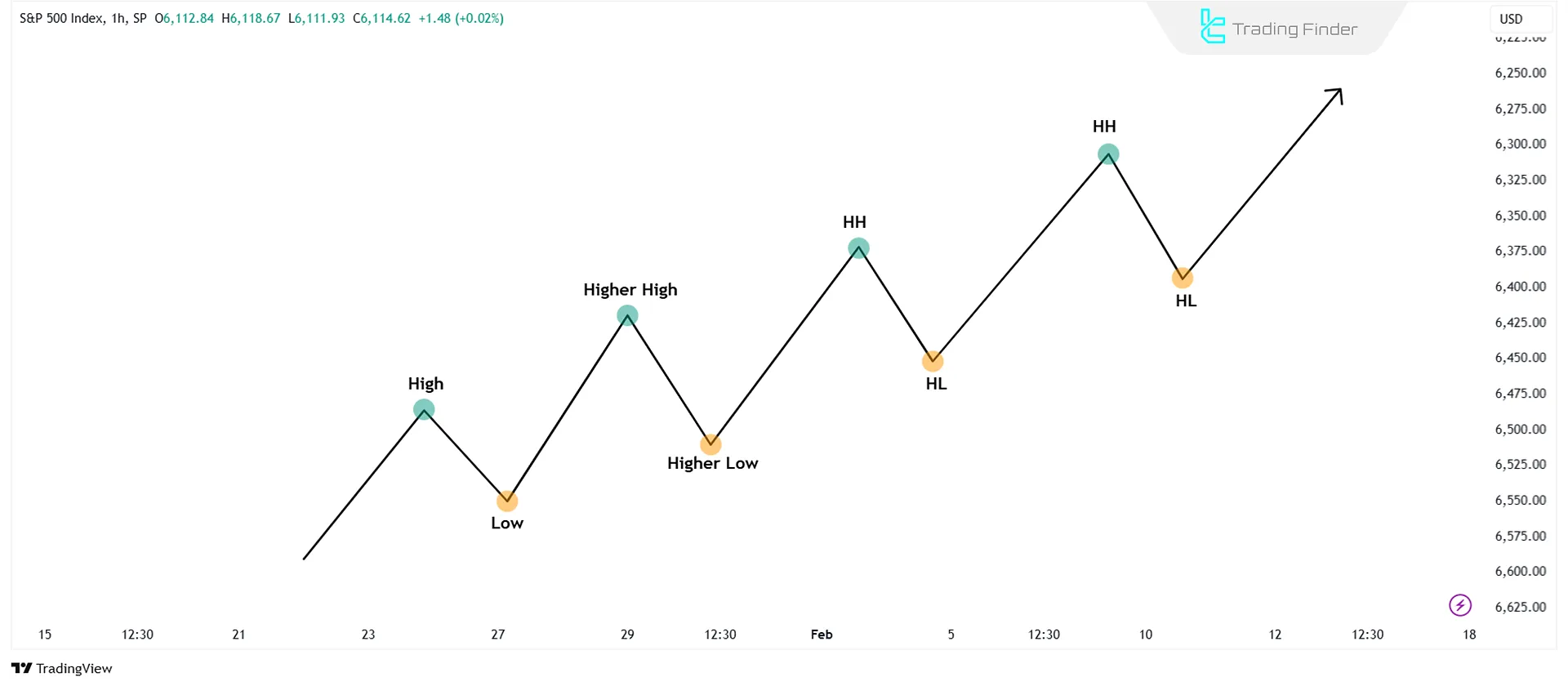

Higher Highs (HH) and Higher Lows (HL) are fundamental components of trend analysis in bullish markets.

These structures indicate the strength of price movements and the tendency for the trend to continue; HL and HH act as critical points for entering and exiting trades.

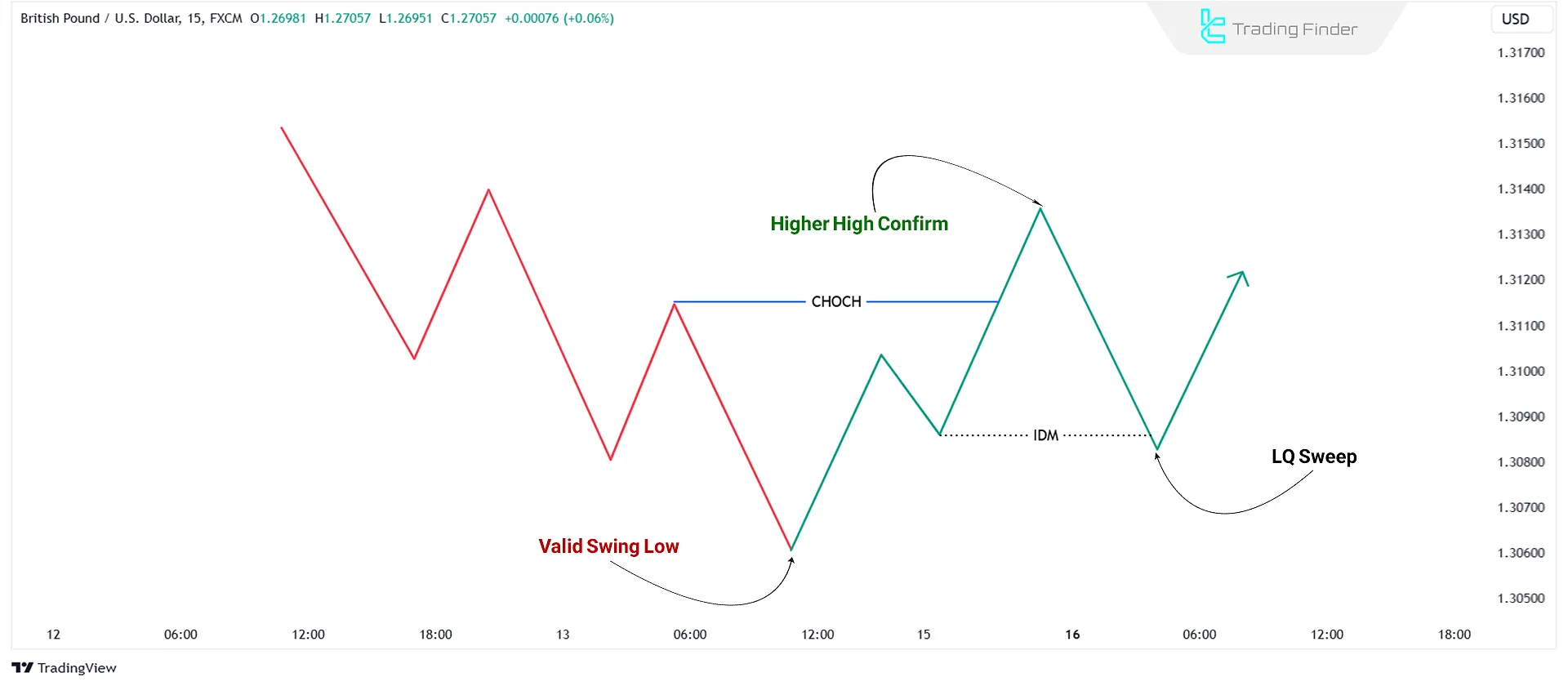

However, identifying these structures requires a deep understanding of Smart Money concepts (SMC), such as Break of Structure (BOS), Change of Character (CHOCH), and Inducement.

What Are Higher Highs and Higher Lows?

Higher Highs (HH) and Higher Lows (HL) are two concepts in technical analysis used to identify and confirm bullish trends in markets:

- Higher High (HH): This occurs when a new high on the chart surpasses the previous high. It indicates the continued strength of buyers in the market and serves as a signal for an uptrend.

- Higher Low (HL): This occurs when a new low is higher than the previous low. It demonstrates sellers’ failure to push the price below the prior low and confirms the validity of the ongoing uptrend.

These two concepts create an upward structure that signifies buyer dominance and trend continuation.

Identifying these patterns is crucial as they allow traders to pinpoint entry points for buy positions and identify suitable areas to place stop losses.

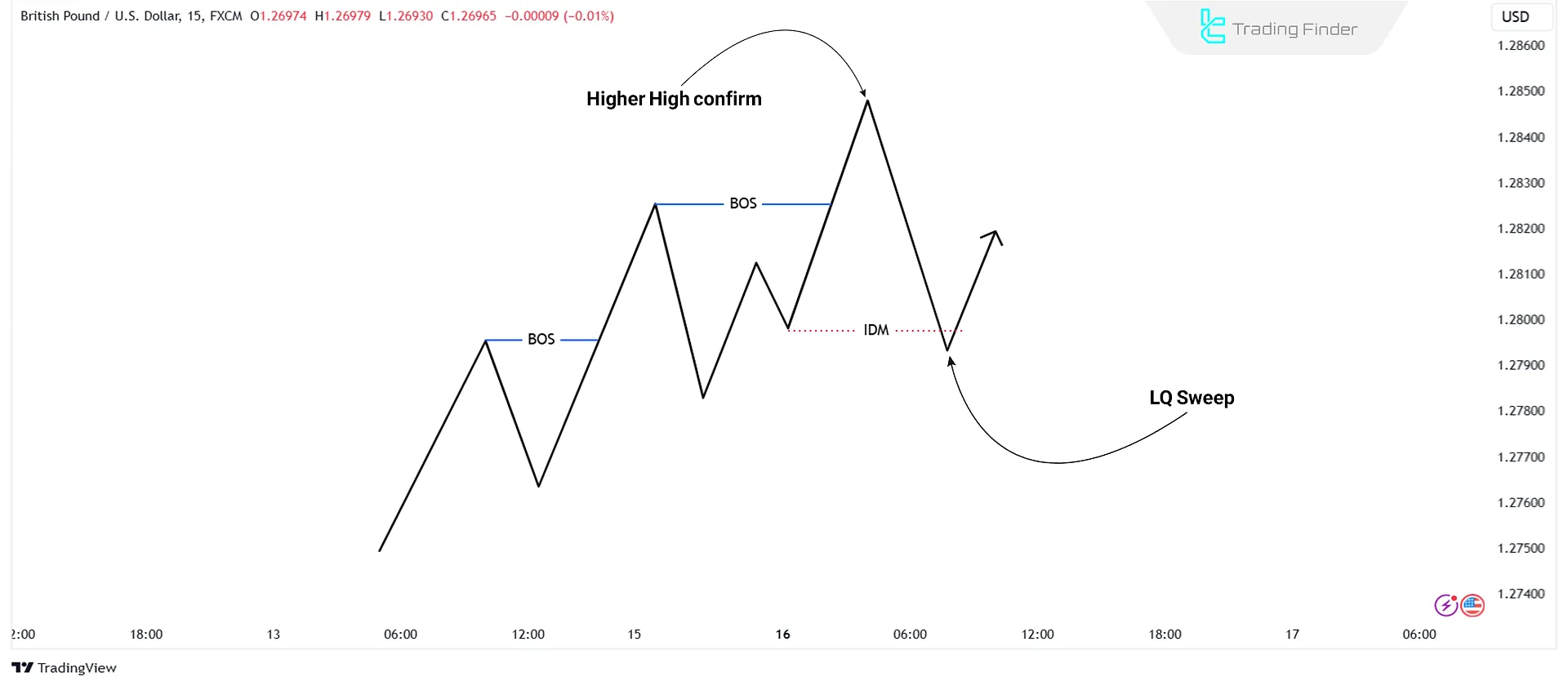

How to Identify Higher Highs in a Bullish Market?

Although price creates higher highs in a bullish market, not all are considered structural highs! Guide to identify valid Higher Highs (HH) in a bullish market:

- Start by identifying Inducement (IDM).

- After detecting the Inducement, wait for the price to form a swing high and pullback to sweep the Inducement.

- When the price collects the Inducement, the last swing high before the collection is considered the valid Higher High.

When the price breaks a Higher High, this is called a Break of Structure (BOS). With each price break, look for Inducement sweeps to confirm the Higher High.

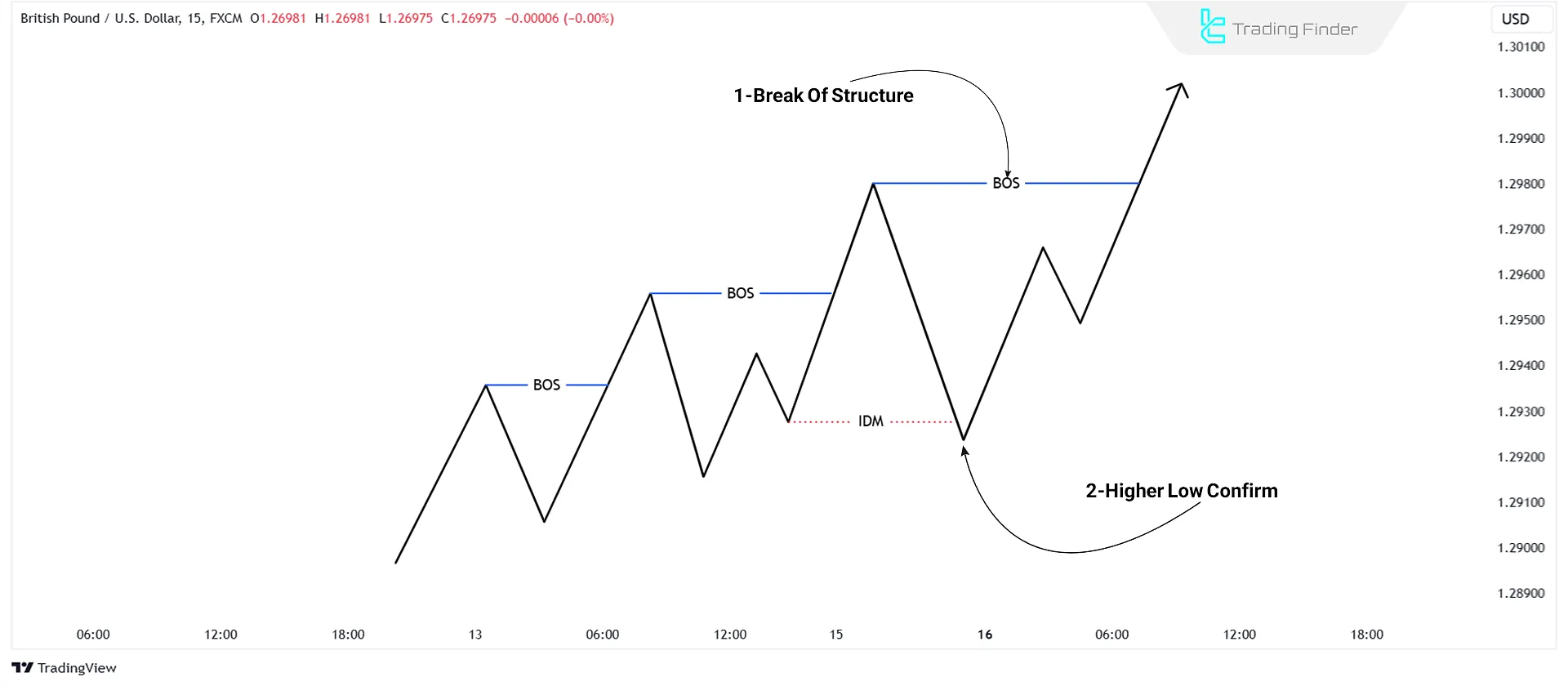

Guide to Identify Higher Lows in a Bullish Market

Even though prices create higher lows in a bullish market, not every low is a valid Higher Low. Follow these steps to confirm a valid Higher Low (HL):

- Look for swing lows forming during Inducement sweeps by the price.

- After forming the swing low, the price rises and breaks the previous high, the last swing low is marked as a valid Higher Low.

Identify Higher Lows by finding Break of Structure (BOS) upwards and liquidity sweeps to confirm their validity.

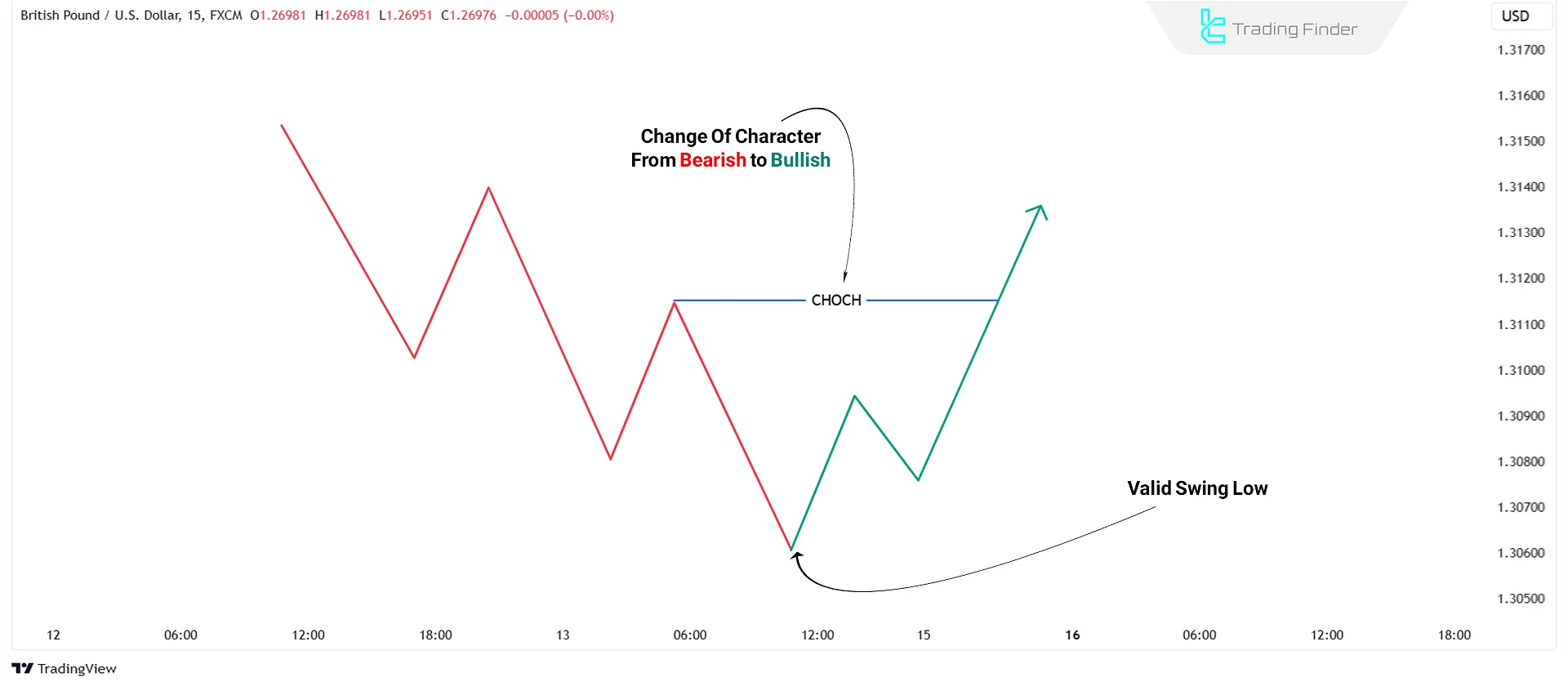

How to Identify Structural Lows After a Bullish CHOCH?

To identify a structural low after a bullish Change of Character (CHOCH), follow the steps below:

- Mark the lowest low created before the CHOCH.

- When the market transitions from bearish to bullish, the lowest low of the bearish trend is marked as the structural low since the bullish trend begins from there.

After every Break of Structure, locate Inducement sweeps and the subsequent upward BOS to confirm the Higher Low.

Guide to Identify Structural Highs After a Bullish CHOCH

CHOCH signifies a change of character; therefore, mark the Higher Highs accordingly when the market transitions from a bearish to a bullish trend. To identify a structural high after a bullish CHOCH:

- Detect Inducement (IDM)

- Wait for a swing high to form

- After the swing high is formed and the price sweeps the Inducement, the last swing high is marked as the valid structural high

Find the Inducement sweeps after every Break of Structure to confirm the Higher High (HH).

Can We Mark a Higher High and Higher Low Without Inducement Sweeps?

No! The Inducement Sweep (IDM Sweep) is essential to validate a Higher High.

Beside that, to confirm a Higher Low, both Inducement Sweeps (IDM Sweep) and an upward Break of Structure are required.

Conclusion

Higher Highs (HH) and lower lows (HL) in a bullish market signify market strength and the tendency to continue the uptrend.

Understanding concepts like Break of Structure (BOS), Change of Character (CHOCH), and Induction is essential to identifying these key points, as not every high or low on the price chart is inherently valid and requires confirmation.