Funding Traders offers funded accounts, ranging from $10,000 to $200,000 with profit split of up to 100% and leverage options of up to 1:100. The cheapest funded account is available for $100 and includes no commissions on challenge phases.

Funding Traders Company Information

Funding Traders is a cutting-edge prop trading firm established in 2023 and led by CEO Stan. The firm’s website is registered in Dubai.

The company offers weekly payouts and up to 100% profit split. Key features of Funding Traders:

- Account sizes ranging from $10,000 to a whopping $200,000

- Structured evaluation framework with 1-step and 2-step challenges

- Up to 100% profit split for successful traders

- Zero commissions on challenge accounts

- Unlimited trading days

- Weekend and overnight holding permitted

The company’s systematic scaling plan allows traders to increase their account size by 25% every three months, provided they maintain profitability. This blend of financial opportunity and trader support makes Funding Traders a compelling choice in the competitive world of prop trading.

Funding Traders Prop Firm Specifications Summary

The prop firm charges no commissions on challenge accounts and takes no percentage of your profits. It only makes money by copying successful traders. Here are the specifics you need to know about Funding Traders.

Account currency | USD |

Minimum price | $39 |

Maximum leverage | Up to 1:100 |

Maximum profit split | Up to 100% |

Instruments | Forex, Indices, Crypto, Metals |

Assets | N/A |

Evaluation steps | 1-Step, 2-Step |

Withdrawal methods | Rise, Coinbase |

Maximum fund size | $200,000 |

First profit target | 10% |

Max. daily loss | 6% |

Challenge time limit | Unlimited |

News trading | Yes |

Maximum total drawdown | 12% |

Trading platforms | DXTrade, Tradelocker, MT5 |

Commission | $3 per lot round-trip on FX and Indices |

TrustPilot score | 4.5 |

Payout frequency | Weekly |

Established country | UAE |

Established year | 2023 |

Advantages & Disadvantages

Like any financial opportunity, trading with Funding Traders comes with its own set of pros and cons.

Pros | Cons |

Generous 100% Profit Split | Relatively New |

Unlimited trading days | Limited Educational Resources |

7-day payouts | Reports of account terminations without clear reasons |

scaling plan up to $2 million | - |

Funding and Pricing in Funding Traders' Prop Firm

The company offers a diverse range of account sizes to suit the needs and experience levels of different traders. Funding Traders' account sizes and their prices:

Challenge Type | Next Gen 1-Step | Next Gen 2-Step | Swing 1-Step | Swing 2-Step | Instant Funded |

$5,000 | $39 | $49 | $59 | ||

$10,000 | $79 | $99 | $89 | ||

$25,000 | $159 | $179 | $189 | ||

$50,000 | $299 | $329 | $289 | ||

$100,000 | $499 | $549 | $589 | ||

$200,000 | $997 | $1,099 | - | ||

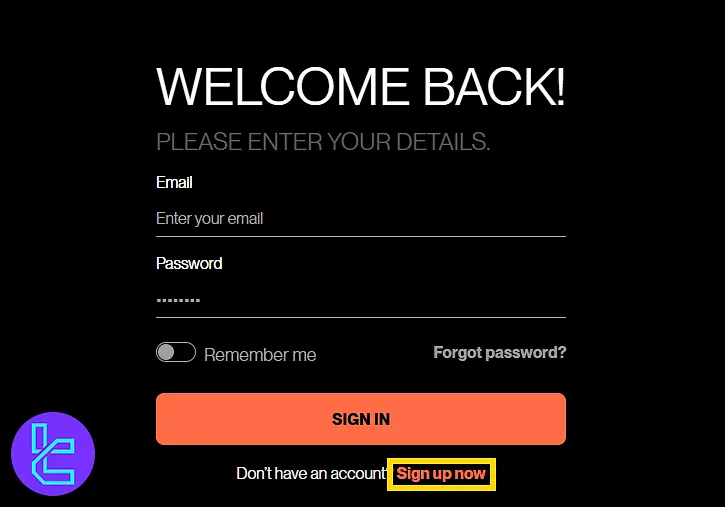

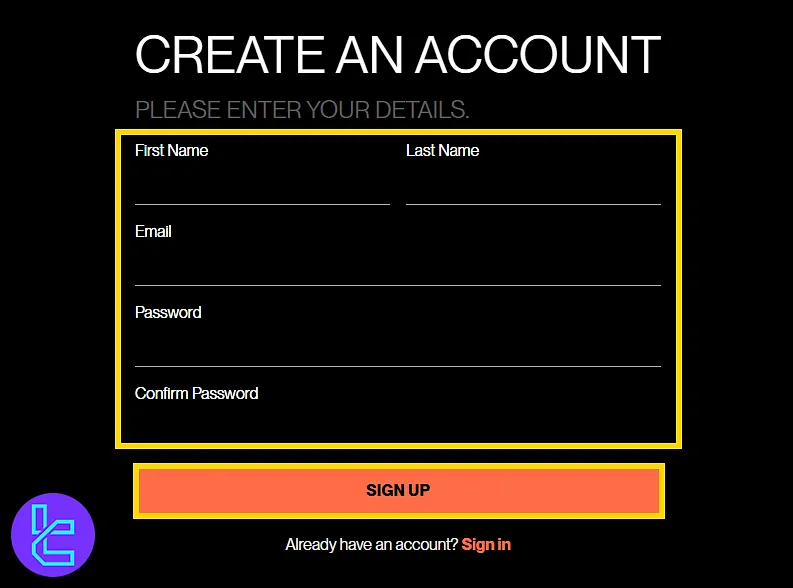

How to Open an Account in Funding Traders

Traders can easily open an account with Funding Traders and purchase one of the available challenges. Funding Traders registration:

#1 Access the Registration Page

Visit the official Funding Traders website and navigate to the "Login" area. From there, click on “Sign Up Now” to begin the registration flow.

#2 Complete Personal Information

Fill out the sign-up form with your first and last name, email address, and a strong password. Once done, hit the “Sign Up” button to proceed.

#3 Access Your Dashboard

Return to the Login section, enter your credentials, and click “Sign In”. You’ll instantly access the dashboard, where you can purchase challenges and explore all available funding tools.

Funding Traders' Prop Firm Evaluation Stages

The prop firm employs a rigorous evaluation process to ensure that funded traders possess the necessary skills and discipline for success in live markets. Key features of Funding Traders' evaluation programs:

Parameters | Next Gen 1-Step | Next Gen 2-Step | Swing 1-Step | Swing 2-Step | Instant Funded |

Minimum Trading Days | 0 | 0 | 0 | 0 | 0 |

Max Daily Drawdown | 4% | 6% | 4% | 5% | 3% |

Max Drawdown | 5% | 12% | 5% | 10% | 6% |

Profit Target Step 1 | 10% | 8% | 10% | 8% | - |

Profit Target Step 2 | - | 5% | - | 5% | - |

Consistency Score | 30% | 30% | 0% | 0% | 15% |

Bonuses and Discounts

Funding Traders understands the importance of providing value to its traders, and they've implemented an attractive bonus and discount structure to sweeten the deal.

- Seasonal Promo Codes: Discounts on challenge accounts;

- Affiliate: A program with a 4-tier structure with commission percentages ranging from 10% to 25%.

Funding Traders Rules

Like any other well-established prop firm, Funding Traders clearly states the rules in the evaluation and funded accounts to help traders avoid account termination. Funding Traders rules:

- VPN and VPS Usage: Allowed, but traders must secure their accounts

- Hedging: Not permitted

- Expert Advisors (EAs) and Bots: Allowed for risk management, restrictions apply

- Restricted Trading Practices: Grid trading, hedge trading, and HFT are prohibited

- News Trading: Swing accounts allowed with specific profit deduction rules

VPN and VPS Usage

Traders are permitted to use VPNs for enhanced privacy and security while trading on the platform. The use of multiple IP addresses is also allowed, although it is important for traders to ensure their accounts remain secure.

It is the responsibility of the traders to keep their login credentials safe and to be vigilant against potential threats that may compromise their account security.

VPN usage is encouraged for those who want to safeguard their connection, but it is crucial to exercise caution and monitor any suspicious activity.

Hedging

Hedge trading is prohibited on the platform to maintain fair trading practices. This restriction ensures that traders cannot engage in strategies that might create an unfair advantage or manipulate market conditions.

The platform aims to promote a trading environment based on responsible and transparent practices, where all traders operate under the same set of rules and conditions.

Expert Advisors (EAs) and Bots

The use of Expert Advisors (EAs) and bots is allowed, provided they are used for risk management purposes only. These tools help promote disciplined and sustainable trading strategies, such as position size calculators or auto-position size execution bots.

However, off-the-shelf EAs or bots that are purchased online are not permitted unless they are explicitly designed to manage risk. Traders who wish to use EAs or bots must consult with the platform to ensure they are compatible and meet the eligibility requirements.

Restricted Trading Practices

Certain high-risk trading strategies are not allowed to ensure the safety and integrity of the trading environment. Specifically, grid trading EAs/bots are prohibited because they have the potential to manipulate the market.

Similarly, hedge trading strategies using EAs/bots are also not allowed. Scaling-in during drawdowns is permitted, but only once per drawdown. High-frequency trading (HFT), including extremely short trades lasting 15 seconds or less, is not allowed due to latency limitations between traders' accounts and the platform’s master account.

These restrictions are in place to maintain a fair and sustainable trading environment for all users.

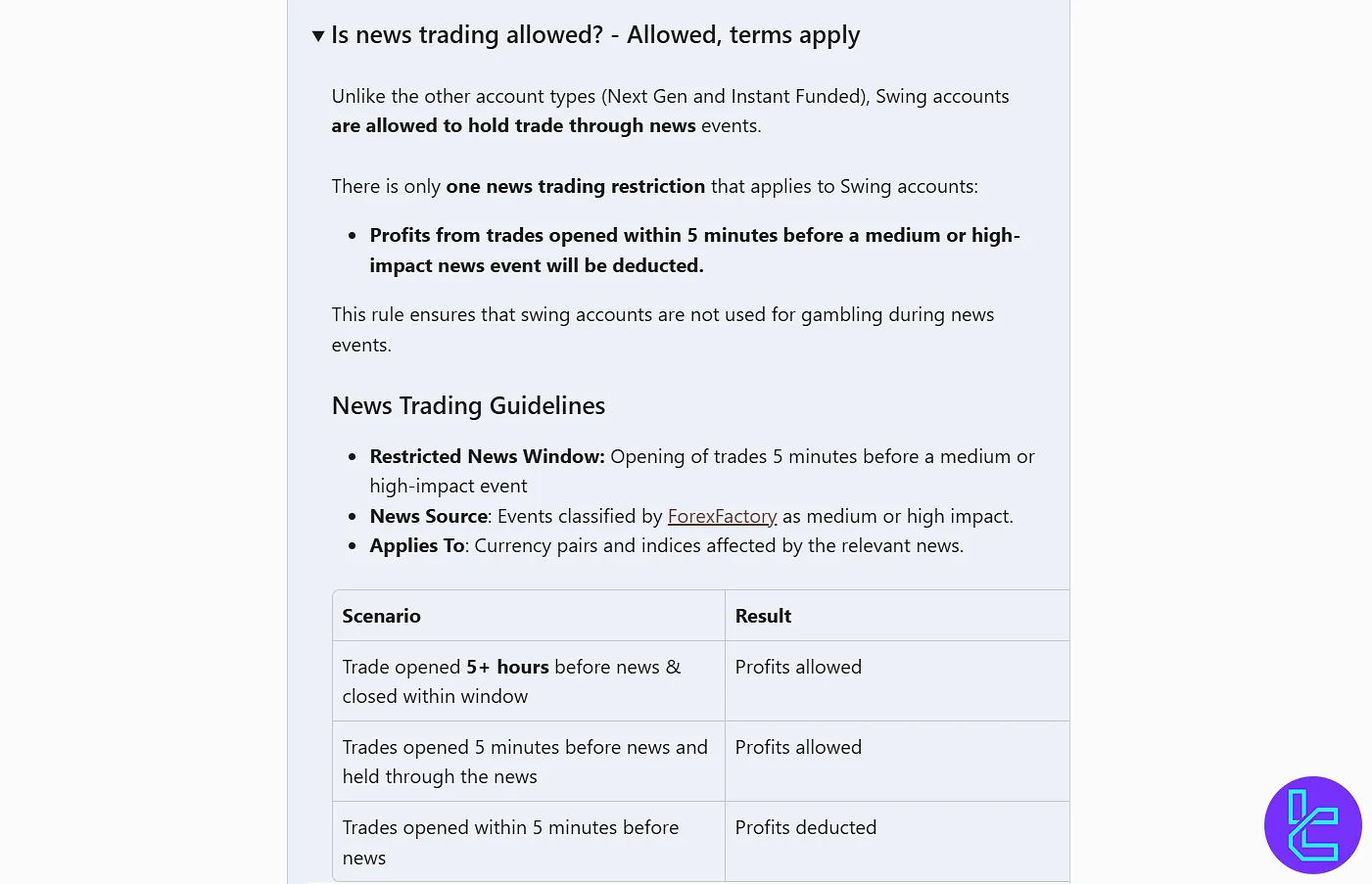

News Trading

Swing account holders are allowed to hold trades through news events, with certain restrictions in place to ensure the strategy isn’t used speculatively. A key restriction is that profits from trades opened within five minutes of a medium or high-impact news event will be deducted.

This rule prevents swing accounts from being used for "news gambling," which could lead to unfair advantages. Traders must adhere to the guidelines of opening trades no less than five minutes before a news event and closing them within the event window.

Additionally, specific rules apply to speech events, where trading is restricted from five minutes before until five minutes after the speech.

Funding Traders Prop Firm Available Platforms

We should discuss available trading platforms in this Funding Traders review. The company recognizes the importance of offering traders robust and flexible trading platforms.

- MetaTrader 5

- TradeLocker

- DXTrade

Tradable Instruments and Symbols

Funding Traders offers a diverse range of tradable instruments, catering to various trading styles and preferences. Here's a breakdown of the available instruments and symbols.

Funding Traders' Payment Methods

Another essential aspect of the Funding Traders review is exploring the supported payment and payout methods. While payments can be made via Credit/Debit Cards and Crypto, withdrawals have a different story. Funding Traders payout methods:

Payout Method | Currency | Processing Time | Min Amount |

Rise | Fiat, Crypto | 2 – 7 business days | $200 |

Coinbase | USDT (ERC20) | 28 – 48 hours | $50 |

Fees & Trading Costs

The company implements a straightforward fee structure. It charges no commissions on challenge phases and a $3 per lot round-trip on FX and Indices. While there is no specific data on spreads, Funding Traders boasts its tight spreads.

Does Funding Traders Prop Firm Offer Educational Resources?

In the competitive world of prop trading, education can be the difference between success and failure. Funding Traders seems to understand this well, offering a robust set of educational resources to its traders through its blog, including:

- Market News

- Step-by-step tutorials

- Technical analysis tutorials and guides

- Prop Trading Introduction

Funding Traders Trust Scores

Trust is paramount in the prop trading industry, and Funding Traders' trust scores provide interesting insights into trader experiences. Users have given the firm an excellent score of 4.5 out of 5 (based on 1,700 reviews) on the Funding Traders TrustPilot page.

Interestingly, Funding Traders doesn’t have any profiles on reputable websites like Reviews.io and Forex Peace Army. Key points of users’ experiences on the firm:

- Positive Feedback: Many traders praise the exceptional customer support, with specific agents like Magnesium, Khalifa, Ced, and Obi-Wan Kenobi receiving accolades

- Areas of Concern: Some negative reviews mention issues with the consistency rule and claim unfair practices

Funding Traders Prop Firm Support (Channels & Opening Hours)

Effective support can make or break a trader's experience with a prop firm. Funding Traders appears to prioritize supporting customers 24/7. However, they don’t offer any phone support which can be a let-down.

help@fundingtraders.com | |

Ticket | “Contact” form |

Online Chat | Available on the website |

Presence on Social Media

In today's digital age, a strong social media presence is crucial for any business, especially in the fast-paced world of trading. Funding Traders maintains an active presence across several social media platforms, including:

- Funding Traders Discord

- Funding Traders Telegram

This multi-platform approach enables Funding Traders to reach a broad audience and maintain ongoing communication with both current and potential traders. The content shared across these platforms often includes:

- Market analysis and trading signals

- Educational resources and webinar announcements

- Company updates and new feature rollouts

- Trader spotlights and success stories

Comparing Funding Traders with Other Prop Firms

By comparing Funding Traders' key features with those of other prop firms, traders will understand the pros and cons of trading with this platform.

Parameters | Funding Traders Prop Firm | |||

Minimum Challenge Price | $39 | $15 | $55 | $32 |

Maximum Fund Size | $200,000 | $100,000 | $200,000 | $4,000,000 |

Evaluation steps | 1-Step, 2-Step, Instant Funding | 1-Step, 2-Step | 1-phase, 2-phase | 1-Step, 2-Step |

Profit Share | Up to 100% | 85% | 80% | 95% |

Max Daily Drawdown | 6% | 4% | 4% | 5% |

Max Drawdown | 12% | 8% | 6% | 10% |

First Profit Target | 10% | 8% | 8% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:75 | 1:100 | 1:100 |

Payout Frequency | Weekly | 10 Days | 2 Times a Month | From 5 Days |

Number of Trading Assets | N/A | 400+ | 200+ | 78 |

Trading Platforms | DXTrade, Tradelocker, MT5 | Match-Trader, cTrader | Metatrader 5, CFT Platform, and Crypto Futures | MT4, MT5, cTrader, MatchTarder |

TradingFinder Expert Suggestions

Funding Traders provides funded accounts with trading capital of up to $2M and a $3 commission on FX and Indices in the profit split phase. The prop firm supports DXTrade, TradeLocker, and MT5 platforms.

Funding Traders’ flexibility through various strategies, such as news trading and holding positions over night and weekends, can be one of the reason for its great score of 4.5 on TrustPilot.