Top-Down Analysis is a structured method in ICT trading style that helps traders identify market trends and key entry points by analyzing multiple timeframes.

This approach allows traders to align their trades with the daily bias and reduce risk.

What is Top-Down Analysis?

Top-Down Analysis involves starting from higher timeframes to identify macro trends and key price levels, then gradually narrowing down to lower timeframes for more precise trade entries.

This method enhances market understanding, improves decision-making, and reduces trade risk.

Benefits of Top-Down Analysis

The Advantages of Top-Down Analysis Are:

- Market Structure: Provides a clear view of market structure and trends

- High Accuracy: Helps pinpoint precise entry and exit levels

- Risk Management: Aligning trades with higher timeframe trends lowers risk exposure

How to Perform Top-Down Analysis?

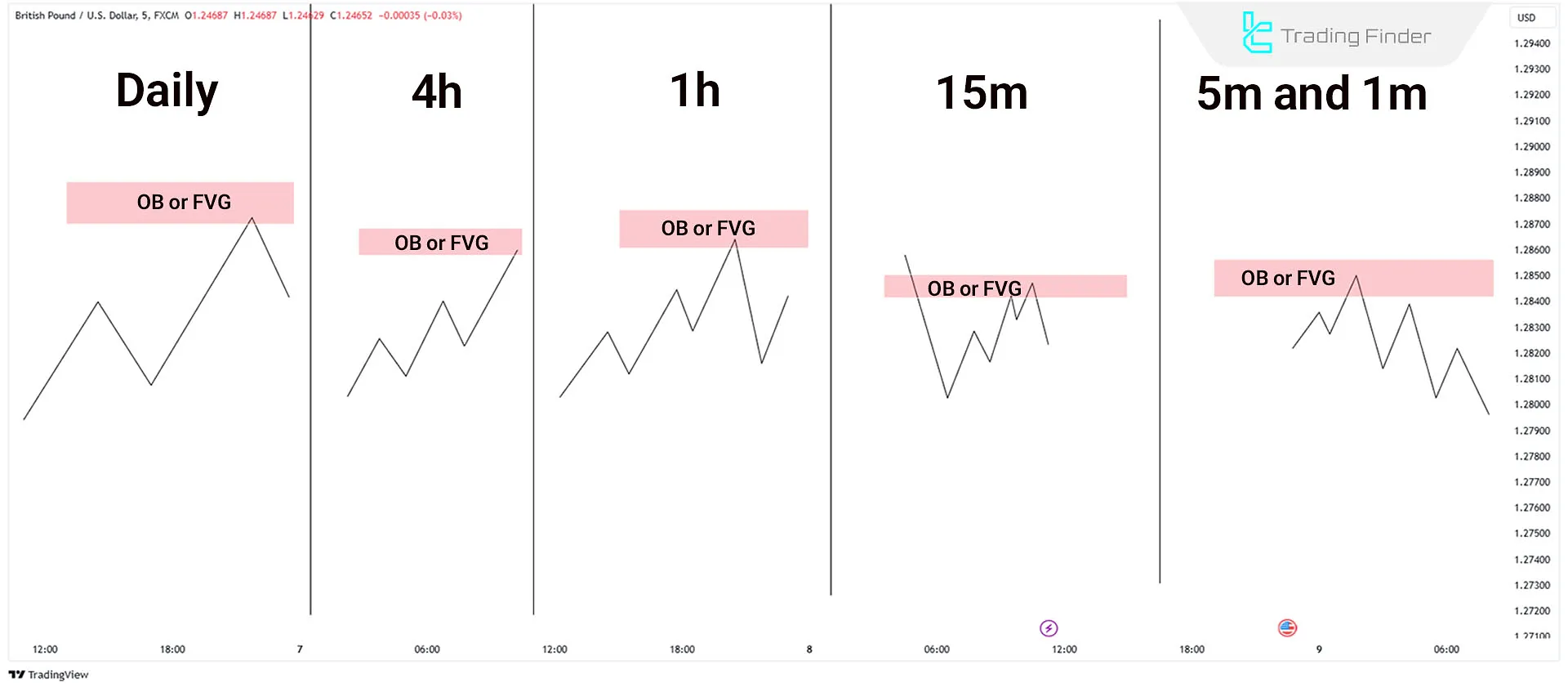

Traders start by analyzing higher timeframes to define the market bias, then zoom into lower timeframes to refine their trade execution.

#1 Daily Timeframe (D1)

The method for analyzing the daily timeframe is as follows:

- Identify key levels such as Order Blocks (OBs), Fair Value Gaps(FVGs), and previous highs/lows

- Highlight important zones, including support, resistance, and liquidity areas

#2 4-Hour Timeframe (H4)

The approach to analyzing the 4h timeframe is as follows:

- Confirm key levels from the daily timeframe

- Focus on FVGs or blocks that align with daily structure

- Consider session-based analysis (e.g., New York Kill Zone)

#3 1-Hour Timeframe (H1)

The process for examining the 1h timeframe is outlined below:

- Validate how higher timeframe zones interact with the current price action

- While H1 may not always provide new insights, it helps confirm market bias

#4 15-Minute Timeframe (M15)

Here is the method used to analyze the 15m timeframe:

- Observe how price interacts with marked zones from higher timeframes

- Identify liquidity grabs, displacement moves, or FVG reactions.

#5 Lower Timeframes (M5 & M1)

The following steps describe how to analyze the Lower Timeframes:

- Look for precise entry triggers, including FVG rejections and market structure shifts

- Consider setups like Break of Structure (BOS), Change of Character (CHOCH), or Mitigation Blocks

- Use lower timeframes to minimize risk and optimize trade execution

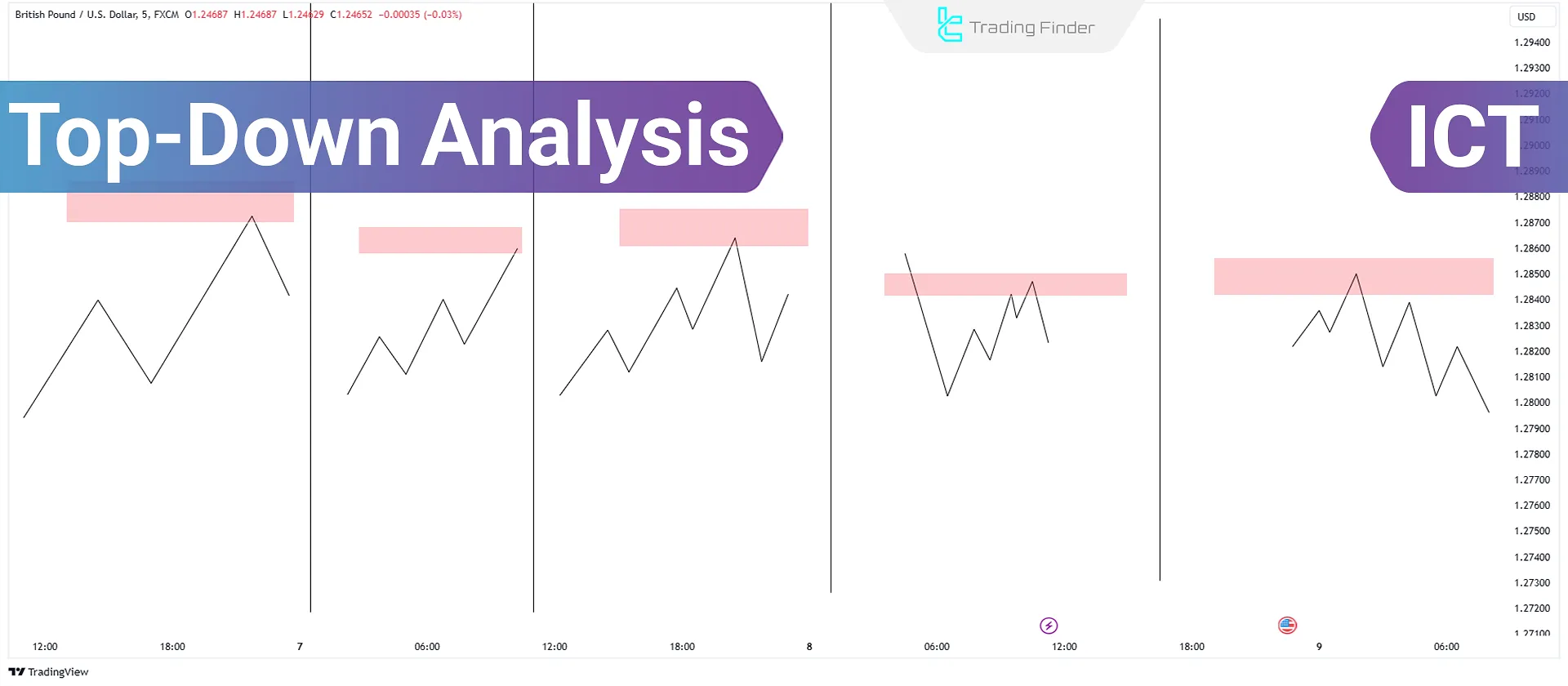

Example of Using Top-Down Analysis

In a GBP/USD chart, the Order Block (OB) and Fair Value Gap (FVG) are first identified in higher timeframes.

On the lower timeframes (M1), price confirms a market structure shift, and upon reaching the OB or FVG, an entry opportunity is revealed.

Conclusion

Top-Down Analysis is a structured approach for identifying market trends and finding high-probability trade setups.

By starting from higher timeframes and moving down to lower timeframes, traders can reduce risk, refine their trade execution, and improve accuracy.

This method is widely applicable in the Forex Market, stocks, crypto, and commodities, using tools such as trendlines, support & resistance, technical indicators, and market structure analysis.