Smart contracts are digital agreements recorded on the blockchain. Asmart contract in blockchain is developed using blockchain-specific programming languages, such as Solidity.

A smart contract enables both parties to fulfill their commitments and receive agreed-upon outcomes without the need to trust or involve a third party to enforce the agreement.

The article on smart contract education published by Investopedia explains the application and usage of smart contracts. It clearly describes what is a smart contract and how it is executed on blockchains.

What Is Smart Contract?

A smart contract outlines a set of conditions between parties on the blockchain. Once these conditions are fulfilled, the smart contract is registered on the blockchain and its terms are executed automatically.

The smart contract in blockchain serves as the foundation for various concepts in the world of digital assets and cryptocurrency, includingNFTs, decentralized applications (dApps), the Metaverse, and more.

Advantages and Disadvantages of Smart Contracts

By storing all contract data on the blockchain, smart contracts provide high transparency. After the contract is signed and stored on the blockchain, it becomes nearly immutable, as a key benefit of this technology.

However, full dependency on code also introduces a risk of coding errors, which may lead to incorrect execution or exploitation of the contract.

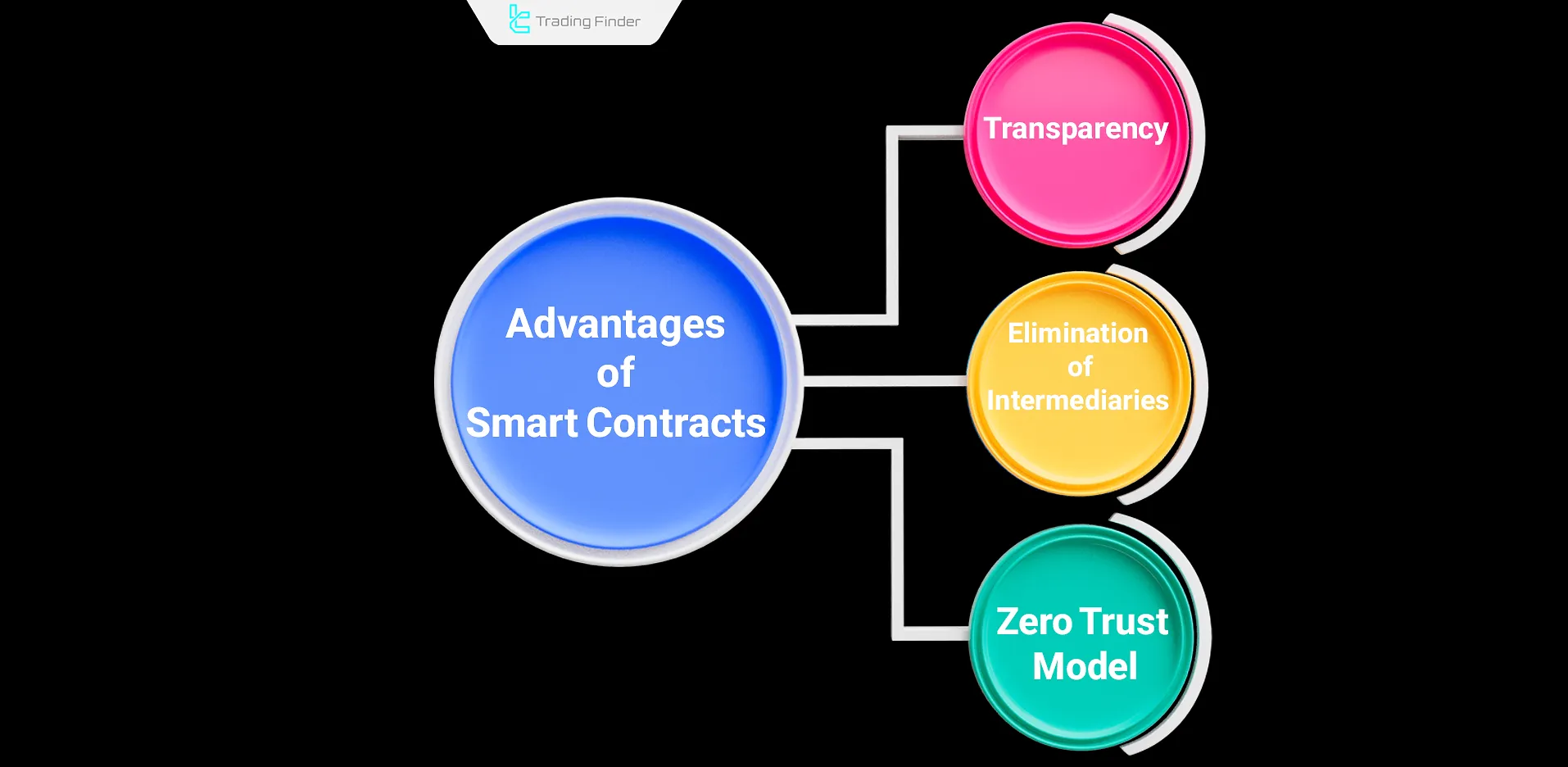

Advantages of Smart Contracts

Using smart contracts, agreements are executed without requiring a third party. This eliminates intermediaries, allowing for direct and trustless transactions between parties.

Some of the core advantages include:

- Transparency: All parties can access a single, verifiable version of the contract data, which reduces manipulation and ensures clarity;

- No Need for Intermediaries: There is no requirement forexternal supervision or enforcement, which speeds up execution and reduces transaction costs;

- Zero Trust Model: Trust is unnecessary. All terms are transparently recorded on the blockchain and are practically unchangeable.

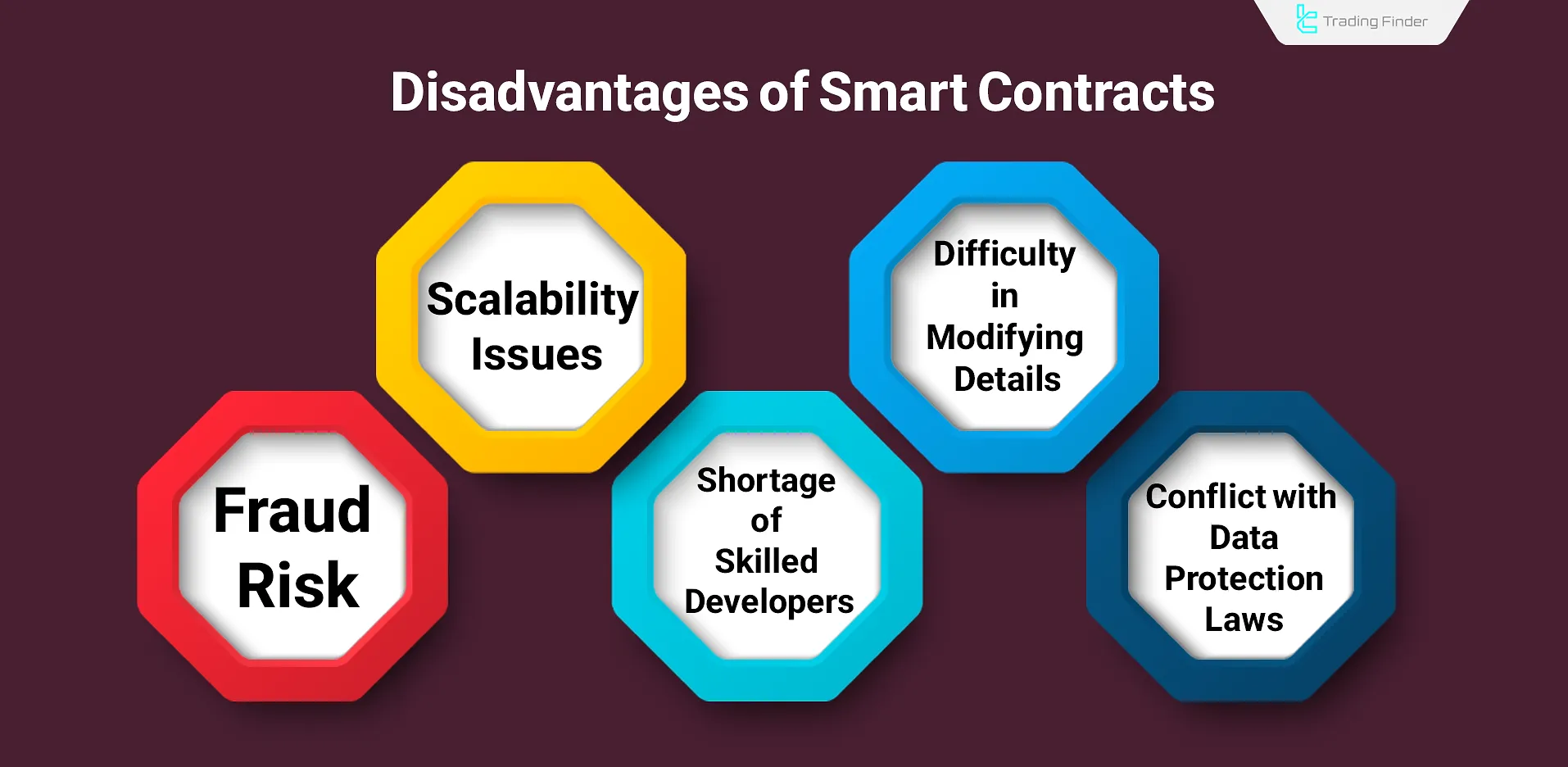

Disadvantages of Smart Contracts

The current infrastructure is not yet fully developed to utilize the full potential of smart contracts, which causes limitations such as scalability issues.

Key disadvantages include:

- Difficulty in Amending Details: Due to blockchain’s immutable nature, making even minor edits to a smart contract after deployment is very challenging and expensive;

- Conflict with Data Protection Laws: Under regulations like the GDPR in the European Union, individuals have the right to delete personal data. This conflicts with blockchain’s unalterable record-keeping;

- Shortage of Skilled Developers: Because this field is still emerging, finding developers with sufficient expertise and experience in smart contract development is difficult;

- Scalability Problems: Currently, even the most prominent blockchains lack the processing power of traditional systems like Visa;

- Fraud Risk: Without thorough code review, smart contracts can be exploited, especially by attackers hiding malicious code.

Smart Contracts vs. Traditional Contracts

Smart contracts are automatically executed in a blockchain environment, while traditional contracts are created and executed with human intervention in real-world systems.

Feature | Traditional Contract | Smart Contract |

Execution | Requires human or third-party intervention | Executes automatically when conditions are met |

Need for Intermediary | Needs legal intermediaries for monitoring and enforcement | No intermediaries required |

Transparency and Traceability | Documents stored in centralized, limited-access institutions | Stored publicly and transparently on the blockchain |

Contract Security | Dependent on institutions and legal enforcers | Ensured via cryptography and decentralized networks |

Execution Environment | Centralized legal or judicial systems | Transparent, decentralized blockchain environment |

Trust Basis | Relies on trust in individuals or institutions | Trust is placed in the code and blockchain infrastructure |

Modifiability | Amendable by courts or legal entities | Almost impossible to modify once deployed |

Cost and Time of Execution | High due to legal, notary, and administrative costs | Lower due to removal of intermediaries and automation |

Drafting Complexity | Requires legal expertise | Requires coding and economic knowledge |

An Example of a Smart Contract

To better understand the concept of define smart contracts in blockchain, imagine two users who want to make a transaction where payment is released only after the delivery of goods. In this case, a digital contract blockchain is created that holds the funds in escrow and releases the payment once delivery is confirmed.

This example clearly demonstrates what is smart contract and how it can build trust without intermediaries. The process ensures the precise execution of obligations without the need for a third party, making it a simple example of how smart contracts operate in real-world scenarios.

On the YouTube channel Whiteboard Crypto, the concept of smart contracts is visually explained, including examples of smart contract trading.

Compliance of Smart Contracts with Data Protection Laws

One of the main challenges of a smart agreement is compliance with data protection regulations such as GDPR. Since blockchain data cannot be deleted, methods such as hashing, encryption, and rotating keys are used to comply with these laws.

Because information recorded on the blockchain cannot be erased, alternative methods should be applied:

- Storing data in a hashed format and off-chain

- Using encryption to restrict access

- Designing rotating keys for indirect data deletion

- Applying data minimization policies when recording personal information

These measures ensure legal compliance while maintaining the transparency of the network.

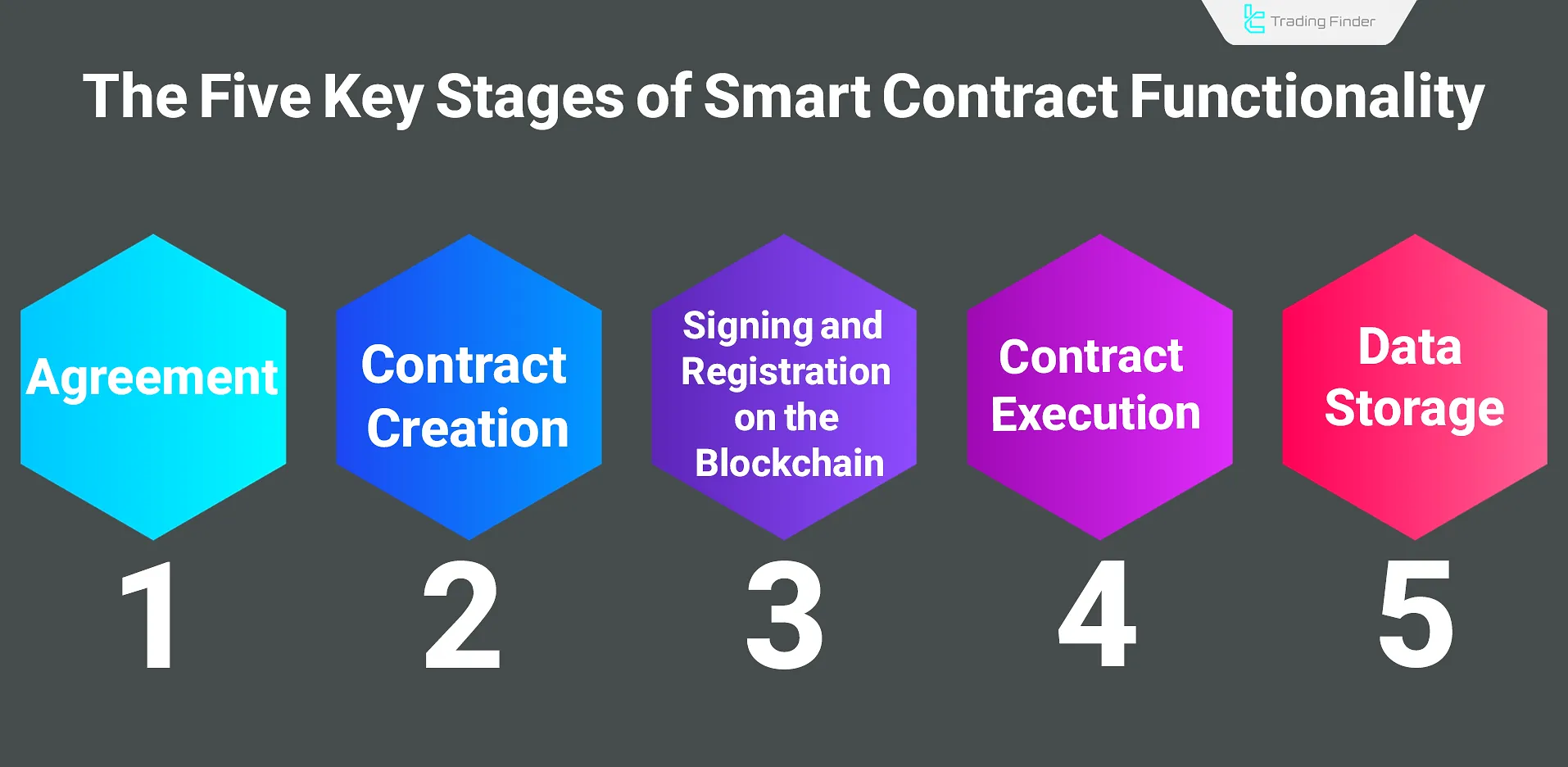

How Smart Contracts Work?

Smart contracts use blockchain-compatible programming languages to define conditional logic, such as If, When, and Then. These logical structures enable the automatic execution of agreements without requiring human intervention.

The working mechanism of a smart contract involves five main stages:

Agreement

First, the involved parties must agree on the contract’s terms and conditions. Then, the functionality and specific logic of the smart contract are reviewed and finalized.

Contract Creation

At this stage, the smart contract is written either by the parties themselves or by a smart contract service provider. This step requires high attention to coding accuracy and security.

Any error in this phase can cause amismatch between what was agreed upon and how the contract behaves.

Signing and Registration on the Blockchain

Once created, the smart contract must be signed by all parties and deployed onto the blockchain. This process is similar to a typical cryptocurrency transaction. After being recorded on the blockchain, the contract is activated and becomes immutable.

Execution

When the contract conditions are met, the smart contract automatically executes its predefined logic and provisions. No human action is needed to initiate or complete this step.

Storage

After execution, the outcome of the contract is stored permanently and transparently on the blockchain. These records cannot be modified, ensuring data integrity and accountability.

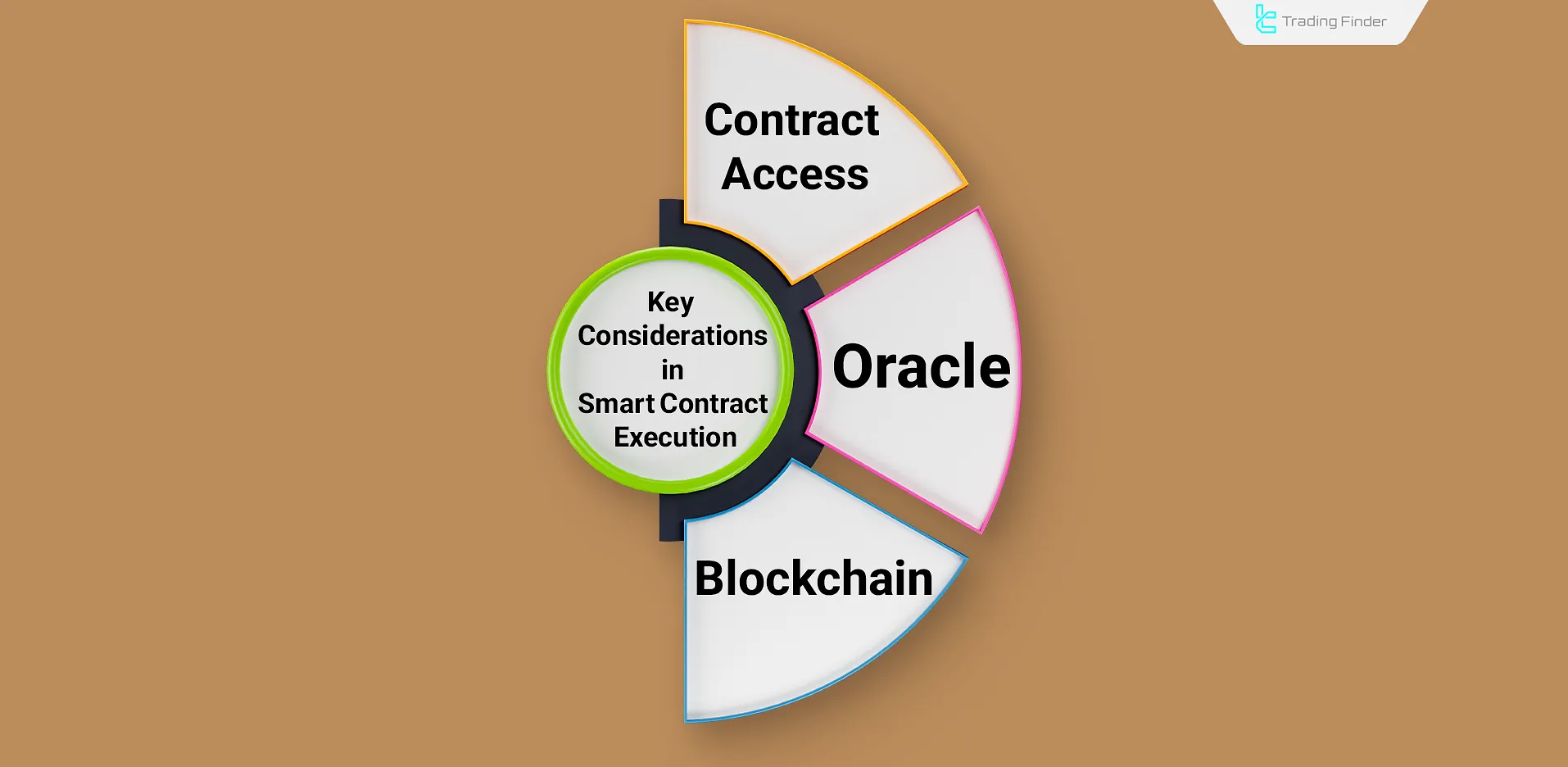

Key Considerations in Smart Contract Execution

For a smart contract in blockchain to work correctly, multiple technical aspects must be in place. These include selecting a suitable blockchain, assigning appropriate permissions, and integrating with oracles to access external data.

Access Control

A smart contract must be granted complete access to perform all agreed actions. If these permissions are not defined correctly, the smart contract may not function properly after initiation.

Example

In an NFT sale, if the contract lacks permission to transfer the NFT, the ownership won’t be changed even after the buyer makes the payment.

Oracle

Some smart contracts require data that exists outside of the blockchain, such as price feeds, weather reports, or economic news. These off-chain inputs are delivered via oracles - trusted third-party services.

Example

A contract based on interest rate decisions or economic announcements, must fetch data from reliable sources. Chainlink is one of the most popular Oracle providers, connecting real-world data to blockchain networks.

Blockchain Selection

Choosing the right blockchain is crucial for the smart contract’s performance. Factors such as transaction speed, gas fees, and scalability affect its usability.

Ethereum was the first blockchain to implement smart contracts; however, several others, such as Solana, Avalanche, and Polkadot, also offer smart contract functionality.

Upgradeability and Governance Patterns in Smart Contracts

Since the direct modification of code after deployment is not possible, developers use Proxy patterns to keep the data intact while allowing the contract logic to be upgraded. This structure is an example of smart contracts advantages that enables sustainable development.

The most common upgrade patterns include:

- Transparent Proxy

- UUPS Proxy

- Beacon Proxy

Additionally, to manage changes and prevent misuse or human error, mechanisms such as multi-signature wallets, time locks, and DAO voting systems are implemented.

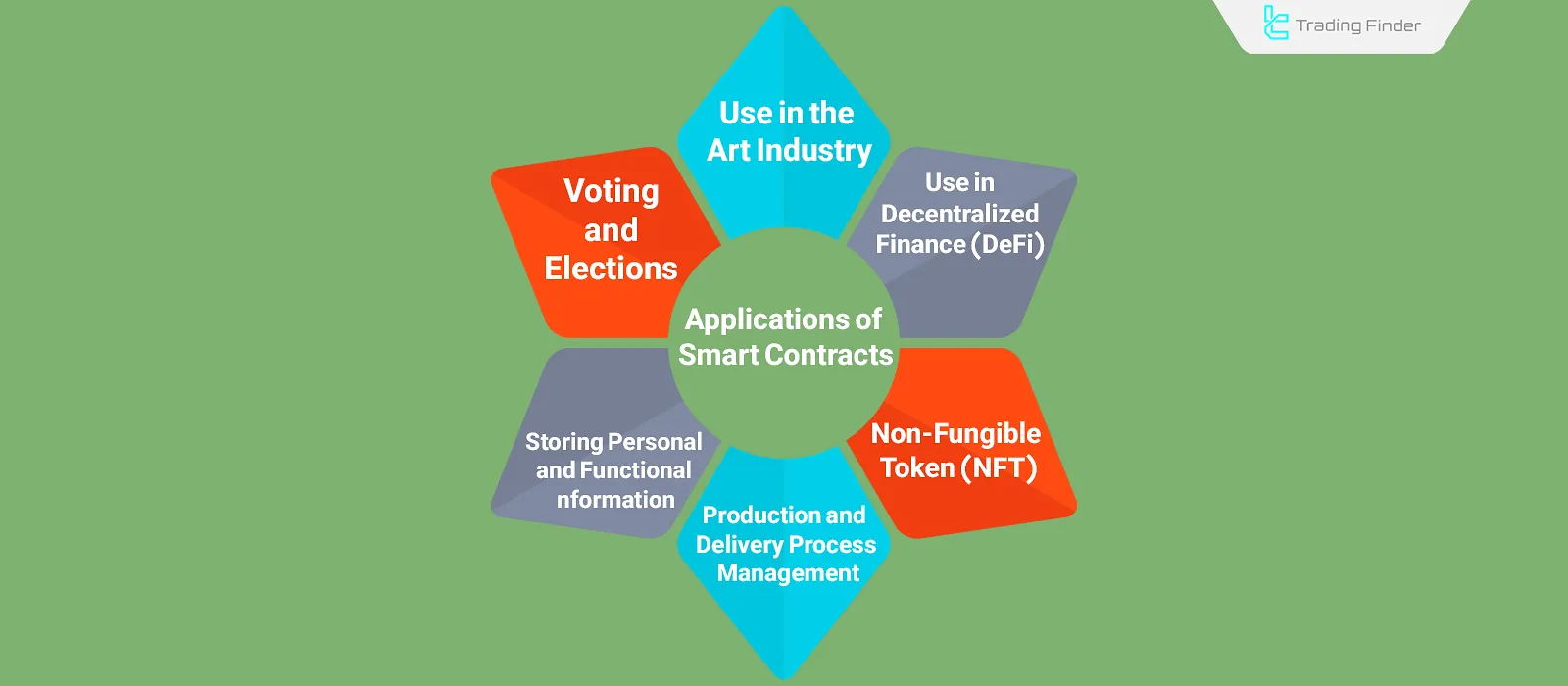

Applications of Smart Contracts

Smart contracts have applications in various sectors, including art, finance, identity verification, entertainment, and data management.

Smart Contracts in the Art Industry

Artists can use smart contracts to register the ownership of their artworks on the blockchain, significantly reducing the risk of copyright theft.

Another application in the art sector is in managing agreements between artists and production companies. By defining revenue shares directly in the smart contract, each party automatically receives its portion of the earnings - quickly and with no calculation errors.

This, eliminates the need for complex legal agreements and time-consuming accounting processes.

Smart Contracts in Decentralized Finance (DeFi)

Initially limited to peer-to-peer (P2P) transactions, the scope of DeFi has expanded significantly through the use of smart contracts. Today, smart contracts enable all of the things below without any central authority:

- Lending and borrowing protocols

- Yield farming and staking

- Derivatives trading

Composability in DeFi and Dependency Risks

In blockchain and smart contracts in the metaverse projects, contracts are often designed in a modular way to interact with other protocols. This feature enhances innovation but also introduces dependency risks.

For this reason, analysts often warn about the advantages and disadvantages of smart contracts, as composability offers benefits but also brings potential technical vulnerabilities.

In the NFT tutorial article on Investopedia, this concept is thoroughly explained.

Smart Contracts in NFTs

The core structure of non-fungible tokens (NFTs) is built upon smart contracts. A smart contract defines ownership, metadata, and custom rules such as:

- Resale royalties

- Access control to digital platforms

- Usage rights and licensing

Without smart contracts, the enforcement and verification of these rules in the NFT ecosystem would not be possible.

Smart Contracts in Production and Delivery Management

Companies can encode their internal rules and timelines into smart contracts for automated oversight. For example, if a deliverable is not submitted on time, the smart contract can automatically send notifications or apply penalties - without human supervision.

This ensures that operational consistency andworkflow compliance are maintained throughout the supply chain.

Smart Contracts for Storing Personal Information

Individuals can use smart contracts to store personal data - such as resumes, identification, and professional experience - on blockchain-based digital identity cards.

When these smart contracts are integrated into external platforms, users can selectively share specific information with third parties. This gives users complete control over who sees what, ensuring privacy and security.

These blockchain-based credentials can also support automated verification during onboarding or credit evaluation processes.

Smart Contracts in Voting and Elections

Using smart contracts in electoral systems eliminates the need for physical presence while improving transparency and tamper resistance.

Votes stored on the blockchain cannot be altered or deleted, making the process ideal for:

- Governmental elections

- Organizational governance

- Blockchain-based DAOs (Decentralized Autonomous Organizations)

Risks of Smart Contracts

Despite their many benefits, smart contracts carry inherent risks, especially related to programming errors and fraud. Once a smart contract is deployed and signed, its terms become unalterable.

This means that attackers may exploit contracts by hiding harmful logic within the code.

Example

A smart contract presented during a wallet connection may appear harmless. But once confirmed, it might execute a hidden transaction - transferring funds to an attacker’s wallet without the user’s knowledge.

How to Prevent Smart Contract Fraud?

To avoid falling victim to smart contract scams, users and developers can adopt the following measures:

- Review Smart Contract Code: Use auditing tools such as SolidityScan to analyze the smart contract code and identify potential vulnerabilities or malicious logic before signing it;

- Check the Platform’s Credibility: Before connecting your crypto wallet to any platform, ensure that the platform is reputable and has a proven track record;

- Verify the Website Address (URL): Many scam projects use domain names that closely mimic trusted platforms. Always check thefull and correct web address to avoid phishing attacks and unauthorized contract interactions.

Smart Contract Security Checklist

Before deploying any contract, manual review, functionality testing, and security auditing must be performed. This process helps developers fully understand the pros and cons of smart contracts and prevent potential risks.

- Manual code review and functionality testing of all functions

- Using secure libraries and verified open-source code

- Running automated unit and integration tests

- Publishing a trial version on the testnet

- Conducting a third-party security audit

- Enabling limiters such as emergency stop (Pausable)

Common Attacks and Prevention Methods

Some vulnerabilities occur more frequently in smart contracts, and being familiar with them is essential for every developer:

- Reentrancy attack during fund withdrawals

- Oracle and price data manipulation

- Unauthorized access to administrative functions

- Front-running attacks in sensitive transactions

- Integer overflow and underflow in older Solidity versions

Some attacks, such as Reentrancy, Oracle manipulation, and Front-running, are among the most critical threats. Implementing the Checks-Effects-Interactions pattern and using Chainlink resources help maintain what are the benefits of smart contracts in ensuring high-level security.

Best Blockchains for Smart Contracts

Multiple blockchain networks support smart contracts in blockchain development and deployment. The following are among the most popular:

Blockchain Name | Programming Language | Average Transaction Speed | Average Transaction Fee | Type of Support (EVM/Non-EVM) |

Ethereum | Solidity | Around 15 transactions per second | About $0.5 to $3 | EVM |

BNB Chain | Solidity | Around 55 transactions per second | About $0.2 | EVM |

Solana | Rust | Over 2,000 transactions per second | Less than $0.01 | Non-EVM |

Avalanche | Solidity | Around 450 transactions per second | About $0.1 | EVM |

Differences Between EVM and Non-EVM Networks

EVM-compatible networks such as BNB Chain and Avalanche use the Solidity language and can directly execute contracts. In contrast, Solana or Aptos operate with a different architecture, reflecting part of the distinction of what is the smart contract across various ecosystems.

Gas Fees and Optimization Methods

Each function execution requires gas payment. Reducing the number of stored variables and removing unnecessary loops helps optimize efficiency. These practices make smart contracts more cost-effective while maintaining performance.

To minimize gas costs, the following methods can be applied:

- Minimizing stored variables in Storage

- Using Mapping instead of long arrays

- Removing unnecessary loops

- Data compression (Variable Packing)

- Moving frequent transactions to Layer 2 solutions

Proper gas management plays a key role in the profitability and sustainability of large-scale smart contract projects.

Programming Languages for Smart Contracts

The cost, efficiency, and security of a smart contract often depend on the programming language used to write it.

Popular languages for smart contract development include:

- Solidity: Most widely used for Ethereum-based contracts

- Vyper: Similar to Python, with a focus on security and simplicity

- Yul: Intermediate language for Ethereum Virtual Machine (EVM)

- Rust: Often used inSolana and other non-EVM chains

- Move: Used in platforms like Aptos and Sui, emphasizing safety

The language selected directly affects the gas consumption, execution speed, and security model of the contract.

Smart Contract Testing and Development Tools

For development, tools such as Hardhat, Foundry, OpenZeppelin Wizard, and Remix IDE are used. In some projects, calendar based smart contract models are also utilized to enable automatic execution at specific time intervals.

Note: Performance testing and automated execution simulation using calendar based smart contract models

Some of the most popular tools include:

- Hardhat: for testing and automated deployment

- Foundry: for fast testing and security analysis

- OpenZeppelin Wizard: for creating standard templates

- Remix IDE: for directly testing Solidity code in the browser

Using these tools reduces errors and increases development speed.

Common ERC Smart Contract Standards and Their Functional Differences

In Ethereum-compatible networks, standards such as ERC-20, ERC-721, and ERC-1155 help maintain interoperability among tokens, representing a large-scale example of the pros and cons of smart contracts.

Main Ethereum Smart Contract Standards:

- ERC-20: for creating fungible tokens such as stablecoins

- ERC-721: for non-fungible tokens (NFTs)

- ERC-1155: for supporting multiple token types simultaneously

- ERC-4626 and ERC-777: for improving interactions and yield vaults

The Future of Smart Contracts with Web3 and Artificial Intelligence

In the future, smart contracts will merge with Web3 and AI, adapting their performance based on real-time data. This integration will expand smart contracts advantages and enhance efficiency in automated processes.

AI Trading Connection Expert Advisor

The AI Trading Connection Expert Advisor is one of TradingFinder’s advanced tools that enables traders to receive intelligent and accurate technical, fundamental, and news-based analyses using AI models such as ChatGPT and Claude. Through the WebRequest capability in the MetaTrader 5 platform, it connects directly to these APIs and delivers analytical text responses to the user.

The primary goal of the AI Trading Connection Expert is to provide fast and reliable access to real-time Forex and crypto market analysis.

This tool can interpret key price levels, market trends, reactions to economic data, and even sentiment-based reports in a structured way. Unlike automated trading bots, this expert advisor functions purely for analysis and does not execute trades automatically.

To activate this tool, users must open the Options menu in MetaTrader, go to the Expert Advisors section, and enable “Allow WebRequest for listed URL.

” Then, by adding official API addresses including https://api.openai.com and https://api.anthropic.com, the connection between the platform and AI models is established.

After that, users can enter their unique OpenAI or Anthropic API token in the Inputs section and select their desired model (such as gpt-4 or claude-opus).

Once the expert is applied to a chart and an analytical prompt is entered, the text is sent to the AI model, and the precise analytical output appears in the Output window.

These responses may include market structure analysis, supply and demand zone interpretation, overall market sentiment, and analytical suggestions.

This advanced tool enables traders to receive both technical and news-based analyses from AI models, serving as an example of the link between trading and digital contract blockchain that ensures accurate and data-driven insights.

Ultimately, the AI Trading Connection Expert Advisor for MetaTrader 5 bridges artificial intelligence and professional trading, offering a practical and transformative tool for traders seeking smarter and data-driven decision-making.

- Download AI Trading Connection Expert Advisor for MetaTrader 5

- Download AI Trading Connection Expert Advisor for MetaTrader 4

Conclusion

Smart contracts automate the execution of agreements through code-defined terms that are stored and enforced on a blockchain. Their primary benefits include:

- Transparency

- Security

- Speed

These contracts operate based on logical triggers, such as If–Then–When, managing every phase of an agreement - from initiation and storage to execution - without manual involvement.

Despite their power and versatility in areas such as DeFi, NFTs, and real estate, smart contracts come with risks. Without sufficient knowledge and code auditing, users may fall victim to coding errors or fraudulent logic.