Stagflation is the worst phase of an economy; Despite rising unemployment rates, economic growth declines instead of reducing inflation.

Central banks face significant challenges in monetary policy during this period due to sticky inflation, leaving little room for expansionary monetary or fiscal policies.

At the same time, stimulative and supportive policies must be implemented to revive the economy.

What is Stagflation in economy?

Stagflation is an economic period where, alongside recession and declining economic growth, inflation also rises.

Essentially, stagflation challenges classical economic theories and the Phillips Curve (which suggests that inflation reduces unemployment in the short term).

How Does Stagflation Occur?

According to economic theory, stagflation is an unusual phase because recession and inflation typically occur under separate conditions.

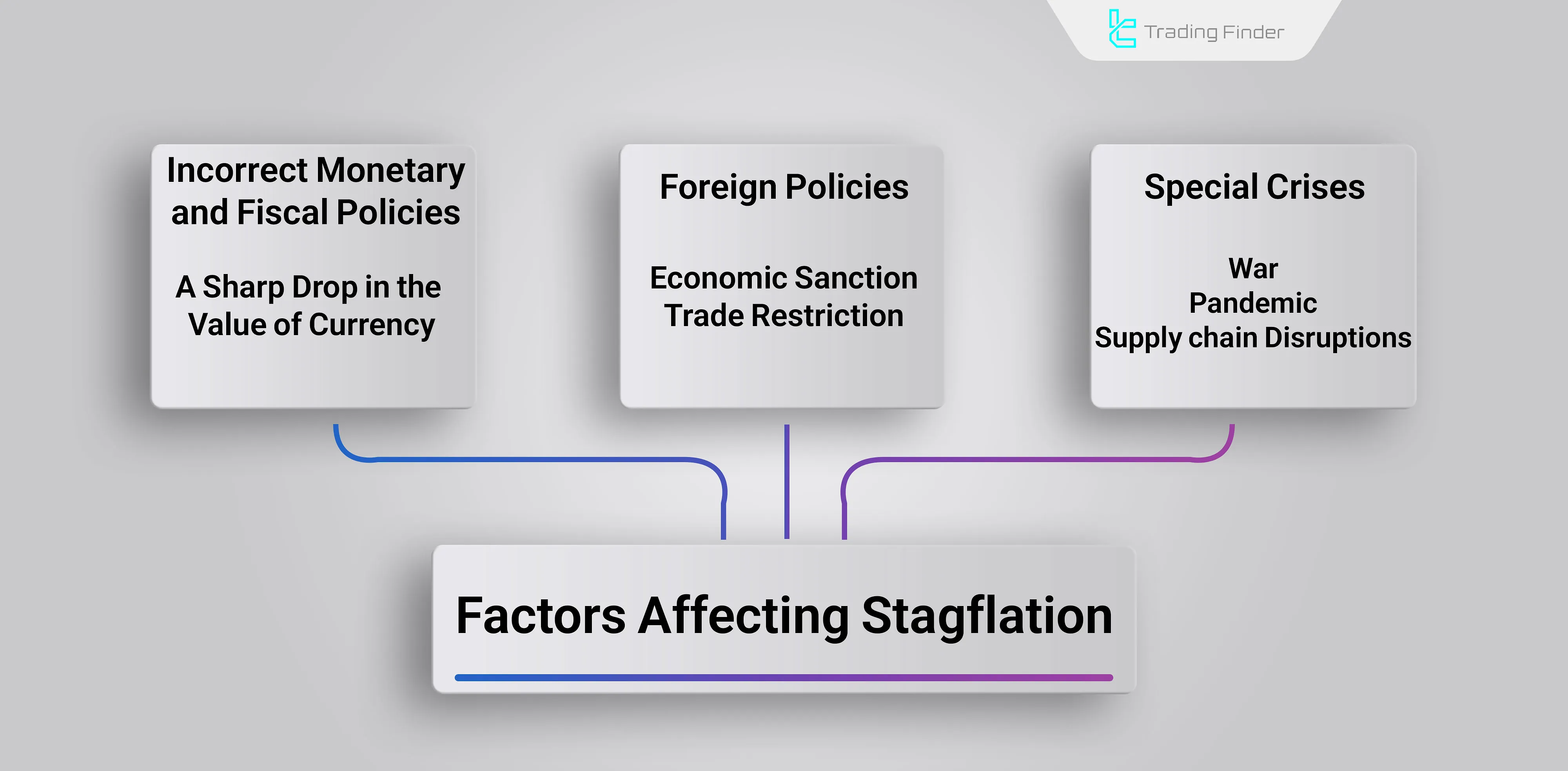

However, recession and inflation may arise simultaneously during supply-demand imbalances (e.g., wars or specific crises).

Rising Prices of Essential Goods

A supply shock, sharp increase in essential goods prices, and rising production costs can lead to reduced output, layoffs, and higher unemployment.

At the same time, increased raw material costs drive up final product prices.

Poor Monetary and Fiscal Policies

Excessive money printing and rapid liquidity growth, coupled with inflation, reduce consumers' purchasing power, leading to stagflation.

High taxes or reduced government spending also increase producers' costs and lower consumer demand, exacerbating stagflation.

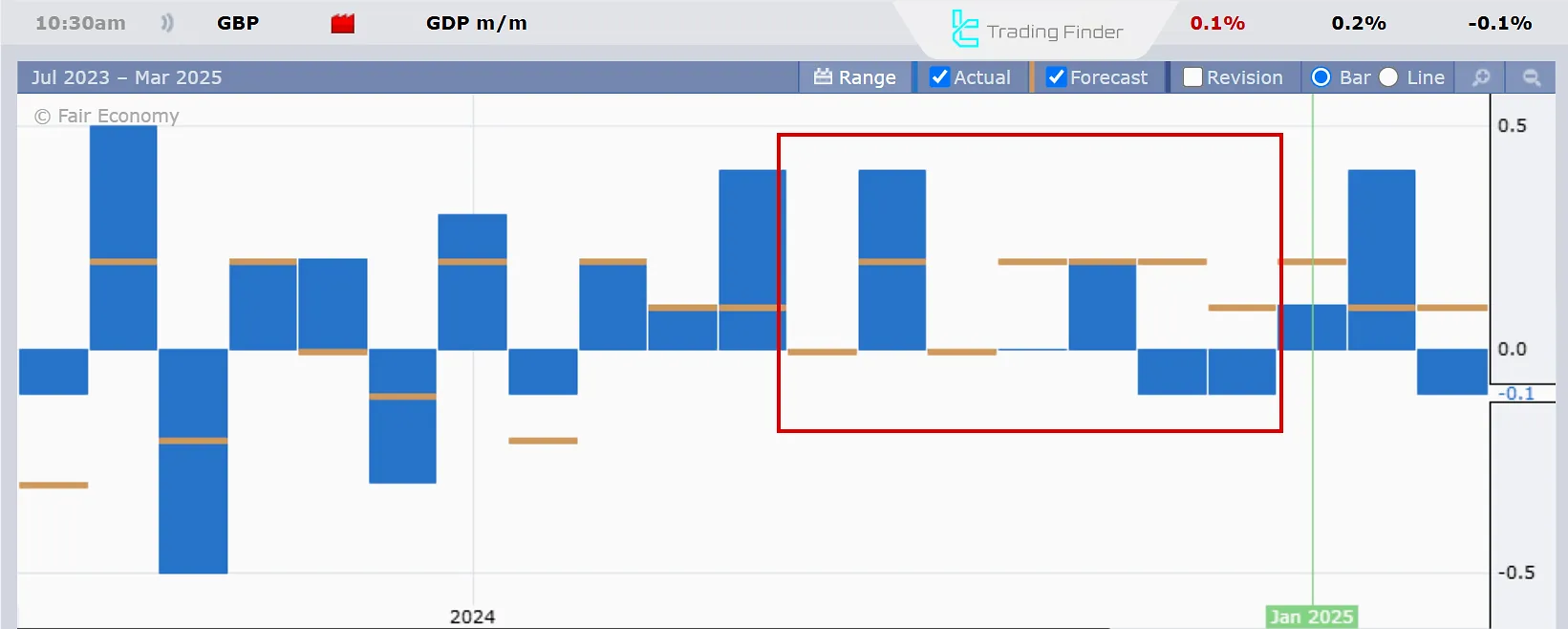

This image shows the UK's economic growth decline in H2 2024 due to sharp tax hikes. If sticky inflation persists, the economy may enter a stagflation phase.

Foreign Policies and Trade Restrictions

Economic sanctions and trade barriers like import tariffs and supply chain disruptions reduce supply and increase raw material costs, contributing to stagflation.

Exchange Rate Volatility (Sharp Currency Depreciation)

Sharp currency depreciation reduces purchasing power and demand, potentially triggering stagflation. It also causes imported inflation, particularly affecting import-dependent economies.

How to Overcome Stagflation؟

Policymakers face complex challenges in overcoming stagflation. A combination of economic tools and supportive policies is required.

Exchange Rate Adjustment

During stagflation, extreme currency fluctuations worsen the recession. Proper exchange rate adjustments through boosting exports and reducing imported inflation help exit stagflation.

Increased Investment and Government Spending

Investment and government spending to support production and job creation improve output and consumer demand, breaking stagflation in economy.

However, spending must be planned to avoid long-term debt accumulation.

Political and Economic Stability

While foreign investment aids recovery through job creation and increased production, attracting investors requires political and economic stability, as capital security is their top priority.

How Does a Country’s Currency React During Stagflation?

During stagflation, currency reactions vary. Typically, central banks use contractionary policies to curb inflation, as inflation control takes precedence over recession recovery in developed economies.

Generally, the currency weakens in the forex market, though it may temporarily strengthen under contractionary policies.

Best Investments During Stagflation

In stagflation, safe-haven assets are in demand because inflation does not drive growth in risky markets.

Recommended assets during stagflation:

- Gold: Precious metals like gold and silver act as inflation hedges, protecting capital;

- Bonds: Fixed-income securities are ideal for capital preservation during stagflation;

- Real Estate: Property in high-growth areas is a viable stagflation investment.

Major Historical Stagflation in Economy

Stagflation is a complex economic phase, often lasting years. Key historical stagflation crises:

The 1970s Stagflation Crisis

In the 1970s, oil supply shocks triggered a deep stagflation lasting nearly a decade. The first oil shock in 1973 resulted from OPEC’s supply cuts, quadrupling oil prices.

The second shock in 1978 followed Iran’s revolution, disrupting oil supply and spiking prices again.

Consequences of 1970s Stagflation:

- Sharp economic decline in industrialized nations;

- Double-digit inflation in the US and Europe;

- High unemployment and reduced consumer purchasing power;

- Declining competitiveness of UK industries;

- Widespread strikes and productivity drops.

The crisis was eventually controlled via contractionary monetary policies and sharp interest rate hikes, though these measures initially worsened unemployment.

Iran’s Stagflation Crisis

Due to post-revolution sanctions, declining oil exports, and currency depreciation, Iran has faced repeated stagflation in recent decades.

Iran’s stagflation stems from heavy oil dependence, currency devaluation, and rising import costs.

Consequences of Iran’s Stagflation:

- Persistent double-digit inflation;

- High unemployment and reduced consumer purchasing power.

Russia’s Stagflation Crisis

In the 1990s, Russia faced hyperinflation and recession while transitioning from a command economy (state-controlled) to a market economy (private-sector-driven).

Consequences of Russia’s Crisis:

- Hyperinflation (exceeding 200% in some years);

- A Deep recession and mass unemployment.

Russia overcame stagflation after 6 years via economic reforms and foreign aid.

Conclusion

Stagflation is the worst economic phase, combining declining growth, rising unemployment, and high inflation.

Exiting it requires monetary policies, support measures, and production boosts. Investing in gold, bonds, and real estate is advisable during stagflation.