Key Points:

- EUR/USD closes above the previous day’s candle after sell-side liquidity has been collected;

- Stabilization of daily closes above the pin bar range and the consolidation zone strengthens the scenario for continuation toward the bullish gap;

- On the 4-hour timeframe, the formation of a Morning Star pattern after a Liquidity Sweep has generated a buy signal; however, the 1.1785$ to 1.1762$ range is considered a key supportive order block and the most important level for maintaining the bullish structure;

- On the 1-hour timeframe, a bearish RSI divergence warns of a short-term correction; nevertheless, a breakout above 1.1848$ could open the path toward $1.1874 and then $1.1899;

- Price behavior during the London session and New York will determine the final direction; liquidity collection within these sessions could either initiate a distribution phase or support continued bullish movement.

Based on the daily analysis of the euro against the US dollar (EUR/USD), after a sell-side liquidity grab, price has reacted to a key level and closed above the previous day’s candle. This behavior indicates the preservation of short-term bullish momentum within the market structure.

If these conditions are maintained, the following is expected, Price closes above the pin bar candle range and the consolidation zone.

Continuation of the move toward the bullish trend gap. The bullish continuation scenario is strengthened when daily closes are stabilized above this range and otherwise, a pullback toward demand zones may occur.

EUR/USD Analysis on the 4-Hour Timeframe

On the 4-hour timeframe, price has reacted to the Fibonacci zone as anticipated and, after a short-term correction, has entered the Fair Value Gap area.

This move has been accompanied by a Liquidity Sweep, followed by the formation of a Morning Star candlestick pattern, which provides a buy entry signal.

Under current conditions, two scenarios are considered:

Bullish Scenario:

- Continuation of the move toward the upper area of the Fair Value Gap (FVG) and the Draw on Liquidity zone;

- Possibility of a short-term correction toward a continuation pattern.

Conditional Bearish Scenario:

- Potential movement toward the Order Block zone;

- Reaction area between $1.1785 and $1.1762;

- If a valid rejection is observed from this zone, a re-entry into a buy position may be considered with a view toward a return to the bullish trend.

EURUSD Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, after a ranging phase, price performs a Stop Hunt and enters a bullish phase. However, on the Relative Strength Index, a bearish divergence is observed meaning that:

- Price is printing higher highs;

- But RSI is forming lower highs.

This divergence may pave the way for a price correction toward the consolidation zone.

Additionally, if market momentum increases, after liquidity collection and a reaction to the order block candle, buy opportunities may be sought with a target above the Fair Value Gap (FVG) zone.

Key levels on this timeframe:

- In case of a close above $1.1848, the probability of continued upside toward the $1.1874 level;

- Entry into the FVG zone at $1.1899 as the next target.

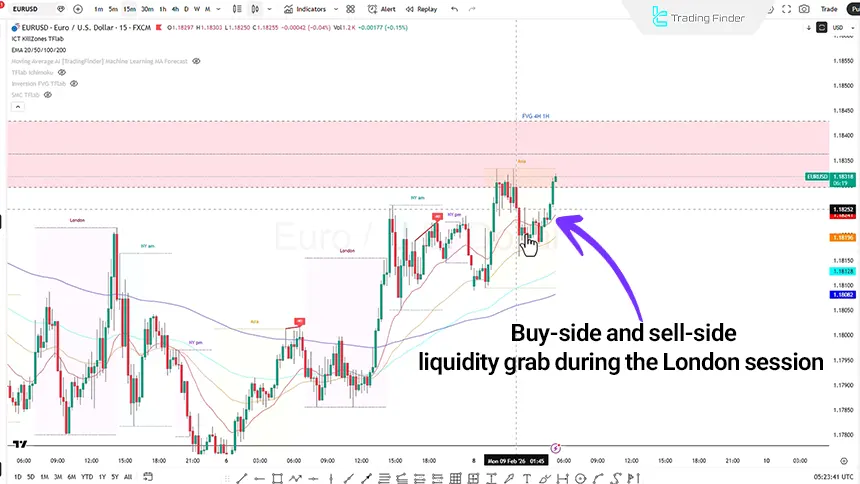

EUR/USD Analysis on the 15-Minute Timeframe (M15)

During the Asian session, price is accompanied by an aggressive upward move. The continuation of direction depends on price behavior during the London and New York sessions.

If a price manipulation move occurs during the London session, along with buy-side liquidity collection and a close inside the Asian session range, the probability of bearish distribution during the New York session increases.

If, during the London session, both buy-side and sell-side liquidity are collected, the formation of a bullish move in New York is possible.

Conclusion

The overall structure of EUR/USD remains tilted toward a bullish scenario; however, on lower timeframes, bearish divergence in the Relative Strength Index may set the stage for a short-term correction.

Nevertheless, as long as the order block range between $1.1785 and $1.1762 holds, the probability of continuation toward buy-side liquidity at the $1.1874 level and then the Fair Value Gap area at $1.1899 remains valid.

Price behavior during the London and New York sessions will play a key role in confirming or weakening this scenario.