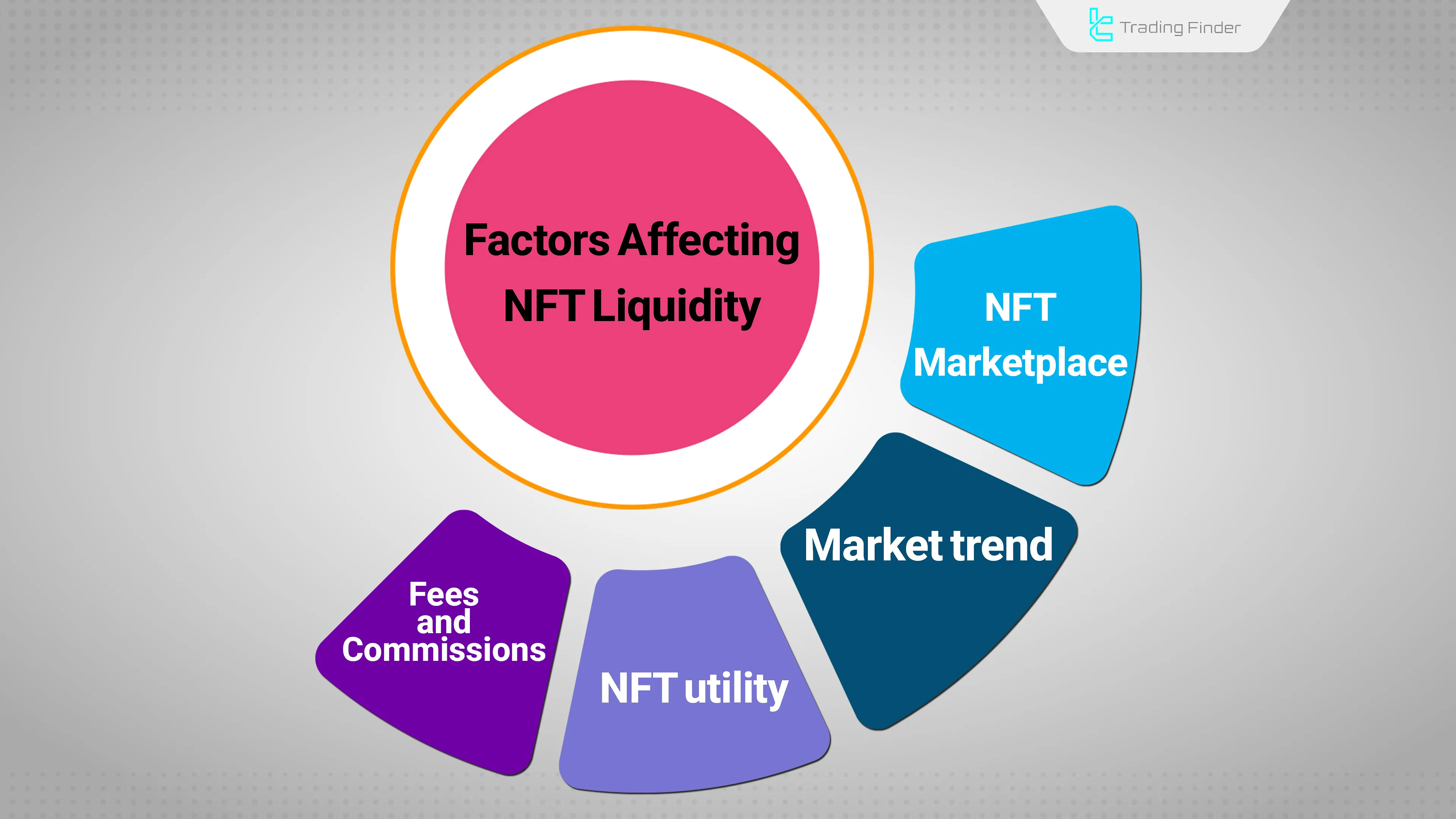

5- Evaluating NFT Liquidity

One of the lesser-noticed NFT buying tips is to evaluate the liquidity of the token. Liquidity depends on the trading platform, supply and demand, transaction fees, and blockchain network.

Factors influencing NFT liquidity include:

- NFT Marketplaces: Popular markets like OpenSea and Rarible with higher transaction volumes offer greater liquidity;

- Market Trends: NFT collections that trend at certain times (e.g., BAYC apes) have higher demand and liquidity;

- NFT Utility: NFTs with practical use—like metaverse or blockchain gaming items—usually have higher liquidity;

- Fees and Costs: Lower fees positively affect liquidity.

6- Evaluating Token Value and Rarity

NFT buying tips are not limited to price and token type; assessing the rarity of the token using rarity analysis tools like Rarity Tools or NFT Stats is also one of the important tips in buying NFT when determining its actual value.

The value of a non-fungible token depends on the popularity of the creator collection, transaction history, and utility.

Key factors in evaluating NFT value include:

- Collection Popularity: The NFT team's updates, execution, partnerships, and community engagement can strongly affect token value, along with their popularity and social media activity;

- Transaction History: Rising prices may signal value growth, high trading volume suggests strong demand, and celebrity involvement can influence value;

- Token Utility: Some NFTs have practical applications beyond artistic value—such as providing access to exclusive communities or events. Others offer functionality within blockchain games or metaverses;

- Rarity Evaluation: Rarity is one of the most important price determinants. Factors include total supply and unique features (e.g., color, design). Rarity.tools ranks NFTs based on their rarity level.

7- Considering Transaction Fees

When buying NFTs, the buyer must pay various fees including network transaction fees, platform fees, and wallet transfer costs.

- Network Transaction Fees: Depend on the blockchain, network traffic, and transaction speed. If a buyer wants faster confirmation, the fee will be higher;

- Platform Fees: Platforms charge fees from both the buyer and seller;

- Wallet Transfer Fees: These vary based on the used blockchain. For instance, Ethereum usually has higher fees.

Conclusion

When buying NFTs, you should consider factors like seller identity and asset authenticity, token value and rarity, liquidity, transaction costs, and the overall trend of the crypto market and macroeconomics.

In addition, trending games or topics and the NFT’s own trading volume are other influential aspects on price that investors in this field should pay attention to.