Social trading refers to leveraging the experience and skills of other individuals in your trading strategy.

Onsocial trading platforms, different traders benefit from each other’s analyses and experiences, enhancing their strategies. At the same time, professional traders earn fees in exchange for sharing their analysis and insights.

Various platforms, such asZuluTrade, NAGA, andMyfxbook, offer social trading services. Therefore, choosing the right one depends on assessing key factors, including the platform's technical infrastructure.

What Is Social Trading?

Social trading is a trading method where market analysis is conducted collectively. On these platforms, traders share their market insights and execute trades with others.

This allows beginner traders to observe and utilize the strategies of more experienced traders.

What Is a Social Trading Platform?

Social trading platforms act like social networks designed for sharing trading strategies. These platforms provide tools to review trader performance, strategy success rates, trading plans, and more.

High-performing traders on these platforms earn income by offering their strategies for public access.

Pros and Cons of Social Trading

Leveraging the experience and expertise of various traders can significantly enhance individual performance. However, consistent reliance without working on personal improvement may create dependency on others for continued trading activity. Social trading pros and cons:

Pros | Cons |

Utilizing the skills and expertise of professional traders | Possibility of becoming dependent on others |

Ability to review trading history and validate traders’ credibility | Potential signal providers may lack professional qualifications |

Saves time | Lack of transparent risk management practices by the signal provider |

Creates valuable connections in financial markets | Risk tolerance is not individualized |

Enables personal strategy enhancement using others’ analyses | Delays in trade execution |

How to Choose a Social Trading Platform?

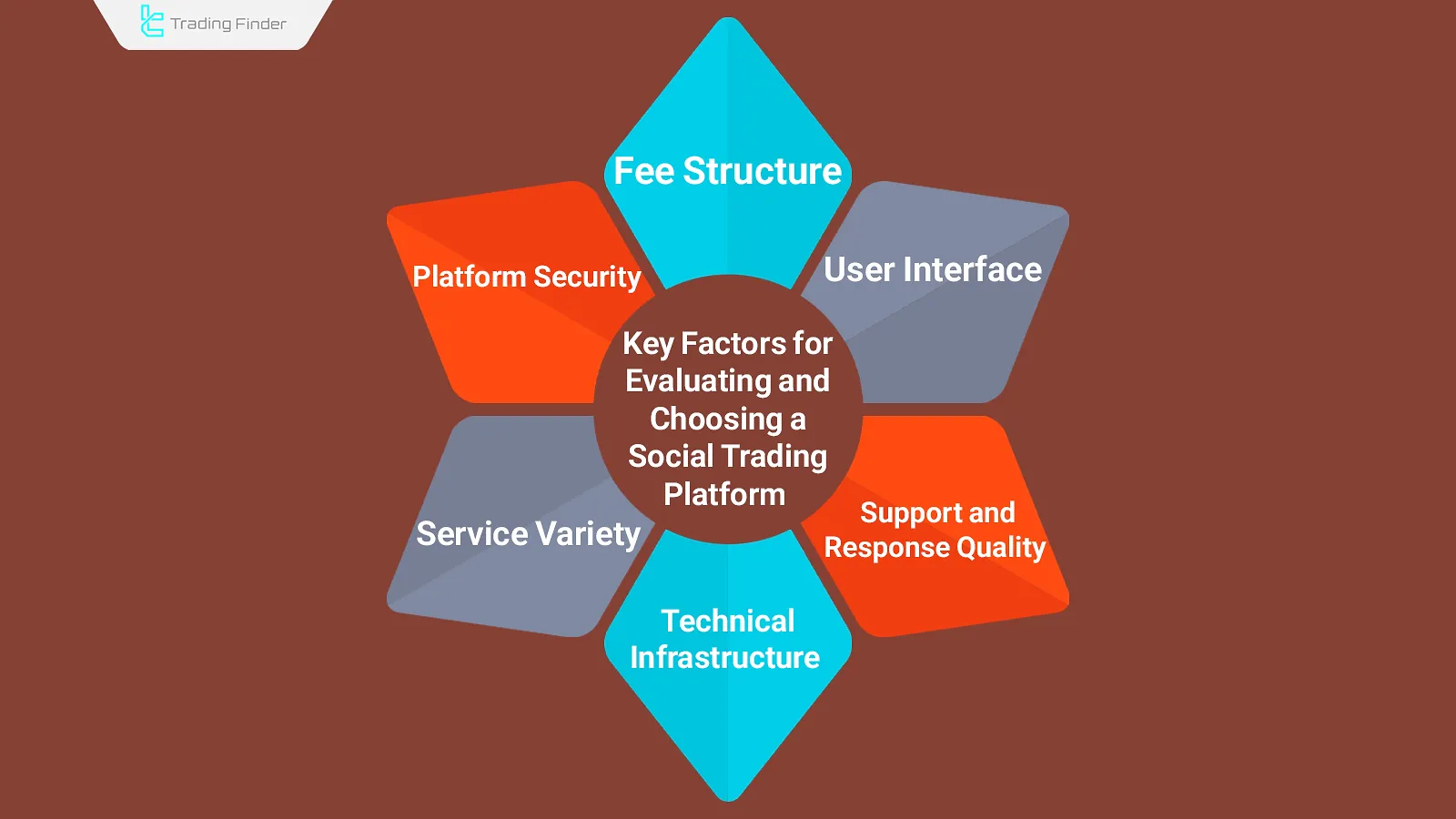

Social trading platforms charge fees in exchange for providing services and enabling the sharing of trading strategies. Choosing the right platform requires assessing several key factors, including commission structure, platform security, service variety, and technical infrastructure.

The main factors to evaluate when selecting a social trading platform include:

- Commission Fees: Compare activity costs across different platforms;

- Platform Security: Evaluate reputation and user experience to assess platform reliability;

- Service Variety: Review different types ofsocial trade services such as copy trading or mirror trading;

- Technical Infrastructure: Assess platform performance during peak hours and high-traffic periods;

- Support: Evaluate customer support response and availability during urgent situations;

- User Interface: Check for ease of use and overall user-friendliness.

Popular Social Trading Methods

Social trading encompasses several branches, such as copy trading, mirror trading, and others. Each has its own unique characteristics.

Copy Trading

In copy trading, the signal provider’s entire trading plan is automatically duplicated and executed in the investor’s trading account. Every action taken by the signal provider is mirrored in the investor’s account with no changes.

Mirror Trading

Mirror trading involves selecting a specific strategy to replicate. Here, the investor defines their loss tolerance and expected return and then starts the mirror trading process. When a trading opportunity that aligns with the chosen strategy arises, the system opens a position in the investor’s account accordingly.

Signal Trading

In this method, traders review and analyze the insights and analyses shared by others, but these actions are not automatically copied to their account. Instead, the trader manually places trades based onboth external and personal analysis.

Getting Started with Social Trading

To start with social trading, you need a solid understanding of basic financial market concepts and the social trade model. It’s also essential to be familiar with risk and capital management principles. The steps to get started with social trading are:

- Learning the fundamental concepts of trading;

- Researching and selecting a suitable social trading platform;

- Reading and understanding the platform’s terms and conditions;

- Opening a trading account;

- Reviewing traderhistories and selecting based on their performance;

- Connecting your account andmonitoring trading activities.

Top Social Trading Platforms

Several platforms offer social trading services, each with its own unique fee structure and service offerings.

ZuluTrade

ZuluTrade hosts over 10,000 signal providers with transparent trading histories. It also allows users to test trader performance using demo accounts.

Trading on Forex market, cryptocurrencies, and stocks is supported on this platform. However, a minimum deposit of $100 is required to open an account.

NAGA

NAGA is structured like a social network where users can share their analysis and trades with others.

It offers an “Auto-Trade” feature, enabling users to automatically copy analytical posts into their personal trading accounts.

Myfxbook

Myfxbook is a comprehensive platform for financial markets that also offerssocial trading features. It provides real-time updates for charts and price indicators.

eToro

eToro is regulated by organizations such as ASIC, FCA, and CySEC, which enhances its platform security.

The performance of different traders is available in detailed categories such as returns, risk levels, and trading strategies. The minimum investment to start trading on eToro is $200.

Darwinex

Launched in 2014, Darwinex offers a range ofsocial trading services. The platform allows users to view detailed risk metrics of various traders and supports the use of trading bots. Mobile apps are available for both Android and iOS.

AvaTrade

AvaTrade offers a user-friendly interface suitable for all types of users. It also partners with ZuluTrade for social trading services.

With a strong history dating back to 2006, AvaTrade offers the trading of over 200 instruments.

TradingView

Although TradingView is primarily used for chart analysis, one section allows users to view the analyses of other traders, which can be helpful for identifying trading signals.

Traders are ranked by performance history, making it possible to assess long-term results.

What Are the Key Considerations in Social Trading?

Using social trading methods can save time and benefit from expert insights, but failing to evaluate factors such as trader history or platform infrastructure can increase the risk of losses. Key points to consider:

- Reviewing the trading journal and history of thesignal provider;

- Assessing the quality and reliability of the platform infrastructure;

- Constantly monitoring trades;

- Applying proper risk and capital management to all trades;

- Acquiring core trading knowledge in the target market;

- Having a clear trading plan for different market conditions.

Difference Between Social Trading and Copy Trading

Social trading, in general, refers to group-based trading and using others’ insights to optimize your strategy.

In social trading, users can modify andpersonalize the strategies of others. In contrast, copy trading (a subset of social trading) involves fully duplicating all actions of the signal provider into the linked trading account without any changes.

Copy trading is considered apassive investment method. However, over-reliance on this approach can diminish a trader’s confidence and create dependency on others. In social trade, this issue is less likely since the trader remainsinvolved in decision-making.

Conclusion

In social trading, traders incorporate the insights and analyses of others into their personal trading. On various platforms, traders share their views on price movements, helping improve collective performance.

Social trading exposes users to a variety of strategies and styles and promotes networking within financial markets. However, relying on this approach long-term—without developing personal strategies or skills—can result in dependence on others for trade execution.

Given the wide range of platforms offering social trading services, proper selection depends on reviewing factors like commission fees, platform security, andtechnical performance.