A pip (PIP) is the standard unit of measurement for price changes in currency pairs and serves as the main basis for calculating profits and losses in the Forex market. To calculate concepts such as stop-loss, take-profit, Trading position size, and risk management, calculating pip in Forex is one of the initial and essential steps.

Moreover, without understanding what a pip is, it is not possible to accurately determine the dollar value of price movements or maintain precise control over trading outcomes.

What is a Pip in Forex?

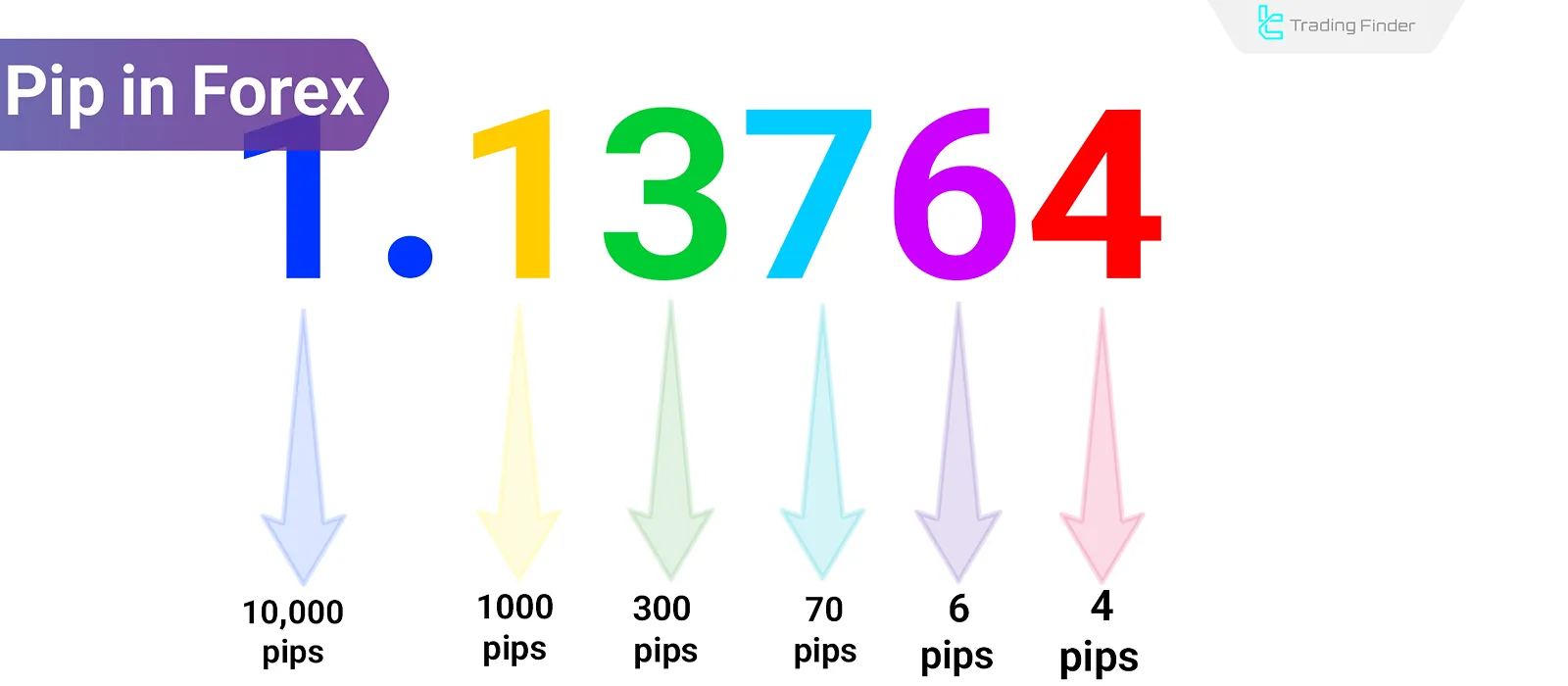

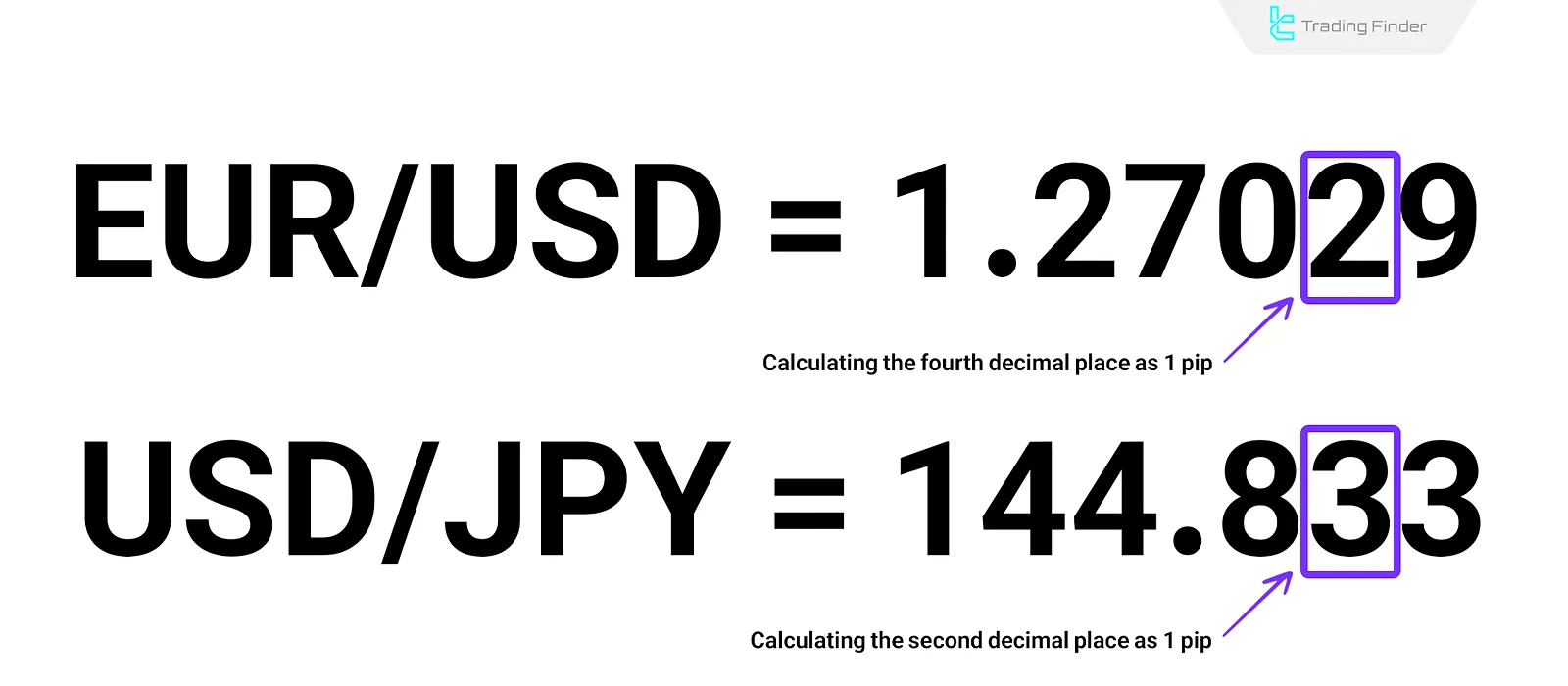

A pip (PIP) stands for "Price Interest Point" or "Percentage in Point" and is the standard unit for measuring price changes in the Forex market. For most currency pairs, one pip equals the fourth decimal place or 0.0001. For example, if EUR/USD moves from 1.1050 to 1.1051, the price has increased by one pip.

In currency pairs like USD/JPY, which are quoted to two decimal places, one pip equals 0.01. In essence, pip is the foundation for calculating profits, losses, and trade sizes in currency trading.

In gold trading (XAU/USD), the definition of a pip differs from currency pairs. Each pip equals 0.01 price movement. For instance, if the gold price changes from 1945.30 to 1945.31, that's a one-pip movement.

What's the Difference Between Pip and Pipette in Forex?

A pip equals the fourth decimal place in most Forex currency pairs and is the base unit for measuring price changes, whereas a pipette is one-tenth of a pip and appears at the fifth decimal place.

For example, if EUR/USD moves from 1.10503 to 1.10504, the price has changed by one pipette. Pipettes provide greater pricing precision and are typically used in ECN platforms or accounts with faster execution and tighter spreads.

The formula for Calculating Pip Value

The value of a pip depends on the trade volume (lot size) and the type of currency pair. For pairs with USD as the quote currency, the pip value is calculated easily:

- Standard Lot (100,000 units): Each pip equals to $10

- Mini Lot (0.1 lot = 10,000 units): Each pip equals to $1

- Micro Lot (0.01 lot = 1,000 units): Each pip equals to $0.10

However, for pairs where USD is not the quote currency (e.g., USD/CHF or USD/CAD), the pip's dollar value depends on the current exchange rate. The formula is as follows:

- Pip Value = (Trade Volume × 0.0001) / Exchange Rate

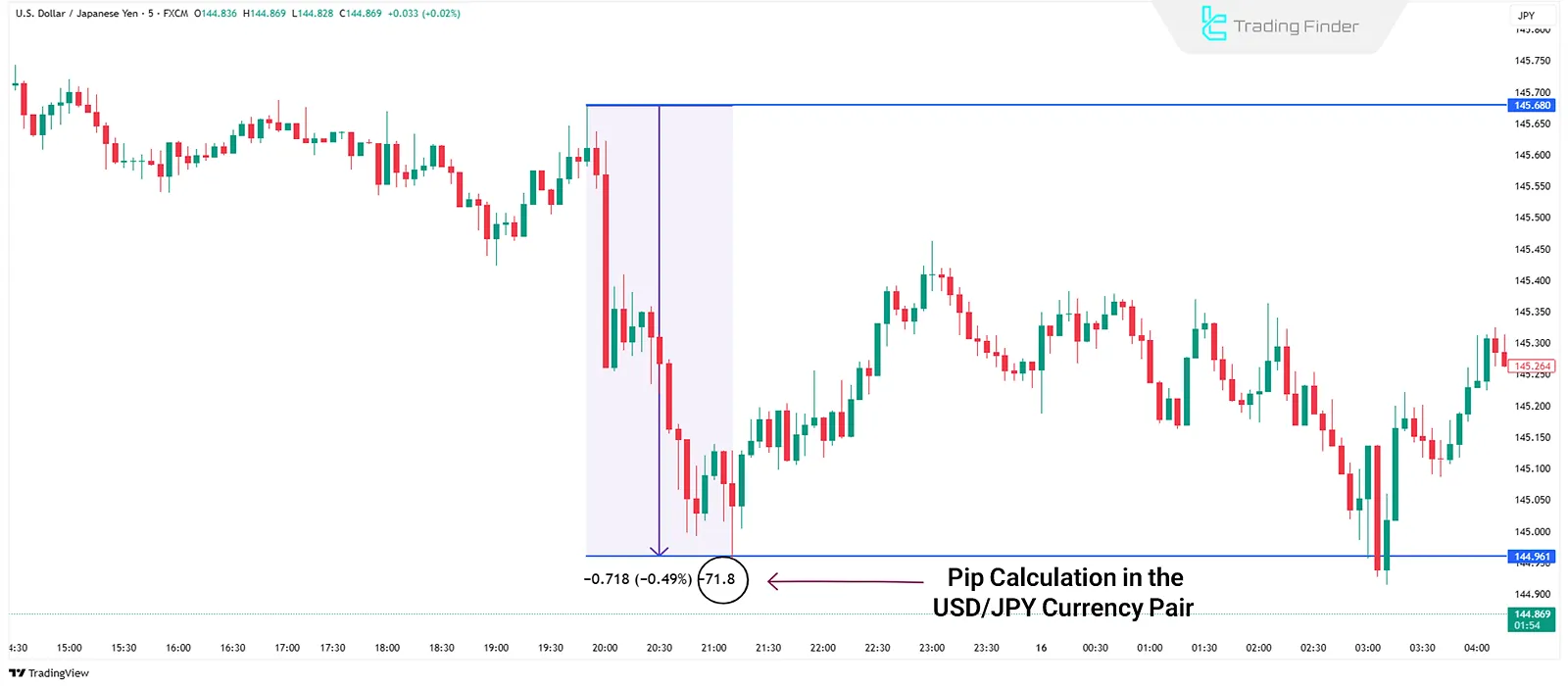

For pairs like USD/JPY with two decimal quotes, the pip value uses 0.01 instead:

- Pip Value = (Trade Volume × 0.01) / Exchange Rate

Example of Calculating Pip in Forex:

Assume you open a standard lot on USD/JPY at 145.00:

- Pip Value = (100,000 × 0.01) / 145.00 = $6.89

How to Calculate Pip Value in Gold?

Pip value in gold differs from Forex pairs:

- Standard Lot (100 ounces): Each pip equals to $1

- Mini Lot (0.1 lot = 10 ounces): Each pip equals to $0.10

- Micro Lot (0.01 lot = 1 ounce): Each pip equals to $0.01

In summary, for XAU/USD, every 0.01 price movement equals one pip, and for a standard lot, each pip change results in a $1 profit or loss.

Note: To calculate pip values accurately in trades, you can use TradingFinder's Forex pip calculator.

Application of Pip in Capital and Risk Management

Pip is the core unit for measuring price distance between entry points, stop-loss, and take-profit levels. Traders use pip distance to calculate the dollar risk per trade. Basic Risk Formula:

- Trade Risk = Pip Value × Stop-Loss Pip Count

By calculating this value, the position size is adjusted so that the risk matches a certain percentage of the total capital. The risk/reward ratio is also determined based on the pip count between stop-loss and target.

Pip in Different Trading Account Types

The impact of a pip depends on the account type and base lot volume. The main difference between cent, mini, and standard accounts lies in the monetary scale, which directly affects pip value:

Cent Accounts

In cent accounts, balances and P/L are shown in cents (¢):

- 1 Standard Lot = 100,000 cents = $1,000

Thus, each pip = 0.10¢ (or $0.001), equivalent to a micro lot.

Standard Accounts

In standard accounts, all values are calculated in USD:

- 1 Lot = $100,000

- Each pip in a standard Lot = $10

- Mini lot = $1

- Micro lot = $0.10

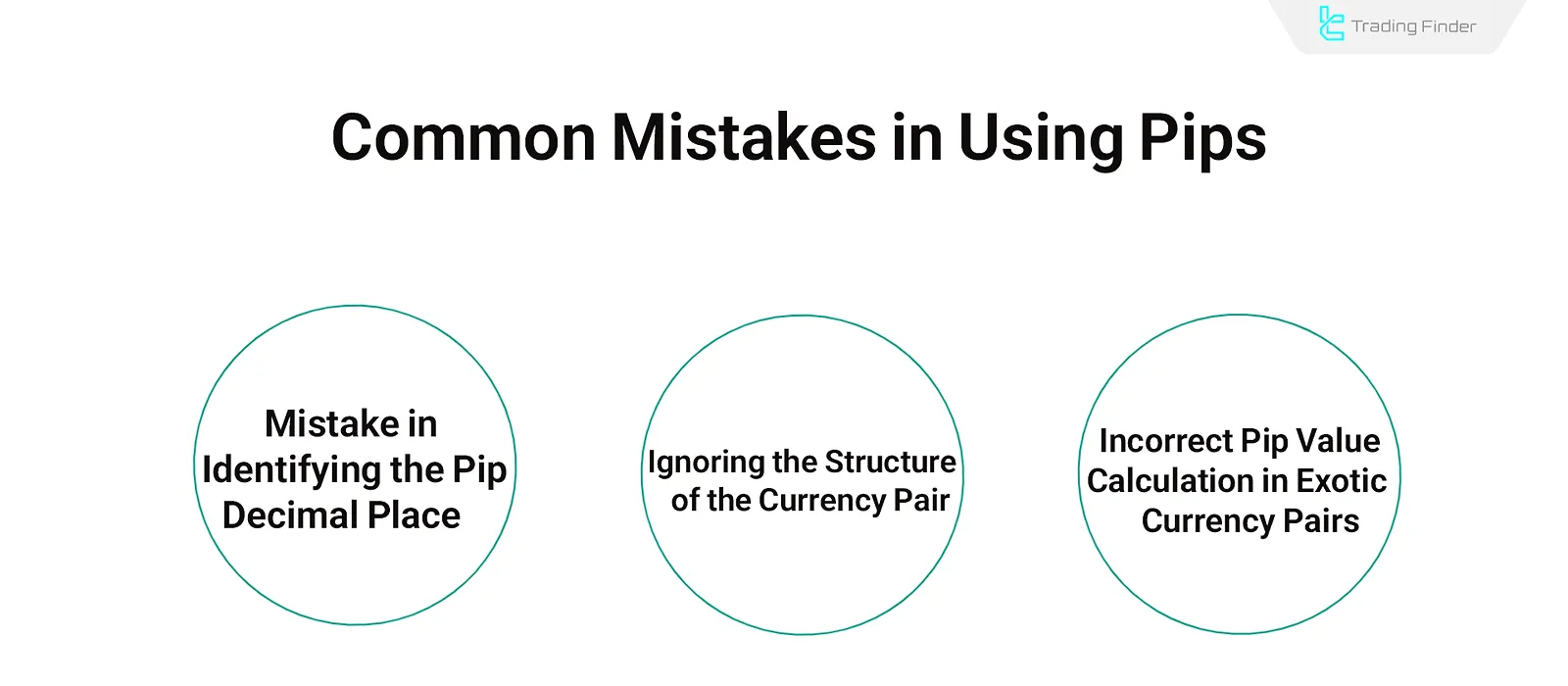

Common Mistakes in Understanding and Using Pip

Some common misunderstandings about what is a pip in Forex can directly lead to incorrect calculations of profit, loss, and risk.

Frequent Pip Mistakes:

Misidentifying the decimal position of a pip

Most pairs use the fourth decimal; however, pairs like USD/JPY use the second. Misidentification leads to incorrect profit/loss estimates.

Ignoring the structure of the currency pair (base and quote)

Misunderstanding which currency is the base and which is the quote may result in incorrect Pip Calculation in Forex, especially when USD is the base and conversion is required.

Incorrect pip value in specific pairs

For pairs like USD/JPY, CHF/JPY, or GBP/JPY with two decimal places, the pip should be 0.01 instead of 0.0001. Using the default can lead to wrong pip value estimations.

Differences Between Pip in Forex and Crypto

In the crypto market, unlike Forex, pip does not have an official or standardized definition. Most exchanges display price changes numerically or as percentages.

Some platforms use a conventional pip definition, considering every 0.01 unit price change as one pip.

In Bitcoin, smaller units like Satoshi are used to express precision. Due to high volatility and lack of uniform standards, pip calculation in cryptocurrencies requires platform-specific tools.

Comparison Table of Pip in Forex vs. Crypto:

Feature | Forex | Cryptocurrency |

Pip Definition | 0.0001 or 0.01 (depending on the pair) | Convention-based or not commonly used |

Standardization | Fixed and well-defined | Variable, depends on exchange and asset |

Use of Lot | Yes | Usually not |

P/L Calculated in Pips | Common and precise | Shown as raw price changes instead |

Conclusion

Pip is the core unit for measuring price changes in the Forex market and serves as the foundation for calculating profit, loss, and trade size. The dollar value of a pip varies depending on the currency pair, account type, and trade volume, and accurate calculation directly impacts trading performance.