Support and resistance are foundational concepts in technical analysis used in markets like Forex Market, stocks, Cryptocurrency, and commodities. These levels indicate zones where a price trend may pause or reverse.

What Are Support and Resistance Levels?

Support is a price level where a downtrend can be expected to pause due to a concentration of demand. In simpler terms, it's where buying interest may overcome selling pressure.

Resistance is the opposite—a level where an uptrend can stall or reverse as selling pressure outweighs buying.

Types of Support and Resistance

In technical analysis, Support and resistance are not just simple lines; they appear in different forms based on market behavior:

Static (Horizontal) Support and Resistance

When price reacts multiple times to a specific level, it forms horizontal support or resistance. These are usually drawn as straight lines on charts.

Dynamic Support and Resistance

Calculated using tools like Moving Averages (MA), such as MA50 or MA200. These levels shift with price and are particularly useful in trending markets.

Trendline-Based Support and Resistance

During an uptrend or downtrend, the trendline itself acts as support or resistance. In an uptrend, the trendline below the price serves as support, whereas in a downtrend, the trendline above the price functions as resistance.

Pattern-Based Support and Resistance

Classical patterns like triangles, channels, and flags create support or resistance. For example, the upper edge of an ascending triangle may act as resistance.

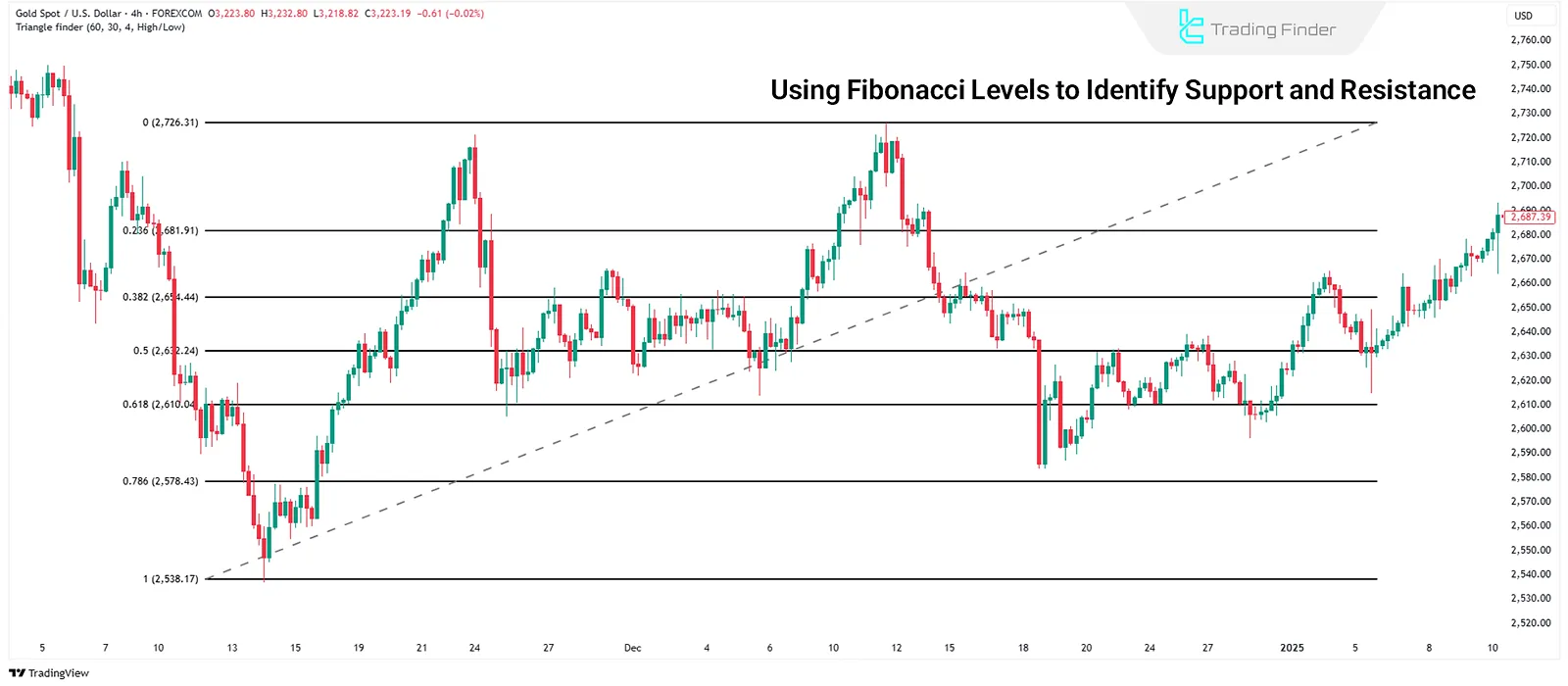

Fibonacci Levels

Fibonacci retracement tools are key to identifying potential reversal zones. Levels like 38.2%, 50%, and 61.8% often act as support or resistance.

Psychological Support and Resistance

These are round numbers (e.g., 1.2000 in Forex or 60,000 in Bitcoin) that attract attention from traders and institutions. They often lead to strong market reactions due to order concentration and trader sentiment.

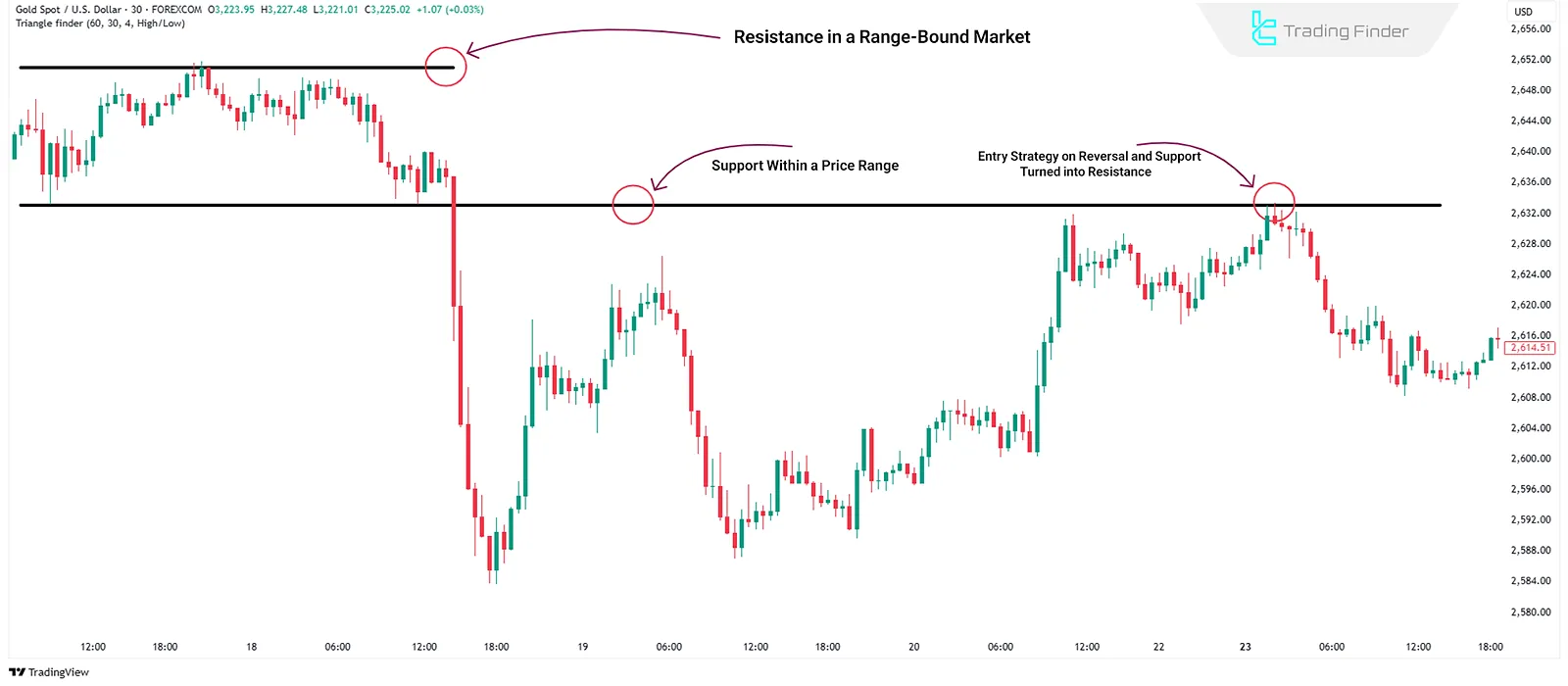

Role Reversal of Support and Resistance

One key concept in technical analysis is the role reversal of these levels:

- If the price breaks below a support level, it often becomes resistance;

- If the price breaks above a resistance level, it may act as support.

Repeated touches of a level, increase its reliability. These zones act as psychological triggers, where market participants are more likely to take action.

Support and Resistance Trading Strategies

The following strategies can be used to trade using support and resistance levels:

Reversal Entry Strategy

In this method, a trader enters a position upon price, hitting a support or resistance level and showing reversal signs. This approach has lower risk, with stop-losses placed near the reaction point.

Range Trading Strategy

Occurs when the price moves between defined support and resistance levels. Traders buy at support and sell at resistance in a horizontal or neutral trend.

Breakout Strategy

Executed when price breaks through a key level. A valid breakout is confirmed by increased volume. Often, the price returns to retest the broken level (pullback) before continuing in the breakout direction.

Conclusion

Support and resistance levels are essential for forecasting price behavior. They signal areas where trends may pause, reverse, or gain momentum.

Once broken, these levels can reverse their roles, providing opportunities for breakout, range, and trendline strategies.