For Traders rules promote fair evaluations with news trading under a strict 5-minute buffer before and after high-impact events. High-risk behaviors, such as placing 70% of profits in one trade or overexposing by more than a 40% margin, are strictly prohibited.

Traders may hold trades over the weekend without restrictions, enhancing flexibility across sessions.

For Traders Rule Topics

Strict but trader-oriented rules are enforced by the For Traders prop firm to promote fair play and consistency among prop firm traders. For TradersKey Rule Areas:

- Challenge Rules

- News Trading

- Weekend Trade Holding

- Expert Advisors (EAs)

- Prohibited Strategies

- Payouts

- Inactivity

For Traders Challenge Rules

The firm offers structured programs with clearly defined trading thresholds; For Traders Evaluation Conditions:

Account Type | Profit Target | Daily Drawdown | Max Drawdown | Trailing |

One-Step Challenge | 9% | 3% | 6% | Yes |

Two-Step Challenge | Phase 1: 8% Phase 2: 5% | 4% | 8% | No |

Three-Step Challenge | Phase 1: 2% Phase 2: 4% Phase 3: 6% | 3% | 5% | No |

Instant Master | No Profit Target | 3% | 5% | No |

Instant Master Pro | No Profit Target | - | 6% | Yes |

As you can see, the minimum daily loss in the For Trader programs is 3%.

For Traders Allowed Strategies

Based on the following data in this For Traders tutorials, the platform supports disciplined traders using personal techniques, as long as they align with manual trading:

- News Trading

- Weekend Trade Holding

- EAs

Each term comes with certain conditions that we cover in the following lines.

For Traders News Trading

Traders in One-Step, Two-Step, and Instant Master Account evaluations are allowed to trade during news events. However, this does not apply to the Two-Step Challenge PRO Master Account, where restrictions remain:

- Holding positions during news is allowed;

- Opening new trades is not permitted within 5 minutes before and after high-impact news.

For Traders Weekend Trade Holding

For Traders permits weekend holding for all assets. This allows traders to seize market opportunities during closures. It’s especially useful for swing and position traders who prefer to maintain open trades without forced liquidation.

By supporting continuous exposure, the firm gives its users more flexibility to align their strategies with long-term market movements.

For Traders Use of Expert Advisors (EAs)

Expert Advisors can support trading decisions but must not execute trades autonomously. This means:

- Use only EAs that aid manual trading;

- Bots/scripts that open/close positions independently are prohibited.

For Traders Prohibited Strategies

Certain practices are banned at For Traders to maintain fairness and evaluate genuine skill. For Traders prohibited behaviors:

- Hedge Arbitrage: Offset trades to reduce risk are disallowed when misused;

- Reverse Arbitrage: Buying/selling price differences between markets is banned;

- Latency Arbitrage trading: Exploiting delayed feeds for faster execution is forbidden;

- High-Frequency Trading (HFT): Trading under 5-second intervals is not allowed;

- Tick Scalping: Bots exploiting quick ticks are restricted;

- 40% Margin: Overexposing margin on a single instrument or direction is disallowed;

- Grid Trading: Layered orders used to game volatility are not permitted;

- Automated Bots: Fully automatic trading is disqualified;

- Cross-Account Hedging: Hedging between accounts is prohibited;

- Overleveraging: Excessive leverage without planning is classified as gambling;

- One-Sided Betting: Large directional trades breaching margin rules are banned;

- Passing in One Trade: Hitting 70%+ of the target in one trade is disallowed;

- Martingale strategy: Martingale-like risk patterns are not allowed;

- Account Rolling: Resetting challenges with high-risk tactics is banned;

- Copying Trading (External Accounts): Copying external trade sources is forbidden;

- System Exploitation: Trying to bypass systems leads to disqualification;

- Poor Risk Management: Ignoring stop loss and risking too much is restricted;

- Multiple Account Abuse: Creating new accounts to bypass rules is prohibited;

- Impersonation or False Claims: Representing For Traders falsely results in termination.

For Traders Payouts

Your first withdrawal can be requested 14 days after your first trade on the Master Account, provided all requirements are met.

Subsequent withdrawals follow a similar14-day rule; Each withdrawal cycle resets after the first trade of the new period.

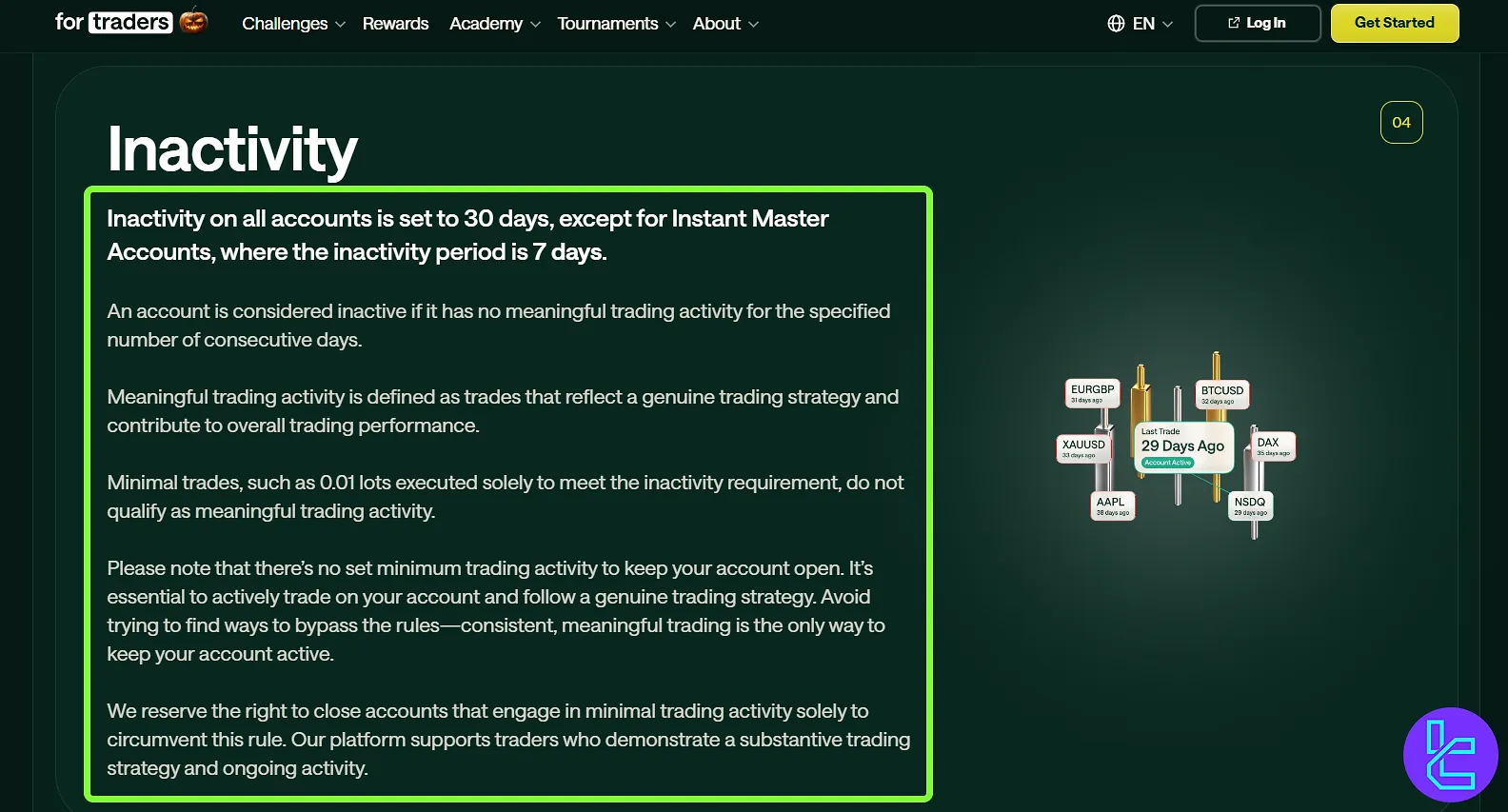

For Traders Inactivity Rule

Accounts on the For Traders platform become inactive after 30 days without meaningful trading activity, while Instant Master Accounts have a shorter 7-day inactivity period.

An account is only considered active when trades reflect a genuine strategy that contributes to overall performance, not when minimal lot sizes are used to maintain status.

Meaningful trading involves consistent participation aligned with real market intent, rather than sporadic or symbolic trades. There is no fixed trade volume required, but traders are expected to follow a legitimate trading approach that supports ongoing account engagement.

For Traders may close accounts showing repeated minimal or artificial activity. This rule is designed to ensure that all participants maintain substantive trading behavior and uphold the integrity of the platform’s trading environment.

For Traders Rules in Comparison to Those of Other Prop Firms

The table below allows you to understand how strict or flexible are the trading policies in For Traders compared to other props.

Prop Firm | For Traders Prop Firm | |||

VPN/VPS Usage | Not Disclosed | Allowed | Allowed | Allowed |

EA Usage | Allowed | Allowed | Prohibited | Allowed |

News Trading | Allowed | Allowed | Allowed | Allowed |

Group Trading | Prohibited | Allowed | Prohibited | Prohibited |

All-or-nothing Trading | Prohibited | Prohibited | Prohibited | Prohibited |

Writer’s Opinion and Conclusion

For Traders rules permit EAs only if they assist manual trading, not replace it through automation. The platform bans HFT under 5 seconds, cross-account hedging, and poor risk management practices.

Withdrawals are allowed every 14 days after a trade cycle begins, provided all conditions are met.