The operational hours of financial markets are broadly categorized into four sessions of Sydney, Tokyo, London, and New York. This division is based on the working hours of major financial hubs in Asia, Europe, and America, with each session differing in characteristics such as trading volume, price volatility, and trading opportunities.

Understanding trading sessions makes it possible to select time windows in which market liquidity and volatility align most effectively with a trading strategy.

Typically, the highest trading volume and the strongest price movements occur during the overlap of the London session and the New York session, while the Asian session is generally characterized by calmer fluctuations and a ranging structure suitable for lower-risk trading.

What is a Trading Session?

Trading sessions are specific time periods during a trading day in which traders from different time zones participate in activity within the 24-hour Forex market.

For example, during the Tokyo session, Japanese and Asian financial institutions are active. As a result, volatility and trading volume in JPY currency pairs increase.

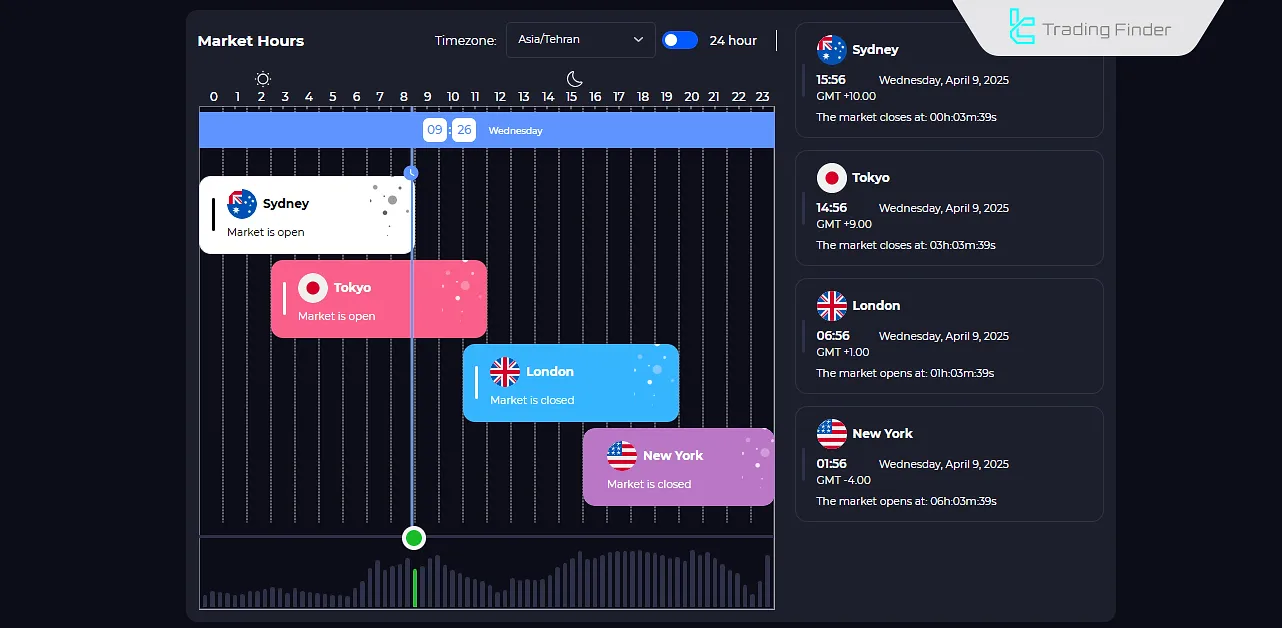

This image showcases the Forex Market Sessions Tool on the TradingFinder website. Traders can use this tool to monitor sessions and their current status (open/closed).

Types of Forex Trading Sessions

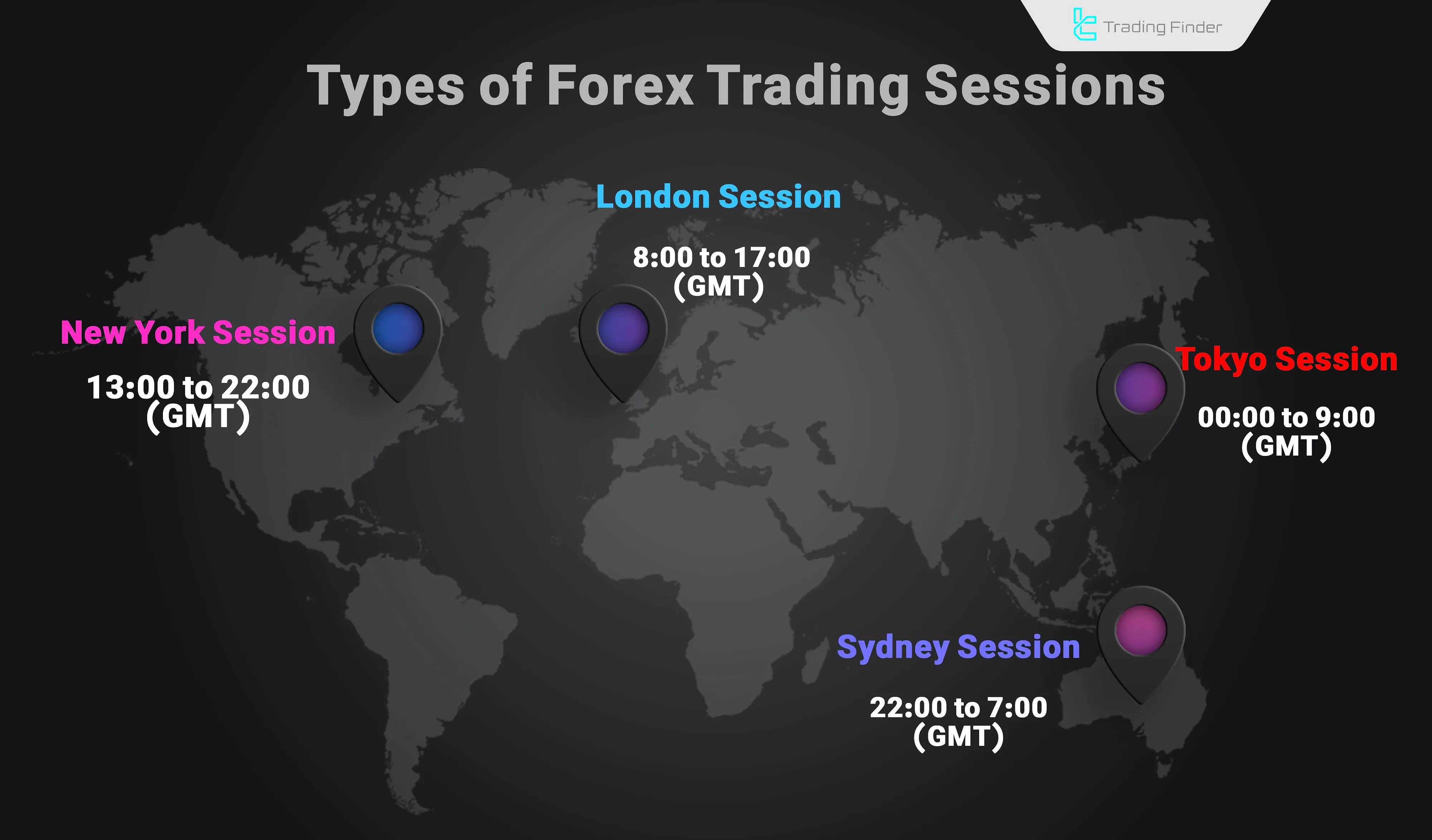

Forex trading sessions are divided into four categories:

- Sydney Session: The first trading session with the lowest volatility among all sessions. The AUD (Australian dollar) is the most watched currency;

- Tokyo Session: Marks the opening of Japanese markets, increasing trading volume in Asian markets, especially the JPY;

- London Session: The London session, overlaps with Asia and the US, sees the highest Forex trading volume, accounting for over 30% of all transactions;

- New York Session: The London-New York overlap offers peak liquidity and tight spreads, ideal for scalping.

Note: U.S. economic reports are released during the New York session. These reports cause short-term volatility in major USD pairs and influence market sentiment (risk-on/risk-off).

Session Start and End Times

Knowing the exact start and end times of trading sessions makes it possible to identify periods of peak liquidity and increased market volatility and prevents entering trades during low-volume periods.

Each session becomes active at a specific time of the day and ends accordingly. In the forex sessions table below, their time ranges are listed precisely:

Trading session | Time range (UTC) |

Sydney | 20:30 to 05:30 |

Tokyo | 23:30 to 08:30 |

London | 07:30 to 14:30 |

New York | 12:30 to 20:30 |

Session Time Changes Due to Daylight Saving Time (DST)

One of the very important points in forex trading is the change in trading session hours during the implementation of daylight saving time.

In some countries, such as the United States and European countries, the official clock is moved one hour forward during part of the year. This change causes the start and end times of the London and New York sessions to shift.

Under these conditions, the overlap between sessions also changes, and if a trader is not aware of this adjustment, they may enter the market during hours when liquidity or volatility is insufficient. Professional traders always check the daylight saving time calendar before executing time-dependent strategies.

The educational video on daylight saving time by the CGP Grey YouTube channel provides one of the most comprehensive explanations for understanding this topic, and interested users can watch it at the link below.

Why is Understanding Trading Sessions Important?

Trading sessions directly impact trading volume, volatility, and strategies (some work only in specific sessions). Understanding these sessions is crucial, especially for short-term traders.

Key Benefits of Knowing Trading Sessions:

- Optimal Trading Times: The London and New York sessions offer high liquidity, making them ideal for scalpers;

- Economic Data Releases: Economic indicators such as inflation rate, NFTs, and interest rates are published during the London/New York sessions, enabling news trading or risk avoidance;

- Trader Psychology: Asian sessions are cautious, while London/New York sessions are high-risk/high-reward.

A Real Example of a Trading Day Based on Sessions

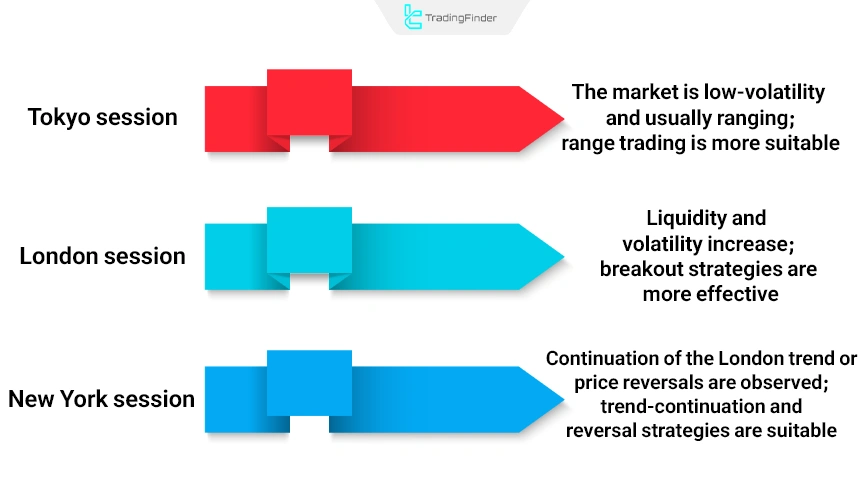

To better understand the role of trading sessions, assume a trader monitors the market throughout a working day. During the early hours of the day, coinciding with the Tokyo session, the market remains in a low-volatility state and prices move within a defined range.

At this time, the trader focuses mainly on analysis and identifying key levels. With the start of the London session, trading volume increases significantly and price breaks out of the previous range.

At this stage, the trader can apply breakout strategies and enter trades in alignment with the main market move. Finally, with the opening of the New York session, the market enters a phase of final decision-making, either continuing the London trend or showing signs of correction and price reversal.

Differences Between Trading Sessions

Forex sessions vary in trading volume, price volatility, active strategies, and key currency pairs.

Parameter | Sydney | Tokyo | London | New York |

Time (UTC) | 20:30 to 05:30 | 23:30 to 08:30 | 07:30 to 14:30 | 12:30 to 20:30 |

Characteristics | Low volatility Start of day | Asian market peak Focus on JPY | Highest liquidity | High volatility U.S. reports |

Key Pairs | AUD/USD, NZD/USD | USD/JPY, AUD/USD | GBP/USD, EUR/USD | GBP/USD, EUR/USD |

Volatility | Low | Medium | High | High |

Trading Style | Swing Trading | Range Trading | Scalping/Day | Scalping/Day |

Technical Patterns in Forex Sessions

Certain technical patterns emerge in high-volatility sessions like London and New York due to high trading volume and reactions to economic news. These patterns help identify reversals, fakeouts, and liquidity grabs.

New York Reversal Pattern

A popular pattern, the New York Reversal, often forms in the latter half of the New York session, signaling trend reversals after strong initial moves.

This pattern often occurs after liquidity has been taken from the highs or lows formed during the London session and is accompanied by signs such as a break of structure or price reaction at key levels.

Combining the New York Reversal with liquidity analysis and market structure can provide precise entry points for reversal trades with controlled risk.

Seek & Destroy Pattern

Another pattern, Seek & Destroy, appears in London/New York sessions. It involves liquidity sweeps and fake breakouts to trap retail traders.

Suitable Strategies for Each Trading Session

Market behavior differs across trading sessions, and using a fixed strategy throughout all forex trading hours can reduce trading performance. Adapting the strategy to the characteristics of each session is highly important:

- Tokyo session: The market is often ranging and low-volatility; therefore, range-trading and limited-volatility strategies perform better;

- London session: With increased liquidity, strong and directional movements form; breakout strategies and key level break strategies are more suitable;

- New York session: The market typically either continues the London trend or reverses at the session open, making both trend-continuation and reversal strategies more effective.

Best Currency Pairs for Each Trading Session

Each trading session has the greatest impact on currency pairs that are directly linked to the economy of that region.

For this reason, selecting currency pairs that align with the active trading session creates better alignment between market liquidity and strategy structure and improves trade execution quality.

- Tokyo session: In this session, pairs like USD/JPY, AUD/JPY, and EUR/JPY are more active because Asian banks and financial institutions focus mainly on the Japanese yen;

- London session: During the London session, pairs like EUR/USD, GBP/USD, and EUR/GBP have the highest volume and liquidity, with stronger and more organized market movements;

- New York session: In this session, U.S. dollar–based currency pairs like EUR/USD and USD/CAD show higher volatility, and price reactions to economic news and data are stronger.

The educational article on currency pairs on investopedia.com provides additional information about different types of tradable currency pairs and explains the structure of major, minor, and exotic pairs for a deeper understanding of the forex market.

Comparison of Volatility Levels Across Trading Sessions

Trading sessions differ significantly in terms of volatility. Understanding these differences helps traders choose strategies that are better suited to the conditions of each session. The table below provides a detailed comparison of volatility across sessions:

Trading session | Volatility level | Volume and liquidity | Dominant price behavior | Peak activity time | Suitable strategies |

Tokyo | Low | Low to medium | Range movement, limited breakouts | Start of the Asian session | Range trading, low-risk scalping |

London | Very high | Very high | Formation of strong trends, valid breakouts | Overlap with the end of Tokyo and start of New York | Trend following, breakout |

New York | High at the start, medium at the end | High | Strong volatility at the open, correction or consolidation later | Overlap with London | News trading, London trend continuation, intraday |

Impact of Economic News During Trading Sessions

Most major global economic news, especially data related to the U.S. economy, is released during the New York trading session. Reports such as unemployment rates, inflation data, and interest rate decisions can lead to sharp volatility spikes and unpredictable price movements.

Under these conditions, novice traders usually face higher risk, as the likelihood of slippage and fake breakouts increases. For this reason, many professional traders either avoid trading during news releases or apply news-specific trading strategies.

Impact of Bank Holidays and Low-Volume Market Days

On certain days of the year, major banks and financial institutions in Europe or the United States are closed. On such days, even if a trading session is officially active, trading volume can decline sharply. This often leads to abnormal, slow, or deceptive price movements.

For example, bank holidays in the United Kingdom can cause the London session to show unexpectedly low volatility. Professional traders typically reduce their position size on these days or stay out of the market entirely.

Common Trader Mistakes in Choosing a Trading Session

A significant number of traders enter trades without considering the active market session, which can directly affect decision quality and trading results. Common mistakes in this area include the following:

Mismatch between currency pair and trading session: Trading Asia-related currency pairs during the New York session or expecting high volatility during the Tokyo session;

- Expecting high volatility during low-volume hours: Trading during periods of low liquidity when price movements are unreliable;

- Ignoring daylight saving time changes: Overlooking shifts in session opening and closing times, increasing the risk of entering the market too early or too late;

- Trading at times incompatible with the strategy: Some strategies require high volatility, while others perform better in calmer market conditions.

Incorrect selection of a trading session often leads to outcomes such as low-quality entries, unnecessary stop-loss triggers, and missed profitable opportunities.

In contrast, alignment between the selected currency pair, trading strategy, and market activity time plays a key role in improving analytical accuracy, enhancing risk management, and boosting overall trading performance in the forex market.

Session Box Indicator

The Session Indicator is one of the specialized tools in the category of session and Kill Zone indicators for MetaTrader. It is designed with a focus on financial market timing and helps traders analyze price behavior during key trading hours.

The forex trading sessions indicator displays the opening and closing times of trading sessions based on the activity of major central banks around the world and provides a precise time-based view of market liquidity flow.

The Session Box indicator uses a dynamic information panel to show whether sessions such as Asia, Sydney, Tokyo, Europe, London, and New York are active or inactive.

In addition to the start and end times of each session, this panel allows synchronization with either UTC time or local time, which is highly important for accurate forex market analysis.

A distinctive feature of this indicator is the drawing of colored boxes on the price chart. Each box represents the volatility range of a specific session and defines the session’s price high and low based on the actual market High and Low.

This structure allows traders to identify key supply and demand areas and evaluate price reactions to either the breakout or the preservation of these levels.

In markets such as forex, commodities, and indices, many instruments experience their highest trading volume and volatility during specific sessions, especially London and New York.

The Session Box was developed precisely for this purpose: to help traders avoid trading during ranging hours and focus on periods when the market has the potential for directional moves.

This makes the indicator highly practical for day trading and scalping styles.

From a technical perspective, this tool performs effectively on timeframes from M1 to M30 and is classified among range, entry and exit, and non-repainting indicators.

It also provides extensive settings for professional users, including customization of colors, box display styles, panel activation, and precise session time configuration.

Overall, the Session Box indicator, as one of the ICT indicators on the MetaTrader platform, is considered an efficient tool for time-based market analysis.

It enables a more accurate understanding of price movement structure and better alignment of trading decisions with the behavior of each trading session.

Conclusion

Forex sessions (Oceania, Asia, Europe and America) are defined by overlaps, trading volume, liquidity, and key currency pairs. Patterns like the New York Reversal and Seek & Destroy can identify short-term trends in London/New York sessions.

During session overlaps, such as the London and New York sessions, trading volume and liquidity reach their peak, and price volatility is typically stronger, creating more trading opportunities.