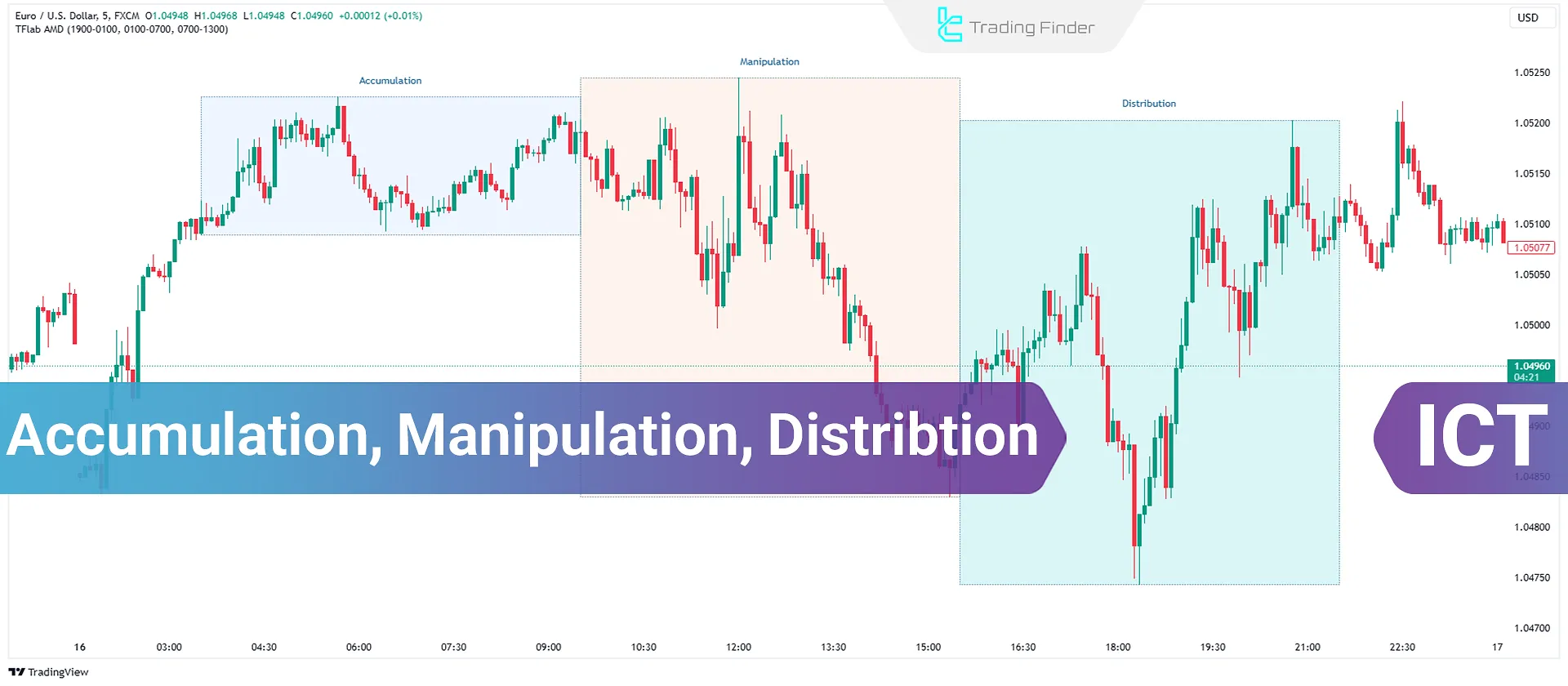

Accumulation, Manipulation, and Distribution (ICT Power of 3 strategy) is a trading strategy designed to help retail traders identify the movements of Smart Money.

This approach divides market activity into three stages [Accumulation, Manipulation, and Distribution].

Large financial institutions discreetly accumulate assets during the accumulation phase without attracting attention.

In the manipulation phase, the market deceives retail traders into making incorrect decisions through misleading price movements.

Finally, in the distribution phase, Smart Money drives the market in its desired direction to maximize profits.

To quickly identify and easily utilize the Power of Three strategy, you can use the Trading Finder (TFLAB) indicator suite:

- Power of Three Indicator for MT4

- Power of Three Indicator for MT5

- Power of Three Indicator for TradingView

What are Accumulation, Manipulation, and Distribution?

Accumulation, Manipulation, and Distribution (or AMD) are the three key phases of a potential price movement in the ICT trading style.

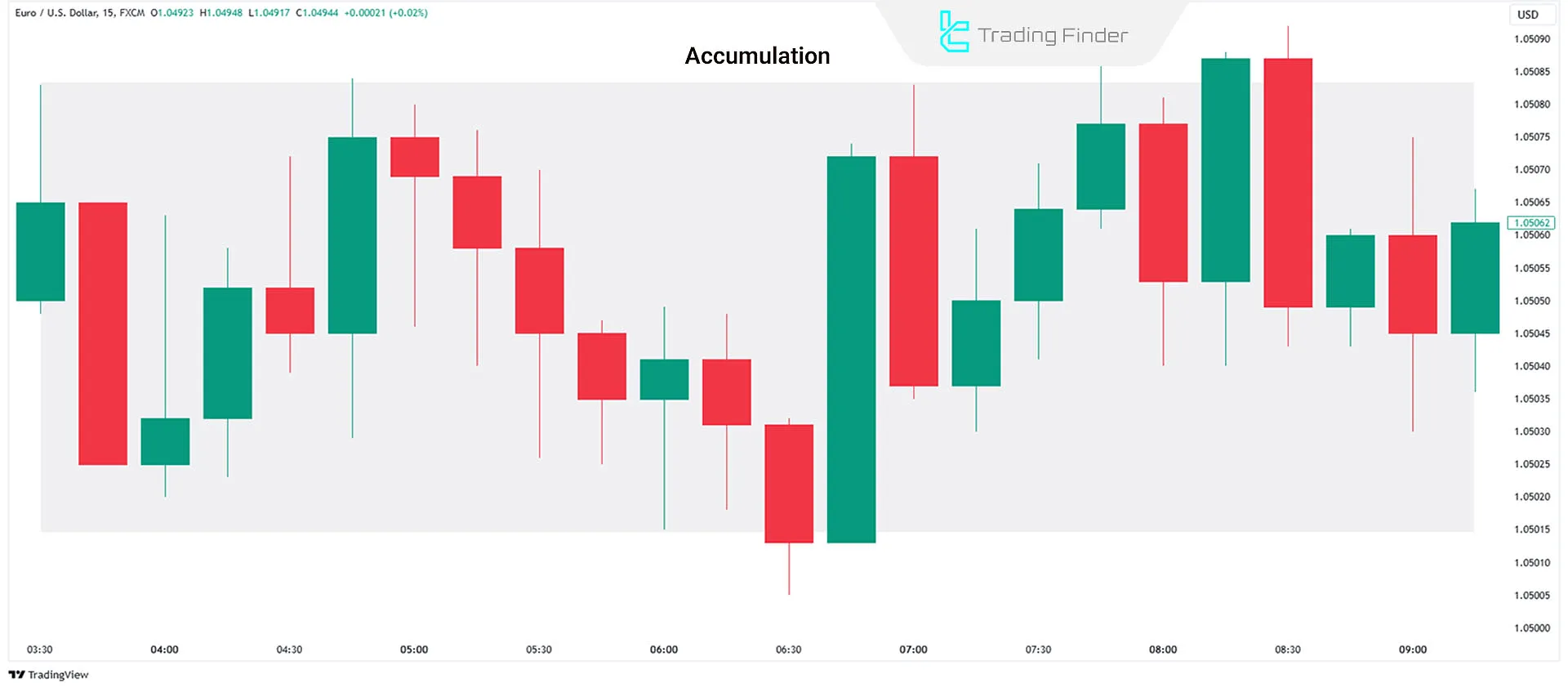

Accumulation Phase

The accumulation phase starts at the market opening, where the price moves within a narrow range near the opening price. During this stage, Smart Money builds its position quietly.

Although the price appears trapped, it signals preparation for a larger movement. In accumulation, retail traders typically place buy orders at horizontal support and sell orders at horizontal resistance.

Manipulation Phase

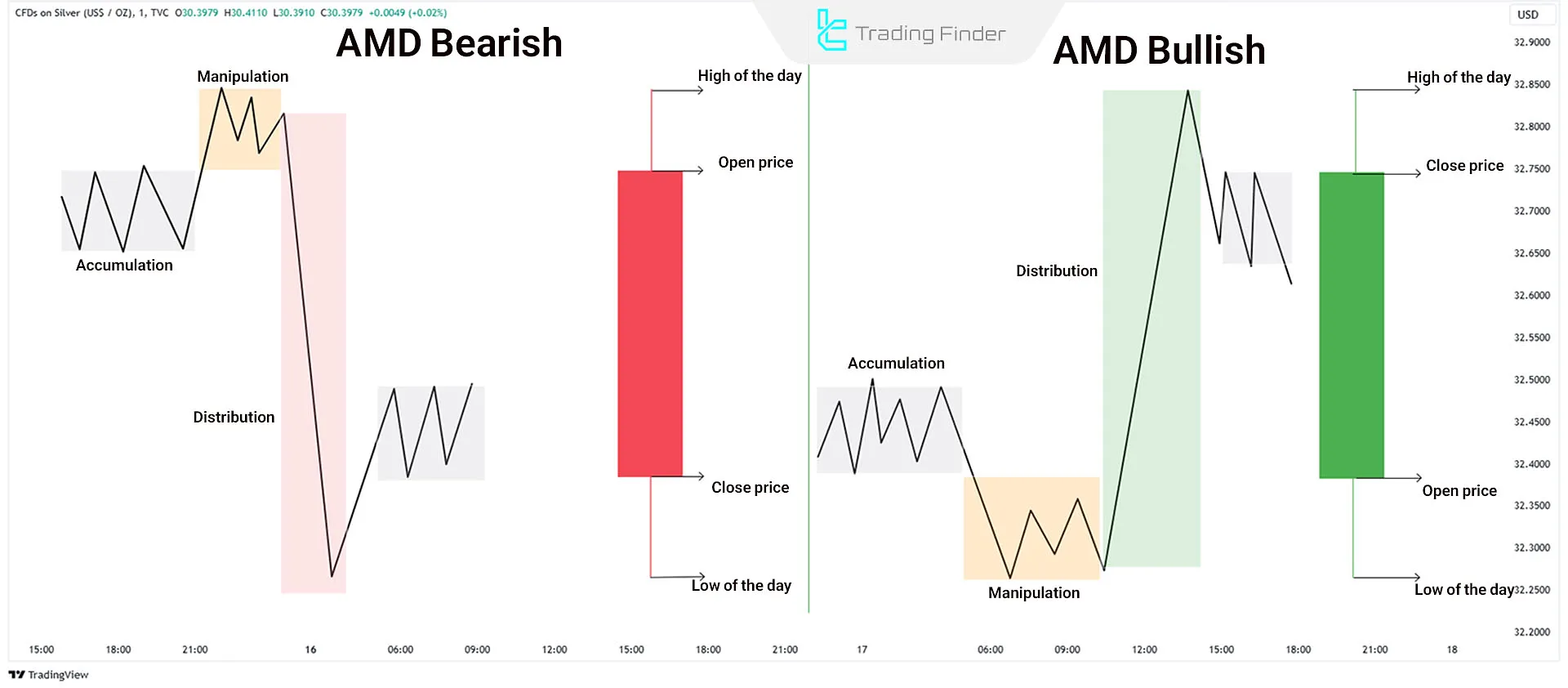

This phase is designed to mislead retail traders. After accumulation, Smart Money drives the market in the opposite direction:

- On bearish days, retail traders are enticed to buy

- On bullish days, traders are persuaded to sell

This is achieved through a false breakout of the accumulation range:

- If the price breaks above the range, it triggers sellers' stop losses and prompts new buyers to enter

- If the price breaks below the range, it triggers buyers' stop losses and prompts new sellers to enter

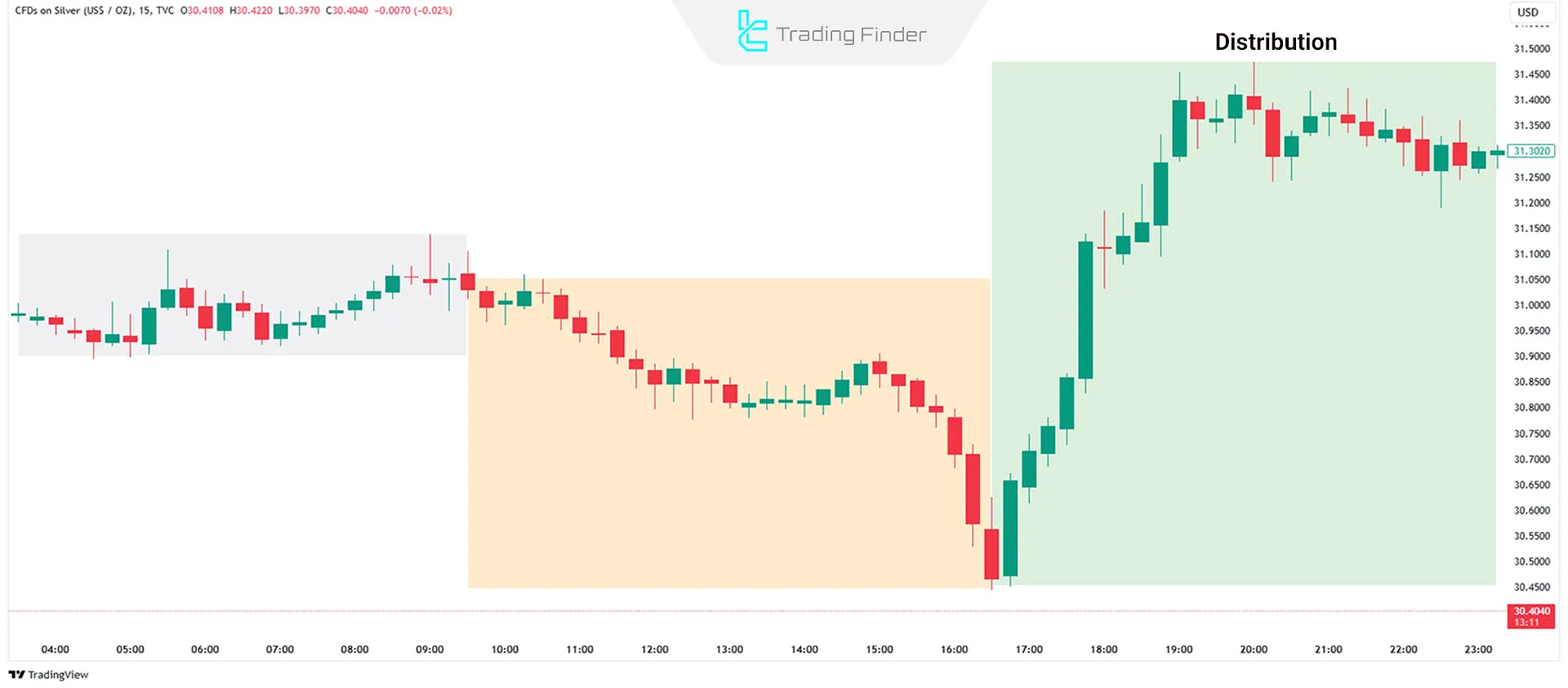

Distribution Phase

The AMD strategy's final stage is the distribution phase, which reflects the day's main market movement.

During this phase, Smart Money strengthens its positions after deceiving retail traders and absorbing their liquidity.

Then the market will move into the opposite direction of retail traders' expectations.

How to Trade with the ICT Power of 3 Strategy?

To implement the ICT Power of 3 strategy:

- Identify Daily Bias: Predict the overall price movement and the next daily candle direction

- Analyze Smaller Timeframes: Use lower timeframes to identify the distribution phase

Power of Three in a Bullish Market

The following steps outline trading with the Power of Three in an uptrend:

- Price Consolidation Near Opening Price: Price stabilizes near the daily opening price, and Smart Money builds buy positions.

- Sudden Sell-Off: A quick downward movement traps retail traders and targets old lows.

- Retail Traders' Losses: Retail buyers face losses due to a false breakout, allowing Smart Money to complete their buy positions at lower.

- Upward Move Towards Old Highs: Price moves towards old highs, activating buy stops and gathering liquidity.

- Reaching the Day's High: Smart Money exits buy positions and initiates sell trades at the day's high.

- Return to Daily Range: After liquidity is absorbed, the price returns to the daily range, marking the end of the trading day.

Power of Three strategy in a Bearish Market

The following steps outline trading with the Power of Three strategy in a downtrend:

- Price Consolidation Near Opening Price: Price stabilizes near the daily opening price, and Smart Money builds sell;

- Sudden Buying Pressure: A quick upward movement traps retail traders and targets old highs;

- Retail Traders' Losses: Retail sellers face losses due to a false breakout, allowing Smart Money to complete their sell positions at higher prices;

- Downward Move Towards Old Lows: Price moves towards old lows, activating sell stops and gathering liquidity;

- Reaching the Day's Low: Smart Money exits sell positions and initiates buy trades at the day's low;

- Return to Daily Range: Once liquidity is absorbed, the price returns to the daily range, signaling the conclusion of the trading day.

Conclusion

The ICT Power of 3 style, focusing on market psychology and its three main phases—Accumulation, Manipulation, and Distribution—is an effective method for identifying Smart Money movements.

This strategy offers high flexibility across various markets, including indices, forex, and commodities, enabling traders to leverage the Power of Three in these markets effectively.