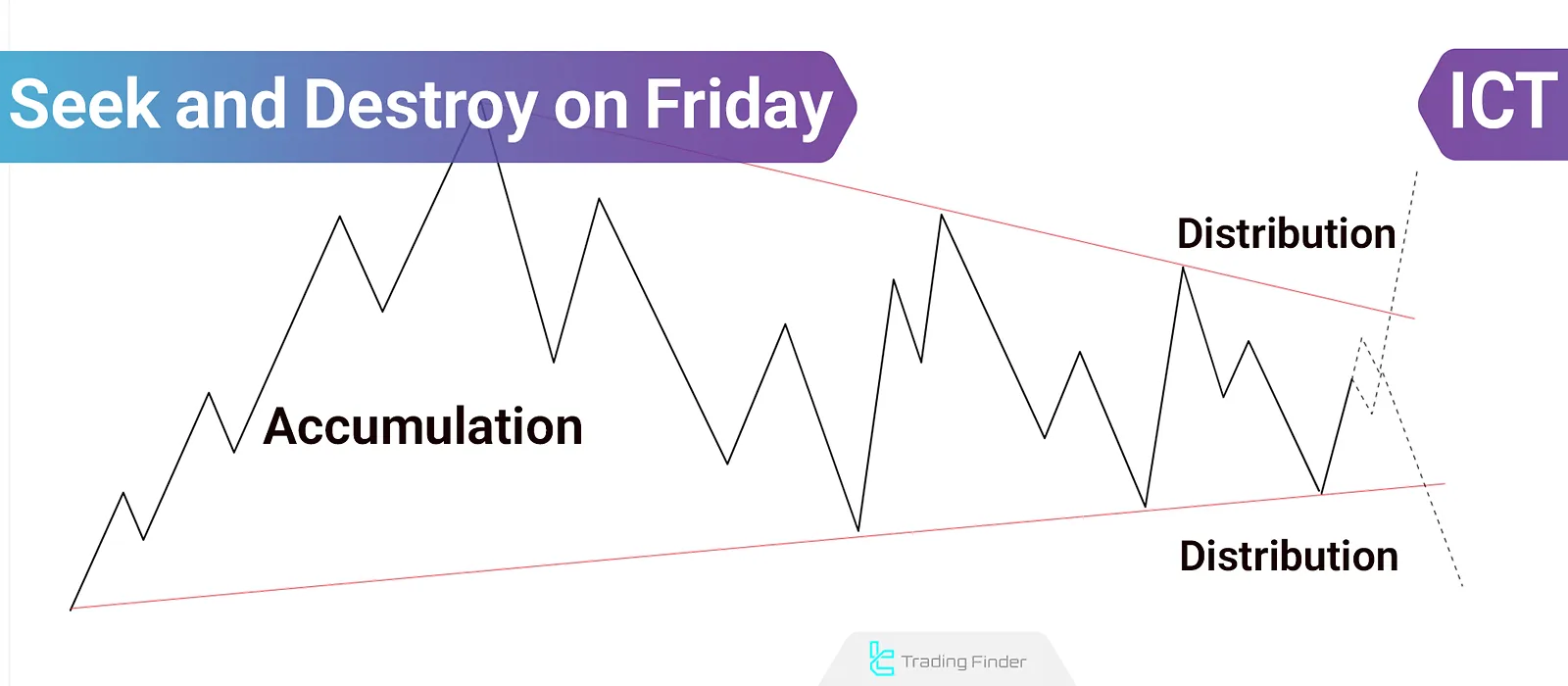

In the Friday Seek and Destroy strategy within the ICT methodology, the market typically enters an accumulation or distribution phase from Monday until the release of major economic news. During this phase, smart money aims to identify and hunt the liquidity clustered around swing highs and lows.

Before the news, the price structure remains in a range-bound, deceptive formation, luring retail traders into premature or false positions. Once the news is released, the market first performs a quick liquidity sweep against the main trend direction to trigger stop-losses, followed by a sharp displacement move in alignment with the weekly order flow.

What Is the Friday Seek and Destroy Strategy?

From Monday until just before high-impact events like NFP or FOMC, markets often consolidate with no clear direction. This results in liquidity building up around swing highs and lows.

Retail traders, misled by false signals or overtrading during this phase, are often stopped just before the market's real move.

On Friday, after the economic release, the market sweeps liquidity on one side and then aggressively displaces in the direction of the weekly order flow. The move typically aims for higher timeframe liquidity levels (Draw on Liquidity).

In such weeks, entering trades before the news is rarely a good idea. A better strategy is to wait for liquidity collection and only enter after confirmation from lower timeframes.

Market Structure Analysis in Friday Seek and Destroy Setup

This concept emphasizes recognizing market behavior and structure during weeks when a Seek and Destroy profile is forming.

Bullish Seek and Destroy Market Behavior

When the main trend is bullish, the seek-and-destroy structure causes erratic, directionless price action from Monday to Thursday—forming higher highs and lower lows but without clear momentum.

This is designed to accumulate sell-side liquidity under support zones. On Friday, with the news release, the market first sweeps sell-side liquidity, triggering stops below support.

A bullish displacement follows, pushing price along with the weekly order flow—often toward higher-timeframe liquidity levels.

Bearish Seek and Destroy Market Behavior

In bearish markets, the structure aims to absorb buy-side liquidity above resistance. From Monday to Thursday, prices might form lower lows and higher highs, appearing erratic.

This manipulates retail buyers into entering longs above swing highs.

On Friday, following the economic event, the market performs a buy-side liquidity sweep and then a bearish displacement in line with the weekly flow—again targeting higher timeframe liquidity.

Entering trades prematurely can lead to stop-outs, whereas patient entries post-sweep offer lower-risk setups.

Common Mistakes in Friday Seek and Destroy (ICT Style)

A major reason why traders fail during Seek and Destroy weeks is misreading the pre-news price action. Between Monday and Thursday, prices are mostly range-bound, but many take these ranges as entry signals.

Entering During Consolidation Phase

While smart money is accumulating liquidity, retail traders enter trades based on classic technical patterns or support/resistance zones—only to get stopped before the real move.

Entering Without Market Structure Confirmation

The Seek and Destroy profile requires waiting until after the news for full liquidity sweep confirmation. Entering without signals like Market Structure Shift (MSS) or Change in State of Delivery (CISD) exposes traders to high risk.

Failing to Identify Draw on Liquidity Zones

Without knowing which higher-timeframe liquidity level smart money is targeting, traders can misread trend direction after the sweep. This leads to counter-trend entries and losses.

Conclusion

The Seek and Destroy setup on Fridays is a structured play designed to trap liquidity and then launch a move in the direction of dominant market flow.

Entering during consolidation without understanding liquidity mechanics often results in repetitive losses.

Without Market Structure Shift (MSS), Change in State of Delivery (CISD) andDraw on Liquidity identification, market structure analysis remains incomplete, and trades are made on guesswork rather than liquidity logic.