BuoyTrade offers funded accounts with an initial balance of $1,000 to $4,000 with no evaluation phases, and profit splits of up to 80%. The prop firm provides access to 60+ instruments with leverage options of up to 1:20.

BuoyTrade (Company Information)

BuoyTrade, founded in 2020, is a proprietary trading firm that provides traders with no-evaluation funded accounts in 11 levels. Based in the bustling financial hub of Singapore, the prop firm has quickly gained traction among traders worldwide. Key features of BuoyTrade:

- Funded accounts ranging from a modest $1,000 to a whopping $1,024,000

- Up to 80% profit split

- No-evaluation funding program

- A partner of the Eightcap broker

- Over 4,000 traders

- 8,000 transactions

BuoyTrade emphasizes corporate transparency and legal credibility. It is officially registered with a globally verifiable Legal Entity Identifier (LEI), allowing traders to validate its status through the Global LEI database, a standard used for confirming the legitimacy of financial firms.

All trader relationships are formalized through a legally binding contract, signed after successfully entering the BuoyTrade program. This agreement outlines the obligations of both parties and confirms BuoyTrade’s role as a compliant and regulated counterparty in the prop trading space.

BuoyTrade Specific Features

The prop firm provides services in 125 countries and works with some of the top liquidity providers around the globe, including JP Morgan, Deutsche Bank, Barclays, and many more. Here are some of the key features you should know about BuoyTrade.

Account currency | USD |

Minimum price | $50 |

Maximum leverage | 1:20 |

Maximum profit split | Up to 80% |

Instruments | Forex, Indices, Commodities |

Assets | 60+ |

Evaluation steps | None |

Withdrawal methods | Wise, PayPal, Bank Wire |

Maximum fund size | $1,024,000 |

First profit target | 5% (no profit split) 10% (profit split) |

Max. daily loss | None |

Challenge time limit | Unlimited |

News trading | Yes |

Maximum total drawdown | 5% |

Trading platforms | MT4, MT5 |

Commission | N/A |

TrustPilot score | 4.1 |

Payout frequency | Bi-Weekly |

Established country | Singapore |

BuoyTrade Pros and Cons

Every trading platform has strengths and weaknesses, and BuoyTrade is no exception. Let's weigh anchor and explore the pros and cons of this prop firm.

Advantages | Disadvantages |

No evaluation phase | Lack of educational resources |

Low entry barrier ($50) | Lack of transparency in regard to fee structure |

Achievable profit target (5%) | Limited leverage options (up to 1:20) |

Strategy freedom | Lower initial profit split (50%) |

Bi-weekly payouts | Relatively new firm (inception in 2020) |

BuoyTrade Funded Accounts and Their Prices

We discuss the pricing in this topic of the BuoyTrade review. The firm offers a unique proprietary trading model that allows traders to access significant capital without risking their own money, without long and time-consuming evaluations.

The program comes in 11 different levels with various initial balances. You can freely choose your starting point from the first three levels: “One Foot In”, Level 1, or Level 2. However, note that the pricing differs based on the level you select.

Funded Account | Price |

One Foot In ($1,000) | $50 |

Level 1 ($2,000) | $98 |

Level 2 ($4,000) | $198 |

BuoyTrade Prop Firm Registration and Verification

Embarking on your journey with BuoyTrade is a straightforward process, but it's important to understand each step. Let's navigate through the registration and verification process in the following sections.

#1 Access the Platform

Go to the official website and click on “Register” to begin.

#2 Select Your Plan

Choose your desired account size and proceed to the registration form.

#3 Complete the Application

Fill in your personal details, including your full name, email address, and phone number.

#4 Make a Payment

Finalize your purchase using PayPal (via credit or debit cards) or Bitcoin.

#5 Verify Your Identity

Submit documents for email, phone, identity (passport or driver's license), and address (utility bill or bank statement) verification.

Once approved, you’ll gain access to your trading dashboard and can begin your evaluation phase.

BuoyTrade Funding Plans (Rules and Conditions)

The firm previously offered two different plans called “Standard” and “Apex”, with various leverage options. However, currently, it only offers the Apex plan with leverage set to 1:20. Here are other rules that we must mention in this BuoyTrade review.

Conditions | One Foot In – Level 9 | Level 10 |

Duration | Unlimited | Unlimited |

Min Active Day (per week) | 1 Day | 1 Day |

Total Drawdown | 5% | 5% |

Profit Target to Scale (no profit split) | 5% | - |

Profit Target to Scale (profit split) | 10% | - |

Profit Split | 50% | Up to 80% |

Account Balance | $1,000 - $512,000 | $1,024,000 |

Promotions and Discount Codes on Buoy Trade

The prop firm offers seasonal discount codes and a comprehensive partnership program with non-withdrawable commissions.

- Coupon Code: At the time of writing this BuoyTrade review, a 5% discount is available through the code “LetMeJoin”

- Affiliate: Refer new clients and receive 5% of the account price in credits

BuoyTrade Rules

This section reviews the trading rules set by the prop firm. Traders must adhere to these guidelines to prevent account closures:

- Hedging: There are no restrictions on the use of hedging strategies by traders;

- Expert Advisors (EA): Expert advisors that perform millisecond scalping are prohibited. These EAs work well in demo accounts but tend to fail in live trading environments;

- Martingale and Arbitrage Strategies: Traders have complete freedom in choosing their trading style. The company does not impose any limits on instruments or trading strategies;

- News Trading: News trading is permitted for traders under Buoy Direct.

VPN Usage

No specific guidelines or restrictions on the use of VPNs were provided by the company's website.

Hedging

The company places no limitations on the use of hedging strategies. Traders are free to employ hedging without any constraints.

Expert Advisors (EA)

The use of Expert Advisors (EAs) that engage in millisecond scalping is strictly prohibited. These types of EAs perform efficiently in demo accounts but fail to adapt to Buoy’s live liquidity environment. Such EAs statistically produce high failure rates on the platform.

The head of the trading desk, Daniel, strongly advises against purchasing tick scalpers from external sites, as they will not work effectively on the platform.

Martingale and Arbitrage Strategies

Buoy does not impose any restrictions on trading strategies. Traders are free to use any approach, including discretionary trading, algorithmic trading, or the use of EAs other than those mentioned above.

As long as the trading is legitimate, adheres to real market conditions, and is replicable on live corporate accounts, no limits are imposed on position sizes or instruments used.

News Trading

News trading is allowed for traders under Buoy Direct. Traders may engage in this strategy without restrictions, provided they are part of the direct trading offering.

BuoyTrade Trading Platforms

The firm offers its trading services through the uTrada platform, a Hong Kong-based brokerage company. The broker provides traders access to the industry-standard MetaTrader 4 and MetaTrader 5.

MetaTrader 4 (MT4)

- Desktop

- MT4 Android

- MT4 iOS

MetaTrader 5 (MT5)

- Desktop

- MT5 Android

- MT5 iOS

TradingFinder has developed a wide range of MT4 and MT5 indicators that are available for unrestricted use.

What Markets Are Available on BuoyTrade Prop Firm?

Buoy Trade provides access to 60+ trading instruments through the global brokerage company “EightCap” with tight spreads from 0.0 pips and execution time of 1ms.

Three asset classes are available, including the Forex market, Commodities, and Indices.

- Forex: 40+ Major, minor, and exotic currency pairs;

- Commodities: Trade precious metals (Gold, Silver, Platinum, and Palladium) and energies (UKOIL, WTI, and Natural Gas);

- Indices: 12 of the most popular global indices, including AUS200, NAS100, US30, and US500.

Buoy Trade Payment and Payout Options

The prop firm offers various funding and withdrawal options to cater to traders of all regions with different needs, including:

- Purchase: PayPal (Credit/Debit Cards) and Crypto (BTC);

- Payout: Bank Wire, PayPal, Wise.

Buoy Trade Trading Fees

Utilizing the ECN, STP, and NDD technologies allows the firm to provide services with low charges. The fee structure mainly consists of spreads and commissions. While the firm offers no specific data about the commissions, we provide a list of average spreads for popular instruments in this BuoyTrade review.

Trading Asset | Avg. Spread (Pips) |

Major currencies | From 0.0 |

AUDCAD | 0.7 |

EURGBP | 0.8 |

USDSGD | 0.8 |

XAGUSD | 1.1 |

XTIUSD | 1.6 |

US500 | 0.4 |

BuoyTrade Educational Resources

While the broker focuses more on providing capital and trading opportunities than extensive educational resources, they do offer an economic calendar.

Their approach is geared towards experienced traders who are ready to trade independently. Thus, they don’t provide any particular Forex education.

Buoy Trade Reviews on Rating Websites

The company’s reputation on rating websites is generally positive. The BuoyTrade Trustpilot profile has a great score of 4.1 out of 5. Users praise several aspects of it, such as fast payouts, a comprehensive scaling plan, and good support.

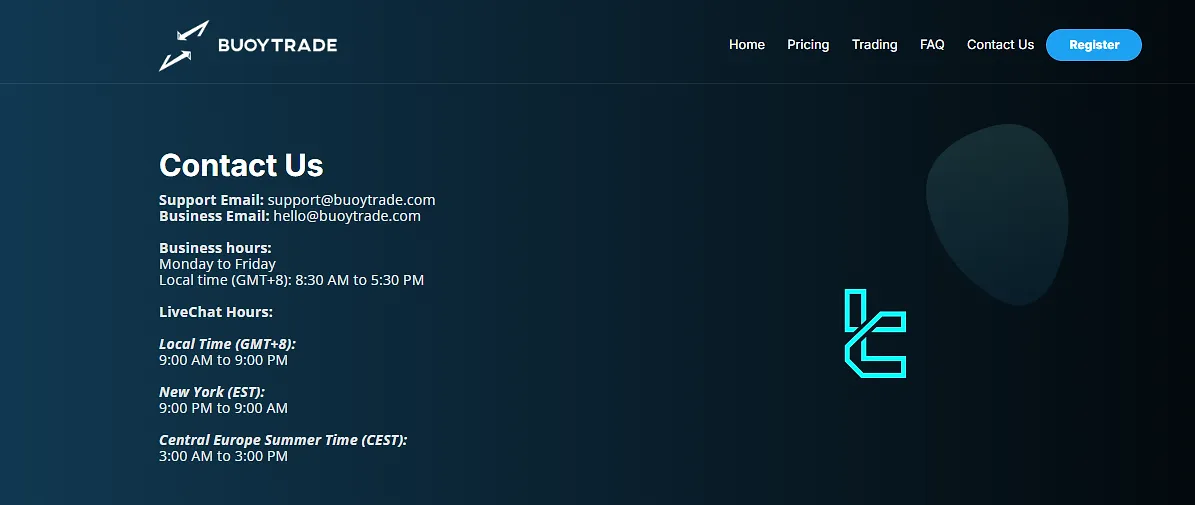

BuoyTrade Customer Support

The prop firm offers 24/5 trading on global markets. However, the support team is accessible 7days a week from 9:00 AM to 9:00 PM (GMT+8) through various channels, including:

support@buoytrade.com | |

Live Chat | Available on the official website |

Ticket | Through the “Contact Us” page |

Buoy Trade’s Social Media Handles

Maintaining an active presence on social media showcases the company’s commitment to its clientele and constant growth. We provide you with a list of the firm’s social media profiles in this BuoyTrade review.

- Telegram

BuoyTrade in Comparison to Its Peers

Here's a table that compares the reviewed prop firm against its major competitors:

Parameters | BuoyTrade Prop Firm | Alpha Capital Group Prop Firm | BrightFunded Prop Firm | For Traders Prop Firm |

Minimum Challenge Price | $50 | $97 | €55 | $49 |

Maximum Fund Size | $1,024,000 | $200,000 | Infinite | $1,500,000 |

Evaluation steps | None | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step |

Profit Share | Up to 80% | 80% | 100% | 90% |

Max Daily Drawdown | None | 5% | 5% | 4% |

Max Drawdown | 5% | 10% | 8% | 8% |

First Profit Target | 5% (no profit split) 10% (profit split) | 5% | 10% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:20 | 1:100 | 1:100 | 1:125 |

Payout Frequency | Bi-Weekly | Bi-weekly | 14 Days | 14 Days |

Number of Trading Assets | 60+ | 40 | 150+ | 130 |

Trading Platforms | MT4, MT5 | MetaTrader 5, cTrader, Dxtrade | cTrader, DXTrade | DXTrade, TradeLocker, cTrader |

Expert suggestions

BuoyTrade has partnered with top-tier liquidity providers (e.g., JP Morgan, and Barclays) and Eightcap broker to provide funded accounts with tight spreads from 0.0 pips on MT4/MT5 platforms. Bi-weekly payouts and a great score of 4.1 on TrustPilot are two of the advantages in this BuoyTrade review.