- TradingFinder

- Education

- Technical analysis Education

Technical analysis Education - 2

Technical analysis is a method for evaluating price movements in financial markets, emphasizing price charts, chart patterns, trends, trading volume, and indicators. Unlike fundamental analysis, which assesses an asset’s intrinsic value based on economic and financial factors, technical analysis relies on historical price behavior and structured patterns to identify high-probability trading opportunities. Classical technical analysis tools include trendlines, support and resistance levels, price channels, oscillators, and momentum indicators. These tools assist traders in defining market direction, measuring trend strength, and pinpointing precise entry and exit points. Modern technical analysis extends beyond conventional tools, incorporating market structure, liquidity dynamics, and order flow. Advanced methodologies such as price action, the Smart Money Concept (SMC), Inner Circle Trader (ICT) strategies, harmonic patterns, Elliott Waves, and the Read the Market (RTM) approach enable traders to identify institutional liquidity zones, track price manipulation, and refine execution strategies with greater accuracy. TradingFinder offers a comprehensive suite of educational content and analytical tools, bridging classical and modern technical analysis. It equips traders with specialized insights into liquidity models, market structure interpretation, and price movement assessments, enhancing their ability to navigate complex market conditions.

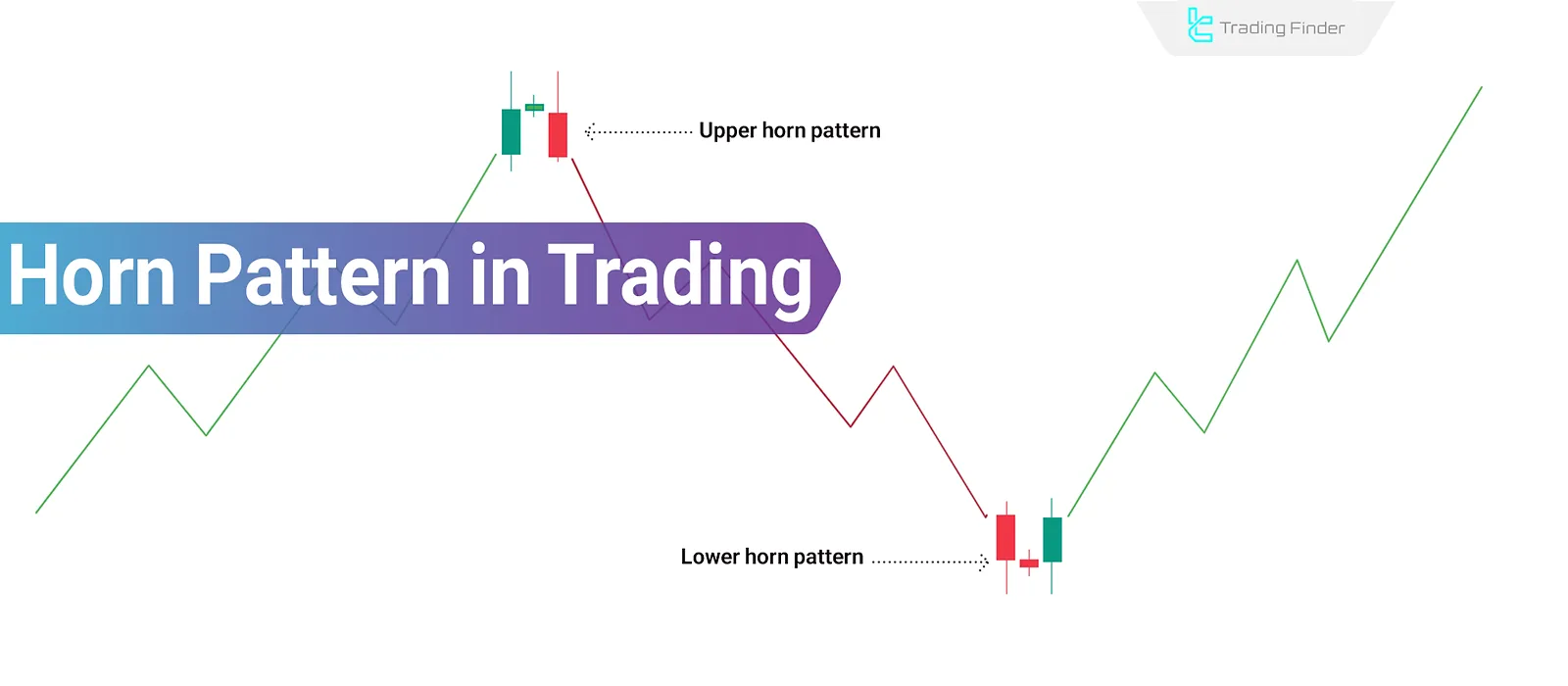

Horn Pattern Trading in Technical Analysis; Horn Top and Bottom

The Horn Pattern in technical analysis is one of the lesser-known reversal patterns that, unlike classical patterns, is based...

What is Ichimoku? Tenkan-sen, Kijun-sen, Chikou Span, Senkou Span A & B

Ichimoku, as both an indicator and a complete trading system in technical analysis, simultaneously provides information about the...

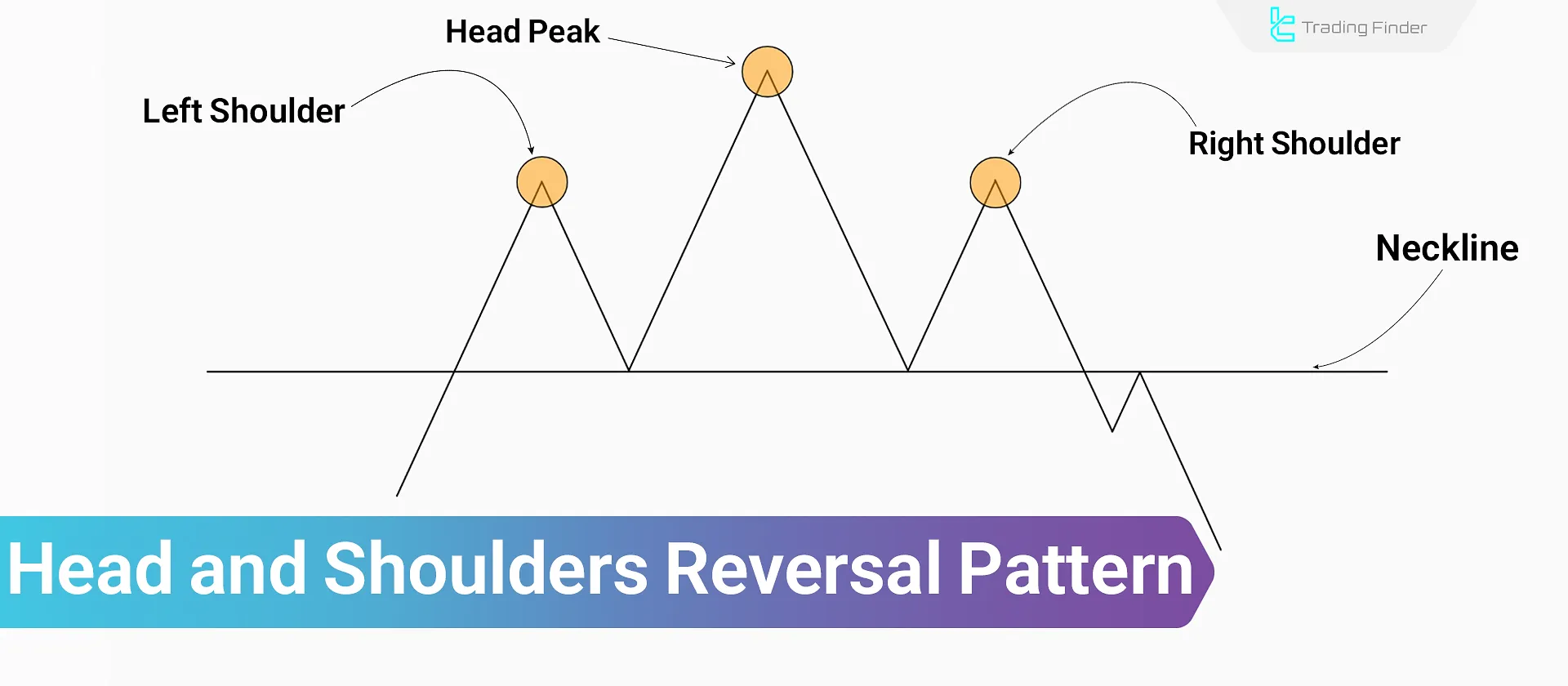

Head and Shoulders Pattern – A Combined Trading Strategy Using RSI Indicator

The head and shoulders pattern is among the classic reversal patterns that reflects shifts in supply and demand sentiment. This...

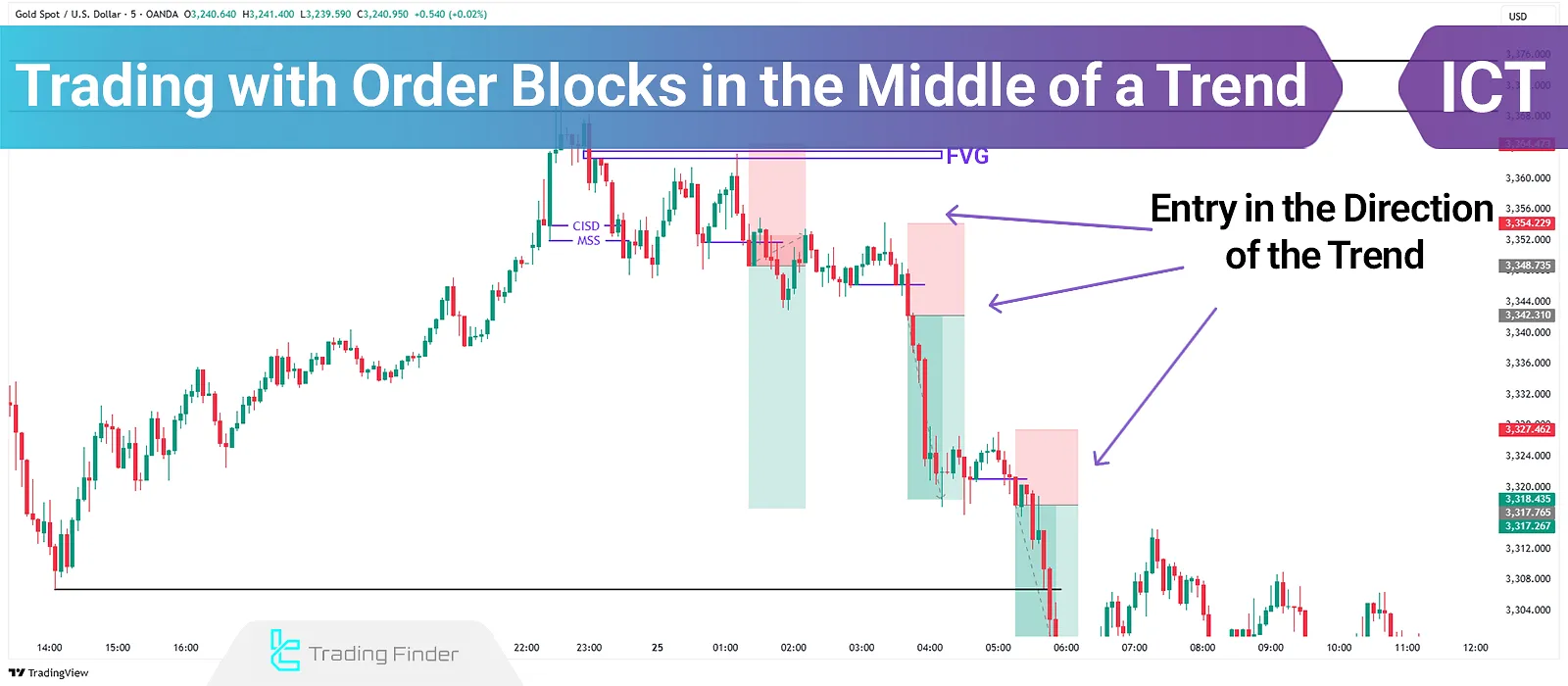

Order Block in Trend Following with ICT – Entry Using OB and FVG

When traders miss the initial entry point and aim to enter in the middle of a trend, the ICT approach recommends re-entry...

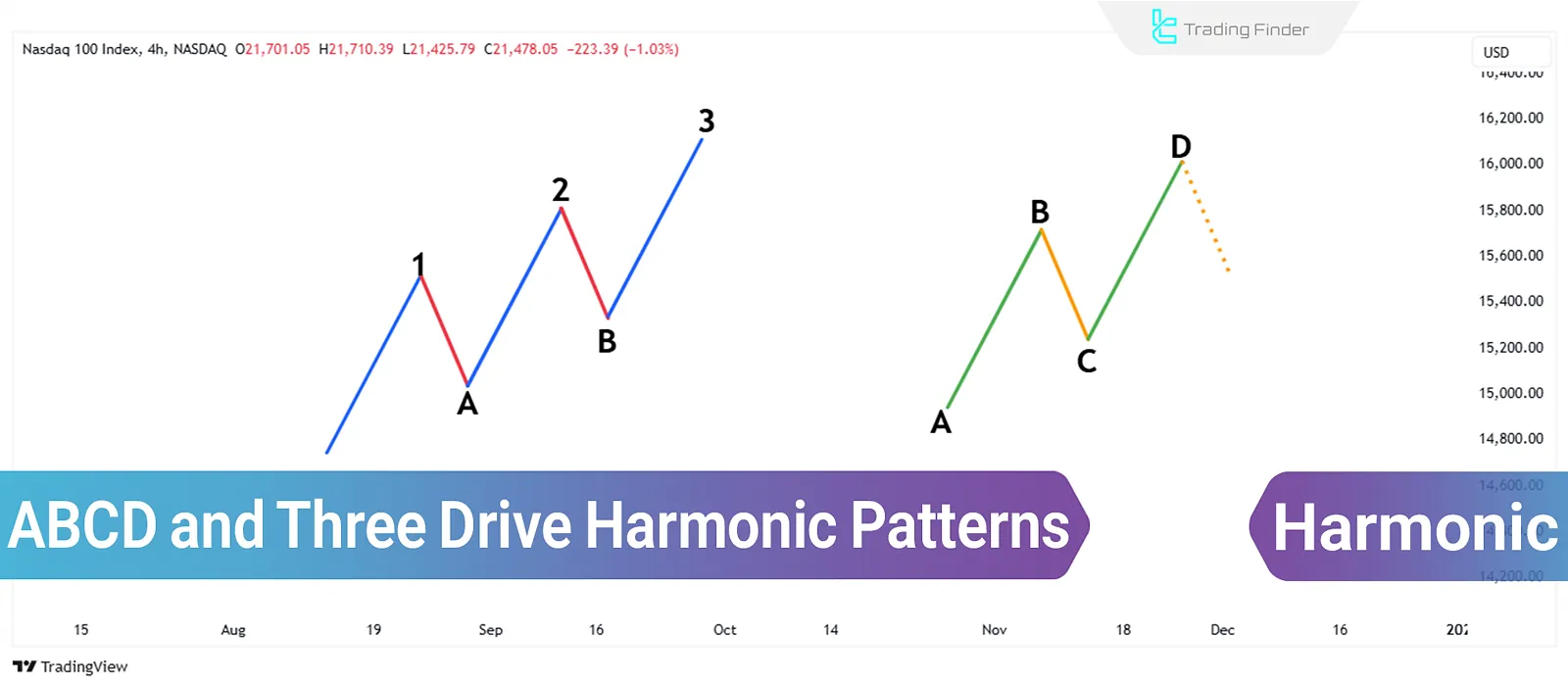

ABCD and Three-Drive; Harmonic Patterns in technical analysis & Fibonacci ratios

Harmonic patterns, based on Fibonacci ratios, are among the tools used in technical analysis. The ABCD pattern and the Three-Drive...

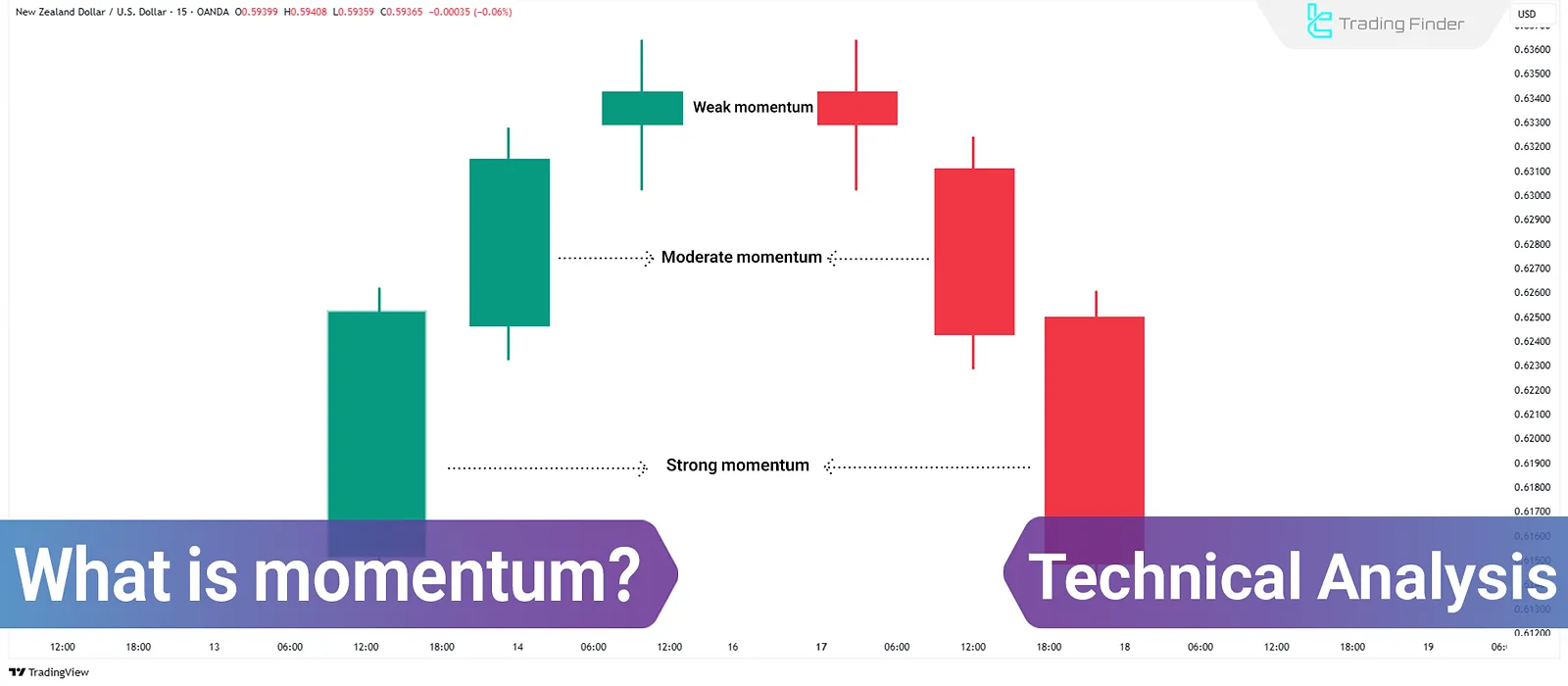

Momentum in Technical Analysis: The Speed and Strength of Price Movement

Among various technical analysis tools, momentum is one of the concepts that examines the speed and strength of pricemovements....

What is Scalping? Short-Term Trades from Seconds to Minutes

Scalping is a highly fast-paced trading strategy in financial markets where the period between opening and closing trades is only...

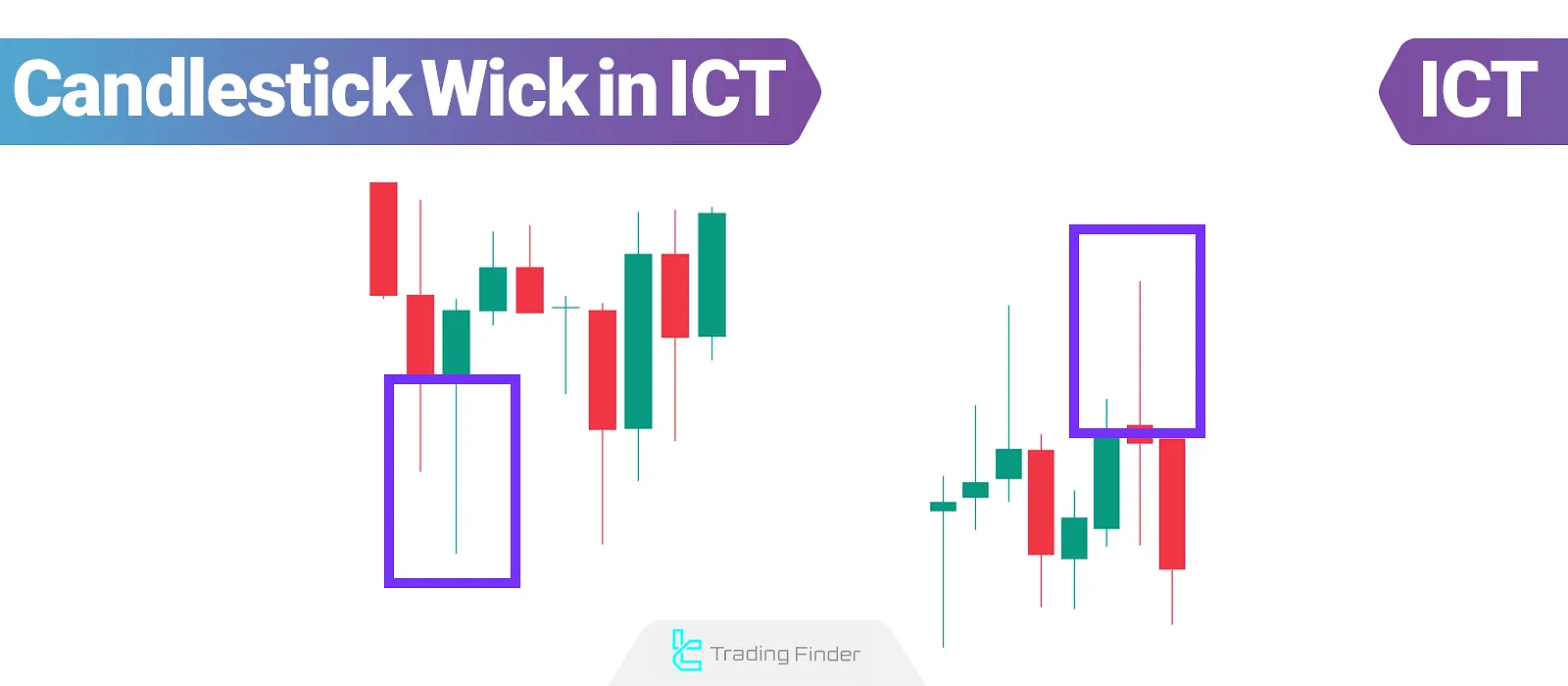

Candlestick Wick in ICT: Wick Sizes & Formation Locations in candlestick shadow

The candlestick shadow in ICT reveals is a precise depiction of the market's reaction to key levels and its behavior relative...

Candlestick Patterns in Support and Resistance: Reversal and Breakout Candles

Candlestick patterns, as the foundation of Price Action analysis, reflect order behavior at key supply and demand zones. Combining...

Xmaster Formula Indicator in Forex: Identifying the Start and End of Trends

The Xmaster Formula Forex Indicator issues entry signals based on overbought and oversold zones. A key advantage of this indicator...

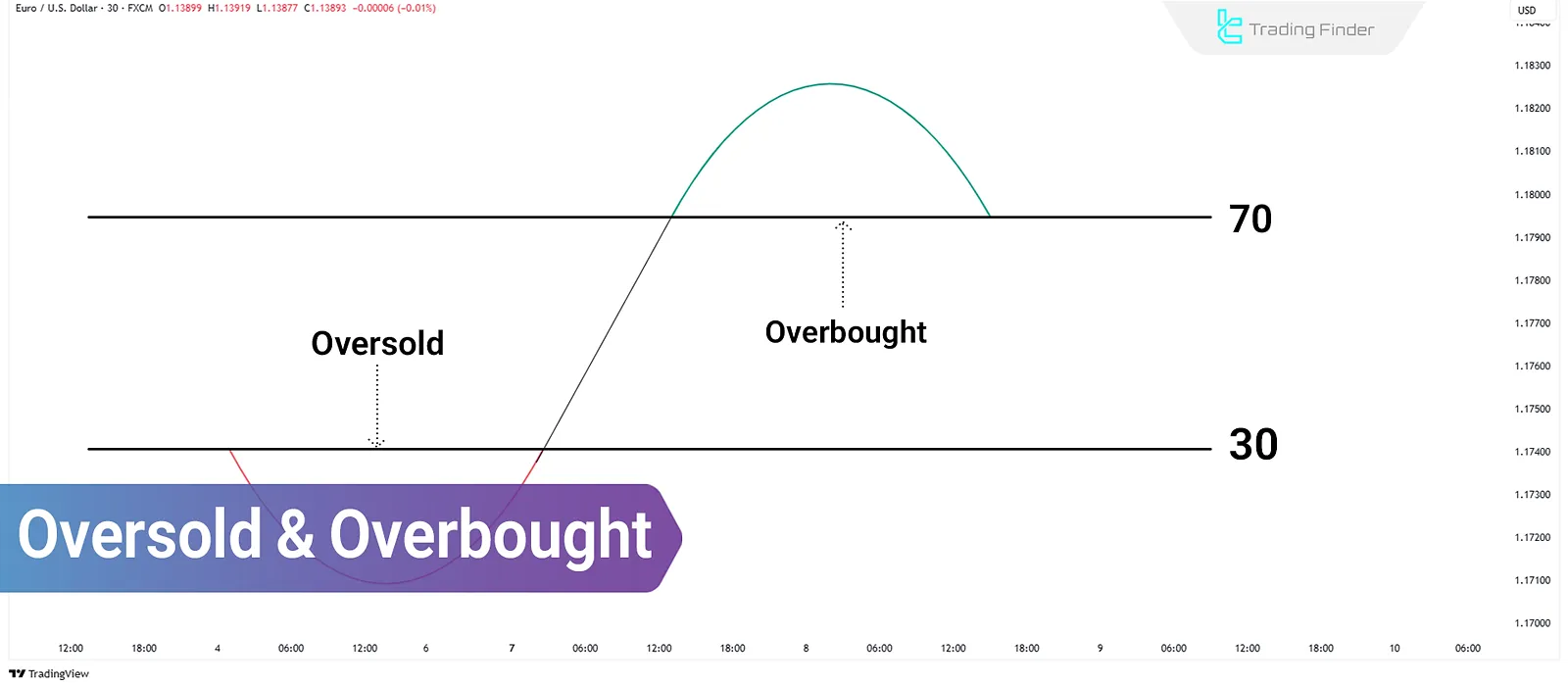

Overbought and Oversold Conditions; Using Tools Like RSI and MACD

Overbought and oversold conditions occur when the price of an asset deviates significantly from its equilibrium or historical...

Fibonacci in Technical Analysis: Tools for Reversal & Continuation

In technical analysis of financial markets, Fibonacci ratios and levels are recognized as one of the oldest tools for...