Capital management and risk control are fundamental pillars of trader success in financial markets. One key tool in this area is the Margin Level, which indicates the amount of available capital for entering new trades.

A proper understanding of Margin Level helps prevent margin calls and stop outs and enables traders to optimize their risk management strategies.

The Margin Level represents the ratio of Equity to Used Margin, expressed as a percentage. This indicator is crucial in controlling a trader's ability to open newpositions and is considered a fundamental tool in risk management.

An increasing margin level indicates greater liquidity and the possibility of opening new trades, while a decreasing margin level indicates higher risk and a potential margin call or, ultimately, a stopout by the broker.

Professional traders continuously monitor the Margin Level to avoid critical scenarios and adjust their trading strategies based on fluctuations.

Margin Level Calculation Formula

Trading platforms automatically display the Margin Level, a key metric for assessing available liquidity to enter new trades.

- Margin Level Formula:Margin Level = 100% × (Equity / Used Margin)

If there are no open trades, the margin level equals zero; Also an increasing margin level indicates more free margin to enter new trades.

Example 1 – Margin Level Calculation: Long Position on EUR/USD

Suppose your account balance is $2,000, and you want to open a buy position of 1 mini lot on EUR/USD. Step-by-step calculation:

- Required Margin Calculation: If the required margin is 5%, the used margin is:

- Trade Value × Margin Percentage = Required Margin

- 10,000 × 0.05 = $500

- Equity Calculation

- Account Balance + Floating P/L = Equity

- $2,000 + $0 = $2,000

- Margin Level Calculation

- Margin Level = (Equity / Used Margin) × 100%

- Margin Level = (2000 / 500) × 100% = 400%

A margin level above 100% allows the trader to open new positions in the forex market.

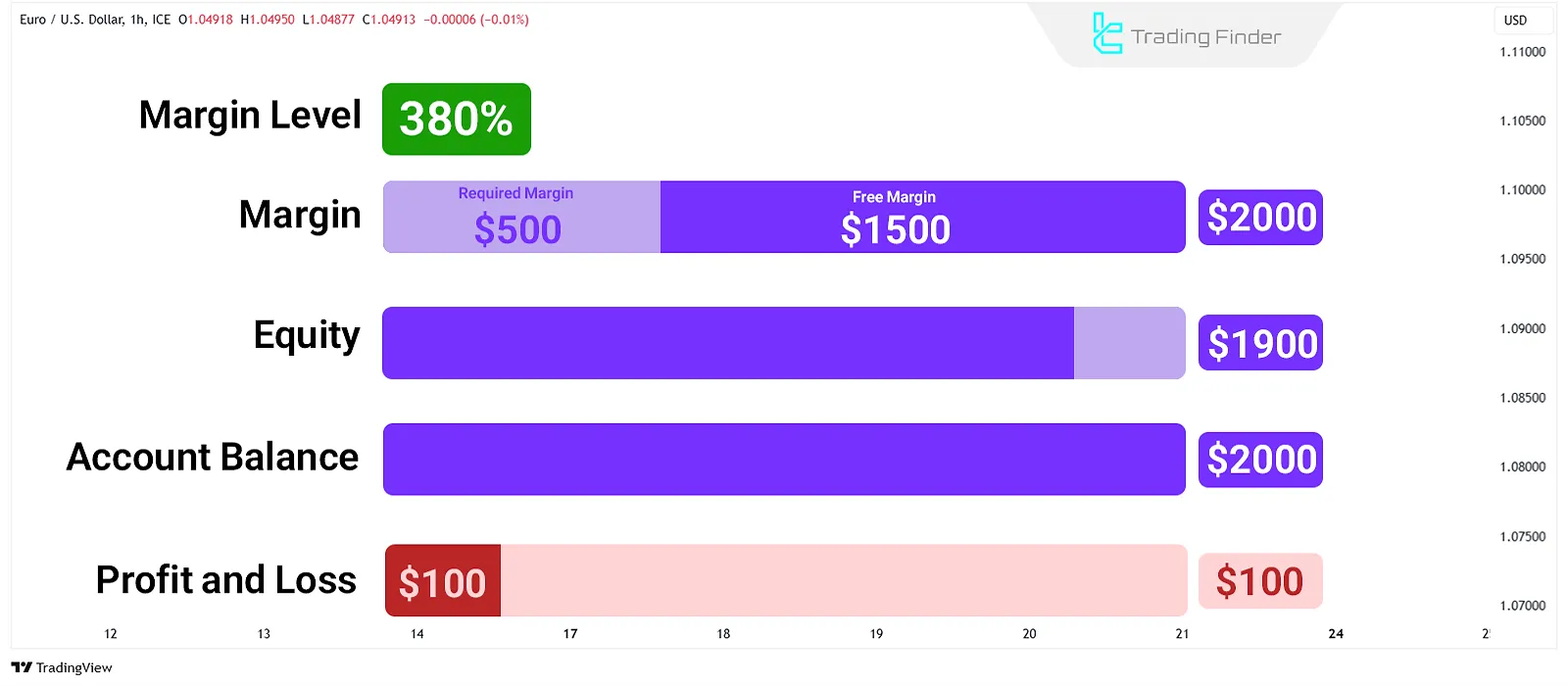

Example 2 – Margin Level Calculation: Losing Trade on EUR/USD

Suppose in the previous example that your account incurs a $100 floating loss after opening the position.

- Required Margin Calculation: If 5% is defined as the required minimum margin, the used margin will be equal to:

- Trade Value × Margin Percentage = Required Margin

- 10,000 × 0.05 = $500

- Equity Calculation

- Account Balance + Floating P/L = Equity

- $2,000 - $100 = $1,900

- Margin Level Calculation:

- Margin Level = (Equity / Used Margin) × 100%

- Margin Level = (1900 / 500) × 100% = 380%

Margin Call and Stop Out Based on Margin Level

A Margin Call occurs when the Margin Level drops to 100%. In this condition, the trader cannot open new trades and must either close some open positions or deposit more funds to continue trading.

If the margin level falls to a critical threshold (usually 50% or less), the broker automatically closes some trades to rebalance the margin level—a process known as Stop-out.

Example:

Suppose that the Equity is $400 and Used Margin is $400, then:

- Margin Level = (400 / 400) × 100% = 100%

In this case, the broker will block new trades. If floating loss increases and Equity drops to $200:

- Margin Level = (200 / 400) × 100% = 50%

At this level, the broker begins closing positions — Stop Out is triggered.

Conclusion

The Margin Level in Forex is a key metric for capital risk management and guides traders in making smart trading decisions.

A margin level above 100% indicates flexibility to enter new trades.

A level at 100% means a margin call, where the trader can no longer open new positions.

A stop-out occurs if the margin level hits 50% or less, and the broker closes positions automatically.

Continuous monitoring of margin level and understanding its changes are essential to avoiding major losses and improving trading effectiveness in the forex market.