In ICT style, Market Structure Shift (MSS) and Change of Character (CHoCH), are two key concepts and powerful tools for identifying trend changes.

While these two concepts share similarities, they serve different purposes and roles in market structure analysis.

What Is Market Structure Shift (MSS) and Its Application?

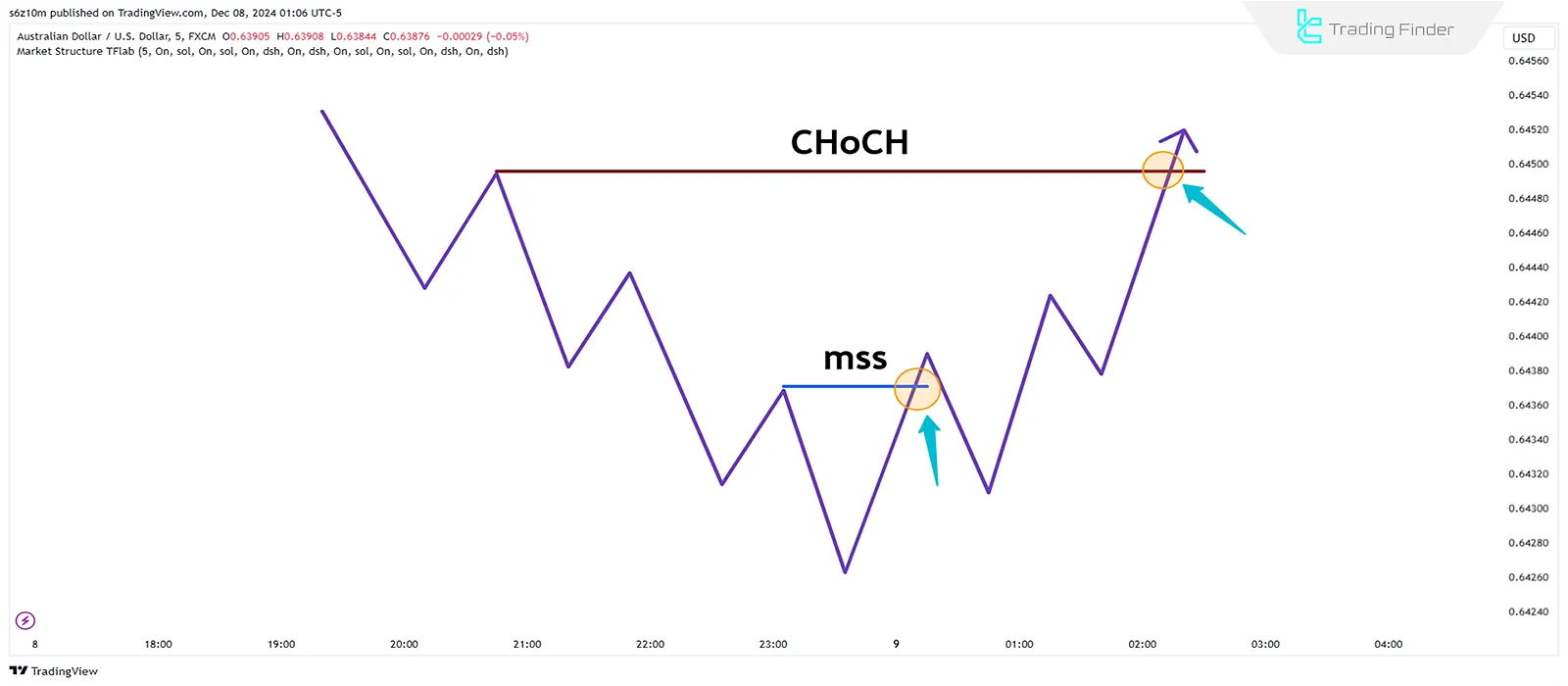

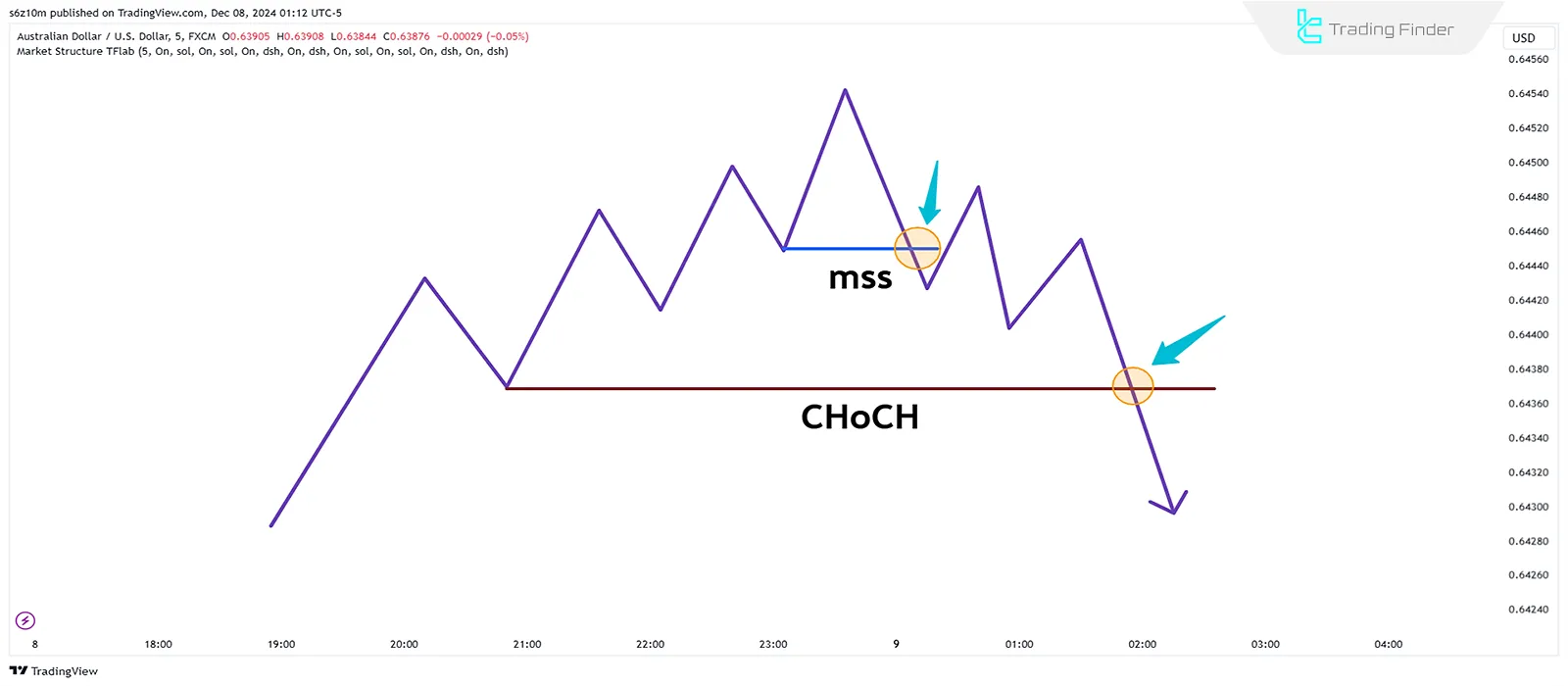

Market Structure Shift (MSS) refers to a short-term change in price direction accompanied by a break of significant Swing Highs or Swing Lows.

This event indicates a temporary shift in price movement and is sometimes considered an early warning of a potential long-term trend reversal.

What Are the Applications of MSS?

- Indicates Temporary Change: It primarily signals a short-term trend change and does not always indicate a complete reversal of market direction

- Tool for Early Confirmation: MSS is often used as an initial signal that might lead to a Change of Character (CHoCH)

Types of MSS

- Bullish MSS: A break of Swing High indicates that the market is temporarily shifting towards an uptrend or buying pressure

- Bearish MSS: A break of Swing Low indicates that the market is temporarily shifting towards a downtrend or selling pressure

Why Is MSS Important?

MSS allows traders to identify short-term market shifts more quickly and act with greater precision when entering or exiting trades.

It is particularly valuable for early confirmation of market structure changes.

Below is a real example of market structure change and character shift during a bullish market:

What Is Change of Character (CHoCH) and Its Application?

Change of Character (CHoCH) refers to a long-term change in trend direction. CHoCH occurs when the current market structure is broken, and price direction fully shifts (e.g., from bullish to bearish or vice versa).

Applications of CHoCH

- Indicates Trend Reversal: CHoCH signifies a break of a key structural point in the market, reflecting the beginning of a new trend.

Types of CHoCH

- Bearish CHoCH: After an uptrend, CHoCH occurs when the price breaks below the previous Higher Low (HL) and forms a new Lower Low (LL)

- Bullish CHoCH: After a downtrend, CHoCH occurs when the price breaks above the previous Lower High (LH) and forms a new Higher High (HH)

Why Is CHoCH Important?

CHoCH helps traders identify major market shifts and align their strategies with the new trend.

It is regarded as a powerful signal for trend reversals.

Below is a real example of market structure change and character shift during a bearish market:

Note: To simplify market structure (Market Structure) identification, traders can use the indicator developed by the [TFlab] team:

- TradingView Version of the Market Structure Indicator

- MetaTrader 4 Version of the Market Structure Indicator

- MetaTrader 5 Version of the Market Structure Indicator

Comparison of MSS and CHoCH in a Table

The major differences between Market Structure Shift (MSS) and Change of Character (CHoCH) are summarized in the following table:

Parameters | MSS | CHoCH |

Type of Change | Short-term change | Long-term change |

Location of Occurrence | At Swing Points | At Key Structure Points |

Potential Outcome | May lead to CHoCH | Indicates a full trend reversal |

Importance in Analysis | Initial signal of temporary shifts | Strong signal of long-term changes |

Primary Application | Identifies minor changes for trade entry | Detects major market direction shifts |

How to Use MSS and CHoCH in Trading?

To use these two concepts in trading, follow the steps below:

- Identify Market Structure Shifts (MSS):

- Analyze the chart to locate Swing Highs and Swing Lows

- If a Swing High or Swing Low is broken, MSS has occurred

- Identify Change of Character (CHoCH):

- Identify the key structural points in the market

- If the price breaks these points and starts a new trend, CHoCH has occurred

- Combine MSS and CHoCH:

- Use MSS as an initial signal

- If MSS is confirmed and structure fully breaks, consider it as a trade entry opportunity

Conclusion

The concepts of Market Structure Shift (MSS) and Change of Character (CHoCH) are powerful tools for identifying trend changes in the market.

MSS acts as an early signal for short-term shifts, while CHoCH indicates a long-term trend reversal.

Combining these two concepts can improve the precision of trading strategies by enhancing the analysis of market structure.