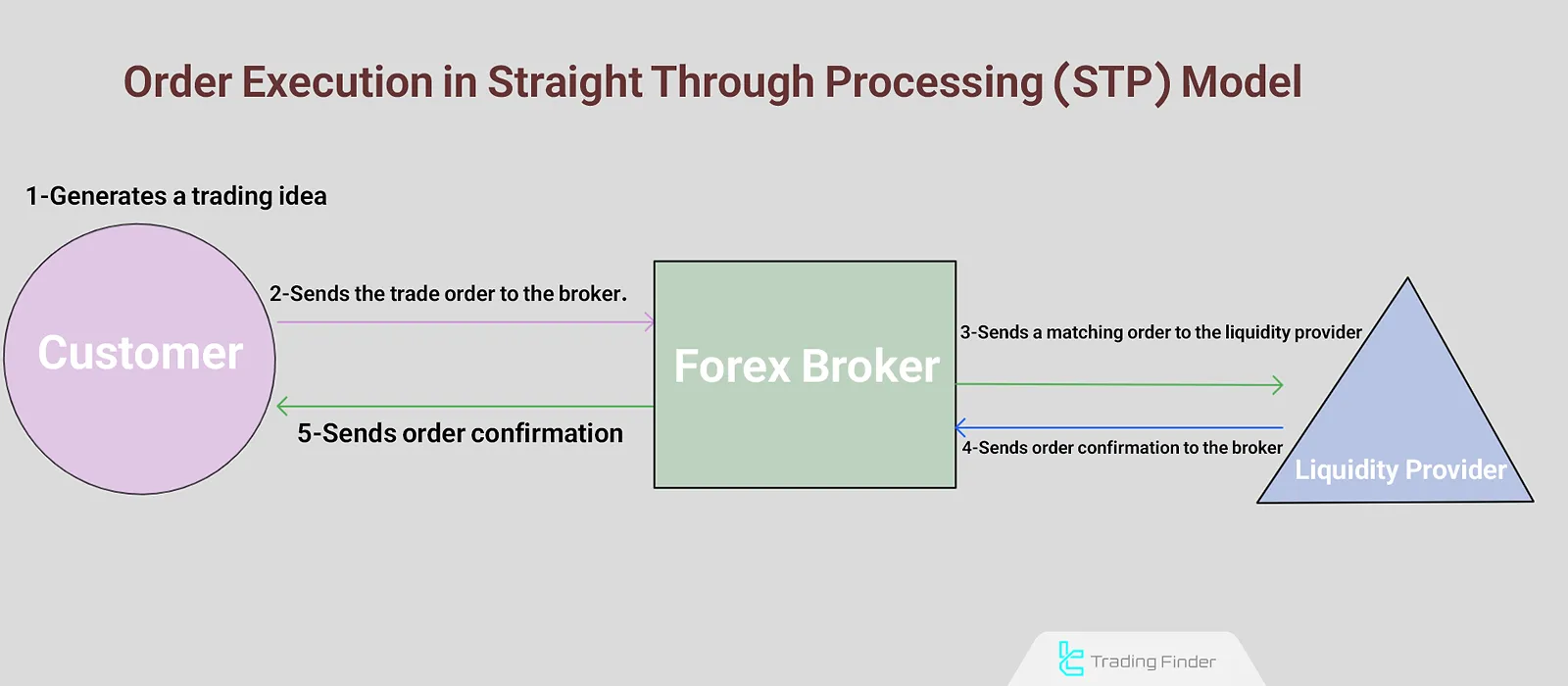

In the Straight Through Processing (STP) model, the broker routes the client's order to a Liquidity Provider (LP) without internal dealing desk intervention.

Before executing the order, an equivalent transaction is arranged with the LP hence, this method is known as "pre-trade hedging."

This model eliminates conflicts between the broker and the trader, as the broker does not profit from client losses. Key advantages of this model include price transparency, access to real market rates, and high execution speed.

What Are STP Brokers?

The term Straight Through Processing (STP) refers to the fully automated order execution without human intervention.

In the STP Execution Model, the broker coordinates the client's order with a Liquidity Provider before executing it. This approach allows the broker to avoid risk, though it may result in slower execution and higher slippage.

Comparison of STP and A-Book Execution Models

In the A-Book model, the broker first executes the client's order, then hedges the risk afterward with a Liquidity Provider.

In contrast, the STP model hedges the risk before executing the order. Therefore, the two models are referred to as post-trade hedging and pre-trade hedging, respectively. Comparison of STP and A-Book Models:

Feature | Pre-Trade Hedging (STP) | Post-Trade Hedging (A-Book) |

Execution Speed | Slower | Faster |

Slippage Probability | Higher | Lower |

Market Risk for Broker | Minimal | Maximum |

Price Transparency | High | High |

Revenue Model | Commission or Markup | Commission or Markup |

Top STP Brokers

Here are four examples of top STP Brokers:

Why Use Straight Through Processing (STP) Brokers?

The key benefit of STP execution for brokers is the elimination of slippage risk between the client's order and the broker's hedge order.

Note:Slippage refers to the difference between the price the trader expects and the price at which the order is actually executed it can work in the trader's favor or against them.

To prevent loss, STP Brokers pre-arrange a matching trade with the LP before executing the client's order. For instance, if a trader places a buy order at 1.1000, the broker ensures it can purchase the same asset from the LP at a slightly lower price, like 1.0999.

STP A Zero-Risk Model

In Straight Through Processing (STP), the broker transfers trading risk to the LP. Thus, this model is known as "riskless principal trading":

- The broker first buys from the Liquidity Provider (acts as the counterparty);

- Records the transaction in its books;

- Immediately sells the same asset to the trader at the same price plus a markup or commission.

Two transactions are created:

- One between the client and the broker (as counterparty);

- One between the broker and the LP (as a hedge trade).

Agent Broker vs. Principal Broker

When executing orders, a broker can act in two ways:

- As an Agent, simply routing orders without taking a trading position;

- As a Principal, directly entering into trades with the client.

In the STP Execution Model, although the broker is technically the counterparty, it immediately hedges the order with an LP effectively taking on the agent role without market risk.

How Do STP Brokers Earn Revenue?

In STP Execution, brokers operate as riskless counterparties or matched principal brokers. Unlike B-Book models, they do not benefit from client losses. Their income is generated transparently through the following:

Markup

The broker slightly increases the price quoted by the LP. For example, if the LP offers EUR/USD at 1.1000, the broker may show 1.1002 to the client. The 2-pip spread is the broker's profit.

Commission

In some accounts, brokers charge a fixed commission per trade instead of or in addition to markup. This is common in ECN/STP accounts and offers higher transparency.

No Profit from Client Losses

Since STP brokers immediately hedge client orders with LPs, they do not take on a risk position — meaning client losses do not impact their earnings.

Reduced Conflict of Interest

STP brokers earn directly from trade execution. Therefore, the more successful the trader, the more trades are placed, benefiting the broker. The broker's incentives are aligned with the trader's success.

Conclusion

The STP Execution Model is a transparent Forex brokerage structure designed to eliminate market risk and minimize conflict of interest.

In this model, the broker only executes the client's order after pre-hedging with a Liquidity Provider (LP), so client profits or losses do not affect the broker's earnings. Revenue is solely from markup or commission.