Selecting the best time frame for trading strategies depends on various factors such as analytical style and trading approach, including scalping, day trading, and swing trading.

Based on these factors, one of the following is chosen as the best time frame:

- Long-term (Daily and above)

- Medium-term (1 to 4 hours)

- Short-term (1 to 15 minutes)

What Is a Time Frame?

A time frame refers to the duration between the opening and closing of a candlestick on the chart. The validity of data and the effectiveness of a trading strategy vary across different time frames.

Choosing the best time frame for trade significantly influences how traders use indicators and technical analysis tools.

Types of Time Frames

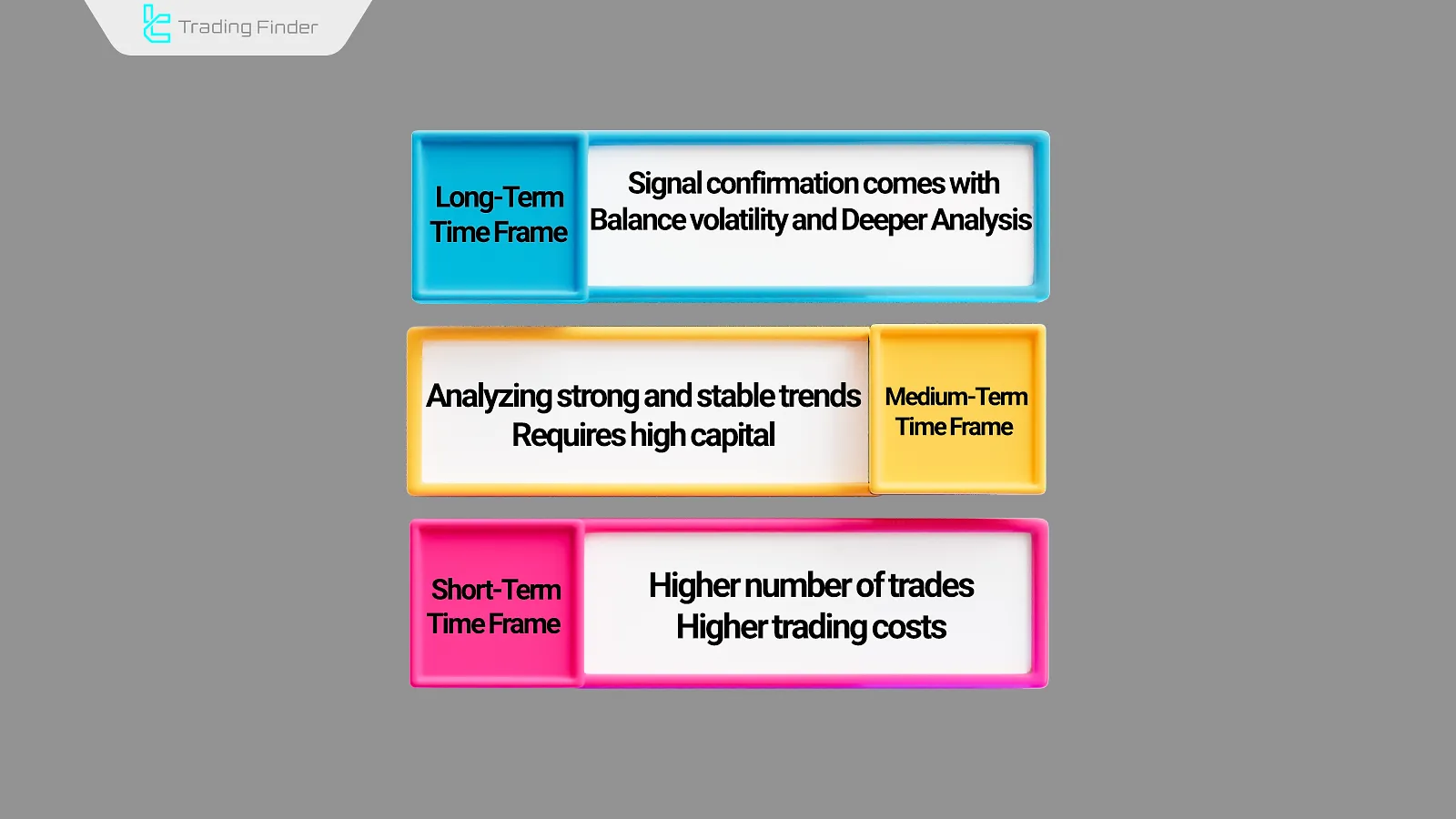

Time frames are generally categorized into short-term, medium-term, and long-term.

Comparison Parameter | Long-Term | Medium-Term | Short-Term |

Time Range | Daily and above | 1 to 4 hours | 1 to 15 minutes |

Trading Style | Swing Trading | Day Trading | Scalping |

Take-Profit Level | High, But Fewer Trades | Moderate | Small, But Frequent Trades |

Risk-to-Reward | Usually, Higher | Balanced | Usually, Lower |

Analysis Style | Market Sentiment, Macro Data, Long-Term Levels | Price Action, Order Blocks, Divergences, Trendlines | Indicators, Price Action, Fast Orders |

The best time frame for trading is selected based on the trader’s goals and needs from among these three categories.

Now let's examine short, medium, and long-term time frames in detail.

Short-Term Time Frame

Time frames ranging from 1 to 15 minutes fall under the short-term category and are ideal for scalping strategies.

Short-term time frames exhibit the following characteristics, making them suitable for scalping strategies:

- High frequency of market noise

- Sensitivity to breaking news

- Sharp, unpredictable price movements

- Compressed market structure

- Fast level breakouts

- High number of trades

Medium-Term Time Frame

Time frames ranging from 1 to 4 hours are considered medium-term and suitable for swing trading.

The balanced price movement and structure in this range make it the best time frame for trading with swing strategies. Key characteristics include:

Long-Term Time Frame

Daily time frames and higher are classified as long-term and are suitable for swing or position trading.

Due to their smoother market behavior and reduced noise, these are considered the best time frames for trade in long-term strategies. Key traits include:

- Minimal noise

- Clear trends

- Slow but reliable price reactions

- Deep market structure

- High level breakout reliability

- Low trade frequency

- Fewer false breakouts

A comprehensive video guide on how to choose the right timeframe has been published on The Trading Geek YouTube channel:

The Impact of Market Type on Timeframe Selection

Choosing an appropriate time frame for technical analysis and short-term trading does not depend solely on the trading style but also on the type of market.

In the Forex market, where price movements occur around the clock, using a short-term time frame such as M15 or H1 is very common.

These allow traders to follow rapid price actions within shorter time frames and take advantage of scalping opportunities. For those seeking the best time frame for scalping, timeframes shorter than 30 minutes generally yield better results.

In the cryptocurrency market, which operates 24/7 , a medium-term time frame like the 4-hour or daily chart is often more suitable for controlling volatility.

In contrast, global stock markets, due to limited trading hours, tend to rely on long-term or weekly time frames, as they provide a broader view of market trends.

These differences make each time frame strategy unique to its market, and it should be adjusted according to trade volume, volatility, and the trader’s goals.

Advantages and Disadvantages of Each Timeframe

Every type of trading time frame comes with its own benefits and challenges, and understanding them helps improve decision-making.

Timeframe | Advantages | Disadvantages |

Short-term (M1 to M30) | Ideal for scalping, multiple opportunities, aligns with best scalping time frame | High price noise, requires intense focus |

Medium-term (H1 to H4) | Balance between precision and trading volume, suitable for swing trade time frame | High risk during major news events |

Long-term (Daily to Weekly) | Simpler analysis, stable trends, suitable for longer time frame and investing | Fewer opportunities, requires larger capital |

Guide to Choosing the Right Timeframe for a Trading Strategy

Choosing the best time frame depends on multiple aspects of your strategy, including trade duration, goals, and preferred volatility range.

Best Time Frame for Scalping

Scalping involves rapid trades with limited profit margins. Alongside execution speed and broker/platform quality, choosing the right time frame is critical. The ideal scalping time frame has:

- High trading volume

- Tight spreads

The goal is to profit from micro price fluctuations, so volume and spread matter most.

Best Time Frame for Day Trading

In day trading, analysis, entry, and exit occur within the same trading day. The best time frame for trade in this case typically ranges from 15 minutes to 1 hour.

Since take-profit or stop-loss orders must trigger within the same day, this time frame should support both price and time analysis.

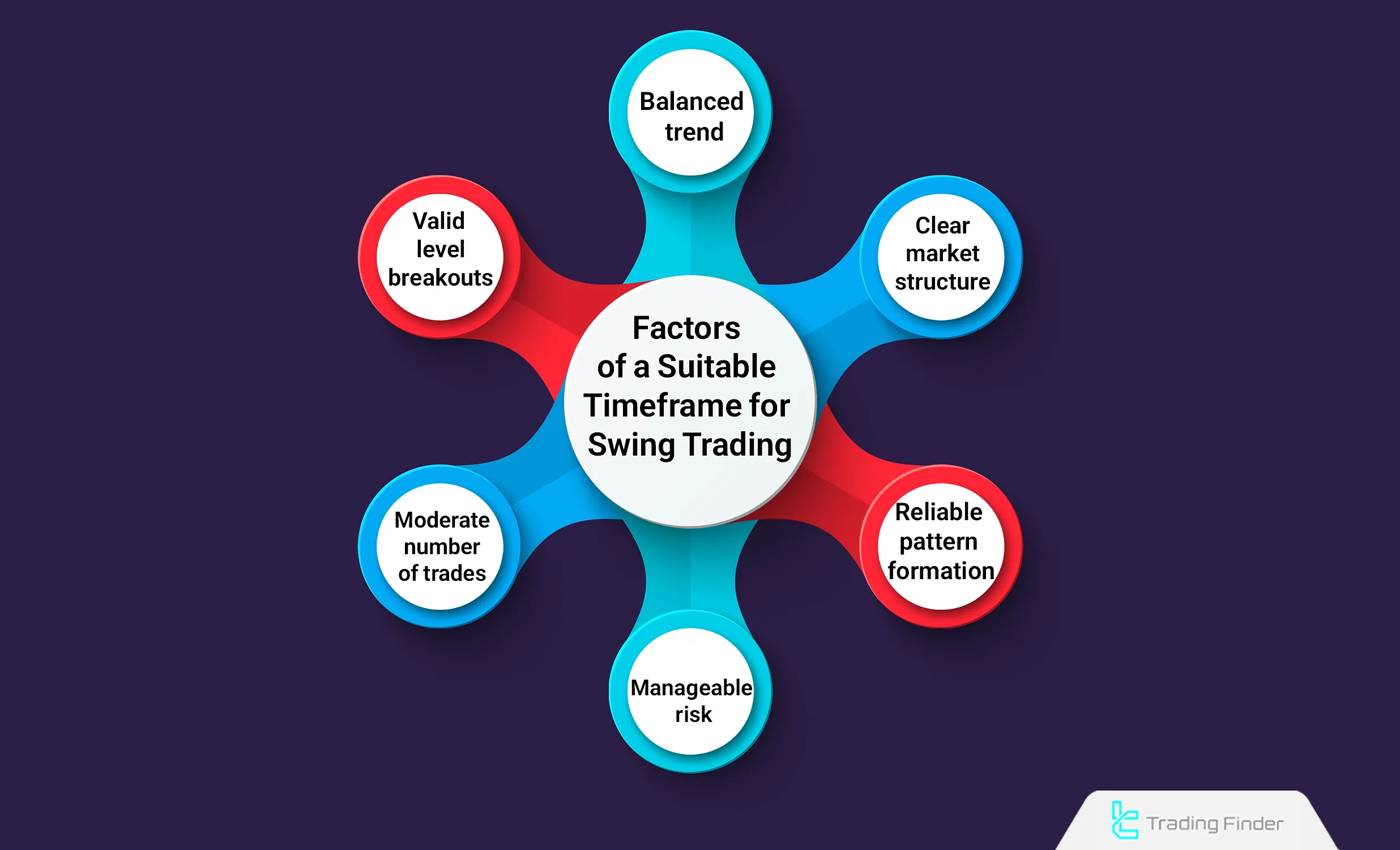

Best Time Frame for Swing Trading

Swing trading targets major price movements and often holds trades from a few hours to several days. Clear formation of technical patterns such as classical chart patterns is crucial in this strategy.

Thus, the market structure must be clearly visible in your selected time frame, typically ranging from 1 hour to daily.

The Role of Psychology in Choosing a Timeframe

The trader’s psychological and personality traits have a direct impact on the choice of timeframe. Each individual should select an appropriate time frame based on their patience level, focus, and ability to handle trading pressure:

- Impatient traders often use a short time frame for quick entries but are more prone to emotional mistakes;

- Precise and balanced traders usually rely on a medium term time frame to maintain a balance between detailed and broad analysis;

- Patient and long-term investors prefer to use a long time frame to avoid short-term market fluctuations;

- The chosen timeframe should align with the time frame for day trading or even the best day trading time frame to help the trader maintain balance between capital management and technical analysis.

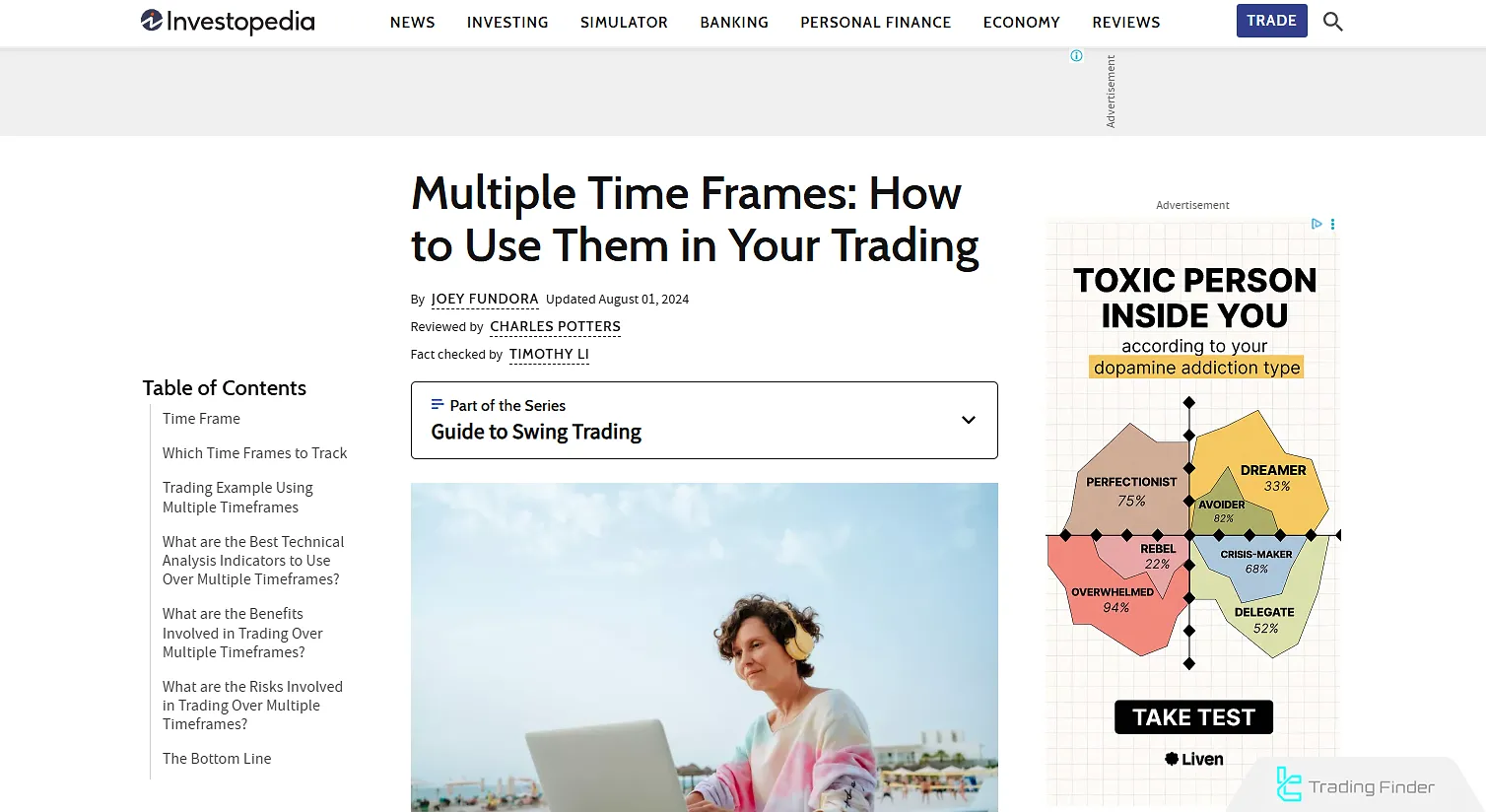

Multi Time Frame Analysis

In the Multi Time Frame Analysis method, the main goal is to create harmony between different timeframes and find the best time frame in trading strategy for entries and exits.

The process starts by analyzing the overall trend in higher timeframes such as daily or weekly charts and then determining more precise entry points in lower timeframes like M15 or H1.

This synchronization, known as timeframe alignment, helps traders balance between shorter time frame and longer time frame.

For example, if an uptrend is observed on the daily EUR/USD chart, entry points can be sought in minor pullbacks within the 15-minute chart.

This is one of the most effective ways to identify the best time frame for day trading, as the trader defines the general direction using a higher timeframe and then captures faster trading opportunities within a small time frame.

The article on learning multi time frame analysis in the Investopedia website provides a complete explanation of this concept.

Example of Choosing the Right Timeframe

Selecting an appropriate time frame in any market plays a crucial role in improving trading performance. Depending on the market type and trading style, using different timeframes produces varying results:

- In the Forex market, short timeframes such as 5 or 15 minutes are most useful for scalpers and are known as the best time frame for scalping;

- In the cryptocurrency market, 4-hour or daily timeframes are often the best time frames for swing trading, as they allow for a more accurate view of mid-term trends;

- In the global stock market, especially in indices like Nasdaq and Dow Jones, using a long term time frame is more effective for identifying main trends and long-term investment opportunities.

Professional traders always consider the alignment of multiple timeframes when designing a time frame strategy to ensure more accurate analysis and consistent decision-making.

Common Mistakes in Timeframe Selection

Many trading losses occur due to incorrect or constantly changing timeframe choices. Recognizing these mistakes helps traders maintain a more structured trading approach:

- Frequently switching between timeframes to justify a wrong signal undermines analysis credibility;

- Using very small timeframes without a clear strategy increases market noise and emotional decision-making; many beginners make this mistake in short term trading time frame;

- Ignoring higher timeframes and focusing only on short ones leads to losing sight of the bigger picture, while using a long term time frame helps identify the market’s main direction;

- Choosing a timeframe inconsistent with account size and risk management is a major cause of trading failure. Traders should test different types of trading time frame and choose one that matches their personality and trading goals.

Lack of timeframe alignment between different charts may result in short-term signals contradicting the overall trend in higher timeframes.

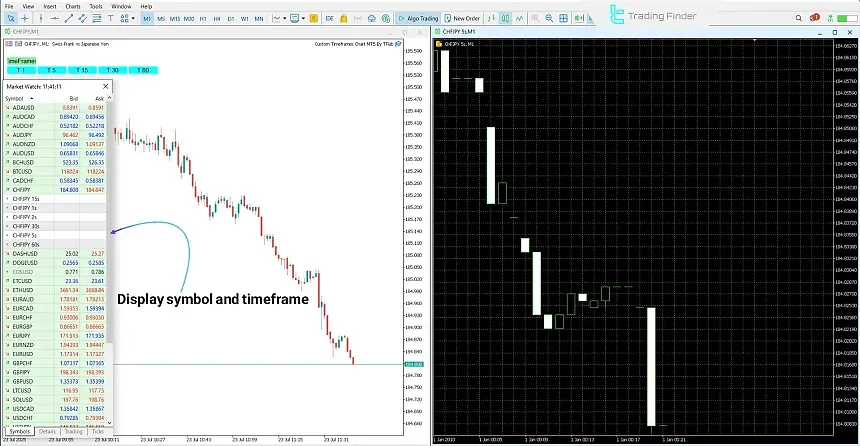

Custom Timeframes Chart Expert

The Custom Timeframes Chart Expert tool is designed to create non-standard charts, allowing users to generate new time intervals such as T5, T15, or even second-based candles.

This tool is ideal for traders who want to analyze price movement within short term time frame intervals and examine market structure in very small ranges.

Unlike the default MetaTrader timeframes, this expert uses tick data, enabling traders to generate highly accurate candles in their desired timeframe.

This feature is particularly useful for scalpers seeking the best scalping time frame. On the other hand, traders using a swing trade time frame can employ it to confirm more precise entry points.

As a result, the generated chart is displayed independently on the trading platform and supports the simultaneous use of indicators, expert advisors, and other analytical tools.

How It Works:

- Tick data collection: every smallest price movement is recorded and processed;

- Custom candle creation: users can define their own timeframe, such as T5 or T15, and receive precise candles;

- Creation of a custom symbol: data is stored as a separate trading instrument;

- Independent chart display: the generated chart behaves like a standard MetaTrader chart and can be fully analyzed.

The main feature of this tool is its support for second-based and short-term analysis.

Therefore, it is ideal for scalping strategies, modeling price behavior in micro timeframes, and detailed examination of market structure. It can also be used across various markets, including Forex, cryptocurrencies, and stocks.

Installation Steps:

- From the View menu, open Navigator;

- In the Expert Advisors section, select the expert and run it on the chart;

- Enter your desired custom timeframes.

After activation, a control panel with time buttons appears, allowing users to generate their desired custom chart with a single click.

The key point is that the base chart’s timeframe does not affect the expert’s performance, as the output is displayed as a completely separate chart.

Download the Custom Timeframes Chart Expert for MetaTrader 5

Conclusion

Selecting the best time frame for trading reduces noise, enhances signalquality, and improves the performance of technical tools.

Market structure analysis without proper time frame alignment lacks consistency and accuracy.

Whether you’re scalping, day trading, or swing trading, time frame selection must reflect not just time intervals but also price behavior and structural dynamics.