The SCOB strategy in the ICT trading style is designed based on a single candlestick (Order Block or Order Block Candle). This candle forms in a specific area with a distinct visual pattern, creating a critical zone. When the price returns to this zone, a trading opportunity arises.

What is Single Candle Order Block (SCOB)?

A Single Candle Order Block (SCOB) is a candlestick that forms in a Point of Interest (POI) and aligns with price reversals. The appearance of this candle serves as a strong confirmation of a market reversal.

By using the highest and lowest points of this candle, a key trading zone can be drawn.

Advantages and Disadvantages of the SCOB Strategy

Using this strategy has its own set of advantages and disadvantages:

Advantages | Disadvantages |

Applicable in all trading timeframes | Poor performance during ranging markets |

Identifies suitable entry zones in terms of risk-to-reward ratio | Requires significant experience and skill |

Applicable in all trading timeframes | - |

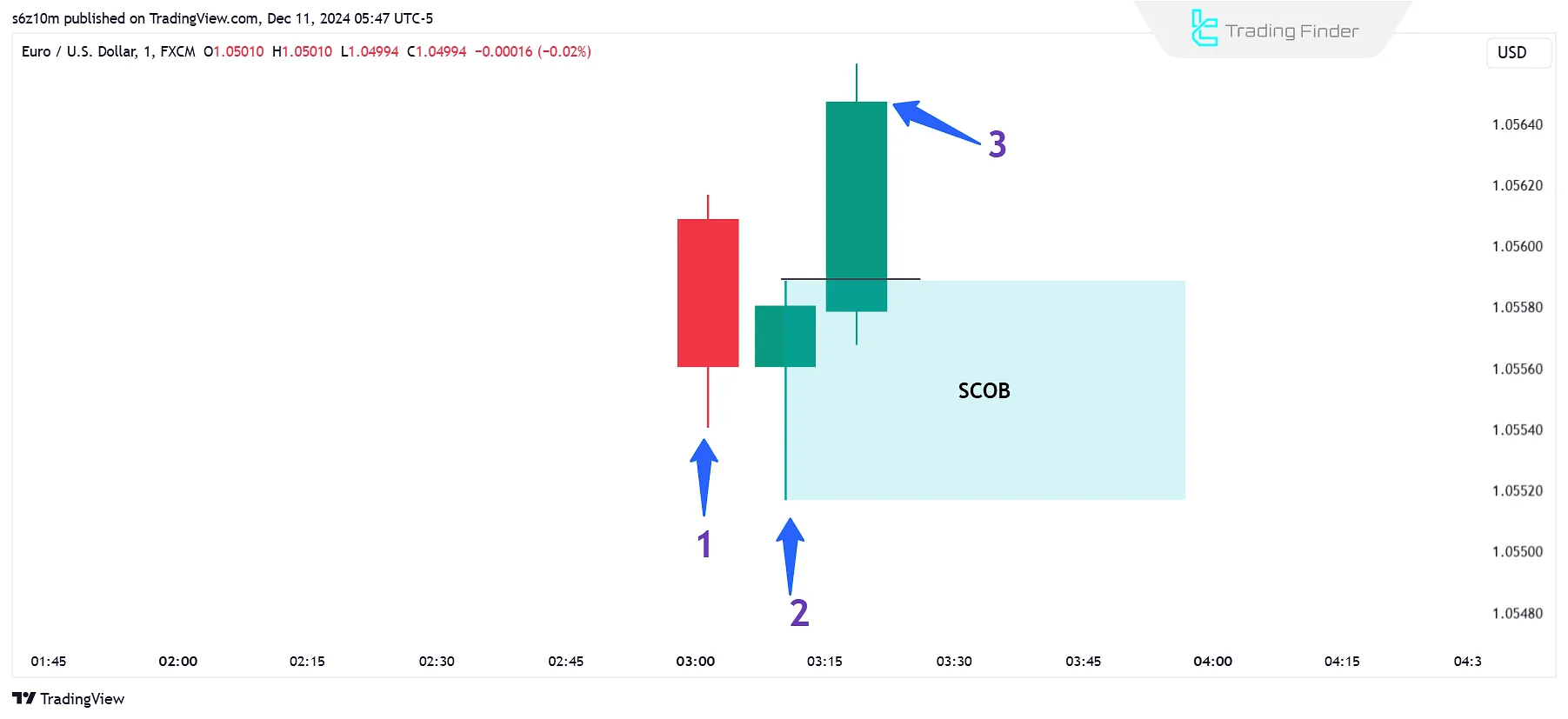

Bullish Single Candle Order Block (SCOB)

A Bullish Single Candle Order Block forms a favorable zone for price increases. To identify a SCOB, three consecutive candlesticks must be examined, meeting the following conditions:

- The first candle forms in a suitable price increase area. This candle, closes in a bearish state by creating a lower shadow (short or long wick);

- The second candle first drops below the previous candle's low, gathering liquidity beneath it, then rises and closes bullish;

- The third candle must rise and close above the high of the second candle.

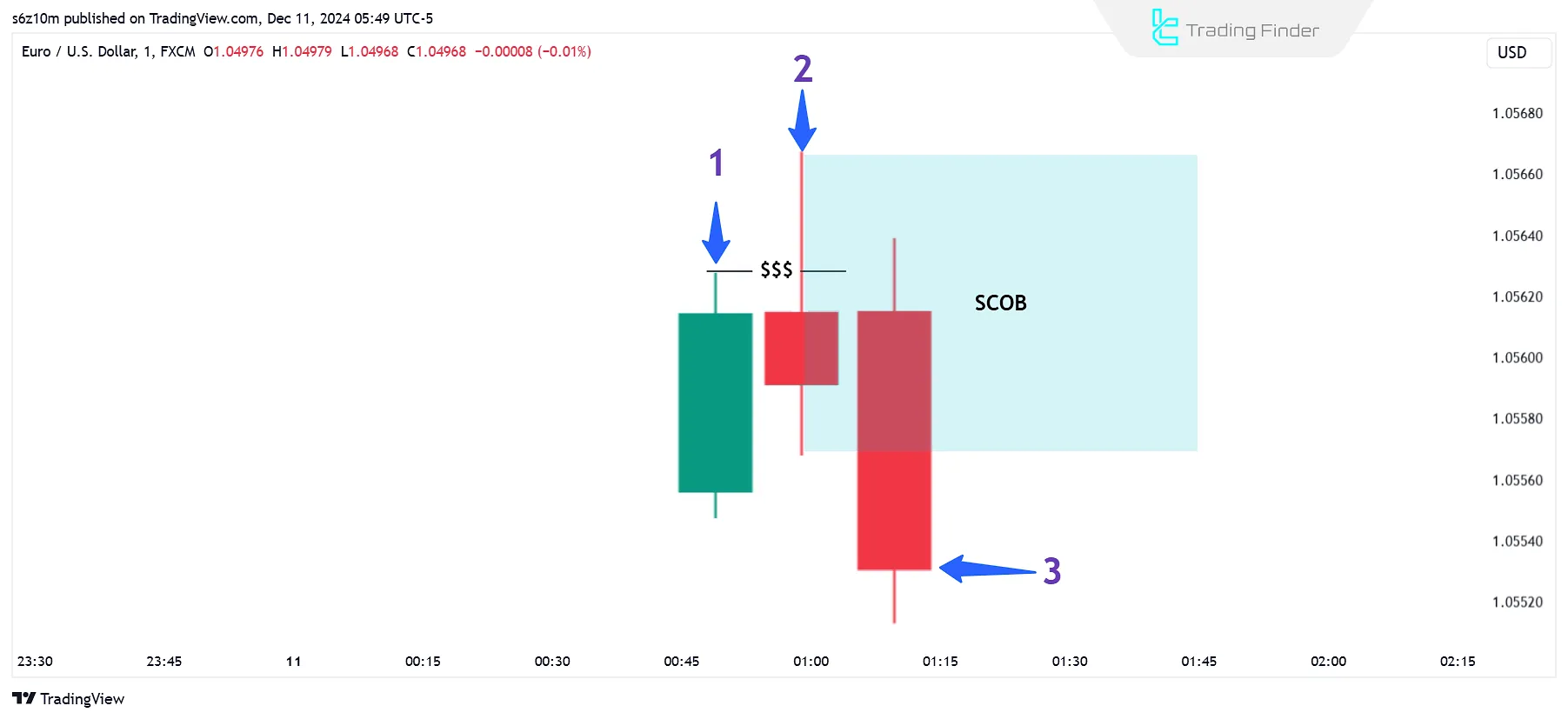

Bearish Single Candle Order Block (SCOB)

A Bearish Single Candle Order Block forms a favorable zone for price declines. To identify a SCOB, three consecutive candlesticks must be examined, meeting the following conditions:

- The first candle forms in a suitable price decline area. This candle creates an upper shadow (short or long wick) and closes in a bullish state;

- The second candle initially rises above the high of the previous candle, collecting liquidity above it. Then, it falls and closes bearish;

- The third candle must fall and close below the low of the second candle.

How to Trade Using the SCOB Strategy?

Trading based on the SCOB strategy follows specific rules. The process of executing a Sell or Buy trade using the SCOB setup is as follows:

Executing a Sell Trade (SELL)

To execute a Sell trade using the SCOB strategy, follow these steps systematically to ensure proper risk management and trade execution:

- Identify the Order Block: Locate an order block in a zone with a high probability of price decline;

- Mark the Zone: Define the order block area on your chart for precise entry;

- Wait for Price to Return: Do not enter immediately; instead, wait for the price to revisit the marked zone;

- Enter a Sell Position: Once the price reaches the identified order block, initiate a Sell trade;

- Set Stop Loss: Place the Stop Loss above the order block to manage risk effectively.

Executing a Buy Trade (BUY)

To execute a Buy trade using the SCOB strategy, follow these structured steps to ensure a precise and well-managed trade:

- Identify the Order Block: Find an order block in a zone with high probability of price increase;

- Mark the Zone: Define and highlight the order block area on your chart;

- Wait for Price to Return: Avoid entering immediately; wait for the price to revisit the marked zone;

- Enter a Buy Position: Once the price reaches the identified order block, initiate a Buy trade;

- Set Stop Loss: Place the Stop Loss below the order block to manage risk effectively.

Conclusion

The SCOB strategy examines the behavior of a single candlestick in key market areas to identify suitable trade entry points.

This strategy emphasizes Order Blocks (OB) formed by a key candle, suggesting potential trading opportunities in the direction of price reversal.