Rocket21 Challenge offers simulated trading accounts ranging from $5K to $300K with a profit split of up to 90%. The prop firm supports Crypto and Bank wire payouts on a bi-weekly basis.

The maximum total drawdown, daily loss limit, and first profit target are 10%, 5%, and 8%, respectively.

Rocket21 Challenge; Prop Firm Information

Rocket21Challenge LLC. is a prop trading firm registered in the USA.

Founded in June 2022, The Delaware-based company has 50K+ traders across 7+ countries. Key features of Rocket21:

- Profit split of up to 90%

- Leverage options of 1:100

- Virtual accounts with a balance ranging from $5,000 to $300K

- Scaling options of up to $2M

Rocket21 Challenge Table of Specifications

The prop firm offers bi-weekly payouts and no time limit on its accounts. Let’s examine the R21-specific features.

Account currency | USD |

Minimum price | $59 |

Maximum leverage | 1:100 |

Maximum profit split | 90% |

Instruments | Forex, Metals, Indices, Crypto, Oil |

Assets | N/A |

Evaluation steps | 1-Step, 2-step |

Withdrawal methods | International Bank Transfer, Crypto |

Maximum fund size | $2M |

First profit target | 8% |

Max. daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Yes |

Maximum total drawdown | 10% |

Trading platforms | DXtrade, TradeLocker |

Commission | Variable based on the instrument |

TrustPilot score | 3.9 |

Payout frequency | Bi-weekly |

Established country | The United States |

Rocket21 Challenge Prop Firm Upsides and Downsides

The company provides a simulated trading environment, allowing users to trade without risking their capital and train in the meantime.

Pros | Cons |

No time limits | Lack of comprehensive educational resources |

High profit split of up to 90% | Copy trading restriction |

Affordable evaluation fees starting at just $59 | Higher than average Forex commission ($7) |

Innovative "Revive" option | Geo-restrictions |

Challenge Pricing

Rocket21 Challenge offers affordable access to its funded programs, with evaluation fees ranging from just $59 to $1,399, depending on the account type and size.

The entry-level cost of $59 applies to a $5,000 one-step Apollo 11 account. For larger accounts or enhanced evaluation options, such as Apollo 11 with add-ons (increased payout, higher drawdown, weekly payouts), fees can reach up to $2,000.

Rocket21 offers 3 funding models with a wide range of account balances for different budget levels, including:

Account Balance | Standard | Swing | Apollo 11 |

$5K | $79 | $79 | $59 |

$10K | $139 | $139 | $119 |

$25K | $249 | $249 | $199 |

$50K | $349 | $349 | $299 |

$100K | $549 | $549 | $499 |

$200K | $939 | $939 | $939 |

$300K | $1,399 | $1,399 | $1,250 |

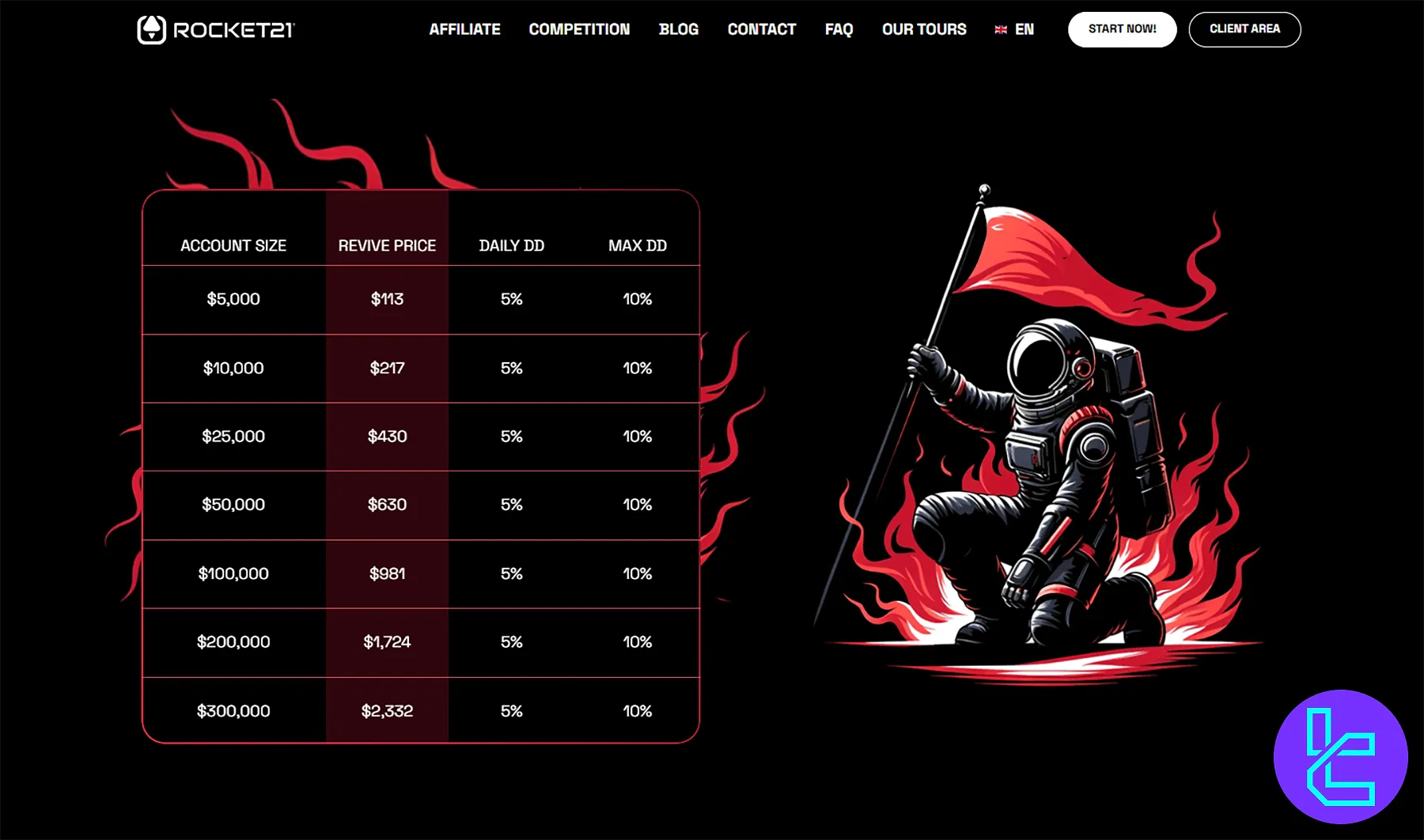

Rocket21 Challenge Revive Feature

Traders participating in 2-step challenges are eligible for the “Revive” program. This feature allows them to restart their phase 2 account if it is breached for a fee ranging from $113 to $2,332.

This feature offers a flexible path to retry without repurchasing the entire challenge.

Rocket21 Challenge Sign Up and KYC

Rocket21 welcomes traders worldwide to join its evaluation programs, but restricts access from Iran, North Korea, Russia, and Syria due to compliance regulations.

The registration process is designed to be smooth and secure, integrating industry-standard tools such as Sum Sub for identity verification.

#1 Head to the Prop Firm's Website

Visit the Rocket21 official website, choose your preferred challenge, and click “Buy Now!”.

#2 Adjust Your Account Settings

Select your account's preferences to change the evaluation program, platform, account balance, and more.

#3 Complete the Billing Form

Fill out the billing form with the following details:

- Email address

- Full name

- Payment details

#4 Proceed with Rocket21 KYC Procedure

Upon completing the R21 challenge, you must pass a KYC verification procedure. The process can be done via SumSub by providing the following documents:

- Photo ID (Passport or Driver’s License)

- Selfie

Rocket21 Evaluation Steps

Rocket 21 takes a flexible approach to trading strategies and allows for news trading (on Standard evaluation phases and Swing challenge) and weekend holding (only on Swing Challenge).

Let’s examine other Rocket21 Challenge rules.

Features | Standard (2-Step) | Swing (2-Step) | Apollo 11 (1-Step) |

Trading Period | Unlimited | Unlimited | Unlimited |

Min Trading Days | 5 / 5 / 5 | 5 / 5 / 5 | 3 / 3 |

Max Leverage | 1:100 | 1:30 | 1:30 |

Max Daily Loss | 5% / 5% / 5% | 5% / 5% / 5% | 3% / 3% |

Max Total Drawdown | 10% / 10% / 10% | 10% / 10% / 10% | 6% / 6% |

Profit Target | 8% / 5% | 8% / 5% | 9% |

Payout Frequency | Bi-weekly | Bi-weekly | Bi-weekly |

Profit Split | 85% (90% with Scaling) | 85% (90% with Scaling) | 80% |

Rocket21 Scaling Plan

Rocket21 allows successful traders to grow their funded accounts up to a maximum of $2,000,000. The scaling plan rewards consistency: traders who maintain solid performance can expect their account balance to increase by 30% every three months.

This structured scaling pathway makes Rocket21 a competitive option for long-term growth within the prop trading ecosystem.

Rocket 21 Profit Split

Rocket21 offers a high-end profit-sharing structure that begins at 85% and scales up to 90% for traders who scale their accounts.

The Apollo 11 program also provides a full refund of the challenge fee upon the first payout, making it one of the most trader-friendly setups in the industry.

Rocket21 Challenge Time Limit

Rocket21 Challenge imposes no time limits on completing any of its evaluations, whether one-step or two-step.

This provides traders with maximum flexibility, removing the psychological pressure of deadlines and allowing them to focus solely on meeting profit targets and staying within risk parameters.

Rocket21 Challenge Prop Firm Promotions

The firm has implemented a comprehensive affiliate service. The affiliate program features a 4-tier system offering up to 20% commissions from sales, 10% discounts for traders, and a $2,000 cash bonus.

The company also offers seasonal discount codes to incentivize potential clients.

At the time of writing this Rocket21 Challenge review, there are 3 active promotions, including:

- New Year: 10% off + 110% bonus via the coupon code “PERIHELION10”

- Revival: 20% off on account restarts via the coupon code “WOLFMOON20”

Rocket21 Challenge Trading Rules

For traders participating in challenges and funded programs, strict guidelines govern the use of VPNs, hedging, Expert Advisors, and news trading to ensure fair and compliant trading practices.

- VPN Usage: VPN and VPS are allowed but must be used in accordance with the Terms and Conditions to avoid violating account integrity;

- Hedging: Hedging between separate accounts is prohibited, but safe-haven and pair trading are allowed;

- Expert Advisors (EA): Only permitted on the Tradelocker platform during Apollo 11 challenges;

- Martingale & Arbitrage: Unrealistic strategies like the use of a delayed data feed are banned;

- News Trading: It's restricted for 4 minutes before and after significant news releases.

VPN Usage

Traders are generally discouraged from using VPNs or VPS services while engaging in the challenge or simulated funded accounts.

These tools can interfere with internal tracking systems and raise suspicions about multiple users accessing a single account. While the use of VPNs/VPS is not outright prohibited, any suspicious activity on a simulated account involving these tools will be thoroughly investigated.

If such tools are used, it is essential to adhere strictly to all Terms and Conditions, avoiding activities like automated trading or multiple users accessing a single account.

Hedging

Hedging is not allowed between two separate accounts. For example, opening a buy position in one account and a sell position in another account is prohibited.

However, using safe-haven assets (like gold) or engaging in pair trading, where opposite positions are taken on two different assets, are allowed forms of hedging.

Expert Advisors (EA)

The use of Expert Advisors (EAs) is restricted to the Tradelocker platform during Apollo 11 challenges. They are not currently supported on the DXtrade platform.

Traders must comply with the platform-specific rules and ensure their strategies align with the accepted trading standards.

Martingale and Arbitrage Strategies

Traders are free to choose any trading strategy during the demo phase, provided it reflects realistic market conditions. Any trading strategy that manipulates the demo environment to create conditions not possible in the real market will be considered a breach of the rules. Prohibited strategies:

- Guaranteed limit orders

- Grid trading

- Use of manipulated data feeds

- Use of delayed data feeds (Latency Arbitrage)

- Martingale

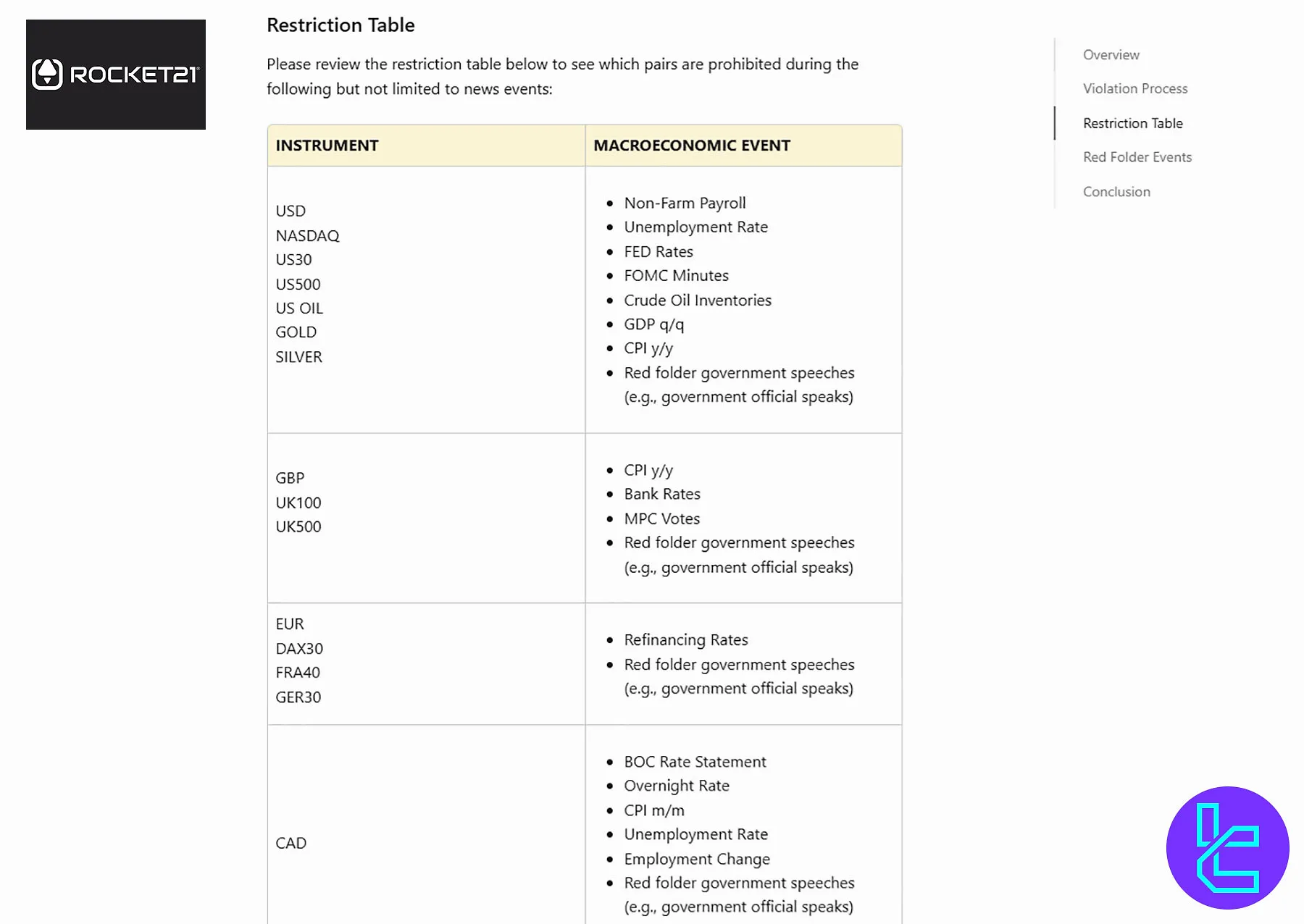

News Trading

News trading is allowed, but there are strict limitations. Traders cannot open or close positions, or have their take-profit or stop-loss orders triggered, within 4 minutes before and after the release of a high-impact news event.

This rule applies to all FX, Oil, Crypto, Metals, and Indices instruments. Violation of this restriction during news events will lead to the removal of any profits generated in the restricted window.

Red Folder News Events

Red Folder news events, such as Non-Farm Payrolls or major economic reports, are subject to trading restrictions. Specific instruments, such as US Oil, Gold, and various currency pairs, are impacted by these events.

It is important to avoid trading these instruments during the defined news release periods to prevent any potential breaches.

Supported Trading Platforms

The firm has partnered with Eightcap broker and offers access to Trade Locker and D Xtrade trading solutions through this partnership. While Eightcap DX is only accessible via web browsers, Trade Locker can be accessed across various devices, including:

- TradeLocker Android

- TradeLocker iOS

- Desktop

- Web

These platforms offer access to multi-asset trading, including forex, metals, indices, and crypto. MetaTrader 4 and 5 are not available, a departure from more conventional prop firm setups.

Rocket21 Challenge Trading Assets

R21 enables traders to use any trading instrument available on its platforms, from the Forex market to Crypto assets.

However, the firm only offers Raw Forex pairs.

- Forex (leverage of up to 1:100)

- Metals (leverage of up to 1:30)

- Oils (leverage of up to 1:30)

- Indices (leverage of up to 1:20)

- Crypto (leverage of up to 1:1)

Payment Options

The firm serves a global clientele and offers 2 main payment methods to cater to its wide range of traders, including:

- Funding: Crypto (CoinPayments) and Credit/Debit Cards (Merchant Warrior)

- Withdrawal: Crypto and International Bank Transfer

Payout requests are typically processed within 24 hours if submitted before 4 PM EST.

Trading Commissions

Rocket21 Challenge has implemented a transparent commission structure. However, it hasn’t disclosed any data about spreads on its website.

Trading commissions on R21:

Asset Type | Commission |

Forex | $7 |

Metals | $3 |

Indices / Crypto/ Oil | $0 |

Does Rocket21 Challenge Provide Educational Materials?

Rocket21 focuses on providing a simulated platform for users to trade and learn without risking their funds. It offers limited content on its blog, covering various topics, including:

- Trading psychology

- Prop trading guide

- Work-Life balance

- Social media effects

You can also access additional educational resources through TradingFinder's Forex education section.

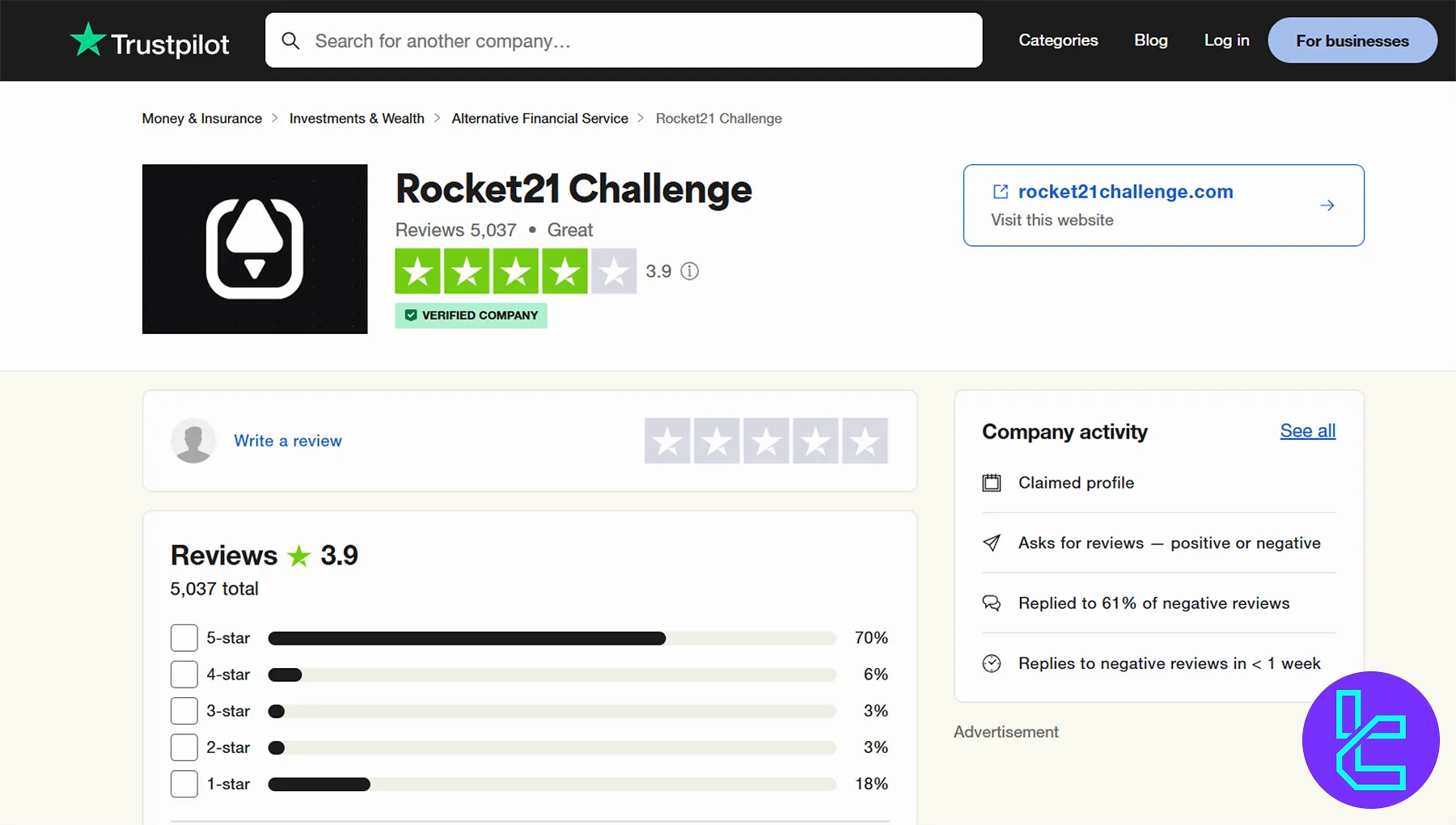

Trust Score

User satisfaction is one of the most essential topics in this Rocket21 Challenge review. The firm is featured on TrustPilot and has garnered numerous comments, mostly positive.

The Rocket21 Challenge TrustPilot profile features 5,037 reviews, 76% of which are 4-star and 5-star. As a result, it has gained a great score of 3.9 out of 5.

Rocket21 Challenge Prop Firm Customer Support

The company boasts 24/7 support through multiple channels, including a hotline and ticket system.

Support21@Rocket21Challenge.com | |

Tel | 754-223-9237 |

Ticket | Through the “Contact Us” page |

Live Chat | Available on the official website |

Rocket21 Challenge Prop Firm Social Media Handles

The firm has held tours across 7 countries, including the USA, Puerto Rico, Spain, England, Peru, Colombia, and the Dominican Republic.

It also maintains an active presence on social media to stay connected with its community of traders.

- Rocket21 Challenge Discord

- Rocket21 Challenge Facebook

- YouTube

Rocket21 Challenge vs Other Prop Firms

Let's check the Rocket21 features and services in comparison with top prop firms:

Parameters | Rocket21 Challenge Prop Firm | Blue Guardian Prop Firm | Funding Traders Prop Firm | FundedNext Prop Firm |

Minimum Challenge Price | $59 | $67 | $100 | $32 |

Maximum Fund Size | $2,000,000 | $2,000,000 | $2,000,000 | $4,000,000 |

Evaluation steps | 1-Step, 2-Step | 1-phase, 2-phase, 3-phase | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 90% | Up to 90% | 100% | 95% |

Max Daily Drawdown | 5% | 4% | 5% | 5% |

Max Drawdown | 10% | 10% | 10% | 10% |

First Profit Target | 8% | 6% | 10% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:100 | 1:100 |

Payout Frequency | 14 Days | 14 Days | 7 Days | From 5 Days |

Number of Trading Assets | N/A | N/A | N/A | 78 |

Trading Platforms | DXtrade, TradeLocker | MatchTrader, Tradelocker, MT5 | DXTrade, Tradelocker, MT5 | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

Rocket21 Challenge provides access to 5 asset classes, including Forex and Crypto. While Crypto trading is free of commissions, Forex pairs incur a $7 fee.

The prop firm offers leverage options of up to 1:100. It has 50K+ users and a TrustPilot score of 3.9.