The Forex Economic Calendar provides essential economic information related to various forex market assets, including central bank interest rates, unemployment rates, industrial growth, and more.

For traders who want to know what is forex economic calendar, this tool offers structured data that is categorized by importance and the level of impact on asset prices.

Also, traders can anticipate potential market volatility by reviewing the forex calendar data release schedule and maintain more effective risk management.

On the other hand, many platforms provide the ability to filter news based on country, indicator type, or impact level, allowing event analysis to be performed more simply and in a more targeted manner.

What Is the Forex Economic Calendar?

The Forex Economic Calendar includes data on upcoming economic news reports, statistical releases, and speeches by economic officials-each of which can influence the price trends of specific assets.

This information is published across variable timeframes such as monthly, quarterly, or yearly. By reviewing this calendar, users can analyze the economic condition of a country.

Applications of the Forex Economic Calendar

Using the information within the Forex Economic Calendar, one can examine various financial factors related to a country’s economy. This data is widely used in fundamental analysis of assets.

The calendar’s data has a direct impact on both short-term and long-term price volatility. At the time of some key announcements-such as central bank interest rates-price fluctuations can become significantly more volatile.

Moreover, public holidays for each country (which indicate reduced asset volatility on those days) are also listed in the calendar. Key applications include:

- Timing of Economic Events: The publication times of economic reports are displayed;

- Holidays in Different Countries: National holidays are clearly indicated;

- Economic Data for Fundamental Analysis: Key impactful data is provided;

- Post-Report Impact Analysis: Price impact assessments are offered after reports release.

How to Read the Forex Economic Calendar?

Most economic calendars include settings to filter information, allowing users to customize the calendar content based on their preferences. These settings typically include filters for impact level, country, asset, date, and specific reports.

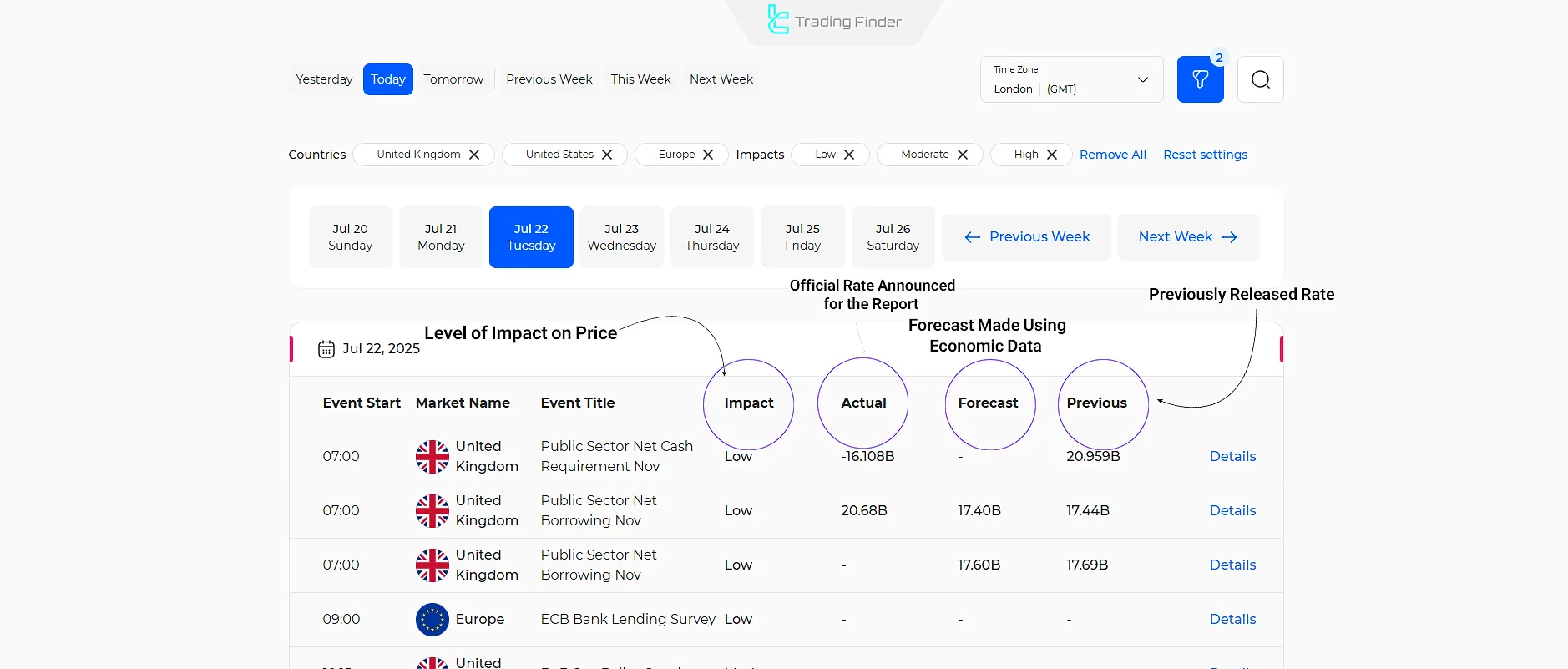

Each report in the economic calendar contains three key figures:

- Actual: The current value published by the relevant country’s economic authority;

- Forecast: The predicted value or market expectations based on analysts’ assessments;

- Previous: The previously published value for the same report.

Different Sections of the Economic Calendar

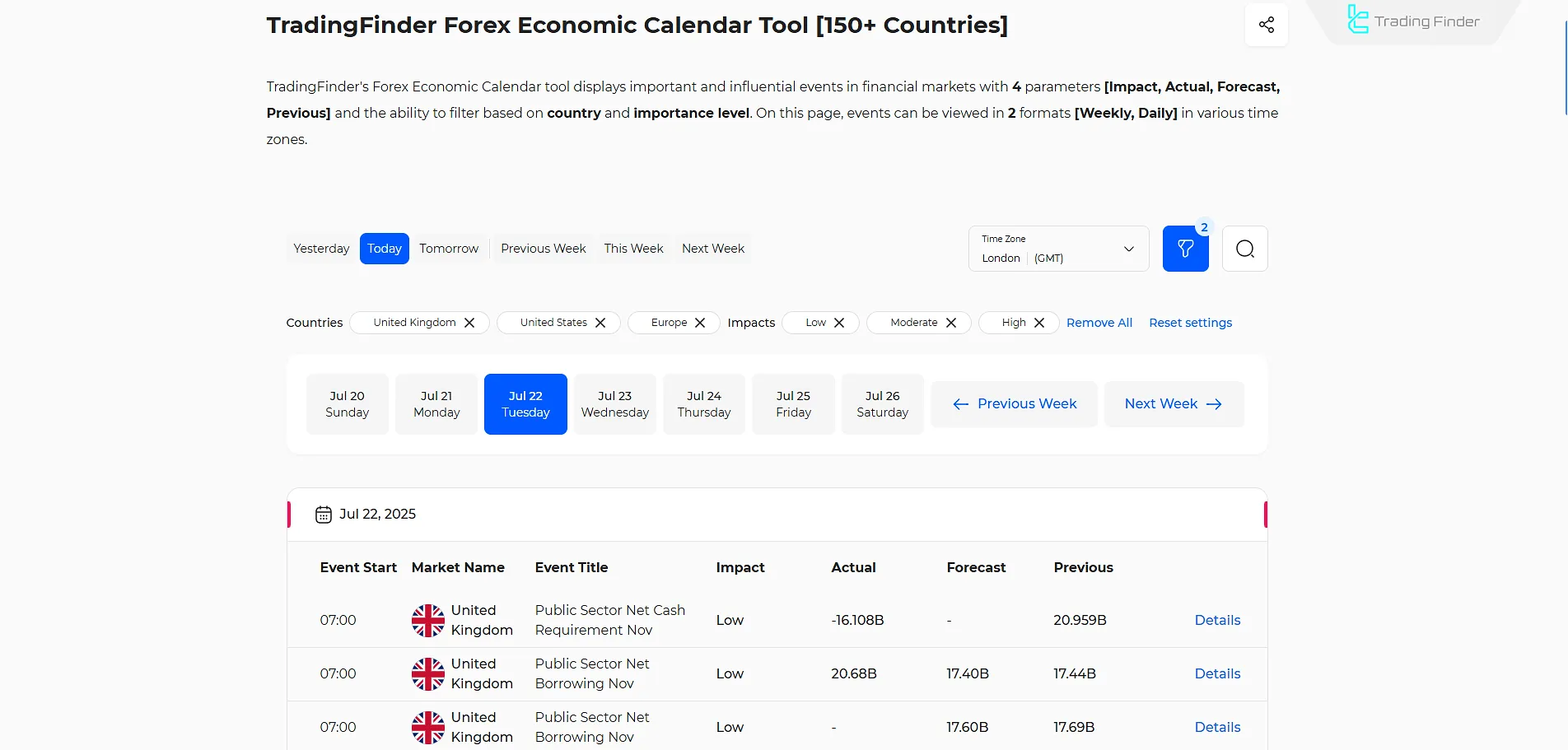

In the components section of the forex economic calendar, the structure of each event is displayed in a precise and categorized manner.

In this part, the trader can view the market name, the report release time, the event title, its level of impact on price, and the three main values, namely the previous rate, the forecast, and the actual rate, which play a central role in forex economic calendar analysis.

Alongside these elements, options are available for selecting time ranges such as today, the current week, or the next week, as well as country filters (such as the United Kingdom, the United States, and Europe), allowing the user to adjust the economic calendar according to their trading needs.

This section of the forex economic calendar is designed in such a way that, at a glance, it provides the most important fundamental data influencing the financial markets in an organized and comparable format for the user.

Many economic calendars also include a Details section that offers comprehensive insights about a selected report, including potential impacts, scenario analysis, and further explanations.

Impact Levels in the Forex Economic Calendar

Each economic news item is classified into three levels based on its importance and strength of influence on the market:

- High Impact events: such as NFP, CPI, and interest rates, which are often marked in red within the forex news calendar and forex calendar news systems;

- Medium Impact events: such as the Retail Sales Index or PMI, which may cause temporary fluctuations according to the investing calendar;

- Low Impact events: which have less influence on the main trend but remain important for scalpers and short term traders.

Understanding these levels helps the trader focus on key news and design entry and exit strategies accordingly.

How to Filter News by Currency and Time Zone

One of the practical features of the economic calendar is the ability to filter events based on currency type, country, or time range. By setting the filter on the currencies you trade, for example USD or EUR, only the relevant news will be displayed.

In addition, by selecting your own time zone, you can view events exactly in your local time so that no important data is missed when working with the forex news calendar and forex calendar news.

On the TTrades YouTube channel, the method of using the forex economic calendar is taught in video format and reviewed through the investing calendar perspective:

The Relationship Between Macroeconomic Data and Market Liquidity

Major economic events alter the flow of liquidity in the global market. For example, United States inflation data can cause liquidity to shift between major currencies.

Understanding these cycles helps traders align liquidity zones with fundamental data and execute entries in sync with changes in market volume using the forex news calendar, forex calendar news, and the investing calendar.

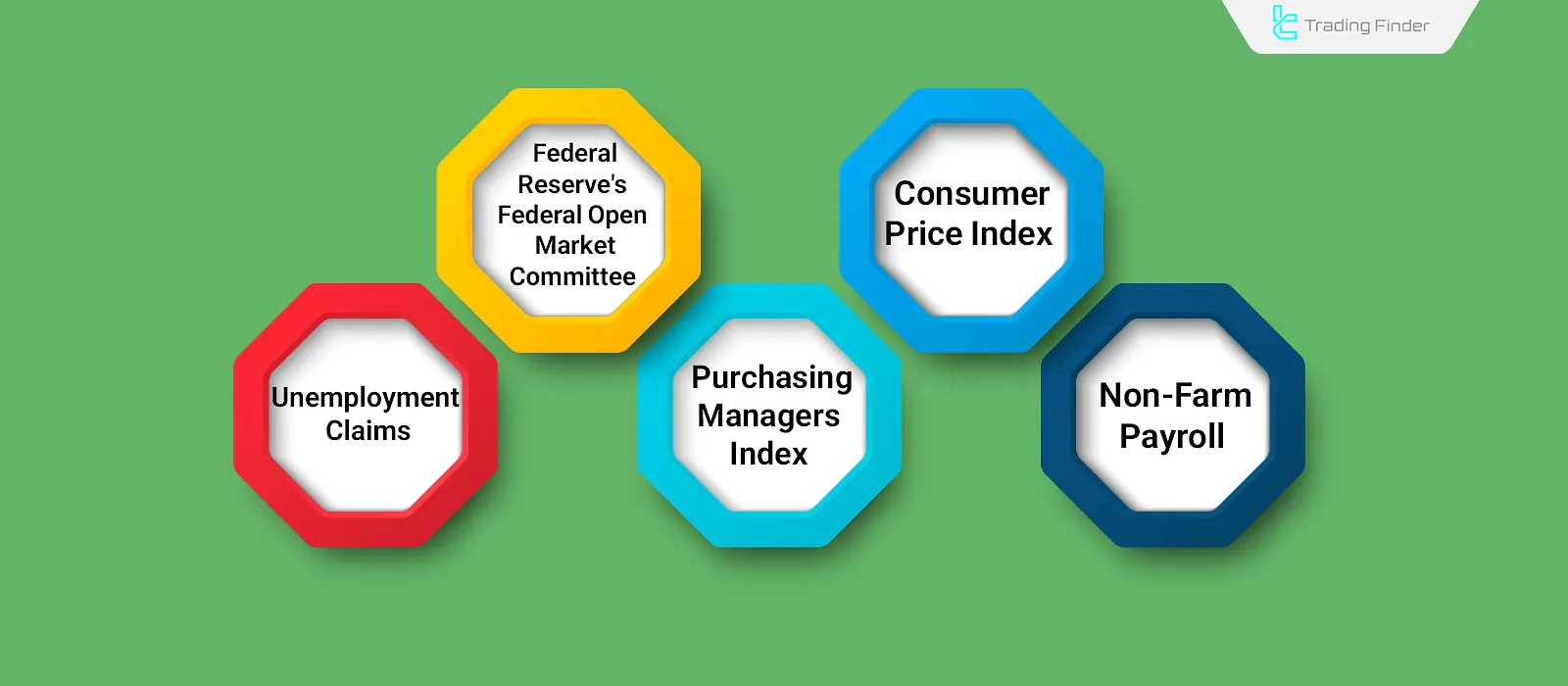

Major Events in the Forex Economic Calendar

Among the various economic reports, some have greater influence on price trends-such as the Non-Farm Payrolls (NFP) and the Consumer Price Index (CPI). However, the level of impact may vary depending on current economic conditions.

Key events in the Forex Economic Calendar include:

Non-Farm Payrolls (NFP)

The Non-Farm Payrolls (NFP) report is published monthly by the U.S. Department of Labor. It shows how many jobs were added in the non-agricultural sector during the previous month.

This report is released on the first Friday of each month, and typically causes significant volatility in assets linked to the U.S. economy. Its impact extends beyond short-term price fluctuations, influencing monthly trends as well.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures the average change in prices for consumer goods and services. The index is based on a fixed basket of essential items such as food, energy, healthcare, and more. Each component of the basket is weighted based on its importance in consumer spending.

Purchasing Managers’ Index (PMI)

The PMI is derived from a composite of monthly surveys of leading companies worldwide. This index measures the performance of specific sectors, such as manufacturing or services. The data is collected via questionnaires sent to purchasing managers and is released monthly.

FOMC Reports and Announcements

The U.S. Federal Reserve is responsible for shaping monetary policy. The FOMC releases announcements, speeches, and statements outlining its policy direction, which can heavily influence market volatility.

The Federal Funds Rate is announced every 45 days by the Fed Chair. Hawkish and dovish tones in statements and speeches are important since they affect both short-term and long-term price action.

Unemployment Claims

This weekly report measures the number of individuals applying for unemployment insurance. It consists of two key figures:

- Initial Jobless Claims: New claims filed by individuals recently unemployed;

- Continuing Jobless Claims: Claims from individuals already receiving unemployment benefits who are requesting extensions.

The Impact of Central Bank Policies on Economic Calendar Data

Central banks shape the direction of economic data through their decisions on interest rates, bond purchase programs, or contractionary policies.

For example, even if the CPI index shows only slight growth, but the central bank adopts a hawkish tone, the market may react with upward movement in the currency.

Therefore, each data point must be interpreted within the context of that country’s monetary policy in order to avoid misinterpretation.

Differences in Data Interpretation Across Forex, Crypto, and Stock Markets

Each market responds differently to economic data. In the Forex market, inflation data and interest rates have the greatest impact, while the stock market responds more to corporate earnings reports and fiscal policies.

Table of Differences in Data Interpretation Across Forex, Crypto, and Stock Markets:

Market Type | Most Influential Data | Market Reaction Method | Key Notes for Traders |

Forex | Interest rates, inflation reports, employment data | Fast and direct reaction to monetary policy and macroeconomic data | Close attention to central bank decisions and interest rate forecasts is highly important |

Stocks | Company earnings reports, fiscal policies, domestic economic data | Reaction is usually shaped based on company performance and domestic economic conditions | Fundamental analysis of companies and profitability evaluation are more important |

Crypto | Public sentiment, global liquidity flow, regulatory policies | High volatility and greater dependence on market psychology compared to official data | Reviewing sentiment, trading volume, and regulation related news is essential |

Differences Between Scheduled News and Unexpected News

Economic news is divided into two general categories: scheduled and unexpected.

News Type | Release Time | Example | Volatility Level | Market Reaction Method |

Scheduled | Pre announced | NFP, CPI | Predictable | Reaction based on forecasts |

Unexpected | Without prior announcement | Sudden statements, political crises | Severe | Emotional and rapid reaction |

How to Use Economic Calendar in Trading?

There are two main approaches to trading around economic report releases:

- Pre-Report Trading

- Post-Report Trading

Pre-Report Trading

This approach involves forecasting the likely outcome of a report based on prior data and market expectations.

Understanding how to use economic calendar in this context allows traders to estimate the expected value, evaluate its potential impact on price action, and identify entry points that align with the probable market movement.

In the educational article on the forex economic calendar on the Investopedia website, this trading tool is explained in full:

Post-Report Trading

This method does not require prediction. Traders evaluate both bullish and bearish scenarios beforehand and prepare corresponding take-profit and stop-loss orders.

After the report is released, traders quickly enter long or short positions based on the actual market reaction.

Note: During major economic releases, unexpected market behavior-such as widened spreads, price gaps, or order execution delays-may occur due to a surge in trading volume.

Example of Economic Calendar Data Analysis and Its Impact on Trading Decision Making

In this sample from the economy calender, the market’s main focus is on the Bank of England’s interest rate decision at 12:00 and the set of United States inflation and industrial economic data releases at 13:30.

Maintaining the UK interest rate at the level of 3.75 percent in line with market expectations conveys a signal of continued contractionary monetary policy, which creates a supportive role for the British pound.

At the same time, the release of United States annual inflation at the level of 2.7 percent compared to the previous 3.0 percent and the growth of the Philadelphia Manufacturing Index in the negative range of 10.2 present a contradictory picture of the US economy, leading to increased volatility in currency pairs such as GBPUSD and EURUSD during the New York session across major forex calendars.

Under such conditions, the professional trader, by combining this data with market liquidity structure and key technical levels, identifies entry and exit points with higher precision and avoids initial emotional movements.

Analytical Mistakes in Reaction to Better or Worse Than Expected Data

One of the common mistakes in news analysis is that the trader assumes every positive economic data releases result leads to price growth, whereas sometimes the market interprets positive data as a sign of a possible interest rate increase and reacts negatively.

Sometimes data weaker than expected leads to an increase in risky assets because it raises the probability of an interest rate cut. Understanding this behavioral logic of the market is of great importance and prevents emotional decisions.

Common Trader Errors in Using the Economic Calendar

Many traders make repeated mistakes when using the economy calender, including entering the market without simultaneously reviewing data from several related countries such as simultaneous USD and CAD releases.

entering at the exact moment of release which causes slippage, and purely numerical analysis without understanding macro policies.

Common Trader Errors in Using the Economic Calendar:

- Multi country: Entering trades without simultaneously reviewing data from related countries such as simultaneous USD and CAD index releases results in incomplete analysis and incorrect decisions;

- Instant entry: Trading exactly at the time of news release leads to slippage, price jumps, and poor order execution;

- Superficial analysis: Relying only on the headline figure without considering macro policies, central bank tone, or market expectations results in incorrect interpretation of data;

- Ignoring holidays: Overlooking official holidays or low liquidity days leads to incorrect volatility analysis and entries at unsuitable times;

- Session misalignment: Ignoring the timing of trading sessions and their overlaps disrupts decision making and increases trading risk.

How to Interpret Data at the Time of News Release

At the time of a news release, the difference between the actual value and the forecast determines the primary direction of the market’s reaction. If the actual data is better than forecast, the value of the related currency usually increases, while weaker than expected data causes it to decline.

However, understanding market behavior is not limited to the number itself; sometimes the market reacts negatively even to positive data if investor expectations have been excessively high.

Therefore, the trader must consider not only the number but also the overall market environment and the central bank’s tone.

The Role of the Economic Calendar in Determining Daily Bias

Many professional traders define their daily bias based on the direction of macroeconomic data. If the data indicates strengthening of the US dollar, the daily bias is set toward selling EURUSD and vice versa.

Analyzing the forex calendars to confirm the bias before the start of the London or New York session is one of the key steps in multi timeframe analysis.

Best Time to Review the Economic Calendar Before Sessions Begin

One of the important habits of professional traders is reviewing the economy calender before the start of each trading session.

Usually at the beginning of the London session (around 10:30 AM Tehran time) and before the New York session (around 17:00), the calendar should be reviewed to identify high risk events.

This practice helps avoid entering trades during the release of important economic data releases and allows the trader to structure the trading plan based on potential volatility.

How to Combine the Economic Calendar with ICT and SMC Strategies

Combining economic data releases with analytical structures such as ICT and Smart Money Concepts provides the trader with a broader perspective.

For example, the release of NFP data often activates HTF liquidity zones. Simultaneously reviewing data with BOS, CHOCH, and ICT Kill Zones allows more precise entries with lower risk.

Key Points for Using the Economic Calendar in Prop Accounts

In prop accounts, observing trading restrictions during news releases is extremely important. Many prop firms prohibit trading during high impact events.

Key Points for Using the Economic Calendar in Prop Accounts:

- News restrictions: Many prop firms prohibit trading during high impact events, and compliance with this rule is essential to avoid account failure;

- Calendar review: Checking the economy calender before the start of the trading day helps prevent rule violations and unintended entries during high risk periods;

- Major events: On days of important data such as FOMC and NFP, it is better to reduce position size and focus more on risk management;

- Volatility return: Entering the market is only appropriate when volatility returns to normal after the news release and conditions become more stable.

Versions of the Forex Economic Calendar

The TradingFinder Economic Calendar is available in three formats:

- Browser Extension

- Application

- Website

Browser Extension

In this version, the TradingFinder Calendar is used as a browser extension, enabling users to view asset charts and economic data simultaneously while reports are being released.

Application

Another version of the calendar is TradingFinder mini app, which is implemented as aTelegram bot.

While most websites are designed for desktop use and offer limited functionality on mobile, this Telegram-based mini app provides economic report notifications directly on mobile devices.

Website

To facilitate easy access without downloading an app or installing extensions,TradingFinder also offers a web-based version of the forex economic calendar under the [TFLAB] platform.

Conclusion

The Forex Economic Calendar contains vital information on various economic reports that influence asset prices. For those seeking to understand what is economic calendar and how it affects trading, each report includes essential details such as release times, historical data, and market forecasts.

Reports are categorized by their impact level on price. More influential reports-such as Non-Farm Payrolls (NFP), Consumer Price Index (CPI), and Purchasing Managers’ Index (PMI)-tend to create more significant price movements.