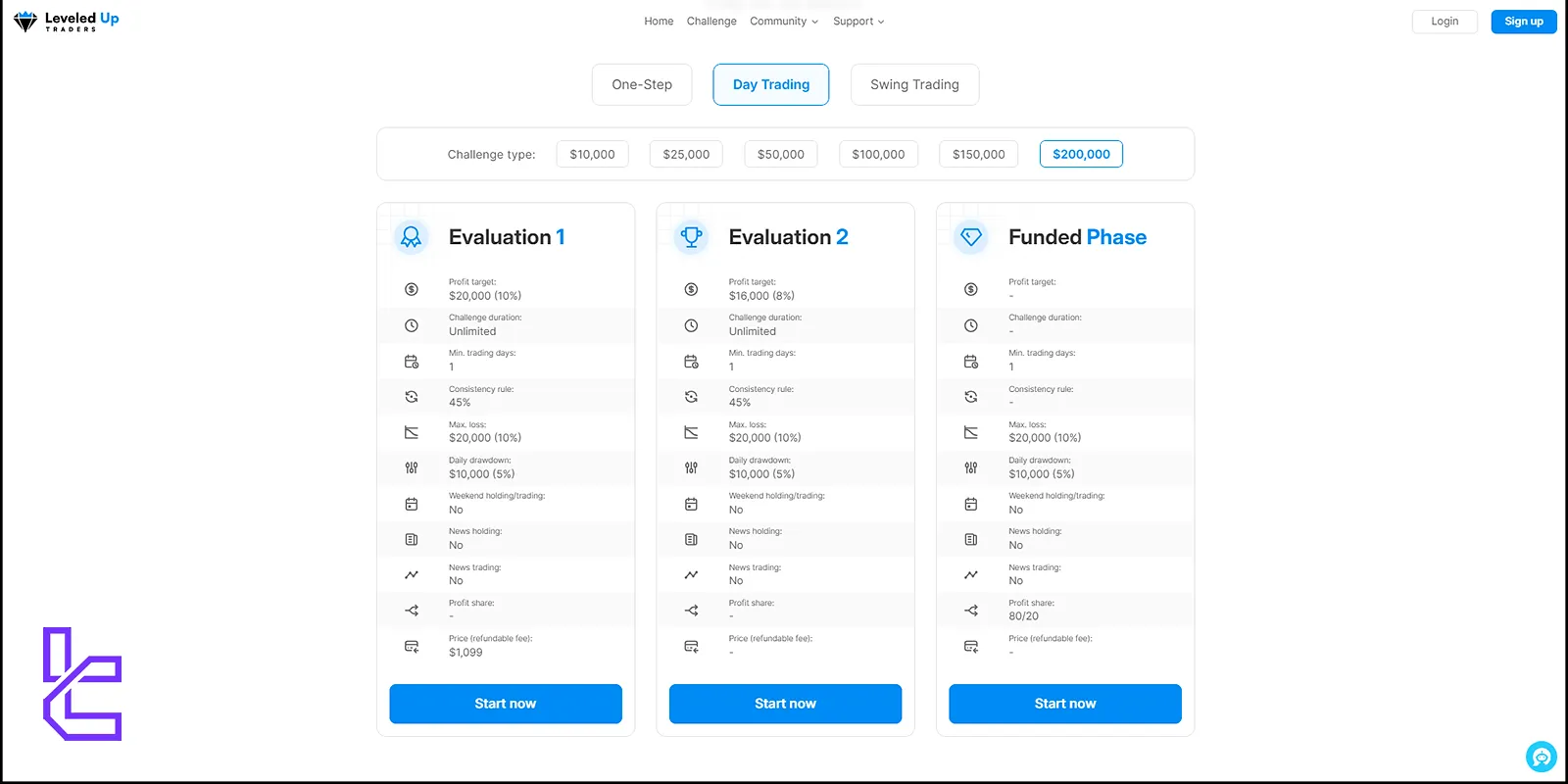

Leveled Up Traders offers accounts denominated in USD, starting at $5,000 and scaling up to $200,000, with evaluation options like one-step (14% profit target) or two-step (10% and 8% targets) processes.

The maximum leverage is 1:50, and traders benefit from the ability to hold trades over weekends (via swing trading challenges) or engage in news trading (as an add-on).

Leveled Up Traders Company Overview

Leveled Up Society is a relatively new player in the prop trading firm arena, incorporated in June 2022. Despite its youth, the firm has quickly gained attention for its competitive offerings and trader-friendly policies.

Leveled Up Traders aims to foster trader success through a comprehensive evaluation process and ongoing support. Their focus on simplicity, flexibility, and competitive terms has attracted a growing community of traders worldwide.

Leveled Up Traders Specifications Summary

Here is what you can find about the prop firm at a glance. Leveled Up Society details:

Account currency | USD |

Minimum price | $79 |

maximum leverage | 1:50 |

maximum profit split | 90% |

Instruments | Currency pairs, Cryptocurrencies, Energies, Indices, Commodities, Metals |

Assets | BTCUSD, ETHUSD, ADAUSD, Oil, Natural Gas, NAS100, SPX500, UK100, XAUUSD, XAGUSD |

evaluation steps | 1-step, 2-step |

Trading platform | TradeLocker |

Withdrawal methods | Crypto |

maximum fund size | $200,000 |

first profit target | 8% |

Max. daily loss | 5% |

Challenge time limit | No limits |

news trading | Yes (Add-on) |

Maximum total drawdown | 10% |

commission per round lot | N/A |

trust pilot score | 3.3 |

payout frequency | Daily |

established country | USA |

established year | 2022 |

Leveled Up Traders Pros & Cons

Leveled Up Traders presents a range of advantages that can enhance the trading experience for participants. However, there are also certain drawbacks that potential users should consider before engaging with the platform:

Pros | Cons |

High-profit split (up to 90%) | less established track record |

Flexible trading conditions | Limited educational resources |

No minimum trading days | Relatively strict profit and loss targets |

Ability to hold trades over weekends (swing trading challenges) | Higher commissions compared to some competitors |

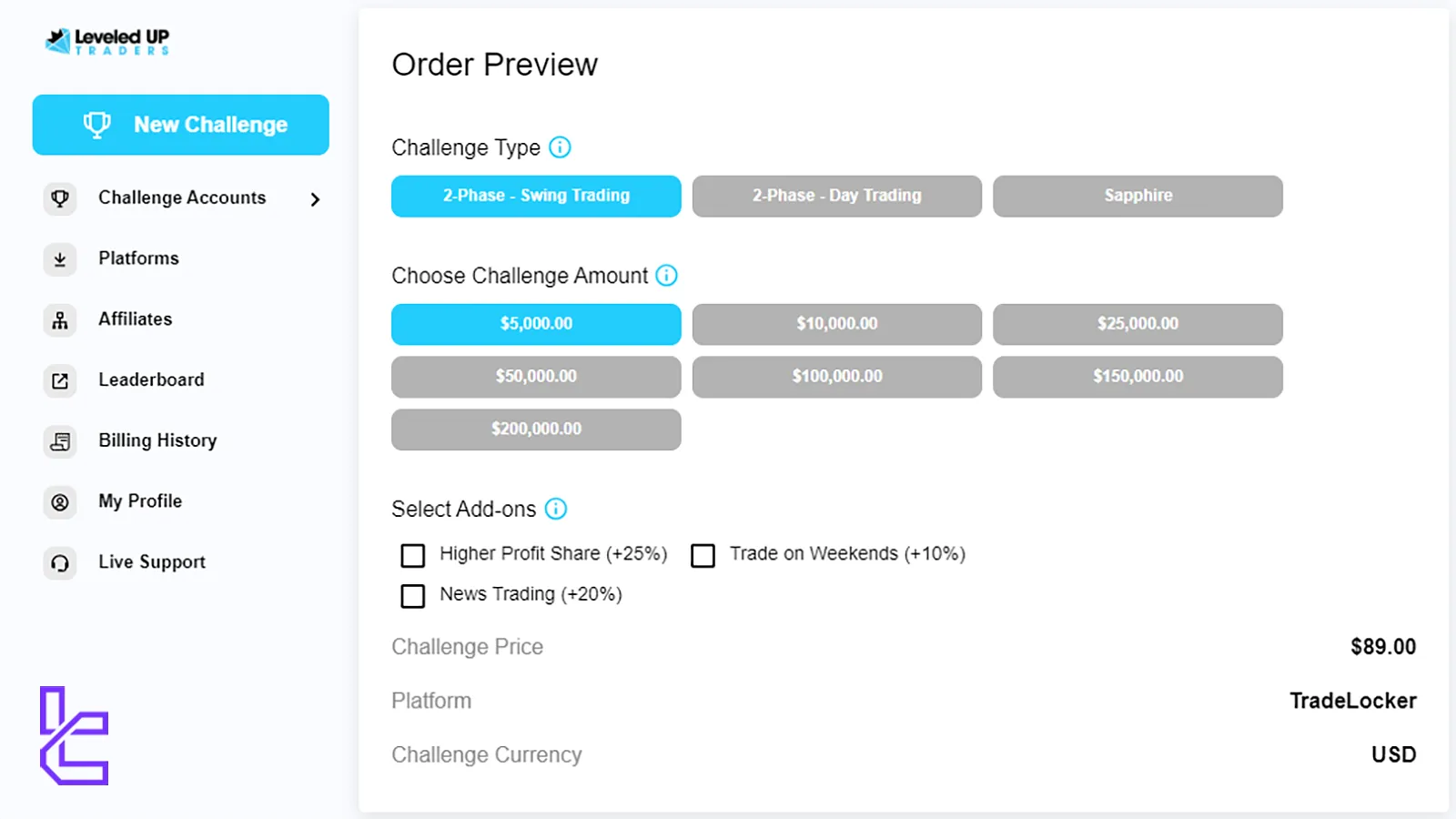

Leveled Up Society Funding & Price

Like the other Prop Firms, Leveled Up Traders offers a range of funding options to suit different trader needs and experience levels. Here's a breakdown of their offerings:

Account Size | Challenge Fee |

$5,000 | $79 ($89 for Swing) |

$10,000 | $139 ($149 for Swing) |

$25,000 | $249 ($269 for Swing) |

$50,000 | $349 ($379 for Swing) |

$100,000 | $549 ($599 for Swing) |

$150,000 | $819 ($899 for Swing) |

$200,000 | $1099 ($1199 for Swing) |

Swing trading challenges incur slightly higher fees across all tiers (e.g., $149 for $10K, $1,199 for $200K), reflecting their extended trade-holding privileges.

All accounts come with scaling potential, allowing consistently profitable traders to grow their capital over time. Notably, the firm does not offer a free trial or evaluation reset, which may be a drawback for budget-conscious participants.

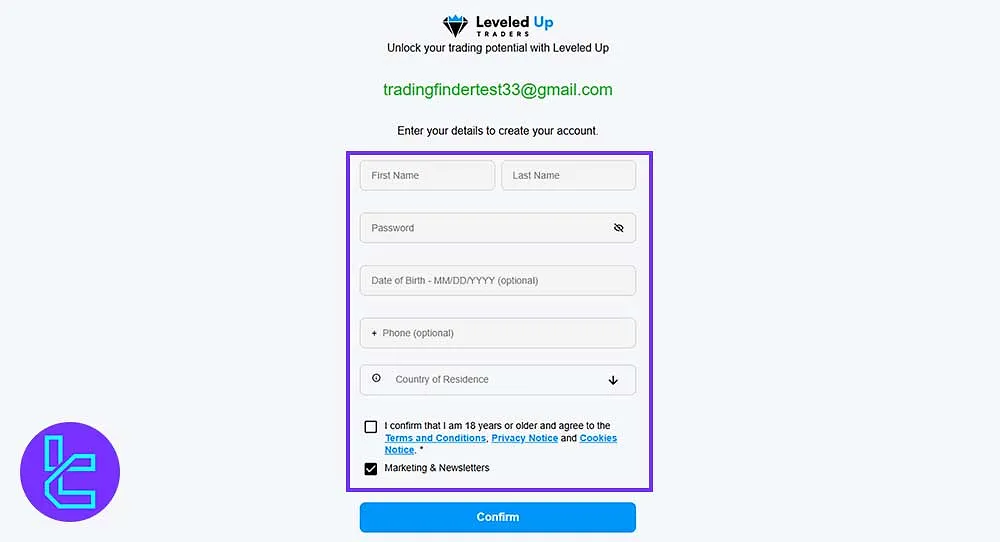

Registration & Verification Process

Creating a new trading account with Leveled Up Traders is straightforward and can be completed in just a couple of minutes. Leveled Up Traders registration:

#1 Visit the Signup Page

Navigate to the Leveled Up Society homepage and click "Sign Up" or scroll down to Open an Account to access the registration form.

#2 Enter Email Address

Provide a valid email address, then click Sign Up to proceed. Ensure accuracy, as it will be used for verification.

#3 Email Verification

Click Send Email to receive the confirmation link. Open the email and select Complete Registration to unlock the full signup form.

#4 Finalize the Form

Input your first and last name, password, and country of residence. Optionally add your birthdate and mobile number, agree to the terms, and click Confirm to complete your registration.

#5 Verify Your Account

After opening your account with Leveled Up Traders, the platform will ask you to verify your identity before allowing you to cash out your profits. The required documents include a passport, ID card, or driver's license.

Leveled Up Society’s Evaluation Steps

Leveled Up Society employs a two-step evaluation process to assess trader readiness:

Challenge | Profit Target | Maximum Daily Loss | Maximum Total Loss |

One-Step | 14% | 5% | 10% |

Day Trading (two-step) | 10%, 8% | 5% | 10% |

Swing Trading (two-step) | 10%, 8% | 5% | 10% |

After completing both phases, traders are awarded a funded account with no profit target.

Leveled Up Society Bonuses and Discounts

Leveled Up Traders doesn't provide typical bonuses or discounts. However, users have the option to apply coupon codes when paying for a challenge. To use a coupon code, follow these steps:

- Sign in to the funded account challenge dashboard;

- Click the "New Challenge" button;

- Enter the coupon code in the designated field (Coupon Code).

Although these offers may vary over time, Leveled Up Society remains committed to providing valuable opportunities for its users.

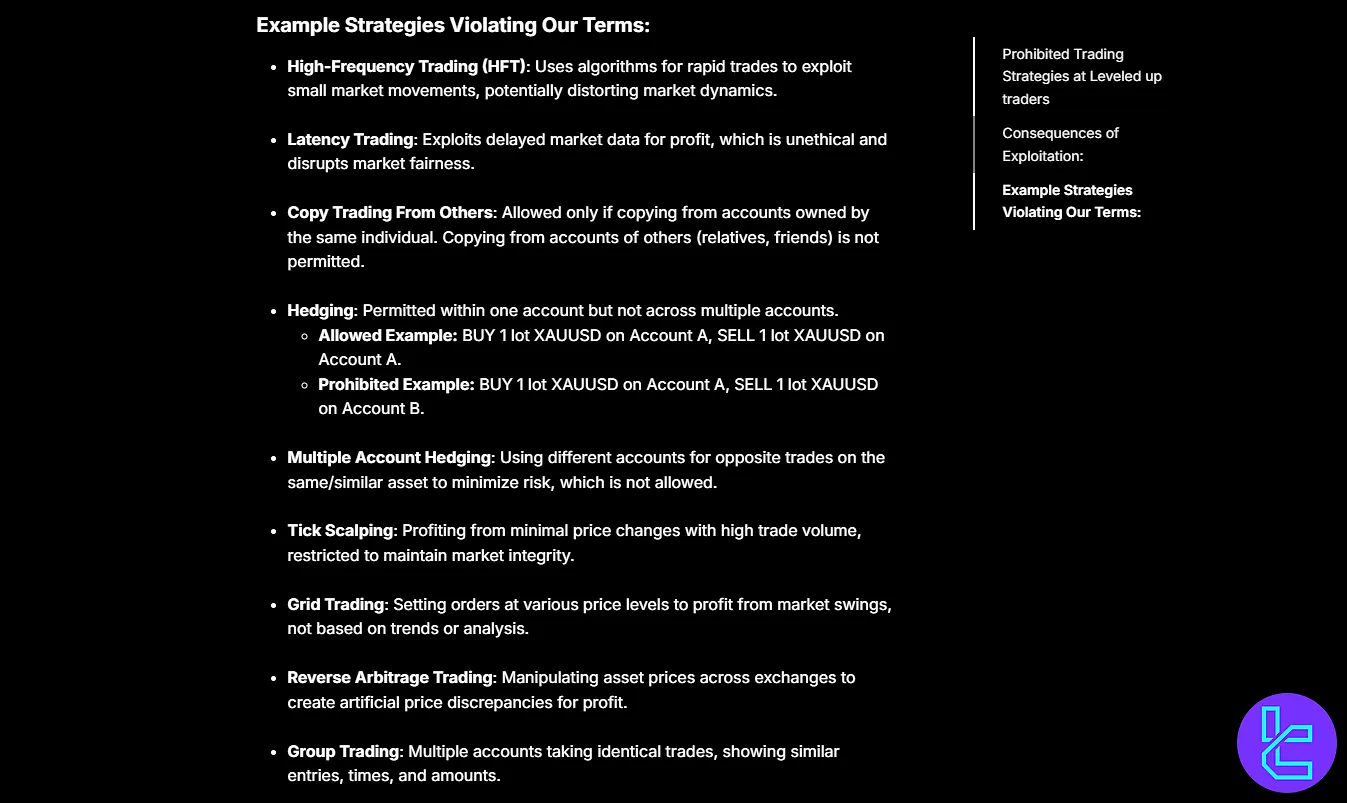

Leveled Up Traders Rules

Traders must familiarize themselves with the trading conditions and policies in the Leveled Up Society prop firm to avoid account termination. Leveled Up Traders rules:

- VPN and VPS Usage: VPN and VPS are allowed but discouraged, and using them with suspicious activity could lead to violations of our terms

- Hedging: Hedging is allowed within one account, but using multiple accounts for hedging across platforms is strictly prohibited

- Expert Advisors (EA): EAs, automated systems, and algorithmic trading are prohibited to ensure skill development, market fairness, and proper risk management

- Gambling and Risk Strategies: High-frequency trading, latency trading, copy trading from others, and multiple account hedging are prohibited and lead to account termination

- News Trading: News trading is allowed only with the News Trading Addon, and trading within 5 minutes of high-impact news events without it results in account breach

VPN and VPS Usage

At Leveled Up Traders, the use of VPNs and VPS for trading accounts is allowed but strongly discouraged. To comply with Terms and Conditions, ensure that no multiple users are trading on your account, and avoid using any type of Expert Advisors (EAs) or automated trading systems (for non-Royal accounts).

If suspicious activity is detected, Leveled Up Traders will consider the use of a VPN or VPS as a key factor in identifying potential violations of the terms. For security and data protection, we require that the Know Your Customer (KYC) and Anti-Money Laundering (AML) verification be completed without the use of a VPN or VPS.

Any use of these tools during the verification process may prevent your account from being funded or lead to the disabling of an already funded account. The prop firm urges all traders to adhere to this guideline to ensure a smooth account verification process.

Hedging

Hedging is permitted within the same account to mitigate risk by holding opposite positions. However, using multiple accounts for hedging across different platforms is strictly prohibited. If your trading behavior suggests attempts to hedge across accounts or bypass daily loss limits, it may be flagged and lead to account termination.

Expert Advisors (EA)

Leveled Up Traders promotes a fair trading environment where skill development and discipline are prioritized. As such, the use of Expert Advisors (EAs), automated trading systems, or any form of algorithmic trading is not allowed.

These tools detract from a trader’s ability to learn, make informed decisions, and manage risk responsibly. Violating this rule can lead to account termination.

Gambling and Risk Strategies

This prop firm prohibit several high-risk trading strategies, including:

- High-Frequency Trading (HFT): Using algorithms to exploit small price movements.

- Latency Trading: Taking advantage of delayed market data for profit.

- Copy Trading: Only allowed if copying from accounts under the same ownership.

- Multiple Account Hedging: Using different accounts for opposite trades.

- Scalping and Arbitrage: Profiting from small price differences or market inefficiencies.

Violating these rules will result in account termination.

News Trading

Traders who opt for the News Trading Addon are allowed to trade any economic data without restrictions. For accounts without this addon, trading is prohibited within 5 minutes before or after medium to high-impact economic news releases.

Examples of such events include FOMC meetings, NFP releases, and interest rate decisions. Breaching this rule will result in the forfeiture of profits from the violating trades and the account being marked as in breach.

Trading Platforms

Leveled Up Traders supports one of the most practical trading platforms in the forex and CFD markets called TradeLocker (built on TradingView). The platform offers:

- Advanced charting capabilities

- Extensive technical analysis tools

- Mobile trading apps for on-the-go access

The platform is especially beginner-friendly, though more advanced traders may find the lack of MetaTrader 4 and MetaTrader 5 support a limitation, particularly for algorithmic strategies using EAs.

What Instruments & Symbols Can I Trade on Leveled Up Traders?

LeveledUpSociety offers a diverse range of trading instruments across various markets, from Forex to crypto, catering to various trader preferences and strategies:

- Currency pairs: Major, minor, and exotic forex pairs

- Cryptocurrencies: BTCUSD, ETHUSD, ADAUSD, etc.

- Energies: Oil, Natural Gas

- Indices: NAS100, SPX500, UK100, etc.

- Metals: XAUUSD (Gold), XAGUSD (Silver), etc.

This selection enables traders to diversify their strategies across various asset classes, potentially reducing risk and enhancing profit opportunities.

Deposit and Withdrawal Methods

LeveledUpSociety strives to accommodate various payment preferences, offering multiple options for challenge fee deposits:

- Bank cards: Visa, Mastercard, and other major credit/debit cards

- Crypto wallets: Bitcoin, Tether, and other cryptocurrency payments

To make withdrawals, traders use their crypto wallets.

Commission & Costs on Leveled Up Traders

Understanding the cost structure is crucial for any trader considering a prop firm. Leveled Up Society's fee structure includes:

Fees/Conditions | Details |

Challenge Fees | $79 to $799, depending on account size |

Trading Commissions | N/A |

Spreads | Variable, determined by market conditions |

Investigating these costs is important when developing your trading strategy and calculating potential profits.

Does Leveled Up Traders Offer Vast Educational Resources?

While LeveledUpSociety focuses primarily on providing trading opportunities, its educational offerings are limited compared to some competitors. The firm provides:

- A help center with articles covering basic concepts and platform usage;

- Regular updates and insights through their Discord community;

- Blog posts (articles about trading concepts and tips).

Traders looking for extensive educational resources may need to supplement Leveled Up Trader's offerings with external learning materials.

You can check TradingFinder's Forex education section to access free learning materials.

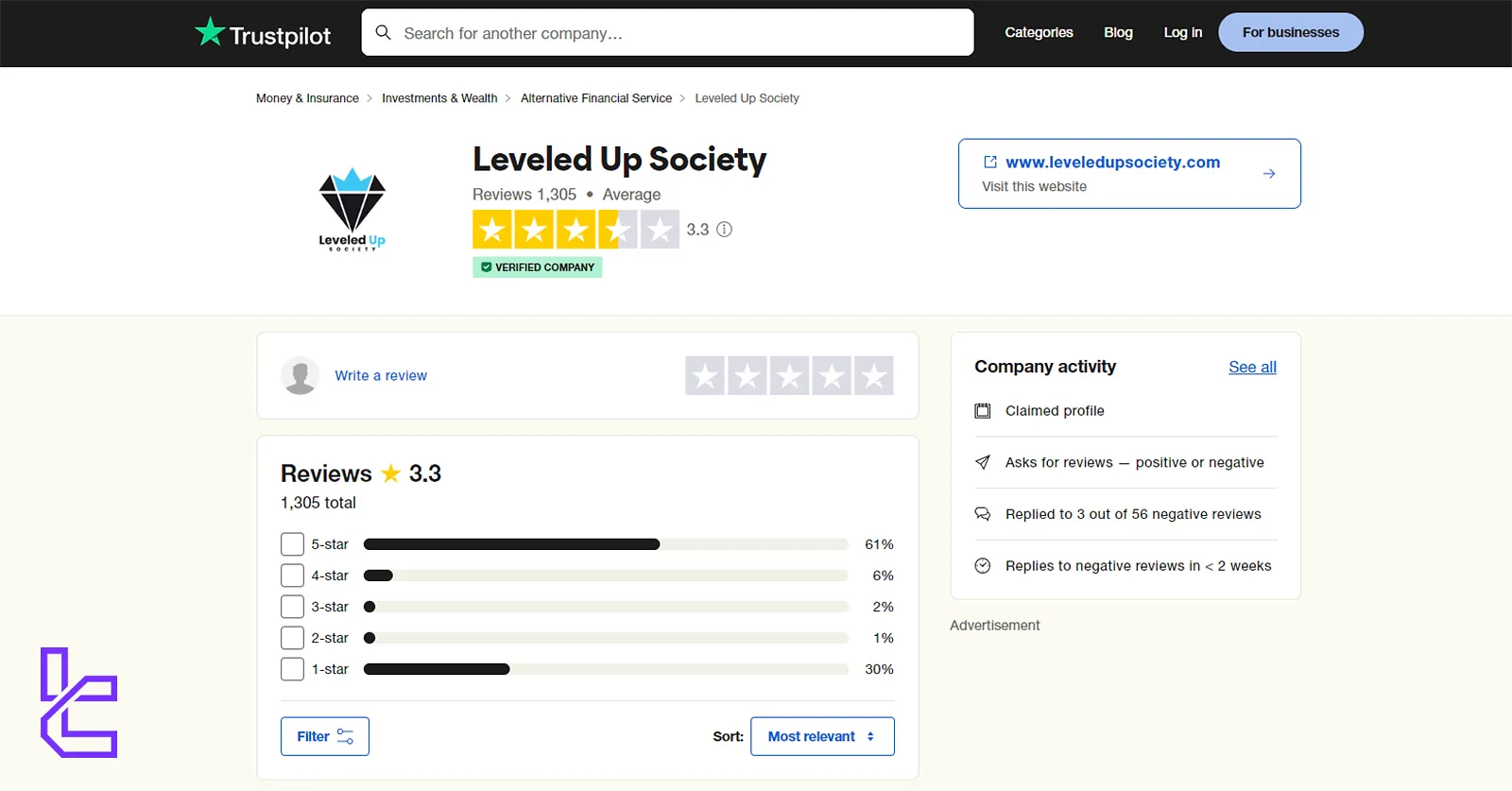

Leveled Up Society Trust Scores on Trustpilot

The Leveled Up Society Trustpilot profile features mixed reviews with a current score of 3.3 out of 5 based on customer feedback. Critical points from reviews include:

- Positive experiences with customer support and challenge structure

- Concerns about payout processes and account terminations

- Mixed feedback on the firm's responsiveness to issues

It's important to note that as a relatively new firm, the number of reviews is limited, and scores may only partially reflect the overall trader experience.

Leveled Up Traders Customer Support Team

LeveledUpSociety offers multiple channels for customer support:

- Email: support@leveleduptraders.com

- Live chat: Available during business hours for quick resolutions

- Help Center: A self-service resource for common questions

- Discord community: Peer support and company updates

Response times and support quality can vary, with some traders reporting positive experiences and others noting room for improvement.

Leveled Up Traders Social Media Channels

LeveledUpSociety maintains an active presence on several social media platforms:

- Discord

- YouTube

- Twitter (X)

Following these channels can provide valuable insights and keep traders informed about the latest developments at Leveled Up Traders.

Complete Comparison of Leveled Up Traders and Other Prop Firms

Let's compare the most important aspects of trading with Leveled Up Traders in comparison with other prop firms.

Parameters | Leveled Up Traders Prop Firm | |||

Minimum Challenge Price | $79 | $50 | $100 | $67 |

Maximum Fund Size | $200,000 | $2,000,000 | $2,000,000 | $2,000,000 |

Evaluation steps | 1-step, 2-step | 1-Step, 2-Step | 1-Step, 2-Step | 1-phase, 2-phase, 3-phase |

Profit Share | 90% | 90% | 100% | Up to 90% |

Max Daily Drawdown | 5% | 4% | 5% | 4% |

Max Drawdown | 10% | 6% | 10% | 10% |

First Profit Target | 8% | 5% | 10% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:50 | 1:5 | 1:100 | 1:100 |

Payout Frequency | Daily | Bi-weekly | 7 Days | 14 Days |

Number of Trading Assets | N/A | 100+ | N/A | N/A |

Trading Platforms | TradeLocker | Proprietary platform | DXTrade, Tradelocker, MT5 | MatchTrader, Tradelocker, MT5 |

Expert Suggestions

Leveled Up Traders stands out with flexible evaluations, high-profit splits (up to 90%), and Fees ranging from $79 to $1,199 based on account size and challenge type.

The platform offers traders a maximum total drawdown limit of 10%. While relatively new, the firm’s scaling opportunities and flexible conditions (e.g., no time limits, weekend trading) make it a viable choice for traders aiming to grow their careers.