Margin in financial markets refers to the collateral a trader needs to open new trades. Leverage is a tool used to amplify trading capital. These concepts play a crucial role in capital management and improving the risk-to-reward ratio.

What is Margin?

Margin is the amount of money that a trader must keep in their account to open a trade. In other words, margin acts as collateral that represents a trader’s ability to execute trades using the credit provided by Forex brokers.

You can use our margin tool to calculate the required amount for positions.

What is Leverage?

With leverage, traders can trade with more capital than their initial deposit. This capability gives them the chance to gain greater profits from trades; however, the higher the profit potential, the greater the risk involved.

Leverage is expressed as a ratio and is typically represented in the form of x:1. For example, if leverage is 50:1, it means that a trader can open a position worth $50 with just $1.

In another example, if a trader uses 25:1 leverage with an initial capital of $4,000, the total tradable capital would be:

- 4,000 × 25 = 100,000

Or, if a trader uses 75:1 leverage with $2,000 capital, the tradable amount would be:

- 2,000 × 75 = 150,000

Difference Between Margin and Leverage

Although margin and leverage are related, they have important differences, which are outlined in the table below:

Parameter | Margin | Leverage |

Definition | Amount held as collateral to open a position | A tool to increase trading capital |

Role in Trading | Initial investment for trades | Increases buying power and enables larger trades |

Calculation | Calculated as a percentage of trade volume | Initial capital × leverage ratio |

Impact on Profit & Loss | Profit and loss are limited to margin amount | Significant increase in both profit and loss potential |

Risk | Risk of losing money increases with higher margin | Higher leverage leads to amplified profits and losses |

Markets Used In | Forex, stocks, commodities, and other financial markets | Forex, stocks, cryptocurrencies, etc. |

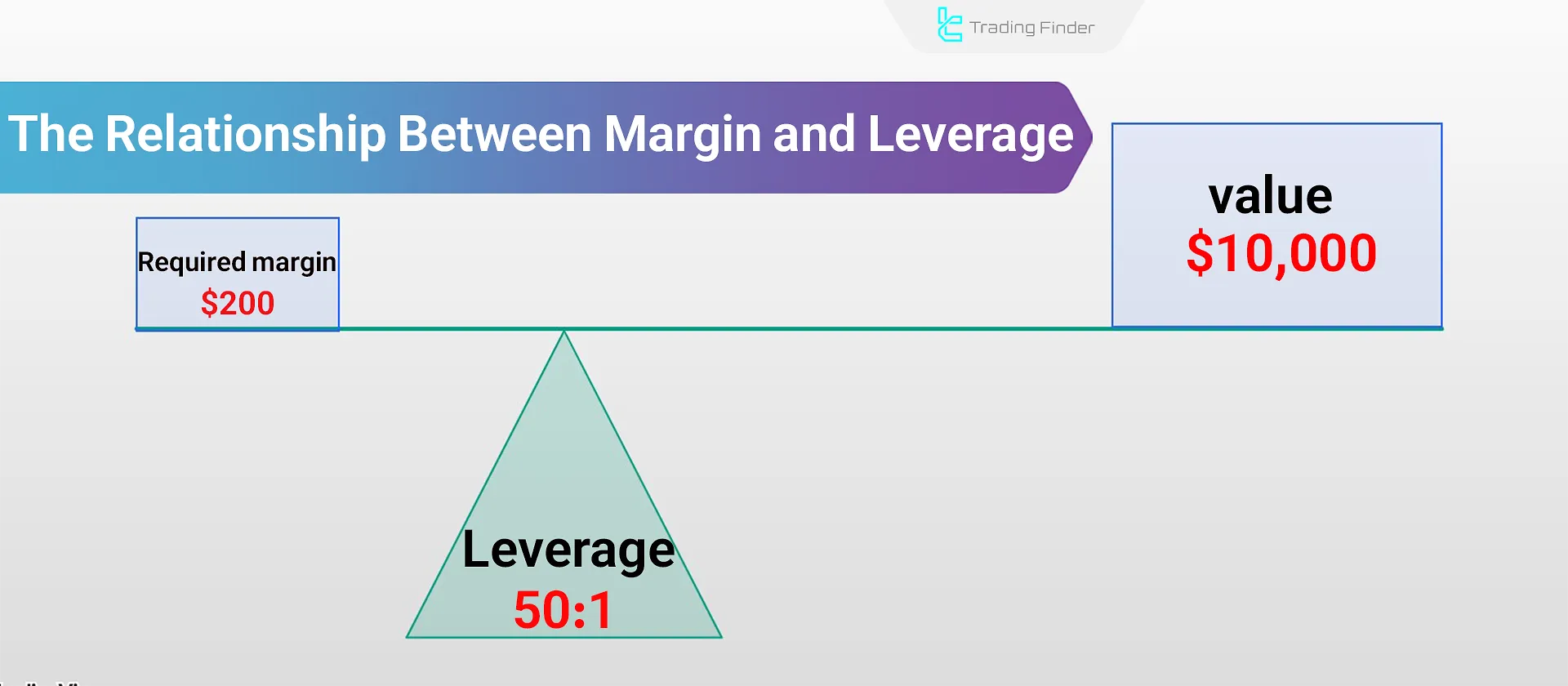

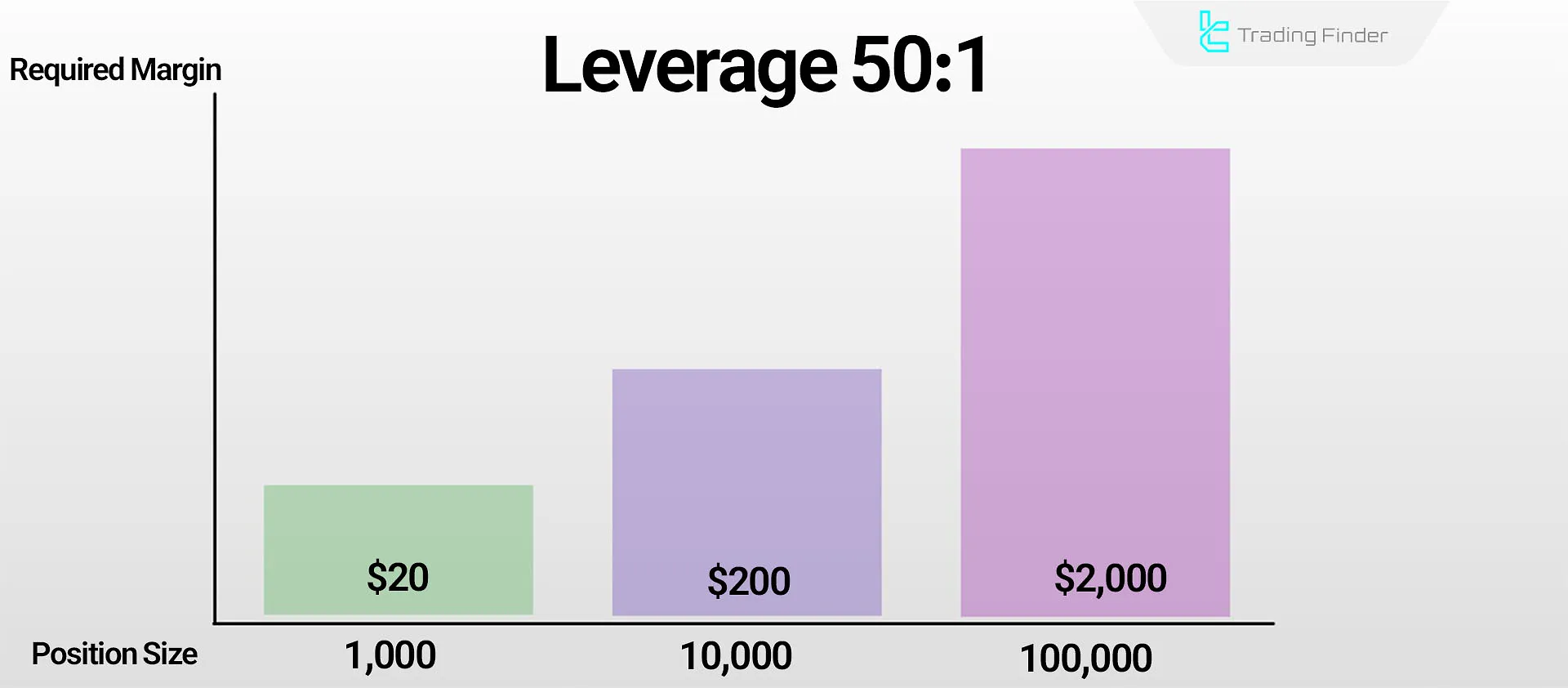

How Are Margin and Leverage Related?

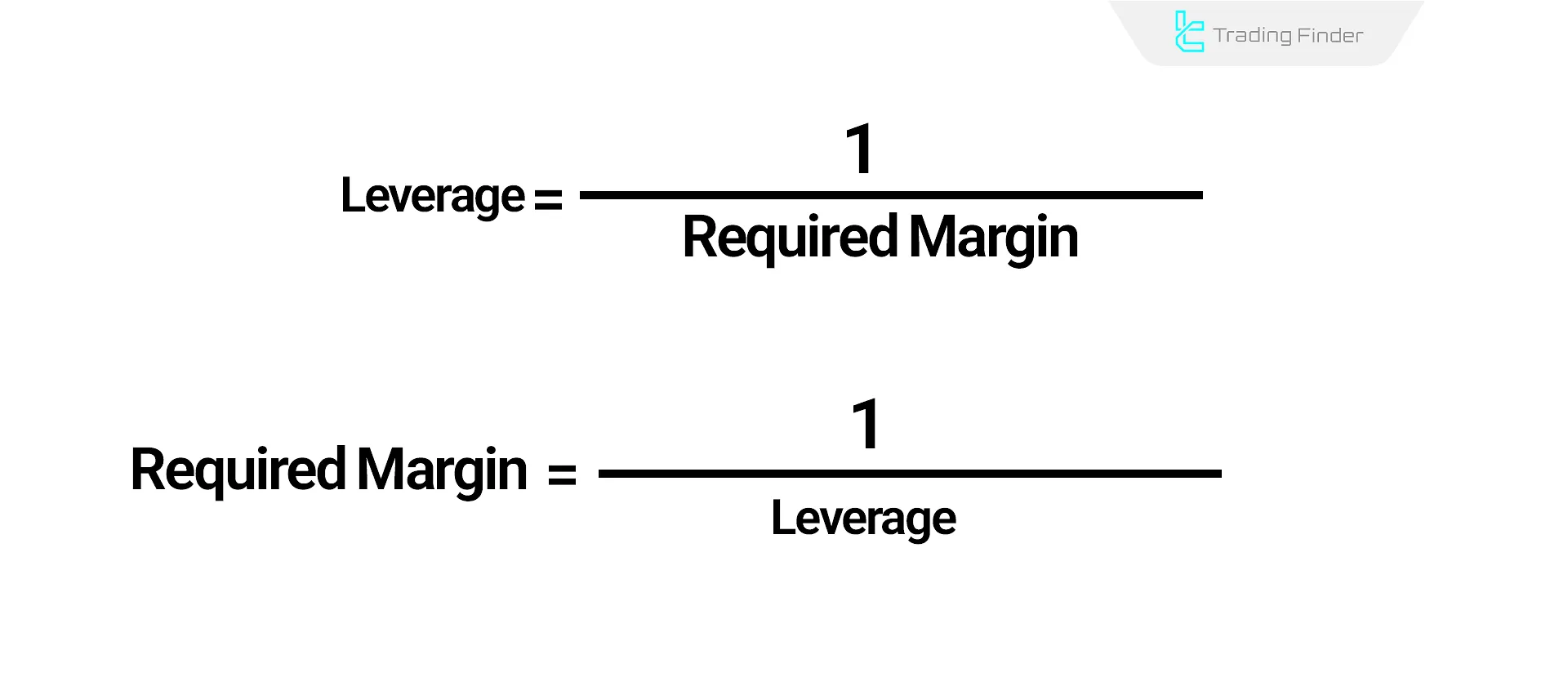

The relationship between margin and leverage is inverse. This means that the lower the required margin, the higher the leverage a trader can use. In other words, reducing the margin requirement increases a trader’s buying power. This relationship can be described using the formulas below:

Examples of Leverage and Margin Ratios in Forex Pairs

The table below illustrates examples of leverage and margin ratios in Forex currency pairs:

Currency Pair | Required Margin | Leverage Ratio |

EUR/USD | 2% | 50:1 |

GBP/USD | 5% | 20:1 |

USD/JPY | 4% | 25:1 |

EUR/AUD | 3% | 33:1 |

Difference Between Margin in Forex and the Stock Market

The difference between the margin in forex market and the margin in stocks is as follows:

- In the stock market: Margin refers to the money a trader borrows from a broker to fund part of a stock purchase. This method is known as "margin trading" and is essentially a loan from the brokerage;

- In the Forex market: Margin is the amount of money a trader must keep in their account to open a trading position. In this case, the trader does not borrow money but rather uses the margin as collateral.

Summary

The relationship between margin and leverage is one of the key concepts in risk management and purchasing power. Margin is the required collateral to open positions, whereas leverage allows traders to control a larger market volume with a smaller amount of capital.

Reducing margin enables traders to use higher leverage, allowing for better risk management.