Key Points:

- In the GBP/USD pair, selling pressure has persisted after the collection of sell-side liquidity, and the bearish structure is being consolidated on the 4-hour timeframe;

- On the 4-hour timeframe, the first bearish target is the $1.3452 area, followed by $1.3354; continuation of bearish momentum increases the likelihood of these levels being reached;

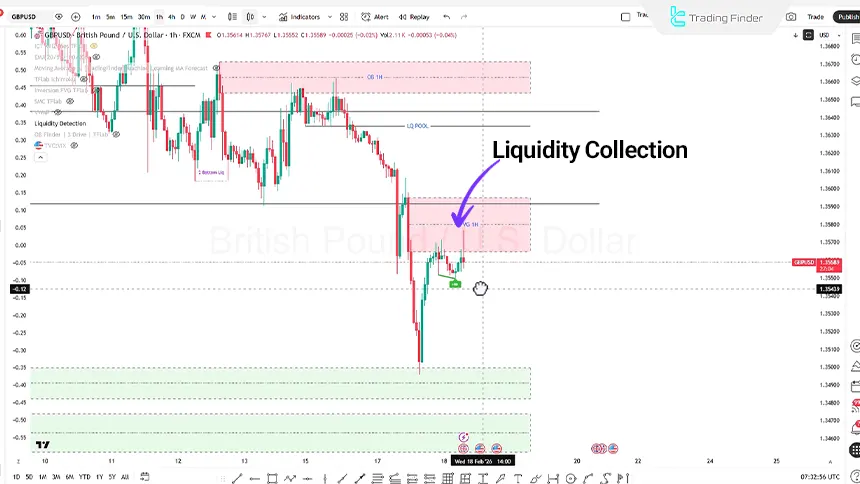

- On the 1-hour timeframe, after the collection of buy-side liquidity, the reaction to the FVG and the formation of a bearish Pin Bar candle confirm buyer weakness;

- As long as no meaningful Market Structure Shift (MSS) occurs, the dominant scenario remains a continuation toward lower liquidity, and bullish corrections are assessed merely as pullbacks within a downtrend.

In yesterday’s trading session, the GBP/USD pair was accompanied by selling pressure and, after collecting sell-side liquidity (Sell Side Liquidity) around the close area, maintained its bearish structure.

At the same time, the strengthening of the U.S. Dollar Index and the release of mixed economic data from the United Kingdom added further pressure on the pound. At present, the combination of fundamental and technical data supports a predominantly bearish scenario; however, price reaction to key zones could determine the short-term direction.

Daily GBP/USD Analysis on the 4-Hour Timeframe (H4)

On the 4-hour timeframe, contrary to the initial expectation of reaching the Fair Value Gap, the price has entered the Order Block zone with direct selling pressure.

If selling pressure continues while the U.S. Dollar Index strengthens simultaneously:

- Price may move toward lower targets;

- The first important zone is the $1.3452 level;

- Subsequently, the next target could be the daily Order Block (optimized on the 4-hour timeframe) at the $1.3354 level.

Continued weakness in the pound and increasing bearish Momentum may raise the probability of these levels being tested.

Daily GBP/USD Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, price moved upward after a consolidation phase and collected buy-side liquidity. It then reacted to the Fair Value Gap (FVG) zone and formed a bearish Pin Bar candle.

Fundamental Analysis of the GBPUSD

The U.S. Dollar Index has been gaining strength in the past day. This strengthening of the dollar, along with the release of British economic data, put additional pressure on the pound. The most important data releases for GBPUSD fundamental analysis:

- The Claimant Count Change was released against expectations and even higher than the previous value, which is considered a negative signal for the British labor market;

- The Average Earnings index was reported lower than the Forecast and the previous value, indicating a decrease in wage pressure and, as a result, a decrease in the ability to cover inflation;

- The Average Weekly Earnings index has reached its lowest level in recent months.

Conclusion

From a technical analysis perspective, the market structure remains in a bearish phase, and price reaction to Order Blocks, Fair Value Gaps (FVG), and candlestick behavior on lower timeframes indicates seller dominance.

As long as no meaningful structural shift is observed in the market, the dominant scenario will remain a continuation toward lower levels and the collection of liquidity in the next support zones.