Cryptocurrencies were created with the aim of protesting against the traditional banking system and establishing a decentralized financial system, in an environment called a "distributed ledger.

Today, cryptocurrencies have uses beyond money transfer for market participants [investment, mining, and trading] and businesses [blockchain network development, supply chain management, financing and lending, marketing, and more].

However, this industry is not without its flaws and challenges. For instance, digital currency's decentralized and untraceable nature makes it an attractive tool for illegal activities.

Additionally, scalability and high energy consumption in Proof of Work (PoW) mechanisms pose challenges for some crypto projects.

What Is a Cryptocurrency?

Cryptocurrency is a form of virtual money that uses blockchain, a decentralized database, for encryption algorithms and asset security, unlike traditional currencies, which governments and financial institutions back. Cryptocurrency tutorial video from Binance YouTube channel:

Introduction to the Best Exchanges Cryptocurrency

In the crypto market, choosing an exchange is not just about having a place to buy and sell; rather, factors such as the liquidity of cryptocurrency trading pairs, the depth of the order book, the quality of the matching system, and the coverage of trading tools must be considered.

Exchanges that are recognized as top-tier globally usually stand out among professional traders by offering professional APIs, futures and margin trading options, as well as multi-layered security. Four examples of the best cryptocurrency exchanges:

- Binance

- Coinbase

- KuCoin

- OKX

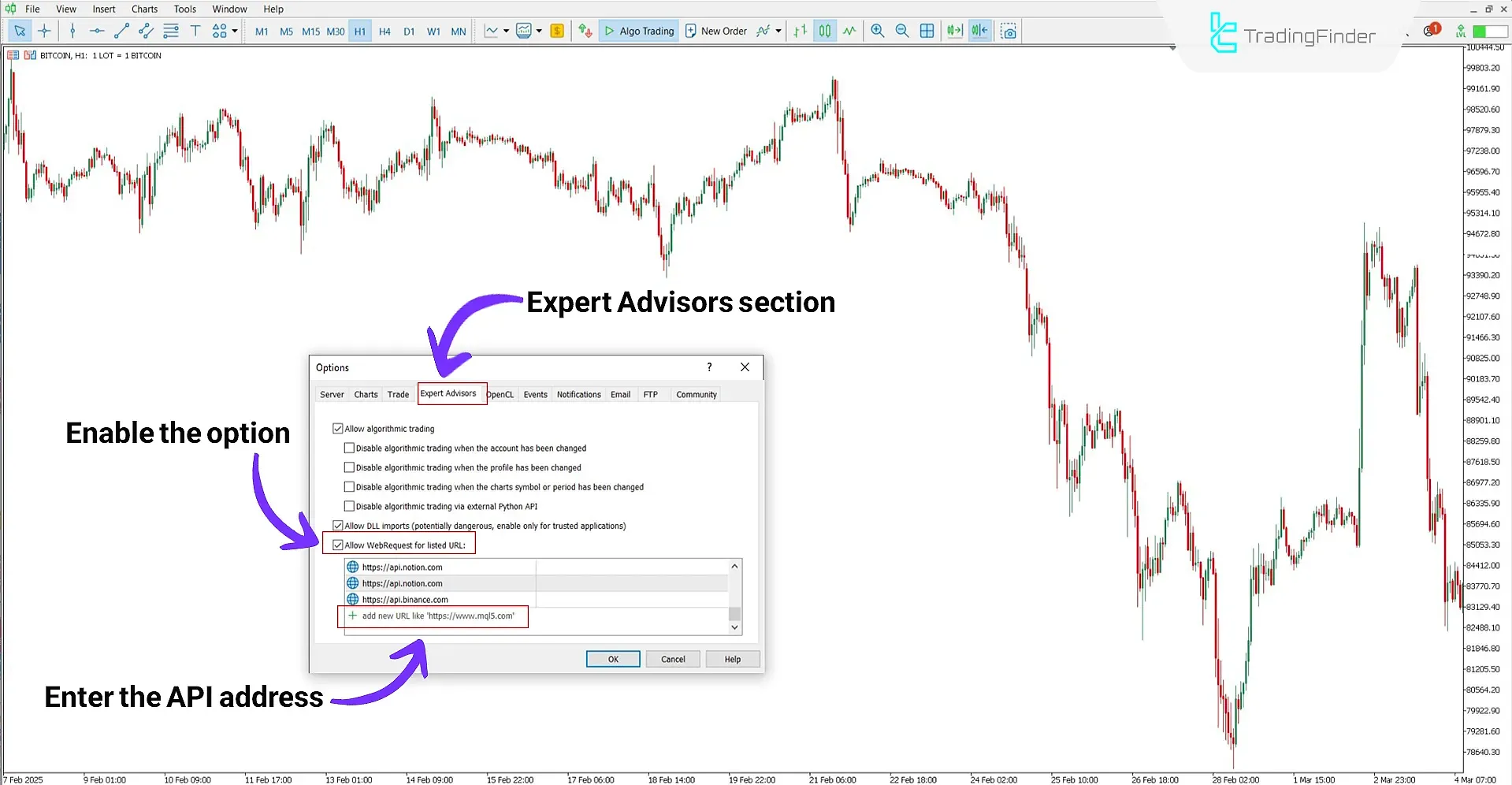

Binance Spot Connection Indicator for MetaTrader 5

The Binance Spot connection service to MetaTrader 5 is one of Trading Finder’s products, acting as a bridge between Binance Exchange and the MT5 environment.

This tool is solely responsible for transferring cryptocurrency price data and does not perform any trading operations.

Binance Spot market data is received via the official API and displayed as precise charts in MetaTrader 5.

Data transfer is carried out using the WebRequest feature in MetaTrader.

To activate it, you must select the option Allow WebRequest for listed URL in the settings and manually add the domain api.binance.com. This ensures a secure connection between Binance servers and the platform.

After running the expert advisor, users can enable their desired symbols from the Binance Spot market in the Market Watch section and view their charts in various timeframes. This allows popular pairs like BTC/USDT or ETH/USDT to be available in real time.

The internal settings of this service are also highly flexible. One of the most important options is defining the number of downloadable candles, which should be between 300 and 10,000.

Another option specifies whether, if a symbol is open in multiple charts, the number of loaded candles will be the same for all of them or not.

When this option is enabled, all charts of the same symbol receive identical data, but when disabled, each timeframe calculates its own price data independently.

Tutorial video for using the Binance-to-MT5 connection service:

These features allow traders to analyze a symbol’s charts across different timeframes either in full synchronization or separately.

Ultimately, the Binance Spot connection service to MetaTrader 5 is an efficient tool for analysts who need accurate live cryptocurrency market data within MT5.

It should be noted that this indicator currently works only on MetaTrader 5, and similar connections to other exchanges are also available on the Trading Finder website:

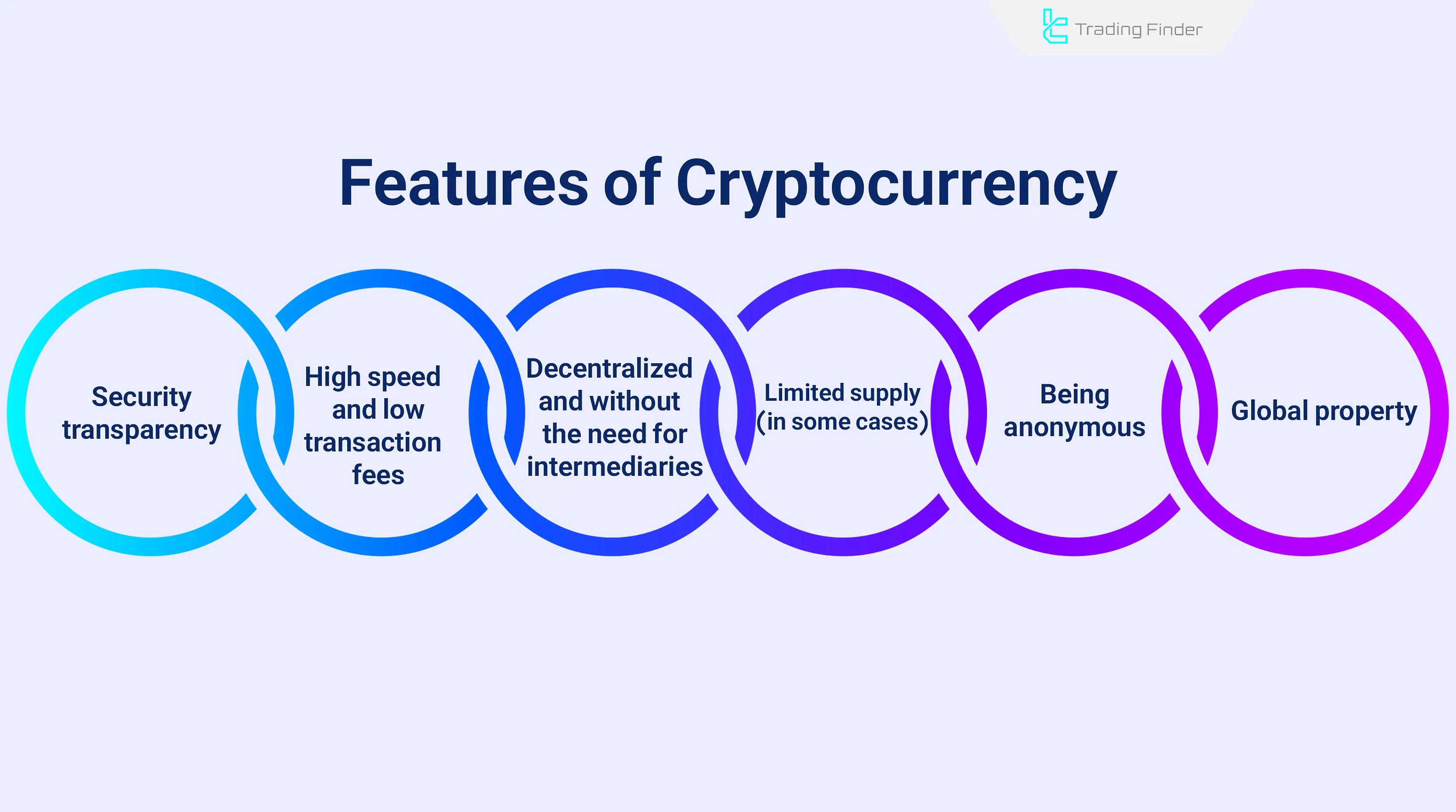

What Are the Features of Cryptocurrencies?

Decentralization and independence from any government or financial institution are among the most important features of a digital currency.

This very attribute makes digital currencies a revolutionary element in the financial sector and represents the primary difference between cryptocurrencies and fiat money.

Features of cryptocurrencies:

- High Transparency: All transactions are recorded on the blockchain and are publicly visible. While every user can access transaction history, individual identities remain anonymous;

- High Security: Cryptocurrency data is highly secure due to encryption with hash algorithms on the blockchain. Altering this data would require a 51% attack control by the majority of miners which is virtually impossible;

- Fast Transactions & Low Fees: Withcryptocurrencies, international transactions can be completed within minutes and at very low fees, whereas traditional systems may take days to transfer money;

- Decentralized and Peer-to-Peer (P2P): Digital currencies are decentralized, cryptocurrency meaning no institution has full control over them. Also, Cryptocurrency transactions are processed without intermediaries;

- Limited Supply: Some cryptocurrencies (like Bitcoin) have a limited supply of coins, helping them maintain value in the long term;

- Anonymity: Instead of displaying users’ names in each transaction, only the wallet address appears;

- Global Asset: Digital currencies are usable across borders without limitations and is unaffected by political or economicsanctions.

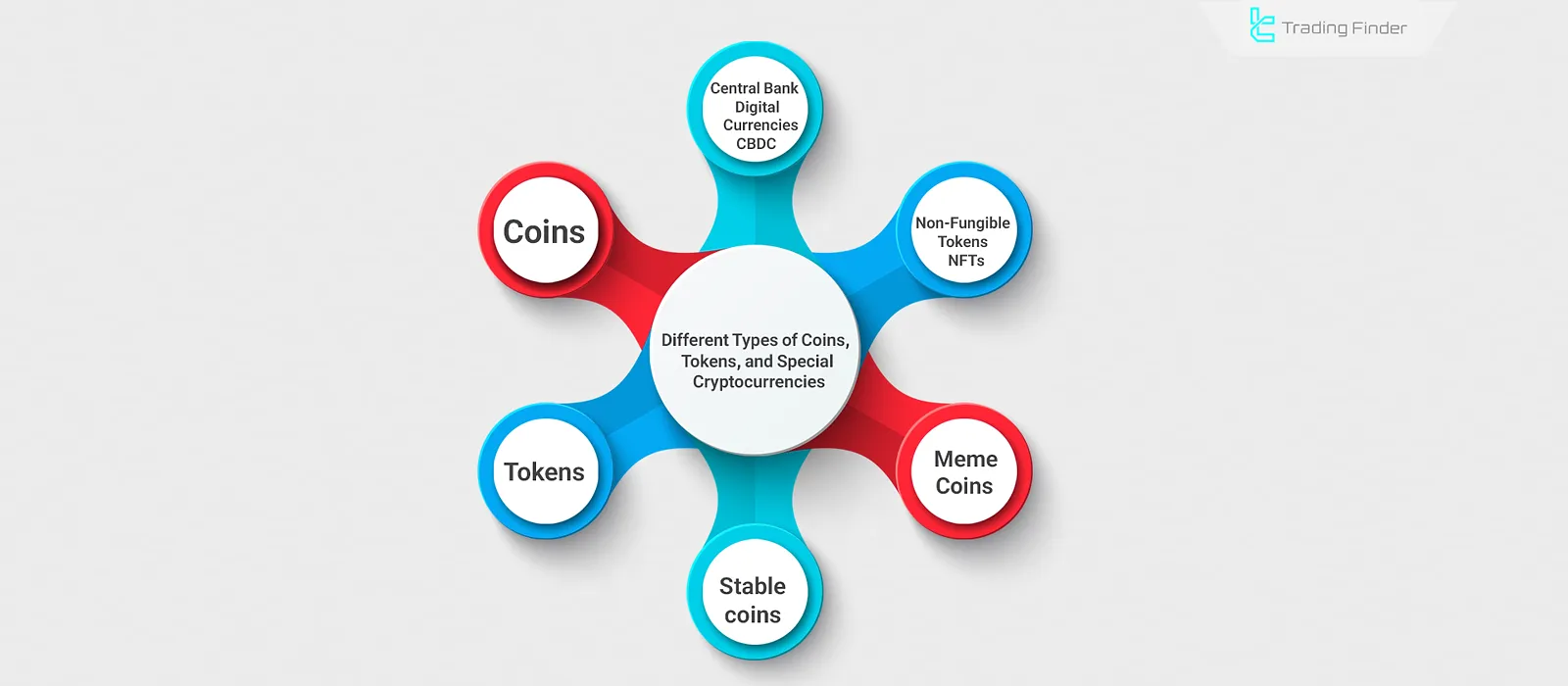

Introduction to Types of Cryptocurrencies

Each type of cryptocurrency has different functions, ranging from payments and network fees to voting rights in projects or even ownership of real-world assets. Becoming familiar with these categories helps determine the right approach to investing. Types of cryptocurrencies:

- Stablecoins: These Digital tokens are pegged to stable assets such as the U.S. dollar or gold, and their value remains steady against market fluctuations;

- Meme Coins: Cryptocurrencies created for humor or entertainment, whose value is usually influenced by hype and cryptocurrency news;

- Non-Fungible Tokens (NFTs): These unique tokens represent digital ownership of assets such as artworks, real estate, or in-game items;

- Central Bank Digital Currencies (CBDCs): Developed by central banks of different countries, these currencies are centralized and regulated by governments, unlike other cryptocurrencies;

- Coins: These currencies have their own dedicated blockchains and operate independently of other assets. For example, Bitcoin and Ethereum are considered coins;

- Tokens: Unlike coins, tokens are usually built on other blockchains. For instance, many tokens such as UNI or LINK are created on the Ethereum network.

In addition, there are other specific types of cryptocurrencies that have different characteristics:

- Transactional: Cryptocurrencies whose main purpose is to facilitate financial transactions and serve as a means of payment;

- Utility: Tokens designed for use within a specific network, functioning as payment for fees or access to services within that network;

- Governance: Digital assets that grant their holders voting rights and participation in the decision-making of a project or blockchain network;

- Platform: Cryptocurrencies that serve as the infrastructure for running smart contracts, decentralized applications, and other blockchain services;

- Security Tokens: Digital assets that represent ownership of a real-world or financial asset, often issued in tokenized form.

Comparison of different types of coins, tokens, and special cryptocurrencies

In the world of cryptocurrencies, coins are currencies with their own dedicated blockchains, while tokens are built on existing blockchains.

In addition, there are special categories such as stablecoins, meme coins, NFTs, and CBDCs, each with their own unique applications and characteristics. Comparison table of types of coins, tokens, and special cryptocurrencies:

Type | Dedicated blockchain | Value stability | Main application | Risk level | Well-known examples |

Stablecoin | No (built on an existing blockchain) | Stable (equivalent to fiat currency) | Store of value, fast payments | Low | USDT, USDC |

Meme Coin | Usually no | Highly unstable | Speculation, community-driven | Very high | Dogecoin, Shiba |

Non-Fungible Token (NFT) | No (built on blockchains) | Unstable | Digital ownership of works and items | High | Bored Ape, CryptoPunks |

Central Bank Digital Currency (CBDC) | Yes (under central bank management) | Stable (official backing) | Official payments and financial transparency | Very low | Digital yuan (China) |

Difference Between Digital Currency and Cryptocurrency

Digital currency is a general term that refers to any type of money that has no physical form such as banknotes or coins and exists only electronically.

For example, a bank account balance or money transferred via a credit card is also a type of digital currency, since it is recorded only as data and has no physical existence.

Cryptocurrency is a subset of digital currency that operates using cryptography and blockchain technology.

Cryptocurrencies are managed in a decentralized manner, ensuring transaction security through cryptographic algorithms, and they cannot be directly controlled by any central authority or government. Table of differences between digital currency and cryptocurrency:

Name | Definition | Advantages | Disadvantages | Practical Example/Key Points |

Digital Currency | Any type of non-physical money that exists only as electronic data and is managed by central entities (such as banks). | Fast banking transactions, ease of transfer, reduced need for cash | Centralization and full dependence on financial institutions and governments | Bank account balance, money transfer via credit card or banking apps |

Cryptocurrency | A subset of digital currency that is created and managed on the blockchain using cryptographic algorithms. | Decentralization, high security due to cryptography, transaction transparency, global transfer capability | High price volatility, need for technical knowledge, high investment risk | Bitcoin, Ethereum, Tether – used for online purchases, investment, and trading in financial markets |

In general, all cryptocurrencies are digital currencies, but not all digital currencies are considered cryptocurrencies.

The main difference is that regular digital currencies (such as electronic bank money) are managed by central entities, while cryptocurrencies operate on blockchain technology and in a decentralized manner.

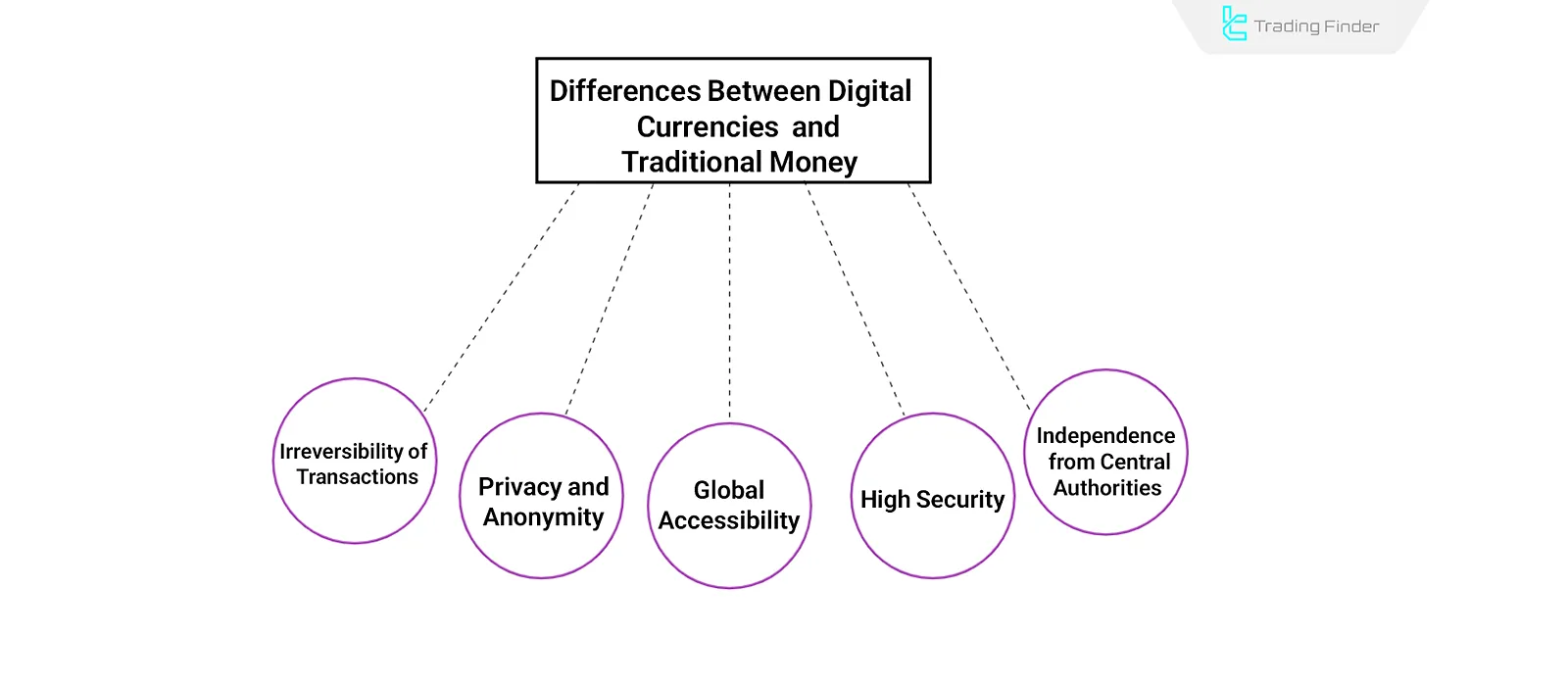

Differences Between Digital Currencies and Traditional Money

One of the most important differences between digital currencies and regular money lies in features that do not exist in traditional financial systems. Some key characteristics that distinguish digital currencies from fiat money are:

Feature | Digital Currency | Traditional Money (Fiat) |

Transaction Reversal | Transactions are irreversible and can only be refunded with the recipient’s consent | Transactions can be traced, canceled, or modified through banks |

Privacy | Identity information is not displayed | Users’ identity information is traceable in the banking system |

Global Accessibility | Fast and direct transfers from anywhere to anywhere in the world without intermediaries | International transfers are time-consuming, costly, and dependent on banking intermediaries |

Security | Security based on cryptography and decentralized networks (public/private keys) | Security dependent on the infrastructure of banks and governments |

Centralization | Decentralized and independent of financial institutions or governments | Fully centralized and controlled by central banks and governments |

Irreversibility of Transactions

Unlike the banking system, where mistaken transactions can be canceled or traced, in cryptocurrencies, once a transaction is confirmed, reversing or changing it is practically impossible unless the recipient voluntarily returns the funds.

Privacy and Anonymity

In banking systems, users’ identity information is directly visible in transactions.

However, in cryptocurrencies, Cryptocurrency wallet addresses do not reveal personal data, and most transactions are anonymous or semi-anonymous—especially on networks like Monero or Zcash, which are privacy-focused.

Global Accessibility

Unlike traditional money, which may require multiple intermediaries and significant time for transfers, cryptocurrencies can be sent directly and quickly from any point to another. This makes transactions global and borderless.

High Security

In cryptocurrencies, transaction security is ensured by a network of users collectively responsible for maintaining and verifying records.

In addition, the public/private key system allows users to have exclusive access to their assets, and no one can control them without the private key.

Independence from Central Authorities

When using cryptocurrencies, there is no need for permission or opening accounts with banks or financial institutions. Blockchain networks are open and decentralized, accessible to everyone, and anyone can easily participate.

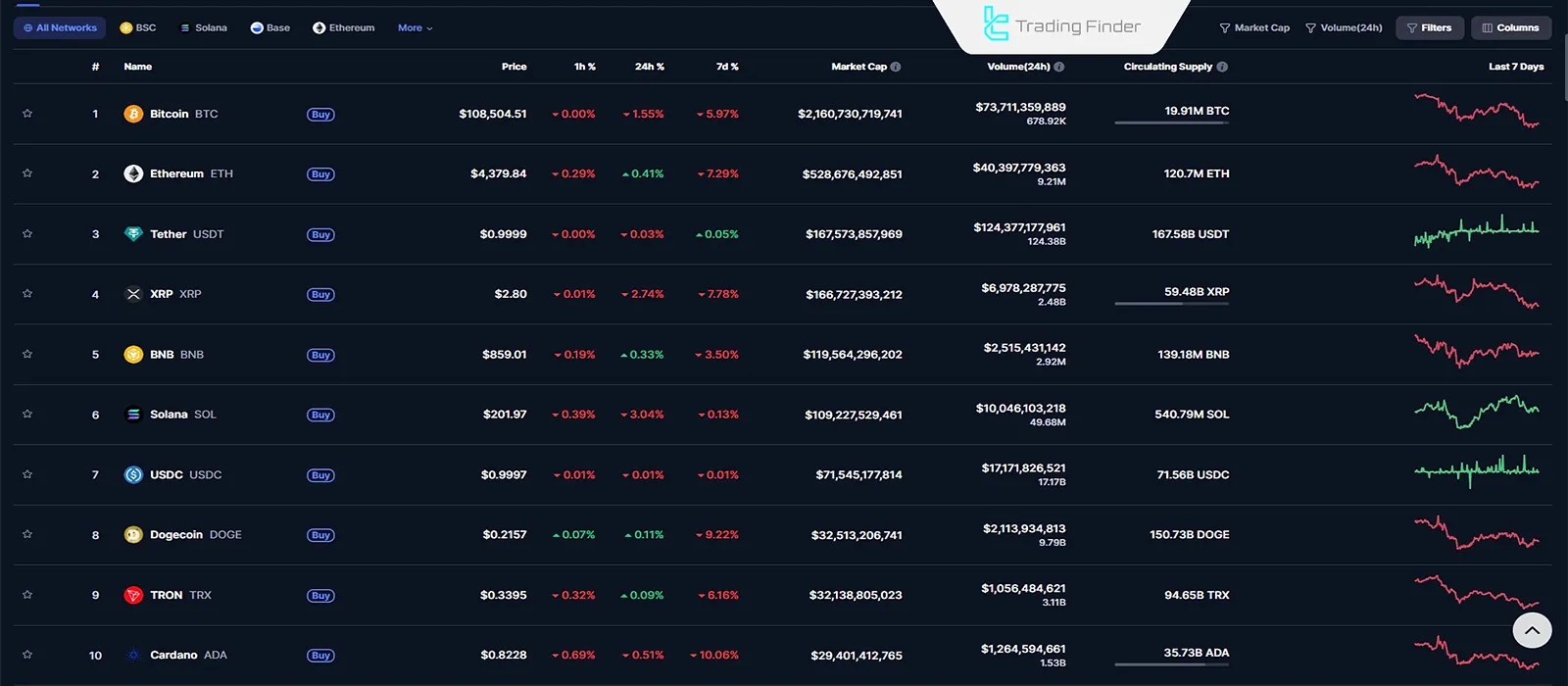

Names of Cryptocurrencies in the Market; Introduction to the Best Cryptos

The top cryptocurrencies in the market each have unique features. Bitcoin (BTC) is known as “digital gold”, Ethereum (ETH) provides the foundation for smart contracts, and Tether (USDT) and USDC are stablecoins used to preserve value during market volatility.

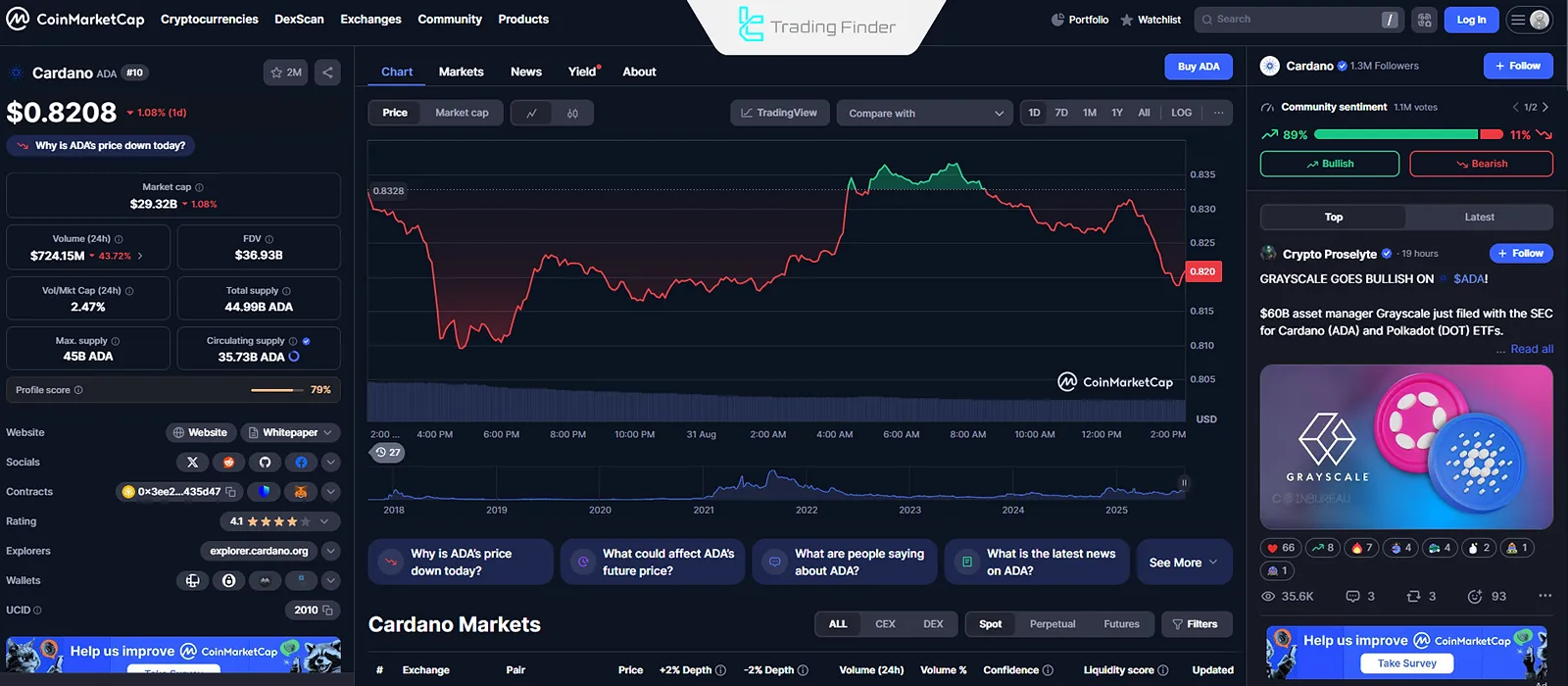

Ripple (XRP) and Binance Coin (BNB) are designed to facilitate transactions, while Solana (SOL) and Cardano (ADA) focus on speed and scalability. These assets have had a major impact on the digital markets.

To view the top cryptocurrencies, one can use CoinMarket Cap. Top 10 cryptocurrency list:

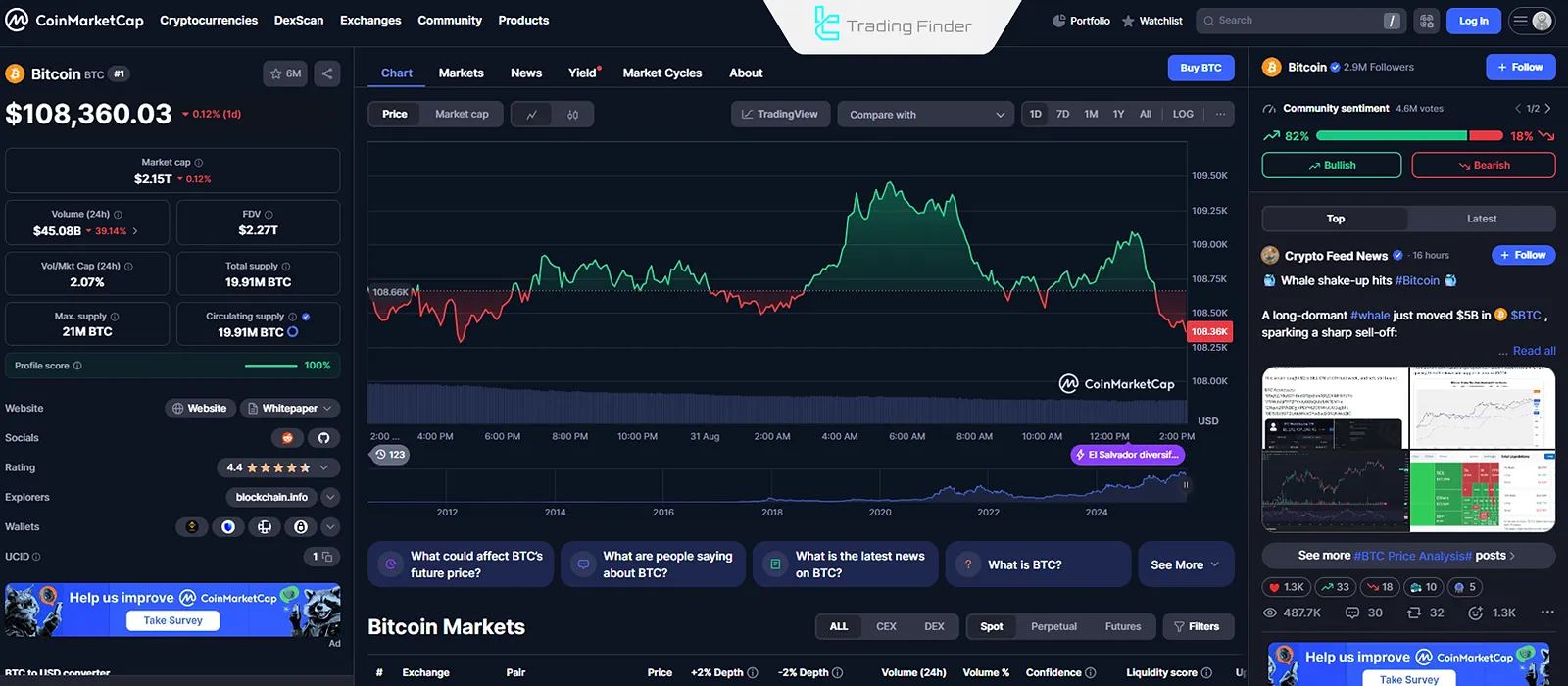

Bitcoin (BTC)

As the first cryptocurrency ever created, Bitcoin is the most well-known and largest digital asset. Many refer to it as “digital gold,” and it is primarily used for storing value and financial transactions.

Due to its decentralization and high security, Bitcoin is considered a safe asset in financial markets.

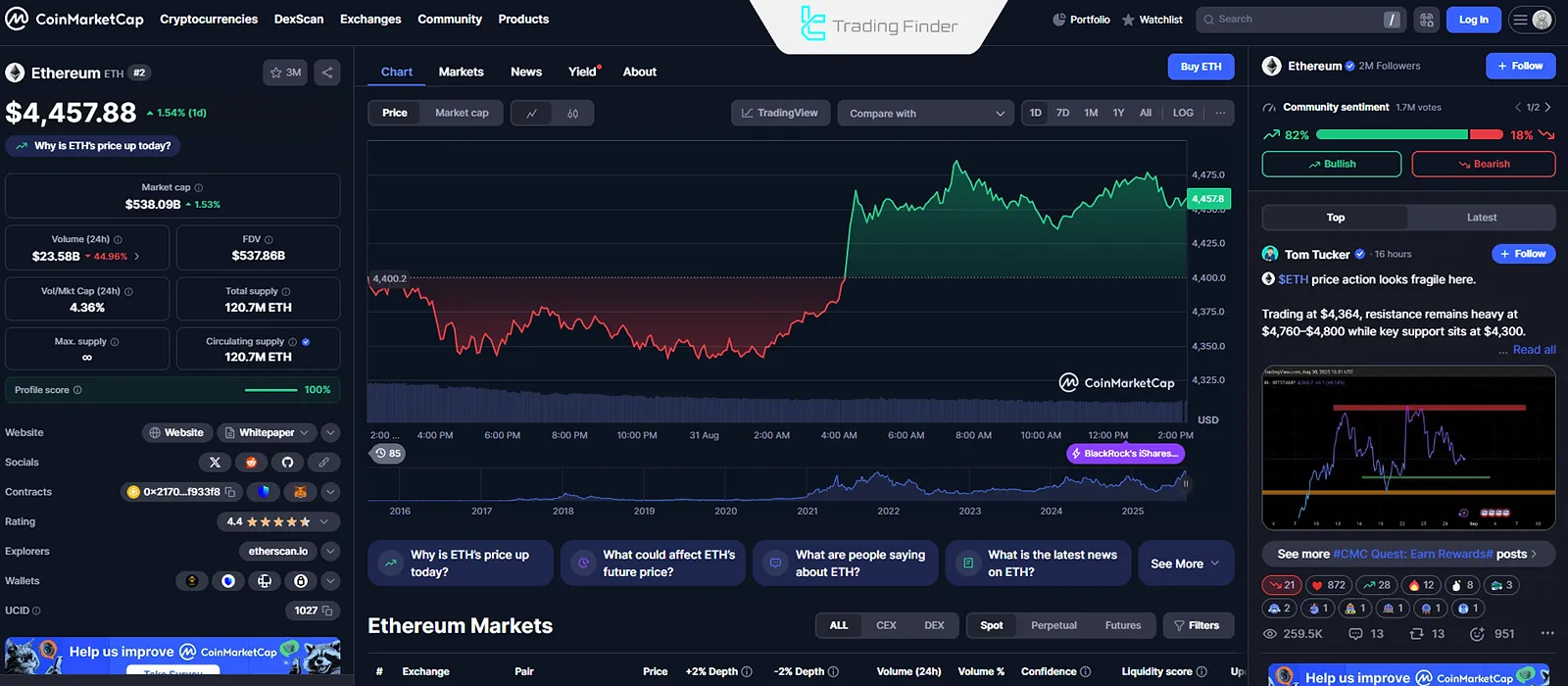

Ethereum (ETH)

Ethereum is a decentralized cryptocurrency that enables the execution of smart contracts and the creation of decentralized applications (DApps).

It has pioneered many innovations in the blockchain industry, and its native currency, Ether, is used to process transactions and run contracts on the network.

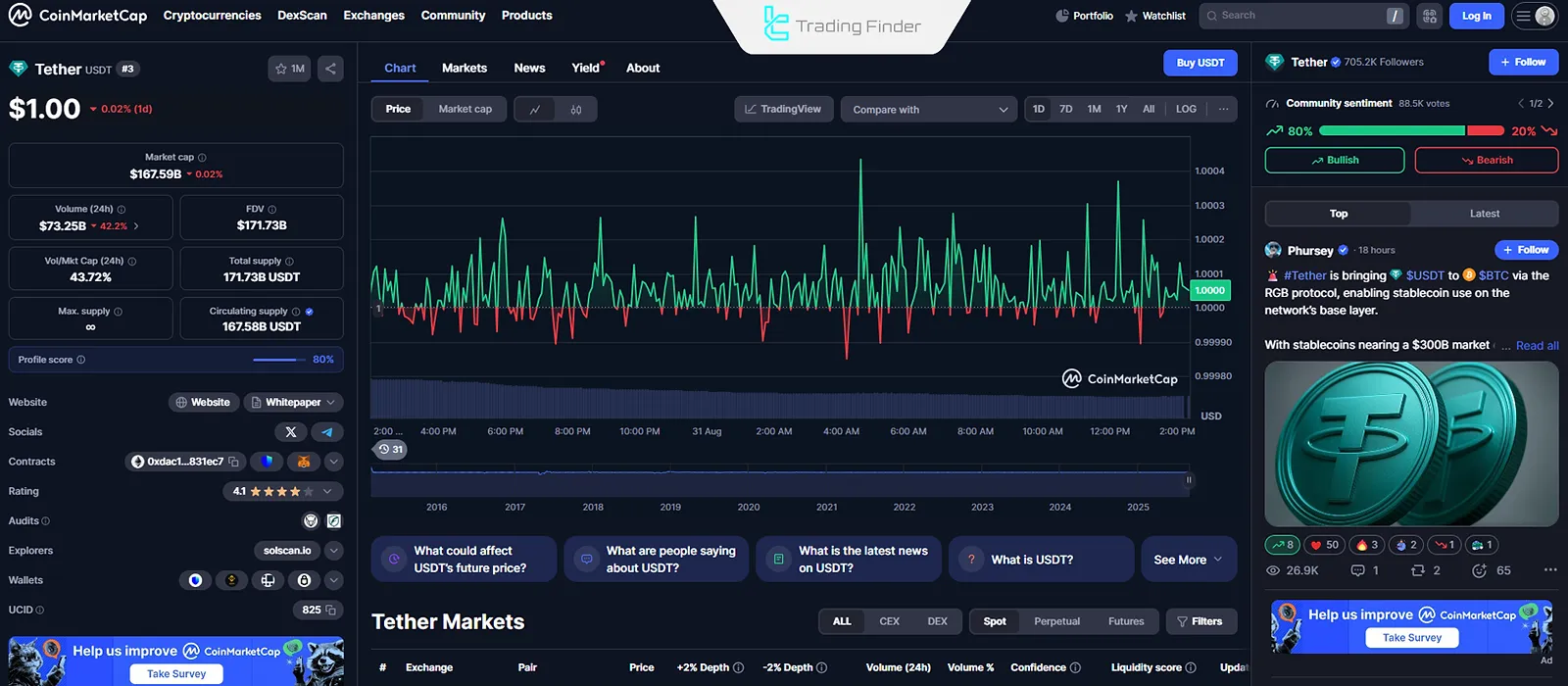

Tether (USDT)

Tether is a stablecoin pegged to the U.S. dollar. For this reason, it is used as a tool to preserve value and reduce volatility in the market. During times of instability, it serves as a safe alternative to other cryptocurrencies.

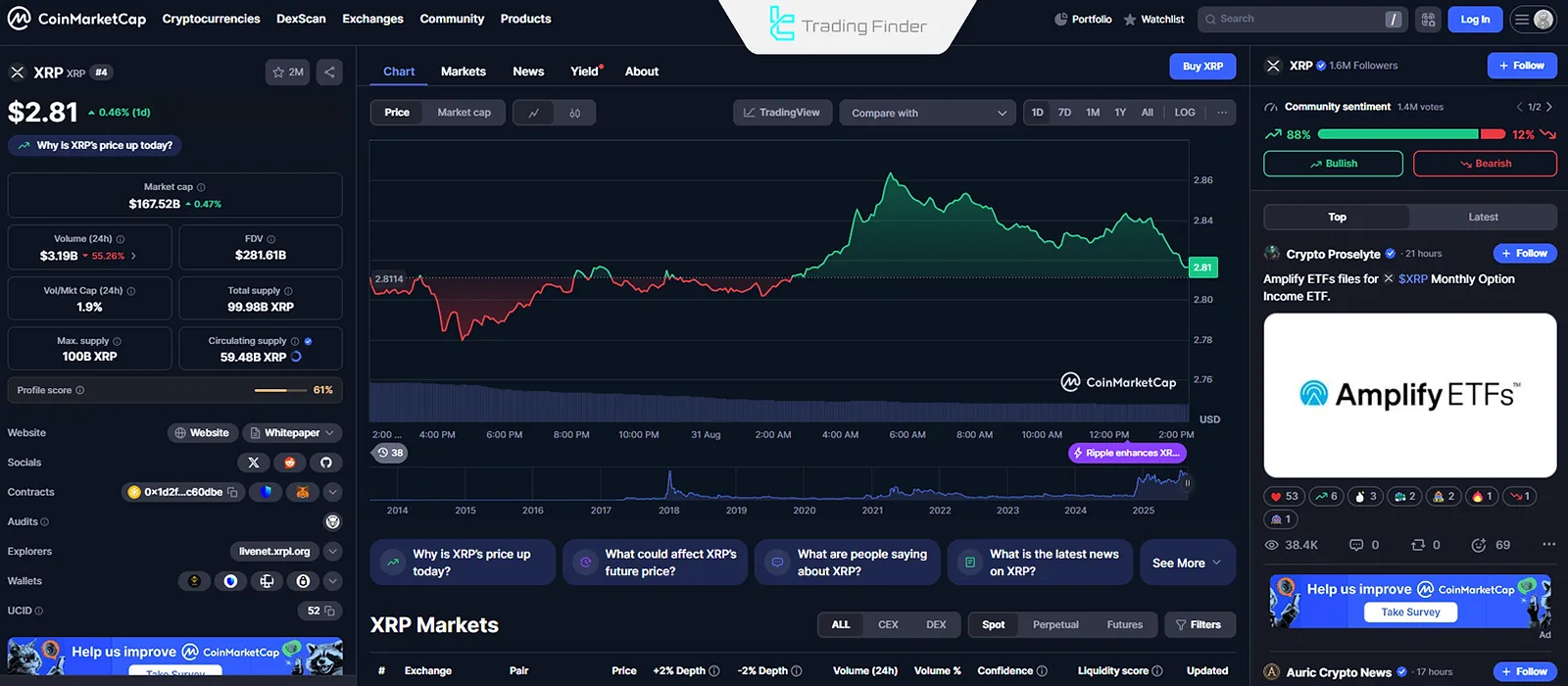

Ripple (XRP)

Designed to facilitate international financial transactions and reduce their costs, Ripple acts as a payment tool within its network. Banks and financial institutions use it for faster and cheaper cross-border money transfers.

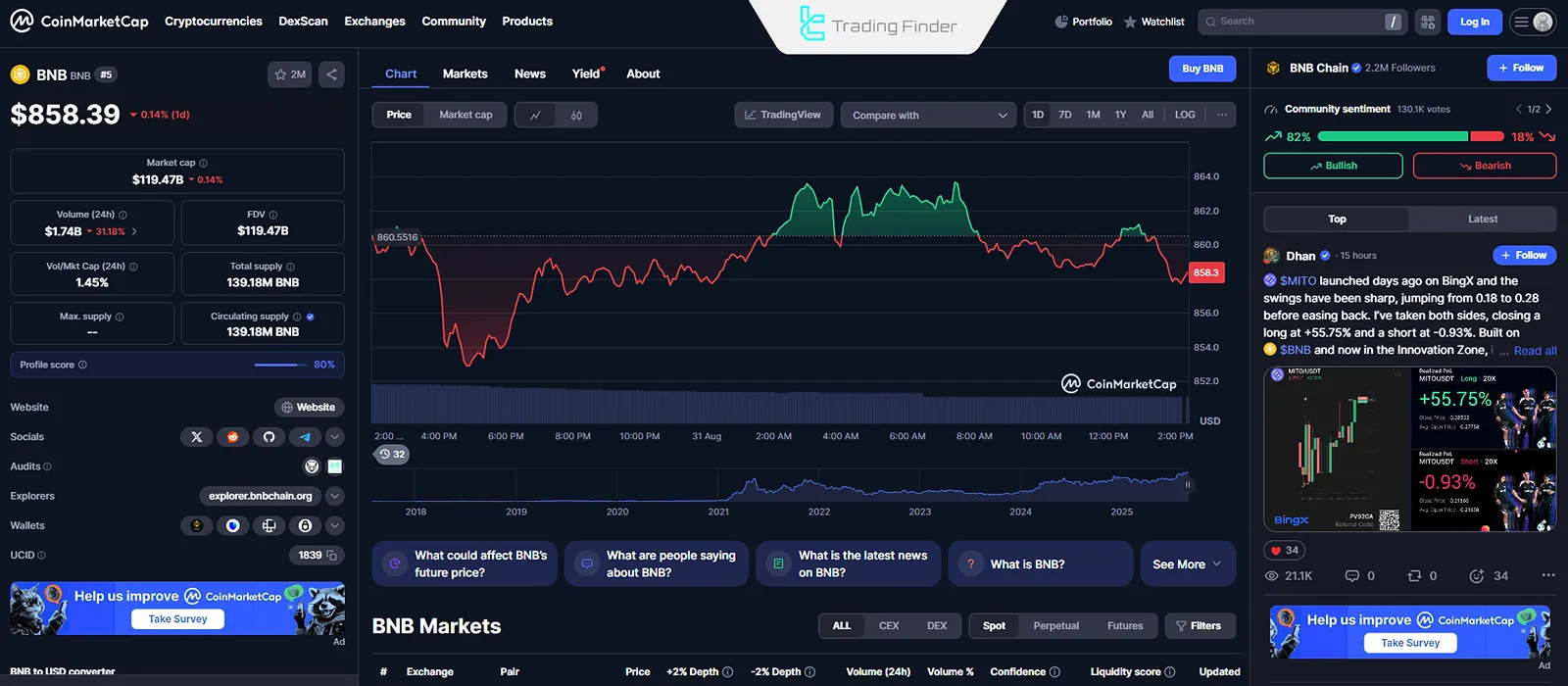

Binance Coin (BNB)

The Binance token is used on the Binance exchange to pay fees and conduct trades. Additionally, Binance uses BNB in areas such as DeFi and the development of different ecosystems.

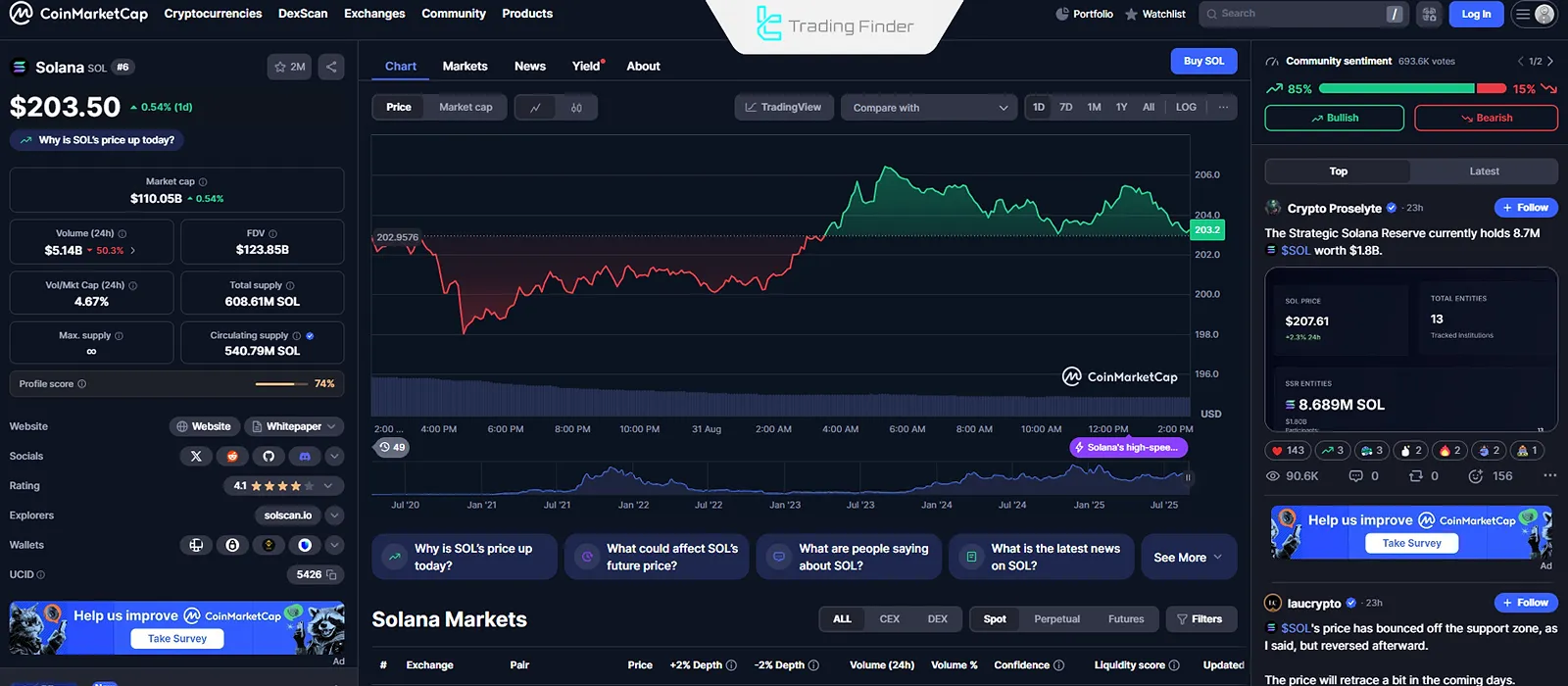

Solana (SOL)

Solana is a high-speed, low-cost blockchain for transactions. It is well-suited for running smart contracts and decentralized applications and has attracted attention due to its scalability and low fees.

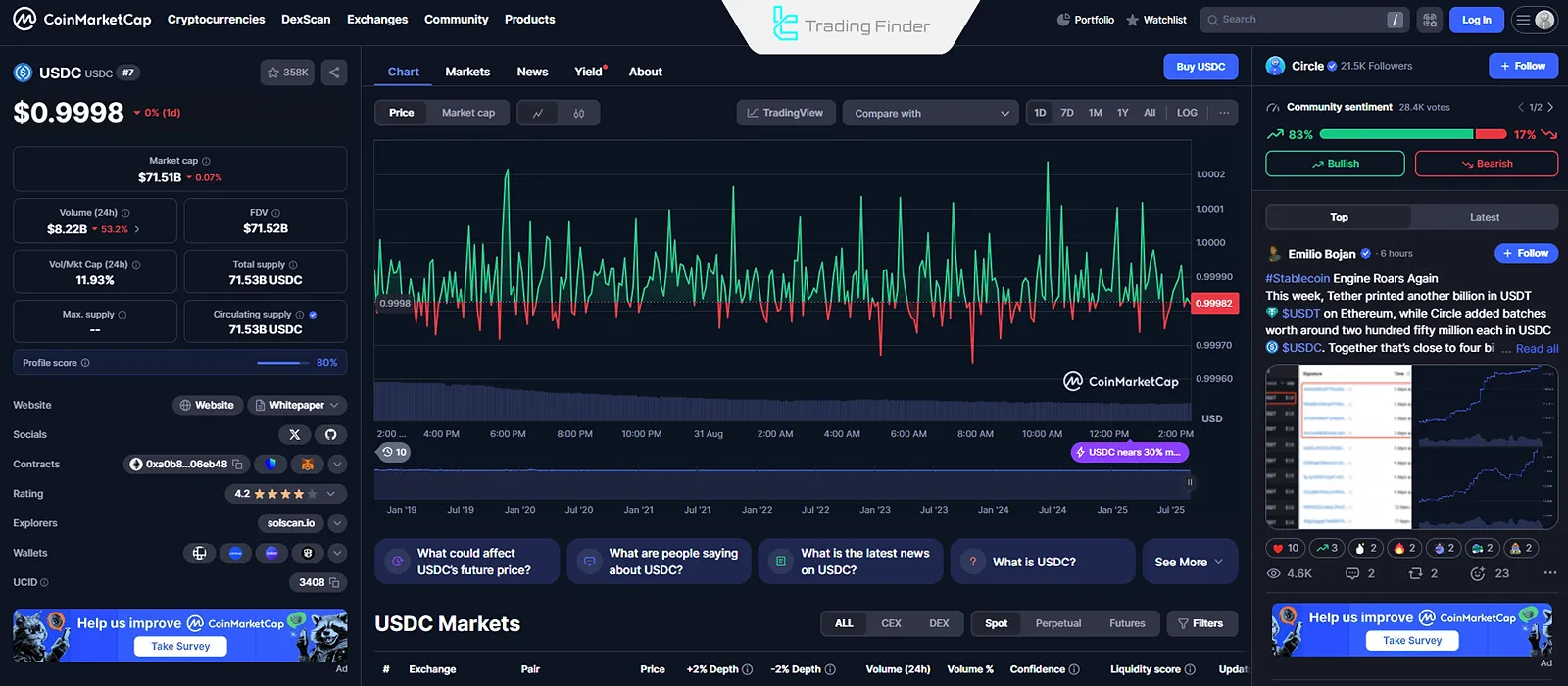

USD Coin (USDC)

Like Tether, USDC is also a stablecoin pegged to the U.S. dollar. It is used in crypto trading to reduce volatility and serves as a safe tool for storing value.

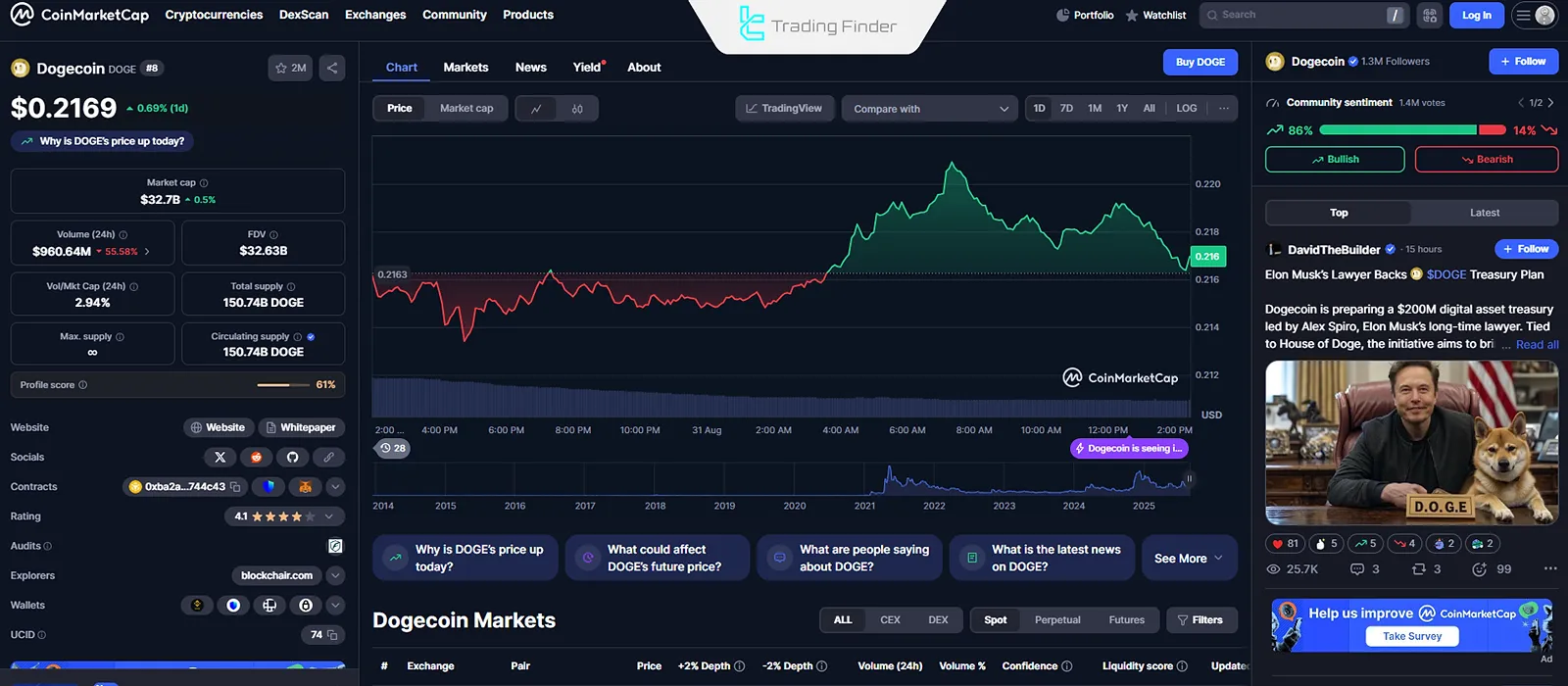

Dogecoin (DOGE)

Originally created as a joke, Dogecoin has become one of the most popular cryptocurrencies thanks to public support and promotion by figures like Elon Musk. It is mainly used for small transactions and sometimes for tipping.

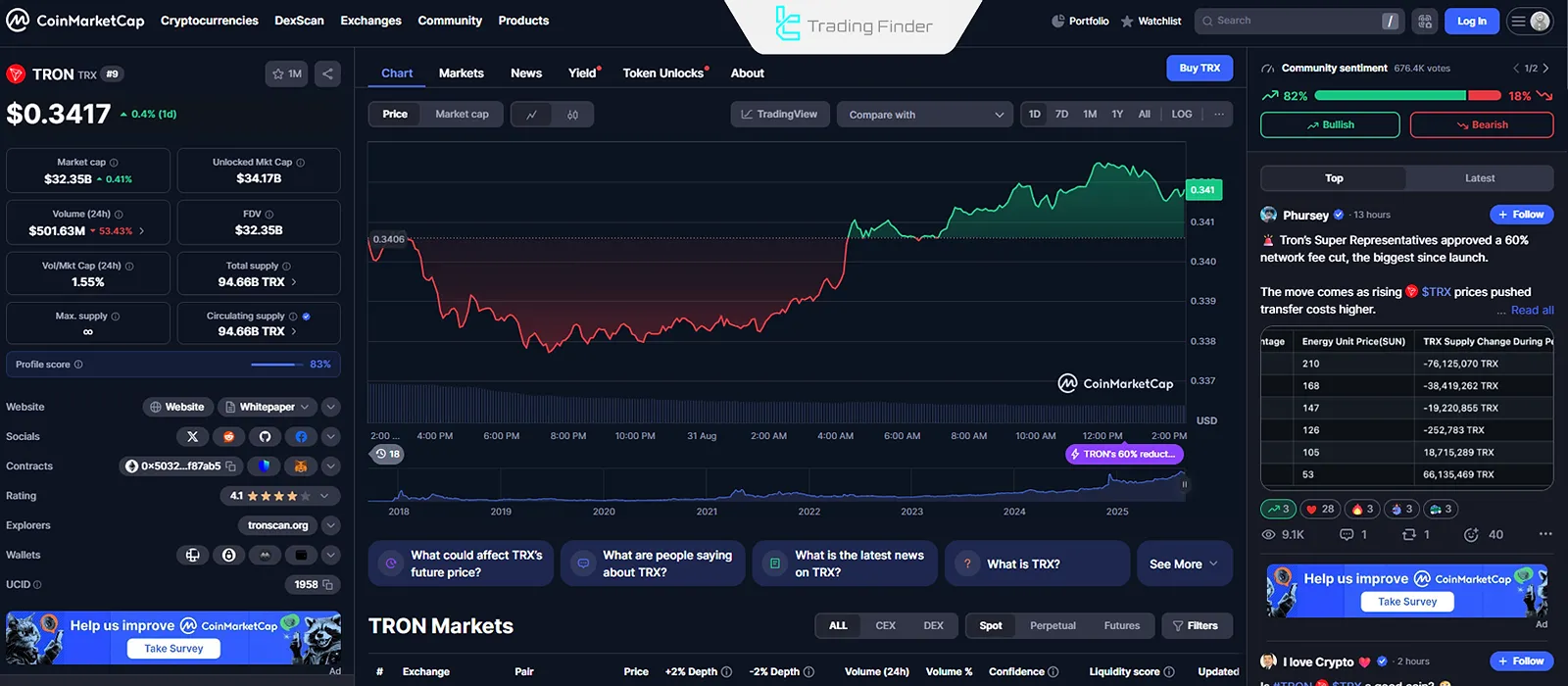

Tron (TRX)

Tron is a decentralized platform designed for content and media exchange. Its goal is to eliminate intermediaries and provide a fast, low-cost way for digital transactions.

Cardano (ADA)

Cardano is a blockchain project with a strong focus on security and scalability. It operates using the Proof of Stake (PoS) algorithm and aims to create a sustainable ecosystem for smart contracts and decentralized applications.

History of Cryptocurrencies

Digital currencies did not emerge overnight; they result from several decades of research in cryptography, decentralized economics, and payment technologies.

Similar concepts had been proposed before Bitcoin, but they failed due to insufficient adoption.

David Chaum – The Father of Digital Money and Privacy

In the 1980s, American computer scientist David Chaum introduced the concept of anonymous digital money. In 1989, he founded DigiCash, whose primary product was eCash, an electronic Digital payment system based on cryptography.

Though Chaum collaborated with reputable banks, DigiCash failed due to bank opposition and a lack of public trust in digital money. Nevertheless, his theories and papers laid the groundwork for the creation of Bitcoin.

The Birth of Bitcoin in 2009

The rise of Bitcoin is closely tied to the 2008 global financial crisis. During this period, major banks like “Lehman Brothers” collapsed, and governments printed billions of dollars to save the banking system leading to inflation and devaluation of fiat currencies.

Bitcoin was created by an anonymous person or group named Satoshi Nakamoto. It aimed to establish a decentralized, peer-to-peer payment system that eliminated the need for banks and traditional financial intermediaries.

It served as a protest against the centralized banking system and a solution to its shortcomings.

On May 22, 2010, the first-ever Bitcoin financial transaction occurred. A programmer named “Laszlo Hanyecz” bought two pizzas for 10,000 Bitcoins (worth about $41 at the time).

This event marked a pivotal moment in the adoption of Bitcoin as a legitimate payment system and is now celebrated as Bitcoin Pizza Day.

Why Did Bitcoin Succeed While DigiCash Failed?

The success of Bitcoin compared to the failure of DigiCash can be attributed to structural differences and public trust.

Reasons Behind Bitcoin’s Success:

- Perfect Timing: Bitcoin was launched after the 2008 financial crisis, during a period of deep mistrust in the banking system;

- Decentralization: Unlike DigiCash, Bitcoin is decentralized and does not cooperate with banks;

- Limited Supply: Unlike fiat currencies, Bitcoin has a maximum supply of 21 million coins, giving it an anti-inflationary characteristic.

The Emergence of Altcoins After Bitcoin

After Bitcoin, other digital currencies emerged to offer enhanced capabilities. These alternatives are known as altcoins. The first altcoins introduced after Bitcoin include:

- Litecoin: Offers faster transaction speeds compared to Bitcoin’s network. It also uses a different mining algorithm, leading to lower energy consumption;

- Ripple (XRP): Focuses oninternational payments within the banking system. For example, financial institutions use Ripple for cross-border transactions, which are much faster than traditional systems like SWIFT;

- Dogecoin: A meme coin initially created for funand tipping online content creators. Dogecoin gained massive attention in 2021 due to Elon Musk’s comments, reaching a price of $0.74;

- Ethereum: Launched in2015 by Vitalik Buterin, Ethereum introduced revolutionary features such as smart contracts and decentralized applications (DApps).

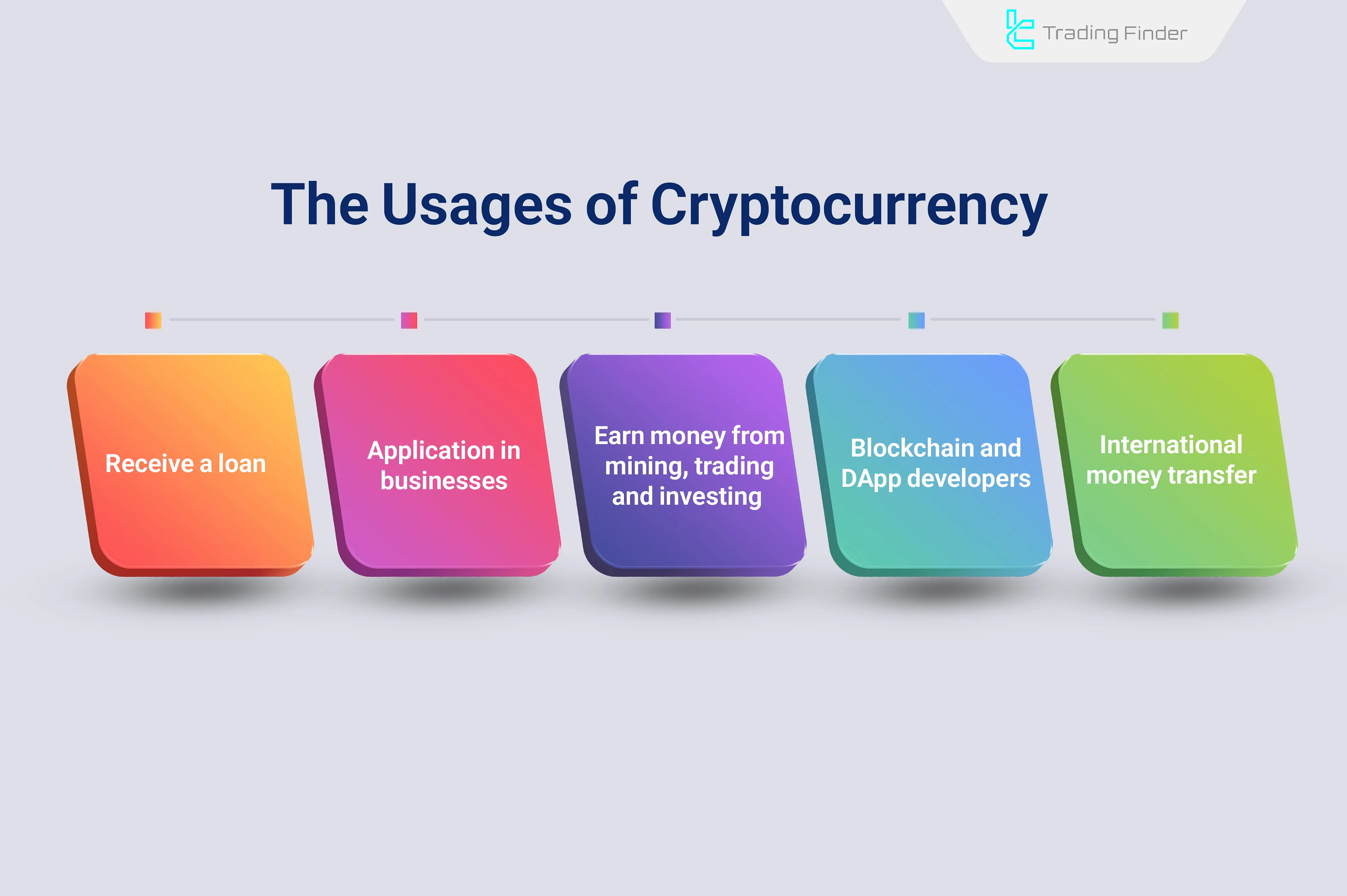

What Are the Use Cases of Digital Currencies?

In addition to being a secure and rapid money transfer tool, digital currencies serve a wide range of purposes for investors and businesses.

Major Use Cases of Cryptocurrencies:

- Trading and Investing: While the Cryptocurrency market is highly volatile, traders can profit using proper market cycles and trading strategies;

Note: The Cryptocurrency market is relatively new and has a small market cap, resulting in high volatility and risk. Therefore, knowing the key points of trading in cryptocurrencies is essential;

- Blockchain and DApp Development: Developers can launch their own digital currency through innovative ideas in areas such as the metaverse, healthcare, education, art, gaming, and more;

- International Money Transfers: Digital currencies like Ripple, Stellar, and Solana enable cross-border transactions that are faster and cheaper than traditional payment systems;

- Mining for Passive Income: Miners can earn rewards by verifying network transactions using either Proof of Work (PoW) hardware or staking in Proof of Stake (PoS) systems;

- Business Adoption: Companies in DeFi, metaverse, and NFTs increasingly utilize digital currencies. Some businesses also accept cryptocurrency as payment or use Bitcoin or crypto-related ETFs as financial tools;

- Lending and Borrowing: DeFi services allow fast, collateral-free loans. Users can lock their digital currency assets as collateral to borrow funds without selling their holdings.

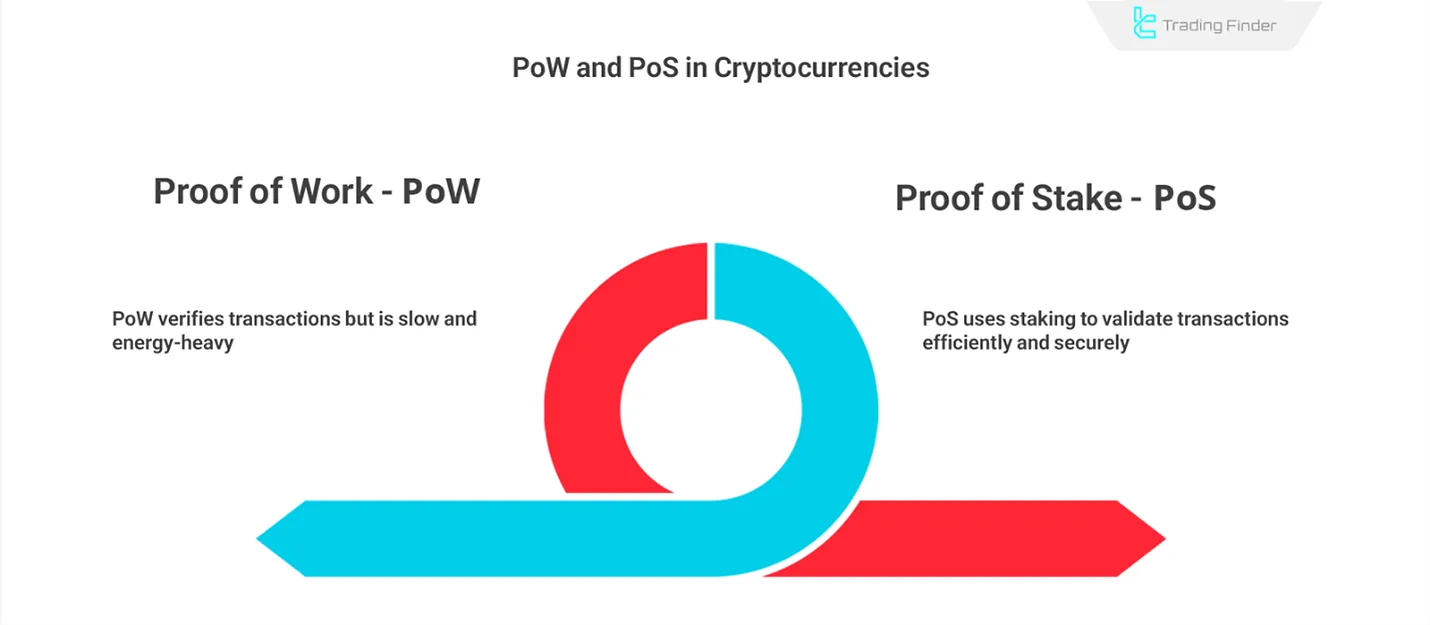

What Are PoW and PoS in Cryptocurrency?

Proof of Work (PoW) and Proof of Stake (PoS) are two common consensus algorithms in blockchain networks whose purpose is to validate and record transactions on the blockchain, but they use different methods to achieve this.

The Proof of Work (PoW) algorithm is based on solving complex computations by miners, providing strong security but consuming large amounts of energy, while Proof of Stake (PoS) works by locking tokens and selecting validators. PoW vs. PoS Comparison Table:

Feature | Proof of Work (PoW) | Proof of Stake (PoS) |

Transaction validation method | Solving mathematical problems by miners | Staking coins by validators |

Processing requirements | Very high, requires powerful hardware | Low, no need for specialized hardware |

Energy consumption | High | Very low |

Speed and scalability | Low | Higher |

Example networks | Bitcoin, Ethereum before the Merge | Ethereum after the Merge, Cardano |

Proof of Work (PoW)

In this algorithm, miners validate transactions and create new blocks by solving complex mathematical problems. This process requires significant computational power, and miners must use substantial hardware and energy resources to solve these cryptographic puzzles.

Bitcoin and Ethereum (before transitioning to PoS) used PoW. One of its main drawbacks is high energy consumption and limited scalability.

Example of Proof of Work (PoW) in Cryptocurrencies

For instance, in the Bitcoin network, which operates on PoW, miners use powerful hardware such as ASICs to solve cryptographic equations.

The first miner to solve the equation adds a new block of transactions to the blockchain and, in return, receives a reward in the form of newly minted Bitcoin.

Proof of Stake (PoS)

In this algorithm, validators confirm transactions and create blocks by staking a certain amount of the network’s cryptocurrency (locking it in the system).

Unlike PoW, this method does not require high computational power. Instead, network security is ensured through the amount of staked currency.

Ethereum transitioned to PoS after the Merge update. This algorithm offers advantages such as lower energy consumption and faster transaction speed.

Example of Proof of Stake (PoS) in Cryptocurrencies

For example, in the Ethereum 2.0 network, which uses PoS, instead of mining with high energy consumption, users can stake at least 32 ETH to become validators. Validators propose new blocks and confirm transactions, earning rewards in return.

What Is Crypto Staking?

Crypto staking is a process in which users lock a certain amount of their cryptocurrency in a wallet or exchange to participate in the security and operation of a blockchain network.

In return for this participation, they receive rewards in the form of cryptocurrency. This method is usually implemented in blockchains that use the Proof of Stake (PoS) algorithm. Table of Advantages and Disadvantages of Crypto Staking:

Advantages | Disadvantages |

Ability to earn passive income without hardware mining | Assets are locked during the staking period and cannot be sold quickly |

Much lower energy consumption compared to Proof of Work | Risk of cryptocurrency value decline during the staking period |

Contributes to the security and stability of the blockchain | Wallet security risks if staking is done through unsafe exchanges |

Easy access even with small holdings (via exchanges or staking pools) | Technical complexity in choosing the right validator or pool |

Cryptocurrency Mining

Cryptocurrency mining is the process in which miners solve complex mathematical problems to validate transactions and add them to the blockchain.

This process is usually carried out in networks that use the Proof of Work (PoW) algorithm, such as Bitcoin and Ethereum before its transition to PoS.

Mining requires specialized equipment such as ASIC devices for Bitcoin and GPUs for Ethereum. This method consumes large amounts of energy and involves high competition among miners.

Some cryptocurrencies have shifted to Proof of Stake (PoS), which consumes less energy and eliminates the need for traditional mining.

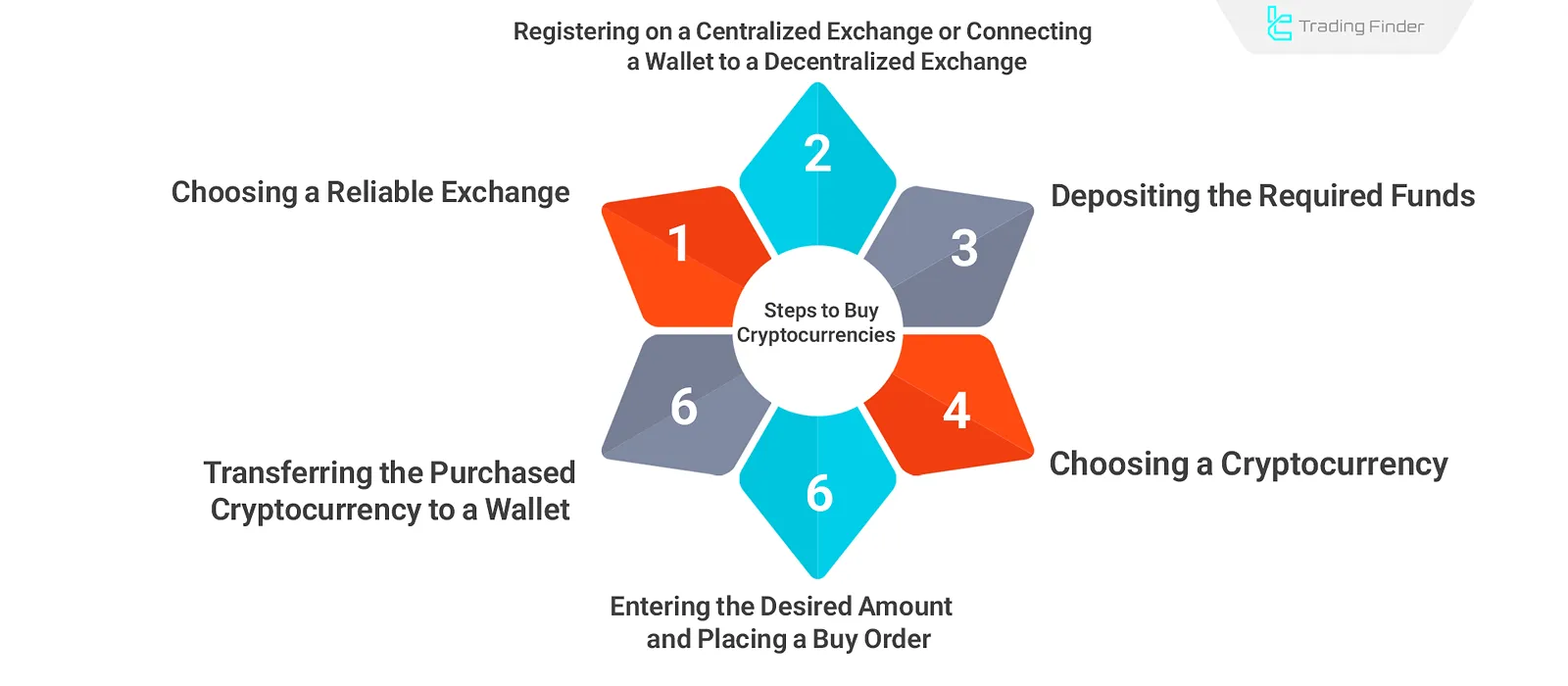

Guide to Buying and Selling Cryptocurrencies

To buy and sell cryptocurrencies, the process must allow real-time pricing, reasonable fees, and high liquidity.

Steps to Buy Cryptocurrencies

Buying cryptocurrencies is not just about choosing an exchange; it also involves steps from creating a secure wallet to identity verification and capital management. Steps to buy cryptocurrencies:

- Choose a reliable crypto exchange (centralized like Binance or Coinbase, or decentralized (DEX) like Uniswap or SushiSwap);

- Register and complete KYC verification in a centralized exchange, or connect a wallet in a decentralized exchange;

- Deposit the required funds (USD or other currencies) or connect a digital wallet to provide balance;

- Select the desired cryptocurrency based on real-time market price;

- Enter the desired amount and place a buy order;

- Transfer the purchased cryptocurrency to a digital wallet for enhanced asset security.

Steps to Sell Cryptocurrencies

Selling cryptocurrencies, like buying, requires accuracy and following specific steps, including transferring assets to the exchange, placing a sell order, and finally withdrawing funds to a bank account or secure wallet. Steps to sell cryptocurrencies:

- Log into the exchange account or connect a wallet to a decentralized exchange;

- Select the cryptocurrency you want to sell;

- Enter the desired amount to sell;

- Place the sell order and receive the equivalent value (in fiat, USD, or stablecoins) in your account or wallet.

Before choosing an exchange, it’s essential to evaluate its security, fee rates, and liquidity. Also, always use digital wallets to store your crypto assets to improve security.

Comparison of Different Blockchain Technologies in Cryptocurrency

Blockchain technology is the core of most cryptocurrencies, enabling transparent, decentralized transactions without intermediaries.

Different types of blockchains public, private, hybrid, and programmable are designed with unique features for various applications in cryptocurrencies. Comparison table of blockchain technologies in cryptocurrencies:

Blockchain Technology | Short Definition | Advantages | Disadvantages |

Public Blockchain | Open-access blockchain with no restrictions | High security, transparency, decentralization | Limited scalability, slower transactions |

Private Blockchain | Accessible only to a specific group of people or organizations | Higher speed, greater control, private security | Requires trust in the network, lack of full transparency |

Hybrid Blockchain | Combination of public and private blockchain | Flexibility, efficient data management | More complexity, higher costs |

Programmable Blockchain | Blockchain that allows programming and smart contracts | Enables decentralized applications (DApps) | Scalability issues, high contract costs |

Analysis of the Cryptocurrency Market

The Cryptocurrency market is relatively new, with a small total market capitalization, making it highly volatile. Macroeconomicindicators (external factors), on-chain data (internal factors), and technicallevels influence these fluctuations.

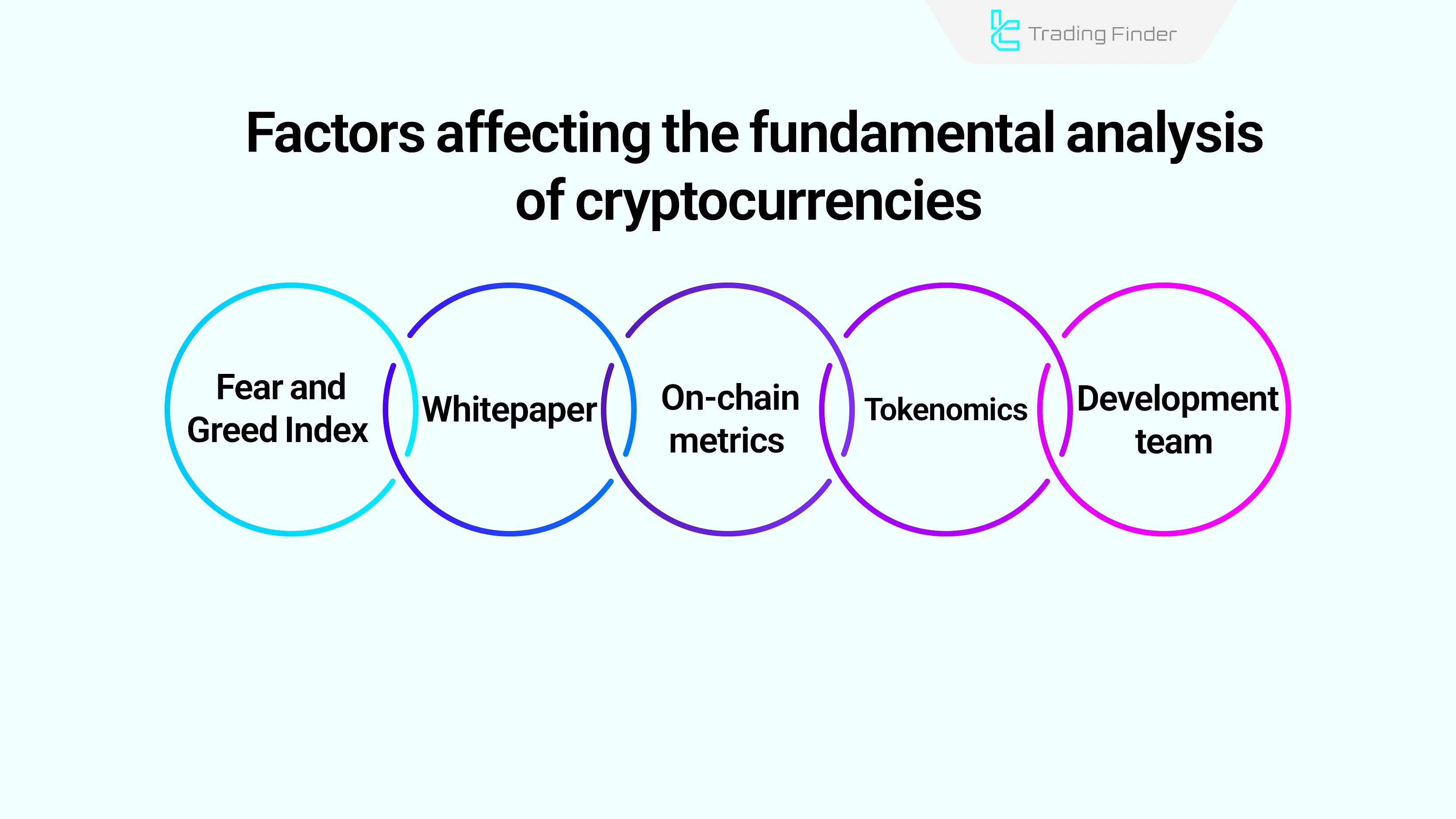

Fundamental Analysis in the Cryptocurrency Market

In cryptocurrencies fundamental analysis, beyond macroeconomics, elements such as the whitepaper (development team and project roadmap), on-chain metrics, and market sentiment (fear & greed index) are also considered.

Key Components of Fundamental Analysis:

- Whitepaper: Technical document that outlines a project's concept, goals, and roadmap. Development team publishes this document;

- On-Chain Metrics: These metrics reflect the technicalactivities of thenetwork, including transaction counts, exchange balances, hash rate, miner behavior, and active wallet Electronic addresses;

- Tokenomics: Involves analyzing token allocation to investors, total supply, maximum supply limits, and deflationary mechanisms;

- Development Team: Factors such as transparency, experience, expertise, and the track record of the project team are essential;

- Fear & Greed Index: This tool measures market sentiment on a scale of 0 to 100. Values below 25 indicate extreme fear and potential market bottoms, while values above 75 indicate greed and possible market peaks.

Note: To become aware of the current market sentiment, you can use the TradingFinder Crypto Fear & Greed tool.

- Macroeconomic Indicators: External market conditions such as economic inflation, unemployment, GDP growth, andmonetary policies also significantly affect the cryptocurrency market.

Technical Analysis of Digital Currencies

Technical analysis uses price charts and candlestick behavior to predict market trends. The analysis timeframe depends on the chart’s time frame, but it's particularly valuable for scalping and short-term trades.

Popular Technical Strategies in the Cryptocurrency Market:

- Scalping: Ultra-short-term trades (typically under 30 minutes), aiming for quick profits;

- Price Action: Analysis based solely on chart patterns and candlesticks without relying on indicators;

- Swing Trading: Capturing mid- to long-term price swings, with trades lasting days or even months.

Disadvantages and Challenges in the Cryptocurrency Industry

Despite their wide applications, digital currencies face technical, infrastructure, legal, and regulatory challenges. Some of these issues have potential solutions.

Technical and Infrastructure Challenges

Scalability and transaction speeds remain limitations in many crypto projects. Additionally, the PoW consensus mechanism is highly energy-intensive.

Technical Issues inDigital Currencies:

- Irreversible Transactions: Due to decentralization, mistaken transactions cannot be reversed or traced. If users lose their private keys, they permanently lose access to their funds;

- High Energy Consumption in PoW: Bitcoin, for example, consumes about 127 TWh of electricity annually more than some countries like Norway. Migrating to PoS is a proposed solution;

- Low Scalability: Bitcoin processes only around 7 transactions per second. Layer-2 solutions aim to address this bottleneck.

Legal and Regulatory Challenges

Even after more than 15 years since Bitcoin's introduction, widespread regulation is still lacking partly due to the decentralized nature of digital currencies.

Legal Concerns in the Cryptocurrency Market:

- Illegal Activities: Due to being decentralized and untraceable, cryptocurrencies are used for dark web transactions, extortion, and criminal activities;

- Limited Adoption: According to TripleA (2021), only 2% of physical retail businesses accepted Bitcoin as payment. Though by 2024, many companies had integrated digital currencies in B2B infrastructure, mass adoption remains limited;

- Hidden Centralization: Despite being decentralized, wealth is concentrated. For example, 27% of all Bitcoins are held in just 0.01% of wallets. Influential figures in the space can also manipulate markets through public statements.

Conclusion

The Cryptocurrency market began with Bitcoin in 2009 as a protest against traditional banking. It gained momentum with the introduction of altcoins, offering broader use cases than Bitcoin.

Altcoins significantly improved scalability and transaction speed. Ethereum, supporting DeFi and decentralized apps, brought a new revolution to digital currencies.

Key features of cryptocurrencies include decentralization, high speed, very low transaction fees, high security (through the use of hash algorithms in blockchain), limited initial coin supply in some of them, and the ability to conduct transactions anonymously.