In sentiment analysis (market sentiment evaluation), the COT (Commitments of Traders) report is one tool that provides data on the trading positions of major traders in the options and futures markets.

This report is published in various formats, including Legacy, Disaggregated, and Traders in Financial Futures (TFF).

What Is the COT Report?

The COT report, or Commitments of Traders, shows the position status of major market participants in futures and options trading.

The report is published weekly on Fridays by the Commodity Futures Trading Commission (CFTC) and includes information on trading positions closed by the preceding Tuesday.

Types of COT Reports

The COT report is categorized into three general types based on the target market:

Legacy Report

The Legacy format is the oldest type of Commitments of Traders report; it includes trades in commodities, metals, energy, forex, and U.S. stock indices.

In the Legacy report details, traders are divided into three categories:

- Commercial traders: This group includes large corporations, producers, exporters, and companies in the futures market that use hedging to manage risk;

- Non-commercial traders: Professional market participants, investment managers, and hedge funds who are Market makers in Forex and other markets;

- Retail traders (Non-Reportable Positions): Individual retail traders with lower trading volumes than the other groups.

Disaggregated Report

The Disaggregated format was first introduced in 2009 and offers more detailed information about trader groups. The trader classifications in this report are:

- Producers and consumers: Large commodity producers aiming to hedge risk

- Swap dealers: Banks and institutions that deal with swaps and financial derivatives

- Hedge funds: Hedge funds, investment managers, and institutional traders

- Other large traders: Private or large individual market participants

Note: Financial derivatives are instruments whose value is derived from an underlying asset like stocks, bonds, currencies, commodities, or market indices. These instruments include Futures, Options, Forwards, and Swaps.

Traders in Financial Futures Report (TFF)

This report excludes commodity trading, making it more suitable for stock, bond, and forex market participants. The trader types in the TFF report include:

- Dealers and intermediaries: Banks and financial institutions aiming to create market liquidity and serve their clients

- Asset managers and institutional investors: Pension funds, insurance companies, and institutional investors trading with long-term strategies

- Hedge funds and leveraged traders: Hedge funds and large traders using leveraged strategies

- Other traders: A mix of large firms and private traders

Differences Between COT Report Types

The table below illustrates the differences between the three main types of COT reports:

Report Type | Trader Groups | Markets |

Legacy Report | Commercial – Non-commercial – Retail traders | All futures and options markets |

Disaggregated Report | Producers & Consumers – Large Financial Institutions & Banks – Hedge Funds – Other Traders | Commodities – Energy – Metals |

TFF Report | Financial Intermediaries – Asset Managers & Institutional Investors – Speculative Funds – Other Traders | Bonds – Forex – Stocks |

Trusted Sources for Studying the Commitments of Traders Report

Although the Commitments of Traders Report is published on the CFTC website, the user interface is not very intuitive and presents data in a very basic format.

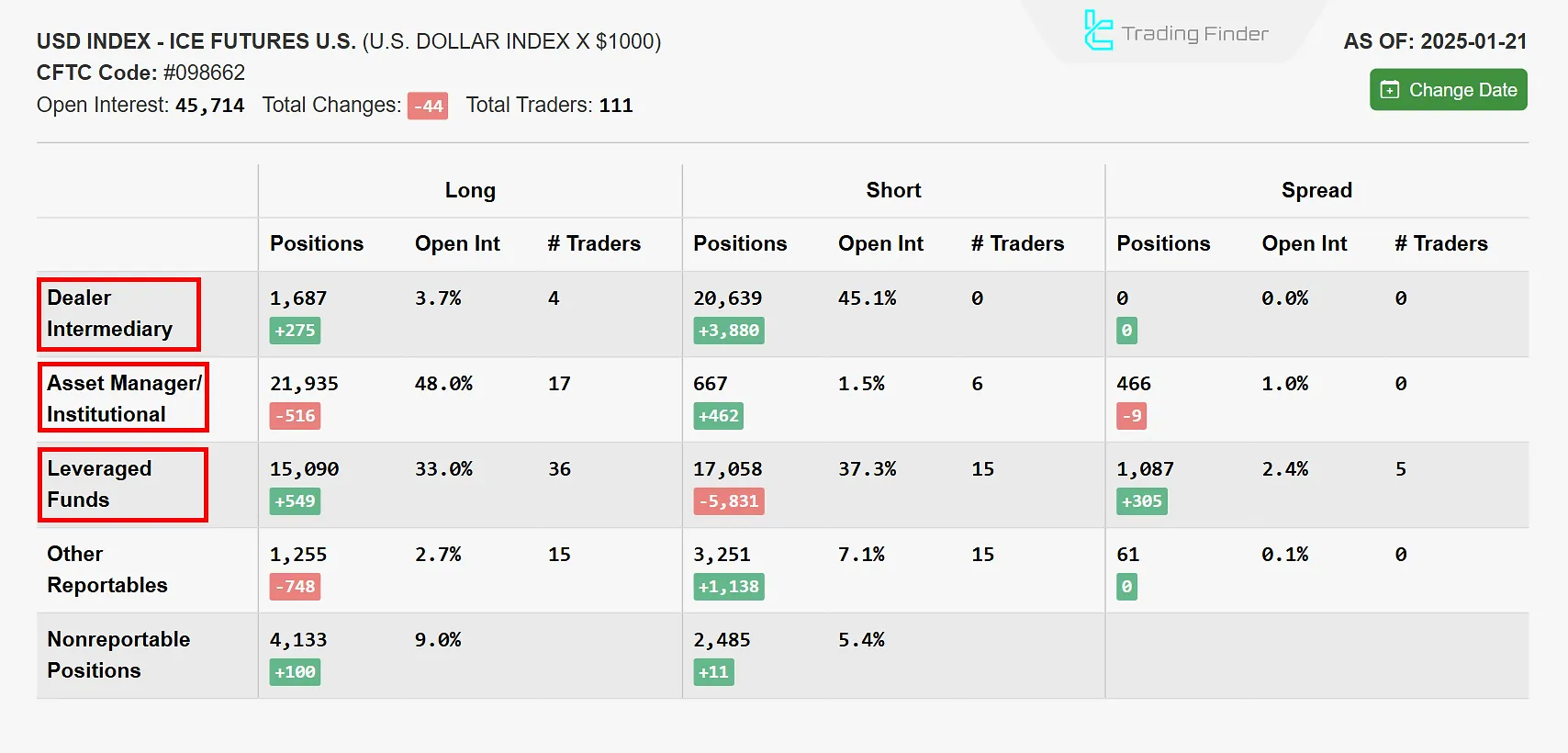

The Tradingster website displays this report in a simple and user-friendly manner. The image below shows a snapshot of the COT report on the Tradingster platform:

On the left side, each trader category is visible:

- Dealer (Retail Traders)

- Asset Manager

- Leveraged Funds (Professional Traders)

How to Analyze the COT Report

In this report, a sentiment or fundamental analyst examines the ratio of long and short positions held by asset managers and professional traders.

The direction of positions that asset managers hold typically reflects the long-term market trend. In contrast, leveraged traders (hedge funds) usually reflect short-term market movements.

For instance, in the image below, the ratio of long and short positions is visible. The U.S. dollar may exhibit an upward trend in the medium to long term, as asset managers are in long positions.

However, professional traders hold nearly equal long and short positions in the short term. In other words, the dollar is likely to remain range-bound in the short term.

Conclusion

The COT report is a tool in both fundamental and sentiment analysis, reflecting the sentiment of traders in the forex, stock, bond, and commodity markets through futures data. This tool can be used in conjunction with interest rate expectations, economic data, and central bank meetings to identify potential market trends.