The scalping strategy in ICT style allows traders to capitalize on short-term market fluctuations by understanding liquidity raids and utilizing Optimal Trade Entry (OTE) setups. It can also enhance the accuracy of entry and exit points.

How to Design an ICT Scalping Model?

To design an ICT scalping model, three main criteria must be defined:

- Entry Conditions

- Stop Loss Placement

- Exit Points [Take Profit]

In this model, "liquidity raids" serve as entry criteria, while OTE provides optimal entry points.

The Stop Loss is typically placed above the recent high or below the recent low, with the first Take Profit or move to break-even occurring after breaking a key level.

Advantages and Disadvantages of ICT Scalping Based on OTE

This section examines the pros and cons of using this strategy for short-term trading:

Advantages | Disadvantages |

Highly accurate entry points | Requires constant chart monitoring |

Improved risk-to-reward ratio | High sensitivity to market noise |

Suitable for algorithmic implementation | Complexity in initial setup |

Flexible settings adjustments | Limited effectiveness in higher timeframes |

Ideal for volatile markets | Requires experience |

Reduced time spent in losing trades | Potential for Take Profit not triggering due to minor fluctuations |

Utilizes multiple confirmations | Necessitates rapid analysis in limited time |

How Does the ICT Scalping Model Form?

For clarity, identify a short-term low or high where the price aggressively breaks through or Displacement Move and then returns. The OTE zone is determined when the price revisits this marked area. The stop loss is set below or above the previous pivot (based on trade direction), and the initial target is set at the opposite structure level.

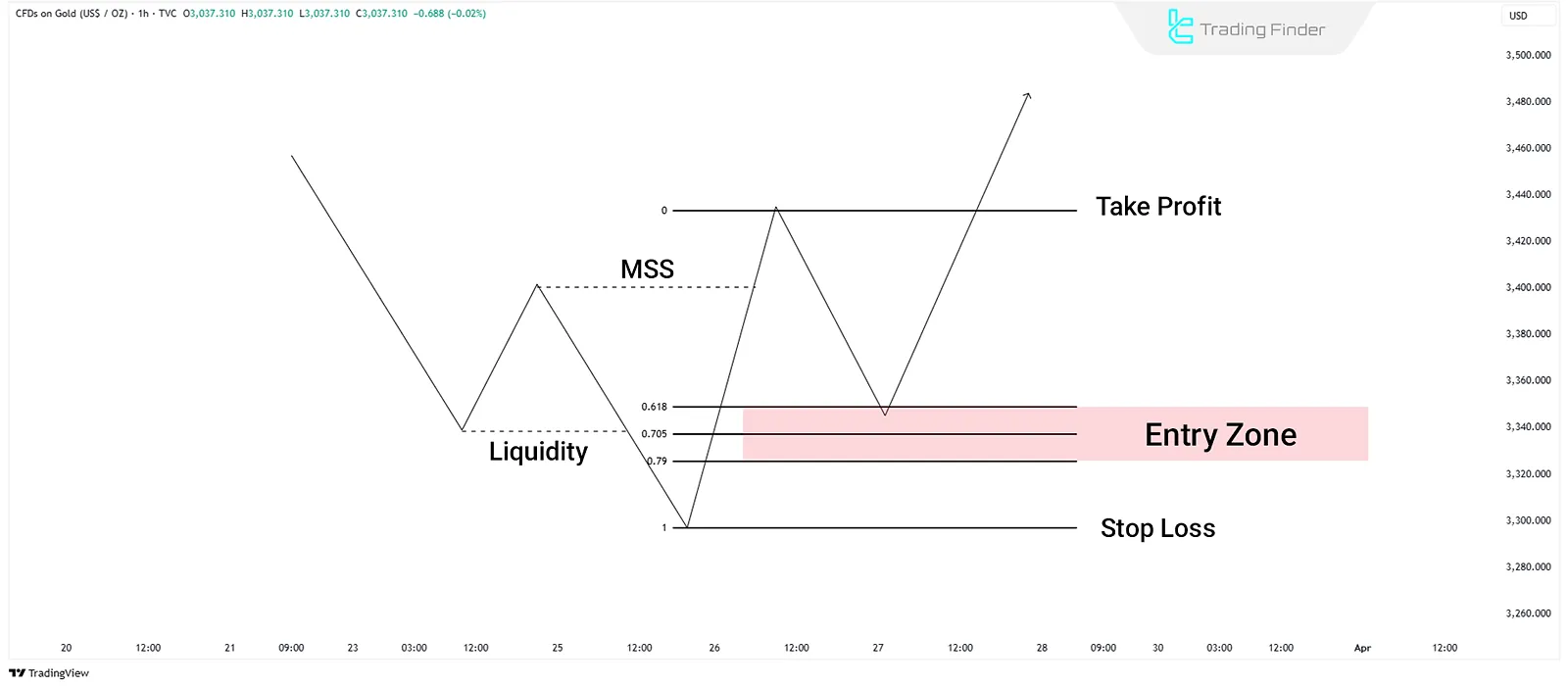

Bullish ICT Scalping

This example uses a 1-minute chart of USDCHF to illustrate the ICT scalping strategy:

First, identify recent highs and lows, as these are critical points for liquidity raids. Follow these steps:

- Price initially breaks below a recent low, perceived by many traders as support, collecting accumulated liquidity;

- After liquidity collection, the price makes a substantial upward displacement;

- This upward displacement breaks the previous high, confirming a Market Structure Shift (MSS);

- After MSS confirmation, apply Fibonacci retracement (OTE settings) on the displacement leg;

- Upon price return, the entry zone occurs between 0.62 and 0.79 Fibonacci levels. Set the Stop Loss below the recent low and the first Take Profit at the new high.

Below is a real example of this strategy:

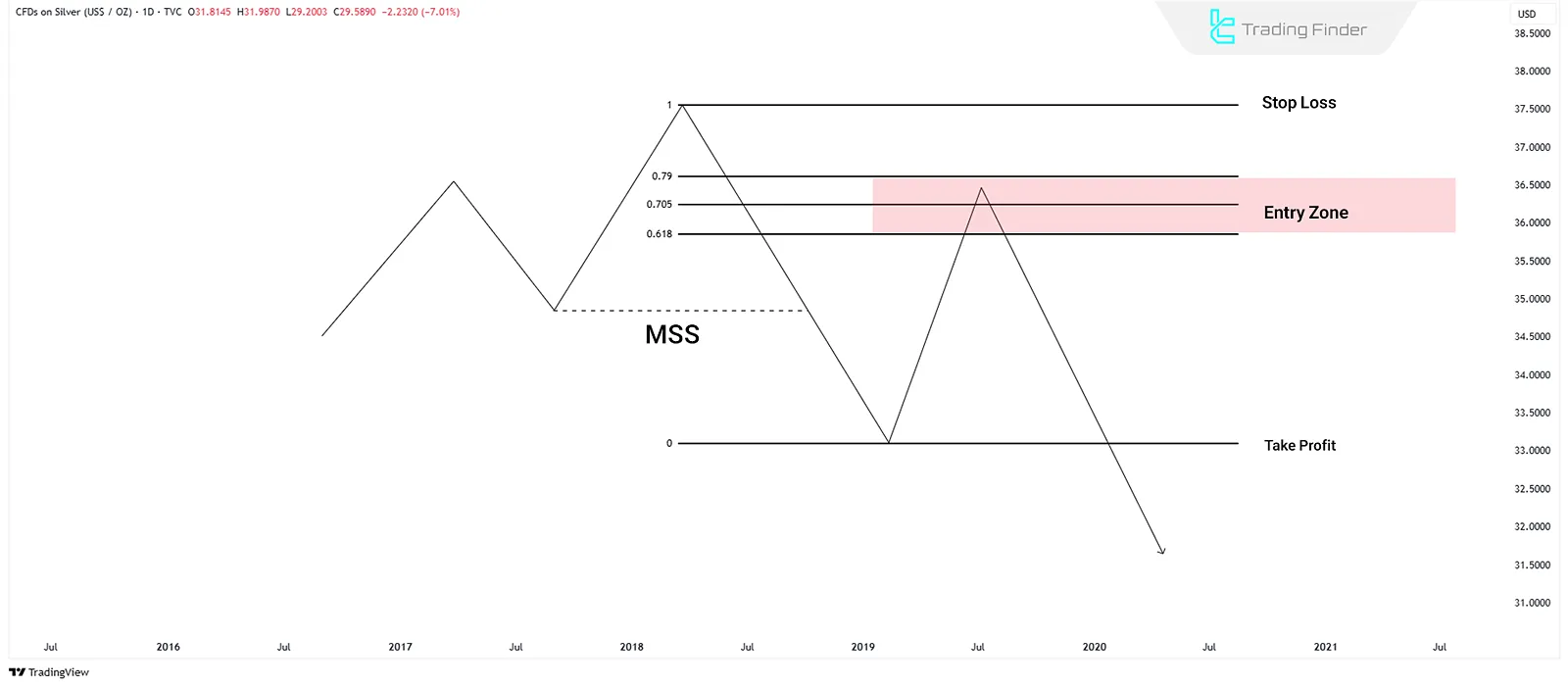

Bearish ICT Scalping

This example uses a 1-minute chart of GBPUSD to illustrate ICT scalping:

Again, first identify recent highs and lows for liquidity targeting, then:

- Price initially breaks above a recent high, seen by traders as resistance, collecting liquidity;

- Following liquidity collection, a substantial downward displacement occurs;

- The downward displacement breaks the previous low, indicating a Market Structure Shift (MSS);

- After MSS, apply Fibonacci retracement (OTE settings) to the displacement leg;

- Upon retracement, entry occurs between the 62 and 0.79 levels. The stop loss is placed above the recent high, and the initial Take Profit is at the new low.

Below is a real example of this strategy:

Summary

The ICT scalping strategy relies on precisely identifying market key points such as liquidity raids and optimal trade entry (OTE) zones.

Defining straightforward entry, stop loss, and target criteria enables accurate short-term market analysis. Key features include optimal OTE entry identification and exit decisions based on market structure shifts.