Apex Trader Funding rules include maintaining a 5:1 risk-to-reward ratio and adhering to a 30% initial drawdown limit, which can be adjusted to 50% as the account grows.

Apex Trader Funding Rules

Various restrictions have been established by Apex Trader Funding prop Firm for traders to follow; Some of the Apex Trader Funding Trading Condition Topics:

- Market Manipulation

- Dollar-Cost Averaging (DCA)

- RR Rule

- Flipping

- Drawdown Limit

Apex Trader Funding Market Manipulation

Market manipulation is strictly prohibited in ATF; Apex Trader Funding Manipulation Cases:

- No HFT or exploitative strategies: Strategies aimed at exploiting system inefficiencies are not allowed;

- Own Account Responsibility: Traders must use their accounts and are not allowed to share login details or let others trade on their behalf.

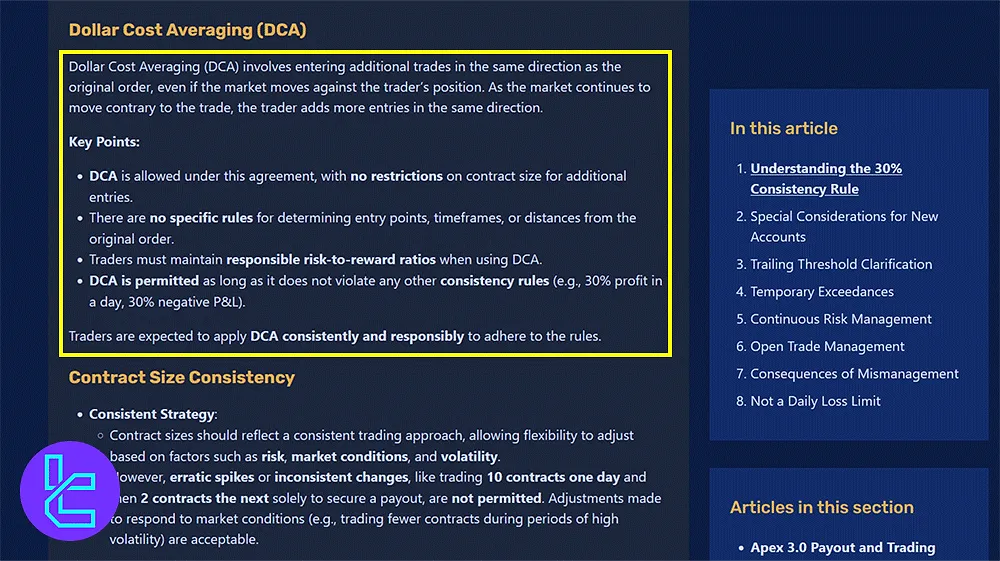

Apex Trader Funding DCA (Dollar-Cost Averaging)

Dollar-Cost Averaging (DCA) is allowed in Apex Trader Funding but must be applied consistently and responsibly; Apex Trader Funding DCA Rule:

- Consistent Application: Traders must apply DCA strategies regularly and in line with other rules;

- No Violations: DCA cannot violate other consistency rules like profit/loss limits, ensuring that the trading approach remains balanced.

Apex Trader Funding News Trading

Trading based on news events is permitted under ATF, but it comes with specific guidelines; Apex Trader Funding News Rules:

- No Opposing Positions: Traders cannot take long and short positions on the same news event;

- Consistency Compliance: News trading must still follow the same consistency rules, including profit and loss limits.

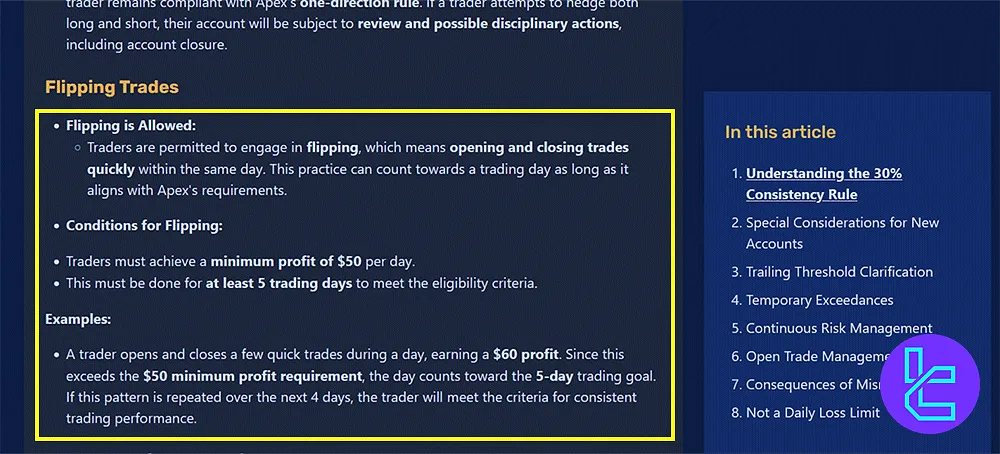

Apex Trader Funding Flipping

Flipping, or rapidly opening and closing trades, is allowed within Apex Trader Funding's framework; ATF Flipping Rules:

- Profit Requirement: Traders must meet the $50 minimum profit for 5 consecutive trading days;

- Rapid Trade Execution: Flipping must still adhere to the overall risk management requirements.

Apex Trader Funding Trading Half Contracts

Traders are initially limited to trading half of the available contracts until the trailing stop threshold is met; ATF Trading Half Contracts:

- Full Contract Trading: Once the trailing stop is achieved, traders can trade the full amount of available contracts.

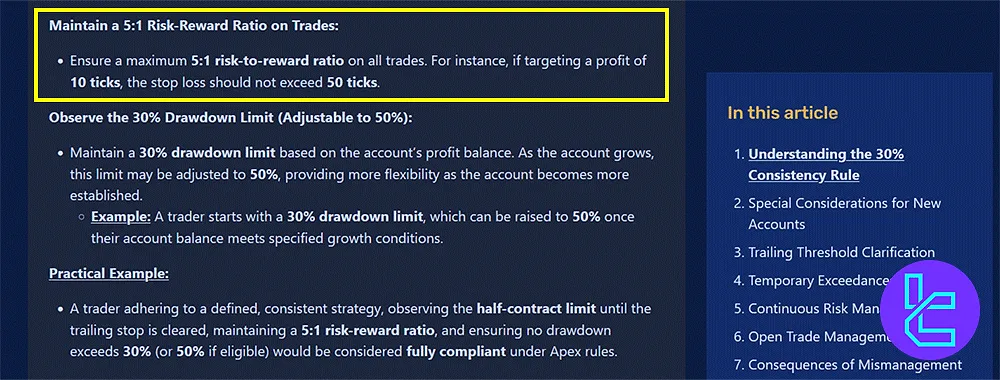

Apex Trader Funding Risk-Reward Ratio

Maintaining a 5:1 risk-to-reward ratio is a core requirement in Apex Trader Funding; Apex Trader Funding RR Rule:

- Risk Management: Traders must ensure that the risk on any trade is not more than 5 times the potential reward;

- Example: For a target profit of 10 ticks, the stop loss must not exceed 50 ticks.

Apex Trader Funding 30% Drawdown

Apex Trader Funding enforces a strict drawdown limit based on the account's profit balance; Apex Trader Funding Drawdown Limit:

- Initial Drawdown Limit: The limit starts at 30% of the account's profit balance;

- Adjustment to 50%: As the account grows, traders may increase their drawdown limit to 50%, depending on the account's performance and growth.

Apex Trader Funding Payout Rules

Apex Trader Funding has updated payout rules, allowing more flexibility in requesting withdrawals; ATF Withdrawal Conditions:

- No Specific Payout Windows: Traders can request payouts at any time once the requirements are met;

- New Requirements: Traders need to complete 8 trading days, with at least 5 days having a $50 profit or more;

- Safety Net Met: The safety net is defined as the drawdown amount plus an additional $100;

- Start Date: Payouts under the new rules start from November 1st.

Payout requests are usually reviewed within 2 business days, and funds are transferred within 3-4 business days for domestic payments and 3-7 business days for international transfers.

Writer’s Opinion and Conclusion

Apex Trader Funding rules require traders to complete 8 days of trading, with at least 5 days achieving a minimum $50 profit per day.

The $100 safety net must be met, and traders can request payouts after 2 business days of approval. To learn more about the platform, check out Apex Trader Funding Tutorials.