The ICT One Trade Setup For Life is a trading method designed based on market analysis and liquidity identification.

This model is suitable for day trading and scalping, as it identifies key liquidity points and market shifts.

What is the ICT One Trade Setup For Life?

The One Trade Setup For Life is a structured trading model based on key ICT principles such as:

- ICT Daily Bias

- Draw on Liquidity (DOL)

- PM Session Liquidity Raid

- London Session Liquidity Raid

- Opening Range Gaps

- New York Lunch Liquidity Raid

- AM Session Liquidity Raid

The One Trade Setup For Life repeats consistently and is applicable for both scalping and day trading. This ICT Strategy is a standalone model and does not require any additional trading approach.

What is the Draw on Liquidity (DOL)?

In simple terms, liquidity in Forex refers to the availability of buyers and sellers in the market, allowing for smoother trade execution. In trading, liquidity represents areas where buy or sell orders can be quickly executed.

"Draw on Liquidity" (DOL) refers to the liquidity sweep that targets active traders' stop-losses or triggers pending orders (Buy Stop or Sell Stop).

DOL is the key factor determining a price movement's direction and primary objective.

How to Trade the ICT One Trade Setup For Life?

To trade using the model, follow the steps explained by ICT:

- Identify Daily Bias and the Draw on Liquidity (DOL);

- Mark the highest high and lowest low of the selected range (typically the PM session from 1:30 PM to 4:00 PM NY time);

- Wait for a sweep above the high or below the low of the chosen range in the opposite direction of the identified bias;

- Look for an FVG (Fair Value Gap) with Displacement, preferably with a Market Structure Shift (MSS). From this point, target opposite-side liquidity levels or other liquidity areas.

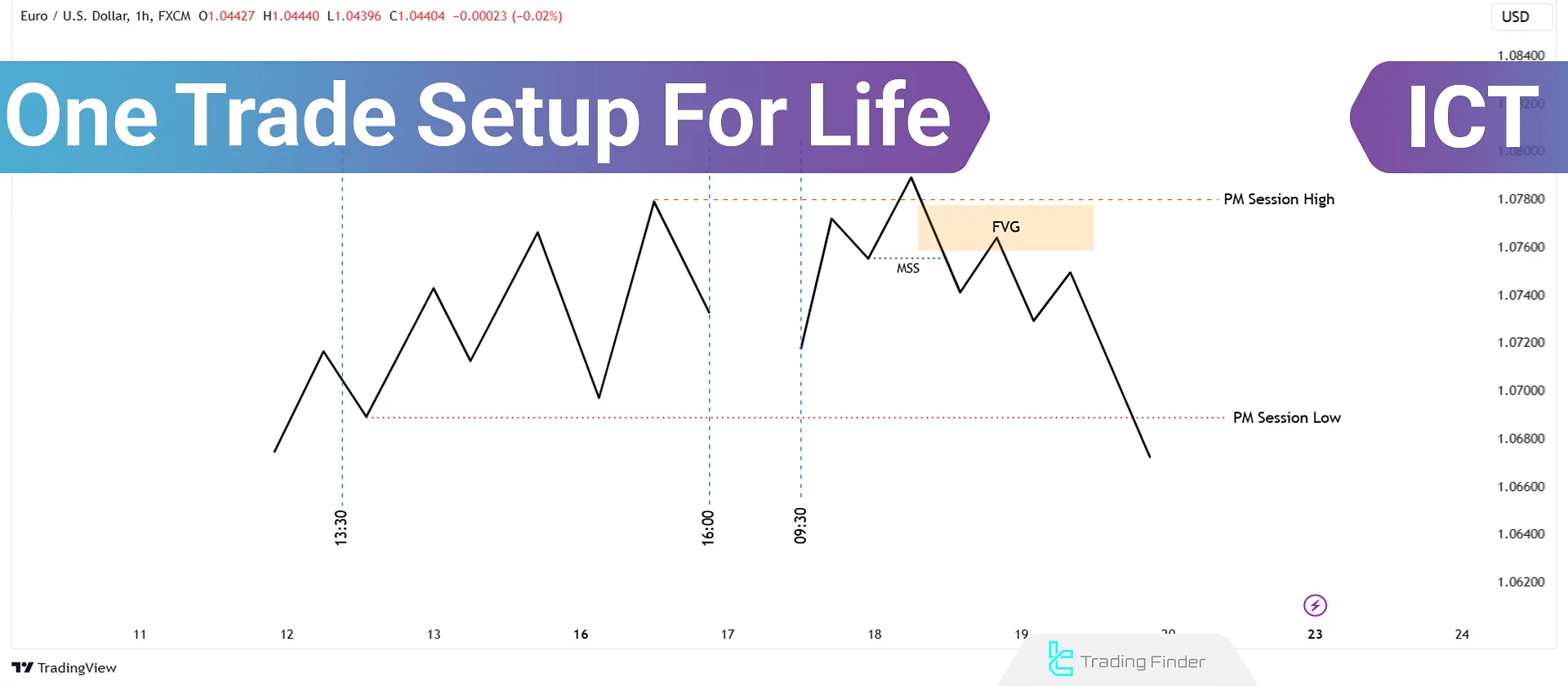

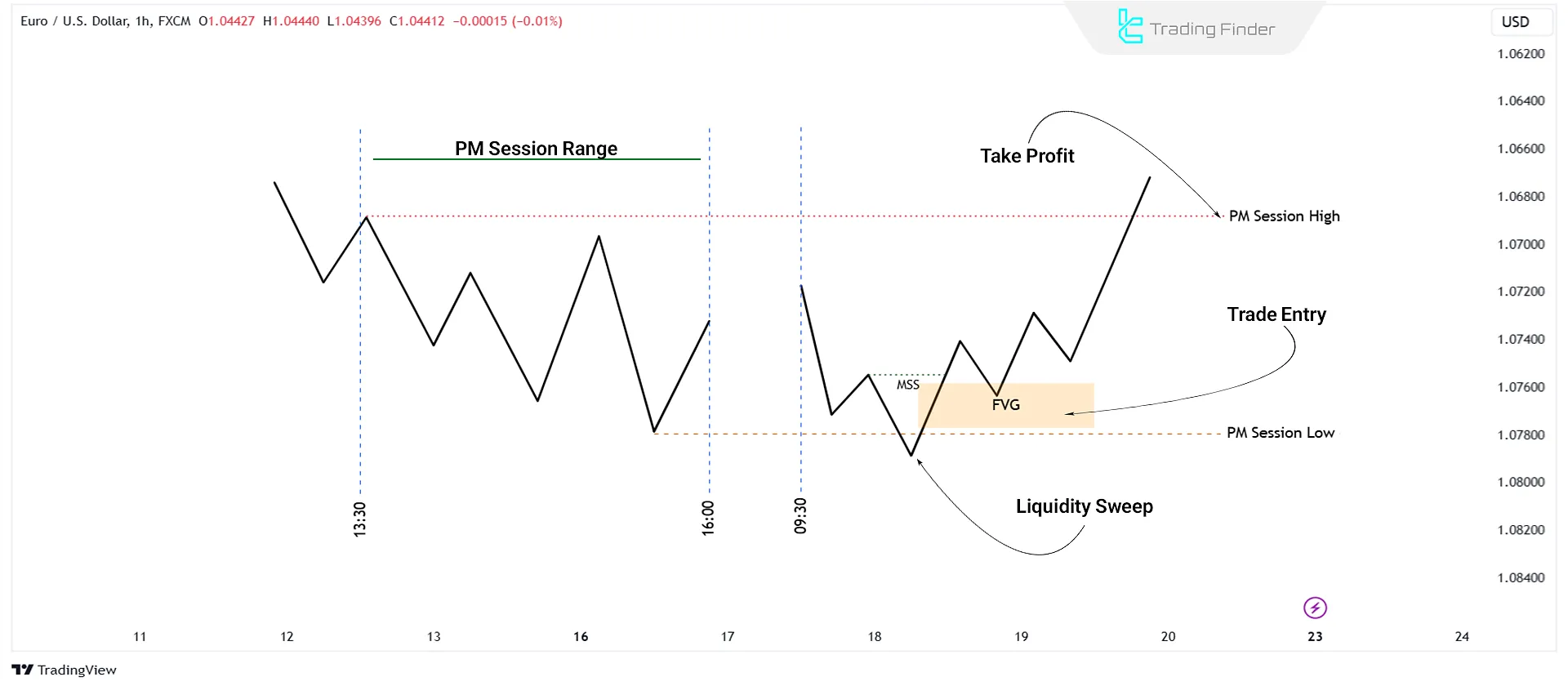

Below is the schematic of the bullish setup for ICT One Trade Setup For Life.

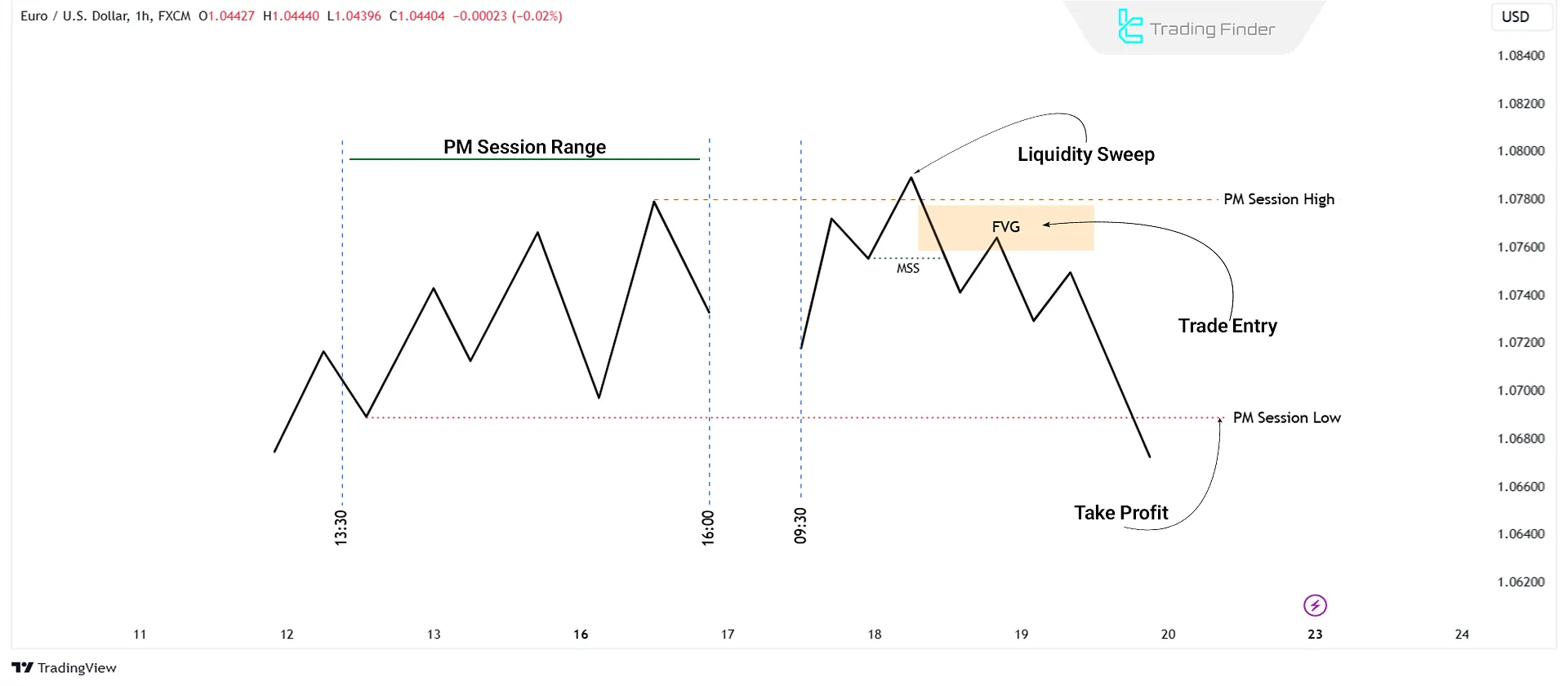

Below is the schematic of the bearish setup for ICT One Trade Setup For Life.

The recommended entry time is between 9:30 AM to 11:00 AM Eastern Time. Setting the trading session time zone to New York local time is essential.

Below are the setup conditions for different session timeframes.

PM Session Ranges

The PM session range reflects the price movement of the previous day. This range covers the timeframe from 1:30 PM to 4:00 PM NY time. To identify liquidity points:

- Mark the session high (Higher High) and low (Lower Low);

- Above the session high lies Buy-Side Liquidity (BSL);

- Below the session low lies Sell-Side Liquidity (SSL).

In a bullish daily bias, the price moves below the PM session low, sweeping SSL and creating an ICT Judas Swing.

The price moves above the PM session high in a bearish daily bias, sweeping BSL.

London Session Liquidity Raid

If the PM session range is irrelevant or the price has moved significantly away, the London Session Liquidity Raid is used instead.

The London session range is from 2:00 AM to 5:00 AM NY time, often leading to a major Liquidity Raid before the New York open.

During the New York opening, price is expected to:

- Move below the London session low in a bullish scenario;

- Move above the London session high in a bearish scenario.

Opening Range Gaps

Opening Range Gaps occur at 8:30 AM for forex and 9:30 AM for indices.

In a bearish daily bias, the price moves towards the opening range gap, sweeping liquidity built in the morning and during the New York lunch period.

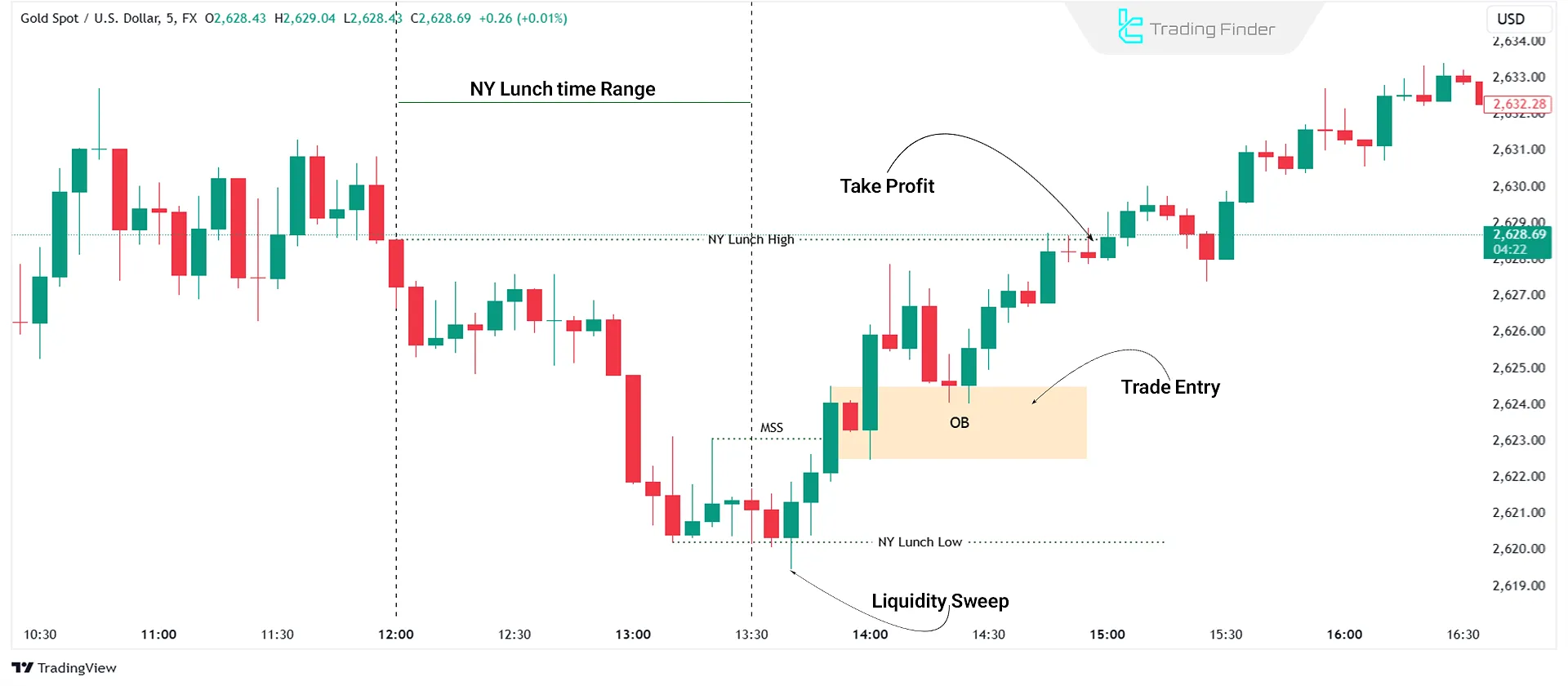

New York Lunch Liquidity Raid

If no liquidity sweeps have occurred earlier, the New York Lunch Range is examined from 12:00 PM to 1:30 PM NY time. Price may:

- Move towards the session high, initiating a bearish move;

- Move towards the session low, initiating a bullish move;

AM Session Liquidity Raid

The final liquidity target is based on the previous day's AM session range (9:30 AM to noon).

- For a bullish setup, the session high is the target;

- For a bearish setup, the session low is the target.

Conclusion

The ICT One Trade Setup For Life provides a comprehensive trading framework designed based on a detailed analysis of market movements and liquidity zones.

This model helps traders by introducing discipline, predictability, and structure in their trading approach.

Following the setup, traders can confidently execute their strategies and take advantage of repeatable trading opportunities.