Key Points:

- After collecting Buy Side Liquidity on the 4-hour timeframe, Litecoin has entered a reaction zone, and with the formation of a Pin Bar, signs of indecision and weakening momentum in both directions are evident;

- On the 4-hour timeframe, the lack of a decisive close above the pin bar, as well as the absence of a valid breakdown to the downside, has pushed the market into a decision phase; the bullish scenario is evaluated solely as a corrective move within the dominant bearish trend;

- In the event of a limited bearish correction and the observation of an MSS on the 1-hour timeframe, a potential long entry with a stop loss behind the relevant swing is possible; however, this scenario is counter to the main and short-term trend;

- On the 1-hour timeframe, the formation of a Swing Failure Pattern following the reaction to the 50% Order Block signals buyer weakness;

- The breakout of the ascending channel on H1 previously triggered a sell signal and has kept the short-term structure tilted to the downside;

- From a sentiment perspective, the positioning of the Fear & Greed Index within the Extreme Fear zone and the uncertainty surrounding the Clarity Act have reduced market risk appetite and increased the likelihood of selling pressure during corrective moves;

- Until a meaningful structural shift is observed on higher timeframes, the dominant scenario remains bearish, with primary focus on price reaction to lower Order Blocks and the quality of candle closes.

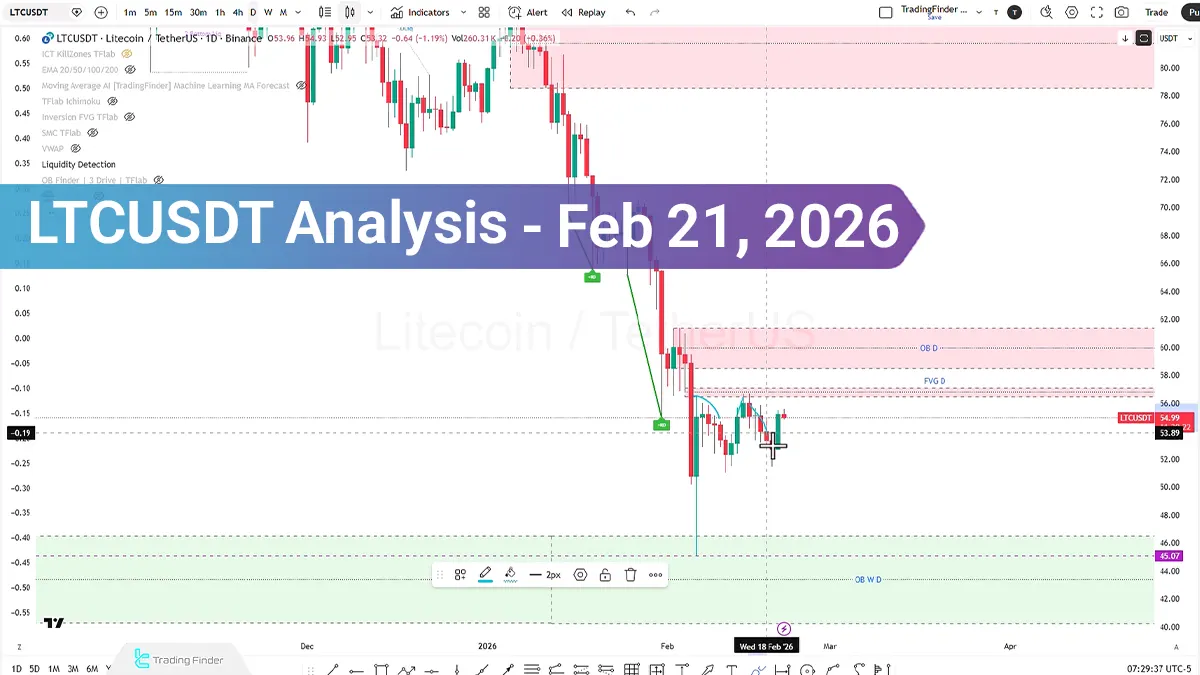

Following the continuation of its recent bullish move, Litecoin has entered a phase of price reaction and increasing selling pressure. Across multiple timeframes, signs of weakening Momentum are visible in both directions, while the overall market trend remains bearish and the prevailing Sentiment is negative.

The placement of the Fear & Greed Index tool within the “Extreme Fear” zone, along with the uncertainty surrounding the approval of the Clarity Act, are among the variables influencing the short-term outlook of this asset. Below, the potential scenarios on the 4-hour and 1-hour timeframes are examined.

Litecoin Analysis on the 4-Hour Timeframe (H4)

Price moved upward in line with the previous forecast and, after collecting Buy Side Liquidity, entered a reaction zone. In this area:

- A Pin Bar candle formed;

- Price failed to achieve a candle Close above the zone;

- Subsequently, no decisive close below the pin bar range was recorded.

This behavior indicates relative weakness in both bullish and bearish directions and the market’s transition into a short-term indecision phase.

In the short-term scenario, price is expected to undergo a limited bearish correction and enter the pin bar zone. If this decline is accompanied by decreasing bearish momentum and a Market Structure Shift (MSS) is observed on the 1-hour timeframe, a potential Buy position with a Stop Loss placed behind the relevant swing and targets set based on market swings could be considered.

However, it should be noted:

- The overall market trend remains bearish;

- Market sentiment remains negative;

- The Fear & Greed Index is positioned within the Extreme Fear zone.

Therefore, any bullish scenario is evaluated strictly within the framework of a correction in the dominant trend, unless a meaningful shift occurs in the macro structure.

Litecoin Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, a liquidity pool range has formed in the central part of the structure. After moving upward, price:

- Collected Buy Side Liquidity;

- Reacted to the 50% level of the Order Block or Rejection Block range;

- Formed a pattern similar to a Swing Failure Pattern.

This pattern, accompanied by price returning back inside the candle range, may signal weakness in the bullish trend and, upon structural confirmation, a Sell position with risk-to-reward targets of 1:1 or 1:2 could be considered.

Previously, price was trading within an ascending channel; after breaking this channel, a sell signal was issued and opportunities to enter short trades were available in that zone.

Conclusion

Litecoin is currently in a condition where, despite bullish corrective movements, the overall market structure remains dominated by a bearish trend and negative sentiment. The formation of pin bars, liquidity collection on both sides of the market, and entry into a consolidation phase indicate structural compression ahead of the next move.

Bullish scenarios are conditional upon weakening selling pressure and a market structure shift, while increasing bearish momentum could pave the way toward lower Order Blocks. Risk management and close attention to price behavior around liquidity zones are of heightened importance under current conditions.