- TradingFinder

- Education

- Forex Education

- ICT (Inner Circle Trader) Education

ICT (Inner Circle Trader) Education

The ICT (Inner Circle Trader) trading style is an advanced approach to price action, focusing on analyzing the behavior of major financial institutions and the role of market makers. In the ICT method, traders aim to identify optimal entry and exit points by analyzing market structure, Break of Structure (BOS), Order Blocks, Liquidity, and Fair Value Gaps (FVG). Trading Finder offers the best ICT-style educational content across four different levels, tailored to the needs of beginner to advanced traders. These courses cover concepts such as the Market Maker Model, Power of Three, and Smart Money Techniques, providing efficient methods for traders.

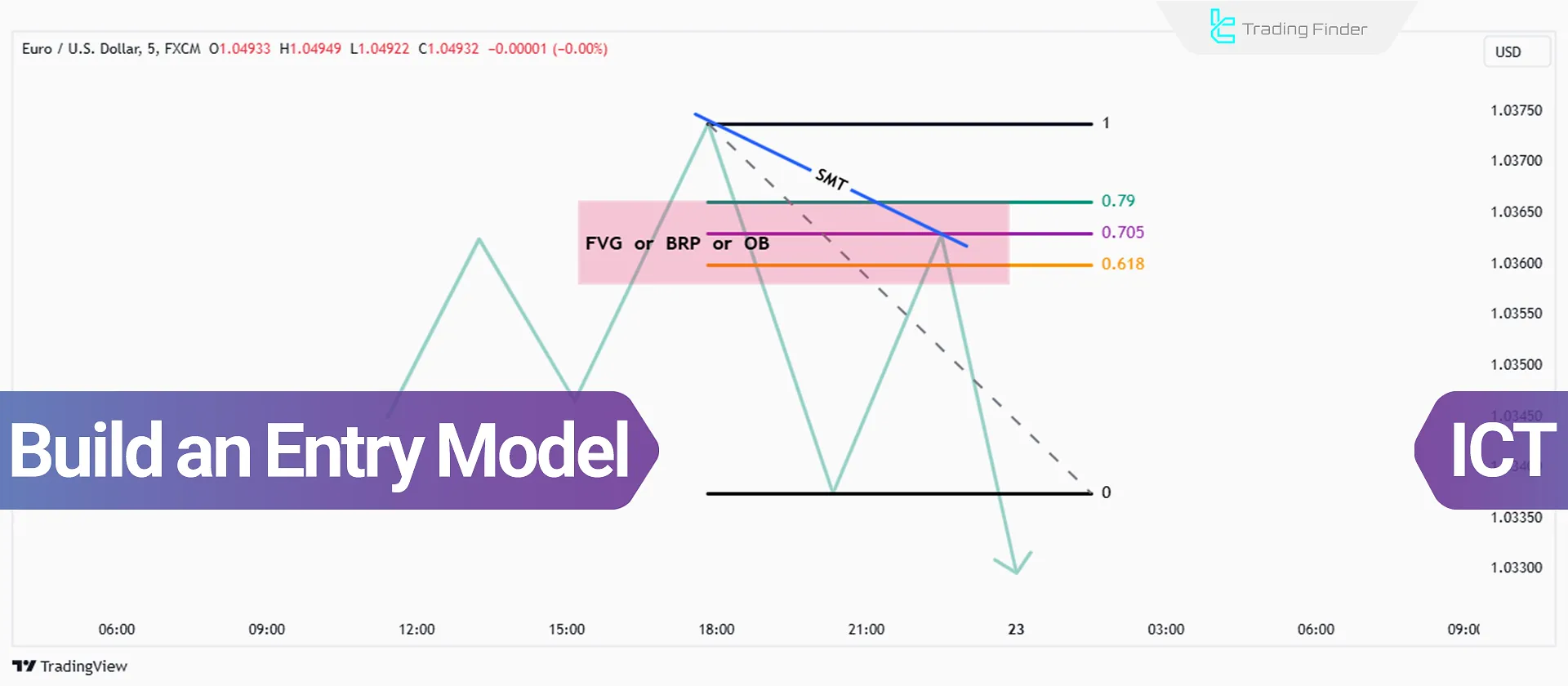

Build an Entry Model in ICT - Select a Model Based on FVG, IRL, OTE, and BPR

To design an entry model using ICT concepts, the primary focus is on shorter timeframes and entry tools, including Fair Value Gap...

Market Structure Shift vs Liquidity Grab – Application in ICT Style Trading

Market Structure Shift (MSS) indicates a genuine trend change that occurs when key support or resistance levels are completely...

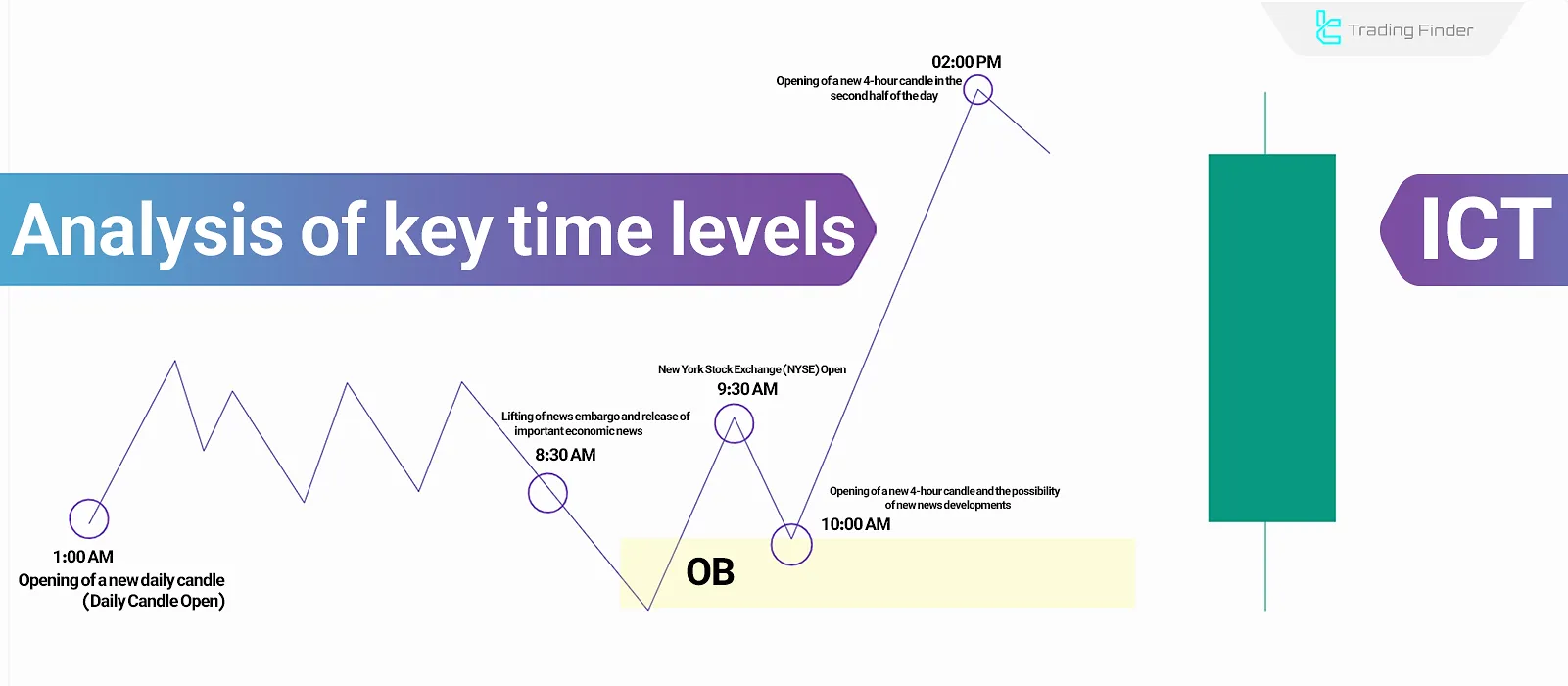

Learning to analyze important time levels and bullish & bearish candles in ICT

Analyzing ICT time levels, such as market openings, major news releases, and candlestick formations, is crucial in predicting...

Reversal vs Pullback in Market Structure – Trend Recognition in HTF

By using the concepts of retracement and pullback in ICT style and Smart Money styles, long-term market trend changes and...

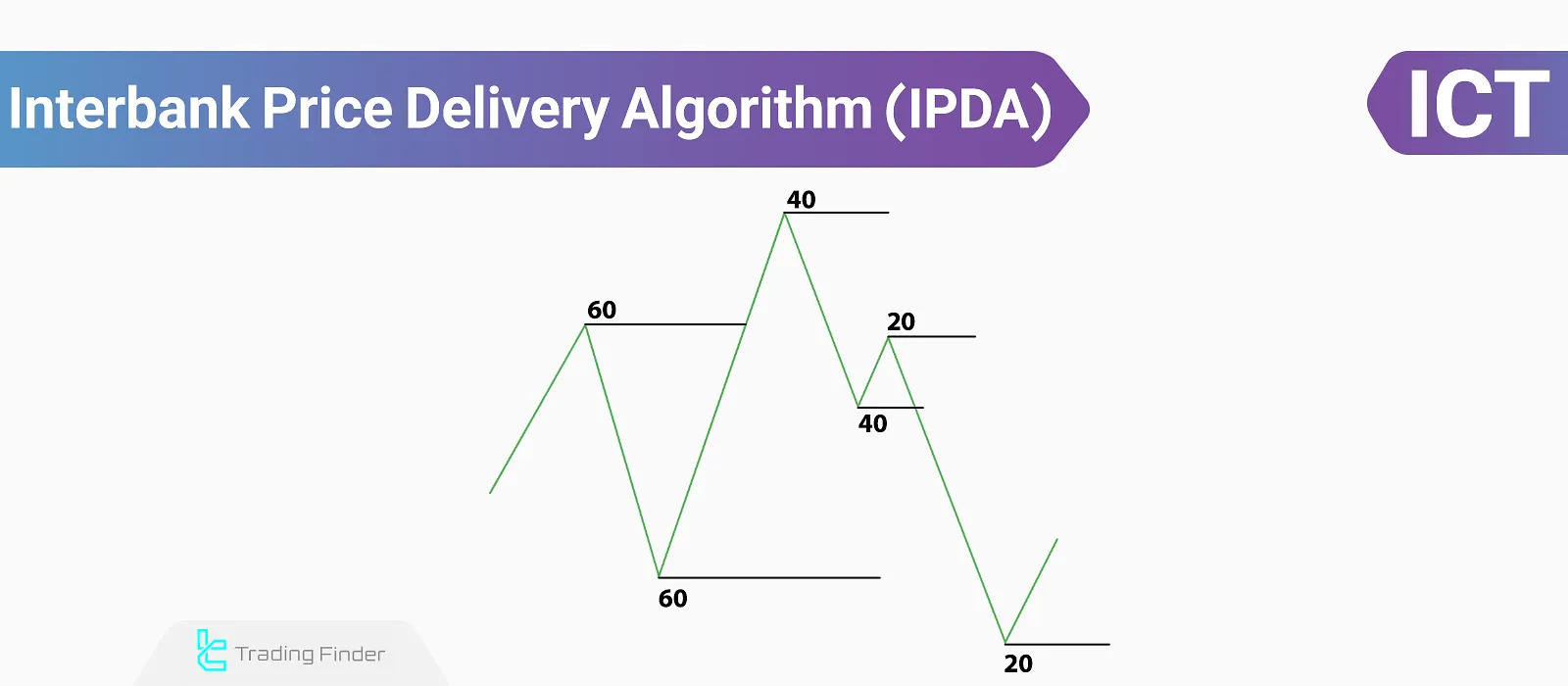

Interbank Price Delivery Algorithm (IPDA), A Guide to ICT-Style Trading Concepts

The Interbank Price Delivery Algorithm or IPDA is one of the liquidity concepts in the ICT style. This concept...

Learn IRL & ERL in ICT; Internal and External Range Liquidity

In the ICT Style, price movement in financial markets like Forex market is shaped solely towards liquidity; In this context,...

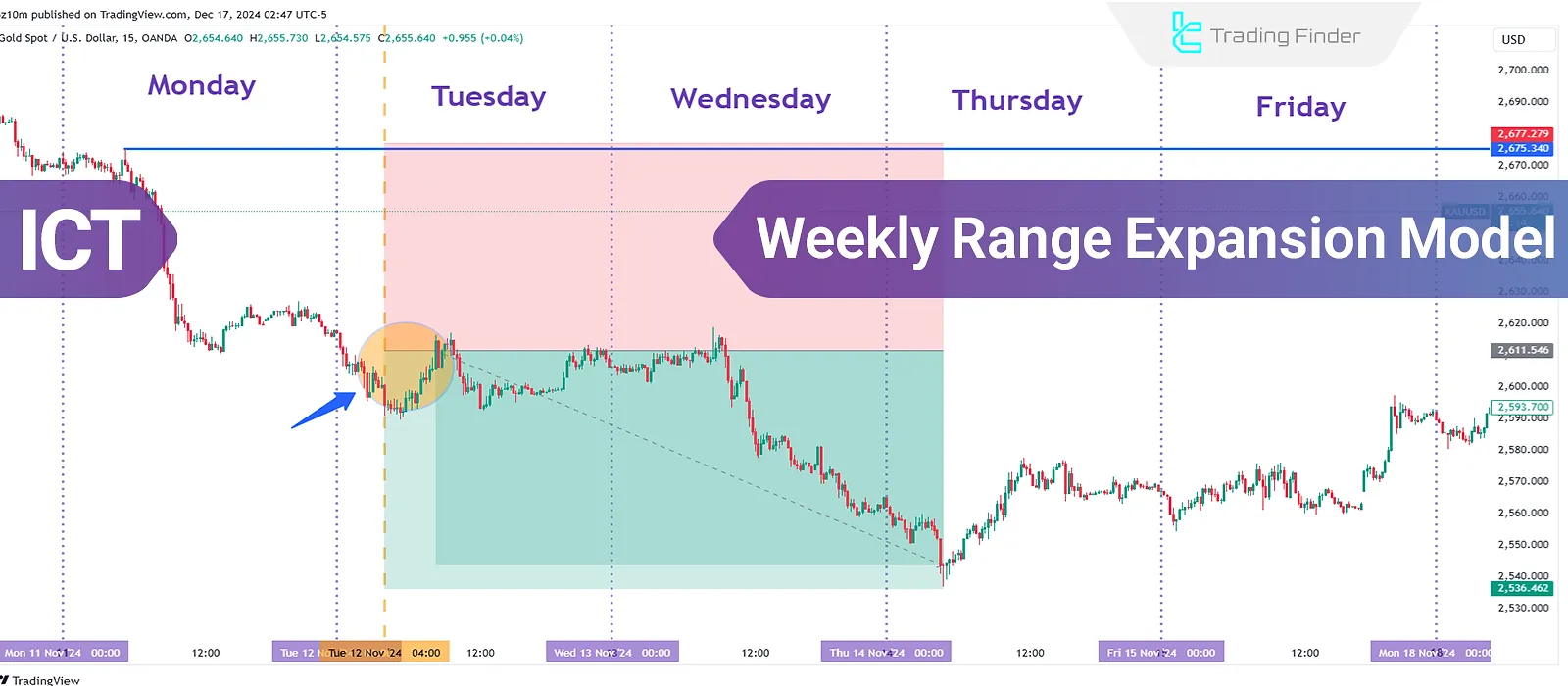

ICT Weekly Range Expansion Model - Stages of Weekly Range Execution

The ICT Weekly Range Expansion Model is an analytical approach used in short-term trading to identify price...

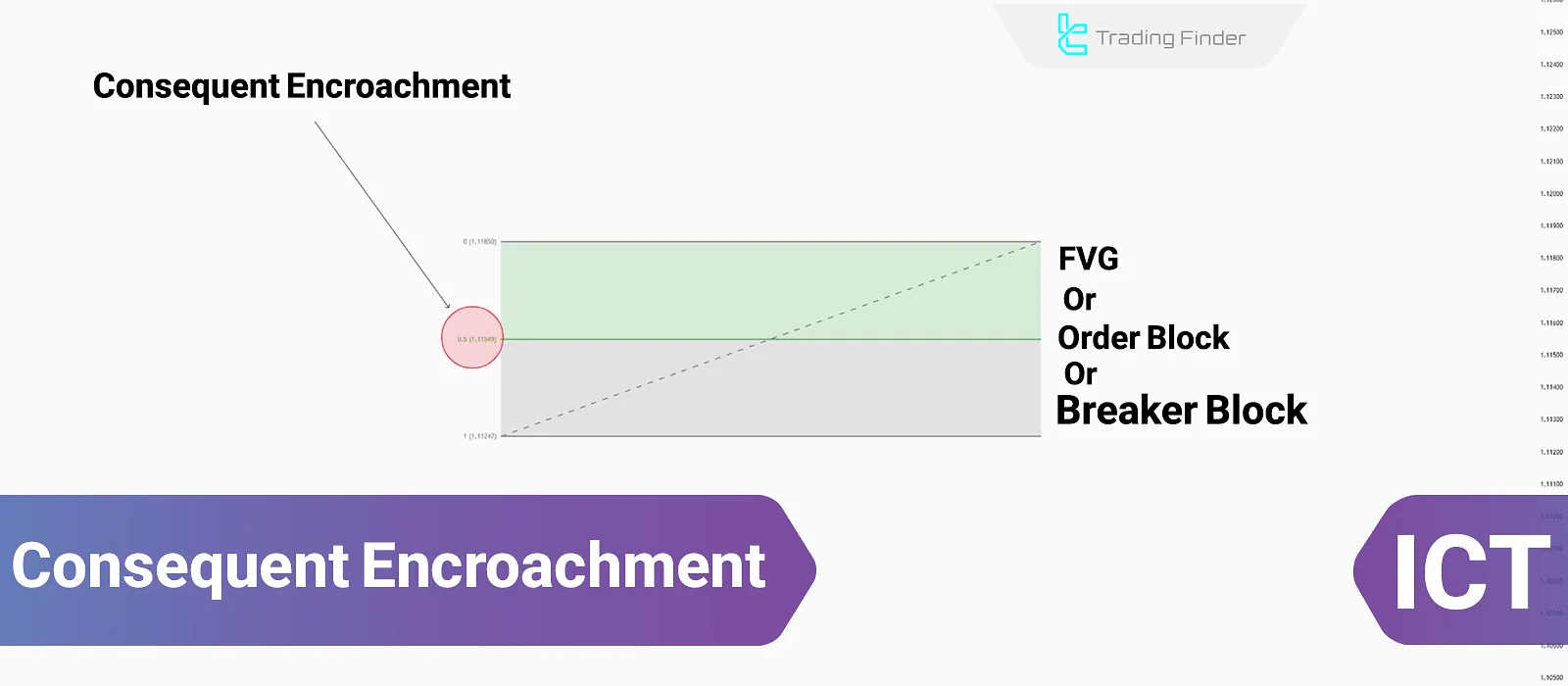

Consequent Encroachment in ICT: The Reason CE is Important in ICT

Consequent Encroachment (CE) focuses on a level where the price is highly likely to react. This concept is crucial, especially...

Buy side and Sell side Imbalance and Inefficiency (SIBI) and (BISI); ICT Style

Sell-Side Imbalance and Buy-Side Inefficiency (SIBI) and Buy-Side Imbalance andSell-Side Inefficiency (BISI) in the ICT...

Single Candle Order Block - Using SCOB in Trading

The SCOB strategy in the ICT trading style is designed based on a single candlestick (Order Block or Order Block...

ICT Broadening Formation; Using Buy-Side & Sell-Side Liquidity

The Broadening Formation is a recurring pattern in technical analysis that helps traders...

Reversal Sequence Strategy: Entering Trades with ICT Concepts [FVG, BB, OB]

The Reversal Sequence Strategy is a method based on the ICT trading style. It aims to enter trades before the main...

![Reversal Sequence Strategy: Entering Trades with ICT Concepts [FVG, BB, OB]](https://cdn.tradingfinder.com/image/288483/7-54-en-reversal-sequence-01.webp)