Lark Funding offers access to significant capital (up to $200,000) through 4 evaluation processes and trader-friendly policies. The challenges are available in 1-step, 2-step, 3-step, and Instant Funding evaluations.

Key specifications include 1:30 leverage, maximum profit splits of 90%, and innovative features such as the "Gain Protector", which allows traders to secure payouts even if the daily drawdown limit (5%) is breached.

Company Overview

Lark Funding is a Canada-based proprietary trading firm that has been making waves in the industry since its inception in June 2022. The company has quickly established itself as a forward-thinking player in the prop trading space, offering a range of innovative features suitable for traders of all experience levels. Key aspects of Lark Funding's company profile include:

- Partnership with EightCap: Lark Funding operates in collaboration with EightCap, a reputable broker, providing traders access to MT4 and MT5 platforms;

- Diverse Account Sizes: The firm offers account sizes ranging from $5,000 to an impressive $1 million, accommodating traders with varying capital requirements and risk appetites;

- Tiered Evaluation Process: Lark Funding's evaluation system is structured into 1-step, 2-step, 3-step, and instant funding programs, each with unique profit targets and drawdown limits.

Lark Funding’s specifications summary

Lark Funding stands out among the prop trading firms with its innovative and flexible approach to trader evaluation and funding. Here's a concise summary of the firm's key specifications:

Account currency | USD |

Minimum price | $32 |

maximum leverage | 1:30 |

maximum profit split | 90% |

Instruments | Forex, Crypto, Commodities, Indices |

Assets | N/A |

Evaluation steps | 1-step, 2-step, 3-step, Instant Funding |

Trading platform | DXTrade, cTrader |

Withdrawal methods | Riseworks, Wise |

Maximum fund size | $200K |

First profit target | 8% |

Max. daily loss | 5% |

Challenge time limit | No limits |

News trading | Yes |

Maximum total drawdown | 10% |

Commission per round lot | N/A |

Trust pilot score | 4.3 out of 5 |

Payout frequency | Monthly |

Established Country | Canada |

established year | 2022 |

The firm's "Gain Protector" feature allows traders to receive payouts even if they breach the daily drawdown limit, demonstrating a commitment to trader success.

Lark Funding’s pros & cons

When considering Lark Funding as a potential prop trading partner, it's essential to weigh the advantages and disadvantages. Here's a balanced look at the pros and cons of the firm:

Pros | Cons |

No Time Limits | Limited Track Record |

Flexible Profit Targets | Limited Educational Resources |

High Profit Split | Additional fees for holding positions over weekends |

Gain Protector Feature (Allows payouts even if daily drawdown is breached) | - |

While the firm offers numerous attractive features, potential traders should carefully consider these factors in the context of their trading goals and experience.

Funding & Price Structure on Lark Funding

The firm offers a wide range of funding options to accommodate traders of various experience levels and capital requirements.

Here's a breakdown of their funding structure and associated costs:

Funding Amount | 1-Step | 1-Step Pro | 2-Step | 2-Step Pro | 3-Step | Instant Funding |

$5K | $75 | $35 | $75 | $32 | $60 | $200 |

$10K | $125 | $80 | $125 | $59 | $105 | $400 |

$25K | $225 | $210 | $225 | $139 | $175 | $1125 |

$50K | $325 | $345 | $325 | $229 | $240 | $2250 |

$100K | $525 | $540 | $525 | $399 | $370 | $4500 |

$200K | $1000 | $1080 | $1000 | - | $700 | - |

Lark Funding's pricing and funding structure is designed to provide flexibility and opportunities for traders at different stages of their careers, with a focus on reasonable profit targets and generous performance splits.

Lark Funding’s scaling program allows funded traders to grow their accounts incrementally up to a maximum capital of $2 million. Scaling opportunities are evaluated after every fourth payout cycle, provided the trader has demonstrated consistent profitability and risk adherence. The plan rewards disciplined trading and long-term sustainability rather than short-term gains.

Registration & Verification Process

Registering with Lark Funding prop firm and completing the verification process is straightforward, allowing traders to quickly begin their journey towards funded trading. Lark Funding registration:

#1 Begin on the Lark Funding Website

Search on your prefered brwoser and enter the official website. First, click on the "Dashboard" button and then choose "Create an Account" to access the registration form.

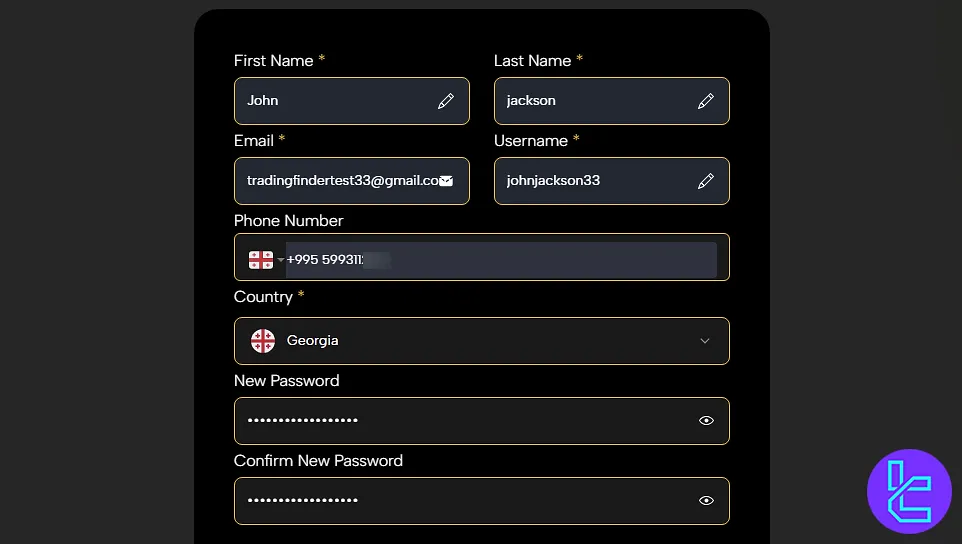

#2 Complete Your Profile

Fill in your:

- Full name (first and last)

- Email address

- Unique username

- Phone number

- Country of residence

- Strong password (use symbols, digits, and varied cases)

Once submitted, you'll gain full access to the Lark Funding dashboard. After passing the challenge, you must verify your Lark Funding account to unlock withdrawals.

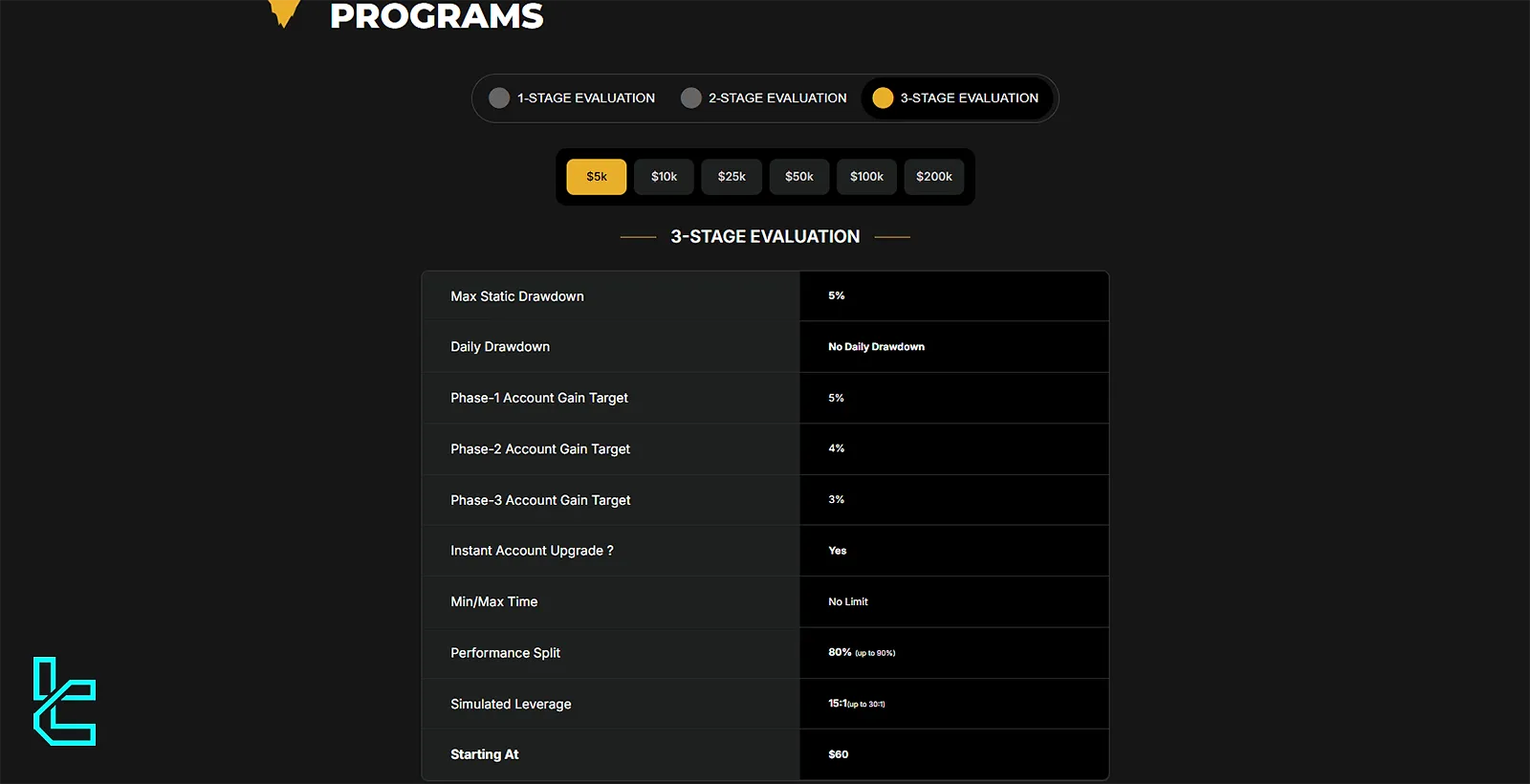

Lark Funding’s Evaluation Steps

Here's a detailed look at each evaluation stage:

Evaluation Type | Profit Target | Maximum Drawdown | Daily Drawdown Limit | Duration | Profit Split |

1-Stage Evaluation | 10% of the account balance | 6% | 5% | No time limit | 80% (upgradeable to 90%) |

2-Stage Evaluation | Phase 1: 8% of account balance | 10% (both phases) | 5% (both phases) | No time limit for each phase | 80% (upgradeable to 90%) |

3-Stage Evaluation | Phase 1: 5% of the account balance | 5% (all phases) | No daily drawdown limit for all phases | Unlimited trading period for all phases | 80% (upgradeable to 90%) |

Instant Funding | - | 8% | 5% | No time limit | 90% |

What sets Lark Funding apart from other firms is a suite of trader-centric benefits:

- 10% Profit Bonus: Traders who pass the challenge receive a 10% bonus on their profit target, offering added motivation and reward;

- Refund Policy: The evaluation fee is fully refunded upon the first successful payout from the funded account.

Bonuses and discount offerings

While Lark Funding doesn't explicitly advertise a comprehensive bonus or discount program, the firm does offer several features that can be considered advantageous for traders:

- Pass-Assist Feature: The automatic recognition of profit targets eliminates the need for manual trade closures, which can be considered a bonus feature for traders;

- Free Withdrawals: The firm doesn't charge fees for withdrawals, which can be seen as a cost-saving benefit for traders;

- Gain Protector: This unique feature allows traders to receive payouts still even if they breach the daily drawdown limit, provided they maintain overall gains;

- Reset Discount: Pay off 75% less than your previous attempt.

While these features aren't traditional "bonuses" or "discounts," they represent the added value that Lark Funding provides to its traders.

Lark Funding Rules

Lark Funding enforces strict trading rules, prohibiting excessive risk strategies, hedging between accounts, and high-frequency trading. However, it allows VPN use with caution and expert advisors under specific conditions. Lark Funding rules:

- VPN and VPS: Using a VPN or VPS is allowed but may raise red flags if suspicious activity is detected;

- Hedging: Hedging is allowed within the same account but prohibited between multiple Evaluation or Simulated Funded Accounts;

- Expert Advisors (EA): EAs are permitted except those used for High-Frequency Trading (HFT) or arbitrage trading.

- Risk Management: Strategies like All-or-Nothing Trading, Martingale, Grid Trading, and High-Frequency Trading are prohibited due to high-risk levels and potential for market manipulation.

- News Trading: While trading during news events is allowed, large position sizes around high-impact news releases can breach risk management policies.

VPN and VPS

VPN Usage: You are allowed to use a VPN or VPS, but be cautious. If suspicious activity is detected, these tools could be seen as a factor in violating the firm's terms. Specifically, using a VPN/VPS during the KYC/AML verification process will result in penalties, including account disqualification or disabling. Important Guidelines:

- Ensure no multiple users are accessing the same account;

- Do not use automated trading systems that might breach terms;

- KYC/AML process: VPN/VPS use is prohibited during this phase.

Hedging

Hedging within the same account is permitted, but hedging between multiple Evaluation or Simulated Funded Accounts is strictly prohibited.

Expert Advisors (EA)

Expert Advisors are allowed, except those designed for High-Frequency Trading (HFT) or arbitrage trading. Any EA used must not manipulate the market or breach risk management principles.

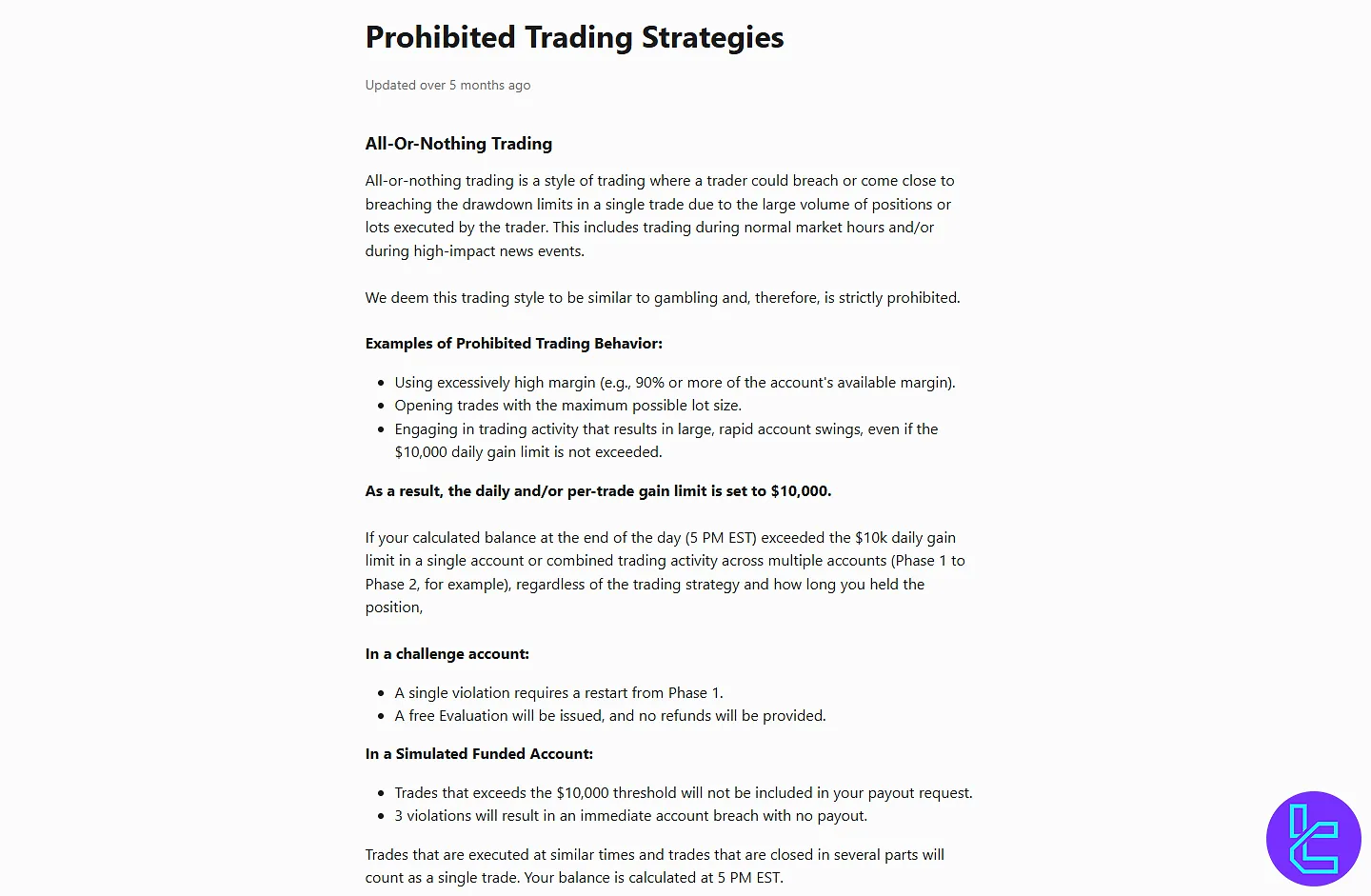

Gambling and Risk Strategies

Lark Funding has prohibited high-risk strategies to create a safe trading environment. These strategies include:

- All-Or-Nothing Trading: This is a high-risk style of trading where traders place large-volume trades that risk breaching drawdown limits, especially during high-impact news events. It’s prohibited as it doesn’t follow proper risk management;

- Martingale Trading: This strategy involves increasing position size after a loss, with the hope of recouping all losses when a win occurs. It’s considered gambling and is not allowed due to the significant risk of account wipe-out. Violating this rule will result in disqualification from the funded account;

- Grid Trading: This strategy involves placing opposite buy and sell orders at the same or similar risk levels. It’s banned because it can lead to market manipulation, excessive leverage, and market instability;

- High-Frequency Trading (HFT): The use of computer algorithms to execute numerous trades in a fraction of a second is not allowed, as it can manipulate markets and create unfair advantages. Any trader engaging in HFT will be disqualified.

- Hedging Between Accounts: Hedging between two or more Lark Funding Evaluation accounts is strictly prohibited. If found, accounts will be breached, and the trader will be permanently banned from the platform.

News Trading

While trading during news events is allowed, large positions before or during high-impact news releases can be considered a violation of risk management principles. This may lead to breaching the All-or-Nothing strategy and violate the firm’s terms and conditions.

Available Trading Platforms

Lark Funding has recently undergone significant changes in its platform offerings, moving away from the traditional MetaTrader platforms to the following:

- DXTrade

- cTrader

This shift in trading platforms reflects broader changes in the prop trading industry, with many firms moving away from MetaTrader due to various restrictions.

What instruments & symbols can I trade on Lark Funding?

Lark Funding prop firm offers a diverse range of tradable instruments, including the Forex market, catering to various trading preferences and strategies. Here's a comprehensive list of the instruments and symbols available:

- Forex (FX) Currencies

- Cryptocurrencies

- Commodities

Lark Funding’s Payment Methods

When it comes to getting paid for your trading success, Lark Funding offers two primary payment methods:

- Wise (formerly TransferWise): A popular online money transfer service known for its competitive exchange rates and low fees;

- Riseworks: A payment platform that specializes in global payouts for businesses.

Funded traders at Lark Funding are eligible to request their first payout 14 days after initiating trading activity. Subsequent payouts can be claimed on a biweekly (14-day) cycle. The standard profit split is 80% in favor of the trader and 20% to the firm. However, traders demonstrating strong consistency and risk management may become eligible for a performance-based upgrade to a 90/10 split.

Commission & Cost Structure

Understanding the fee structure is crucial when choosing a prop firm. Lark Funding's commission and cost structure includes:

- Challenge fees: Vary based on account size and evaluation type;

- Extra charge: An additional 10% of the challenge fee for holding trades over the weekends.

It's important to note that while the extra 10% charge might seem steep, it's offset by the potential for higher profit splits.

Does Lark Funding Offer Vast Educational Resources?

In comparison to some of its rivals, Lark Funding prop firm's educational offerings are relatively limited. The platform primarily provides:

- FAQ section: Covers basic questions about the platform and trading conditions;

- Articles: Offers some insights into trading strategies and market analysis.

However, Lark Funding falls short of providing:

- Comprehensive video tutorials;

- Webinars or live trading sessions;

- In-depth trading courses.

You can use TradingFinder's Forex education section to access additional resources.

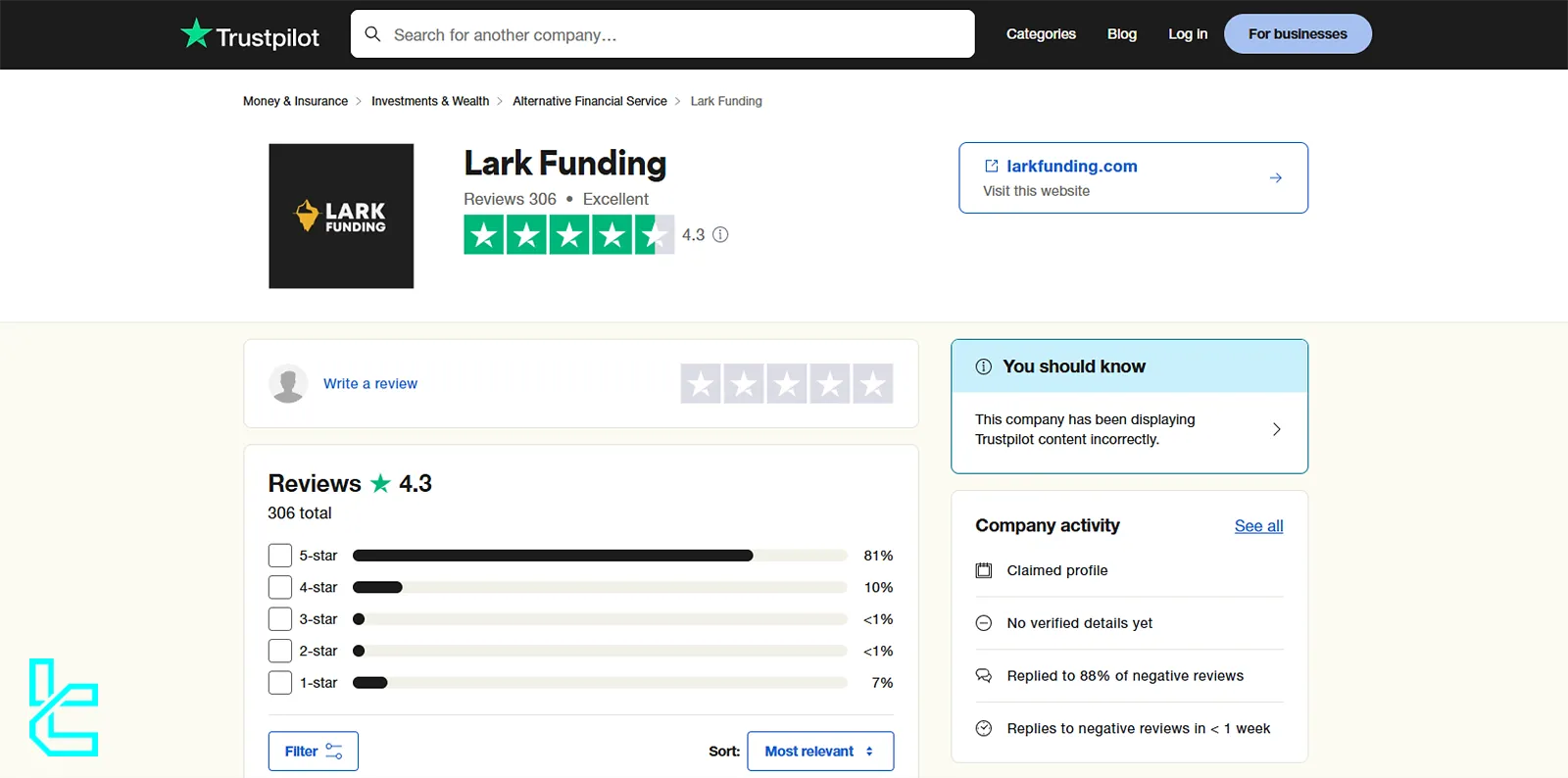

Lark Funding’s Trust Scores on Trustpilot

Trust is paramount in the prop trading industry, and Lark Funding's Trustpilot score provides valuable insights into trader satisfaction. With a score of 4.3 out of 5 (November 2024), Lark Funding demonstrates a strong positive reputation among its users.

Key points from the reviews include:

Positives | Negatives |

Excellent customer service | Some reports on the support team response delay |

Well-structured challenges | Some complaints about strict rules |

Fast payout | - |

The Trustpilot score and the overall positive reviews suggest that Lark Funding is a reputable firm with a strong focus on customer satisfaction. However, as with any financial service, it's essential to approach with due diligence and carefully review the terms and conditions.

Lark Funding Prop Firm Customer Support

Effective customer support is crucial for any prop firm, and Lark Funding offers multiple channels for traders to seek assistance:

- Email support: support@larkfunding.com

- Live chat

- Contact form

Lark Funding's customer support team aims to respond to all queries within 24 hours, ensuring prompt assistance for traders.

Social Media Channels

In today's digital age, social media presence is crucial for brand visibility and customer engagement. Lark Funding maintains active profiles on several platforms:

- YouTube

- X (formerly Twitter)

While Lark Funding's social media presence is growing, it may not be as extensive as some larger, more established prop firms. However, the content provided is generally informative and relevant to their trader community.

Lark Funding Table of Comparison

The table below compares the most important aspects of trading with Lark Funding prop firm (profit target, minimum challenge price, maximum drawdown) with those of other prop firms.

Parameters | Lark Funding Prop Firm | |||

Minimum Challenge Price | $32 | $32 | $49 | 55 EUR |

Maximum Fund Size | $200,000 | $200,000 | $100,000 | $200,000 |

Evaluation steps | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step |

Profit Share | 90% | 95% | 90% | 100% |

Max Daily Drawdown | 5% | 5% | 3% | 5% |

Max Drawdown | 10% | 10% | 6% | 10% |

First Profit Target | 8% | 8% | 9% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:100 | 1:125 | 1:100 |

Payout Frequency | Monthly | 5 Days | Bi-weekly | Bi-weekly |

Number of Trading Assets | Not Specified | 78 | Not Specified | 150+ |

Trading Platforms | DXTrade, cTrader | MetaTrader 4, MetaTrader 5, cTrader | DXTrade, TradeLocker, cTrader | Proprietary |

Expert Suggestions

In conclusion, Lark Funding (founded in 2022) presents itself as a competitive option in the prop trading space, offering attractive profit splits of up to 90%.

Lark Funding prop firm’s no-challenge time limits and a Pass-Assist feature enhance its trader-friendly approach, while monthly payouts and tools for copy trading further bolster its appeal.

Also, generous offerings like a 75% reset discount make it a worthy consideration for new and experienced traders.