Key Points:

- The EURUSD pair, after a bearish displacement on the 4-hour timeframe, has entered a consolidation phase and formed two-sided liquidity; the market is on the verge of a decisive move;

- The reaction to the BPR range and the Rejection Block is the core axis of the scenarios; the collection of Sell Side Liquidity can pave the way for a continuation of the bullish trend;

- On the 1-hour timeframe, there is a possibility of Buy Side Liquidity being absorbed and a return to the consolidation range; this behavior can serve as an entry signal within the smart money framework;

- On the 15-minute timeframe, the Asian accumulation structure and the behavior of the London and New York sessions determine the activation of short-term buy or sell scenarios;

- Weak momentum in the US Dollar Index and the limited impact of Forex economic calendar CPI data, alongside the US holiday, support the euro’s relative short-term strength.

During trading on February 16, 2026, the EURUSD pair, after a bearish displacement move on the 4-hour timeframe, entered a consolidation phase and simultaneously formed buy-side and sell-side liquidity on both sides of the range.

The outlined scenarios are defined based on the collection of two-sided liquidity and the reaction to the BPR and Rejection Block zones.

From a fundamental analysis perspective, despite the release of strong NFP data, the limited impact of the Consumer Price Index (CPI) and the US holiday have weakened the US dollar’s momentum, placing the euro in a more favorable sentiment position.

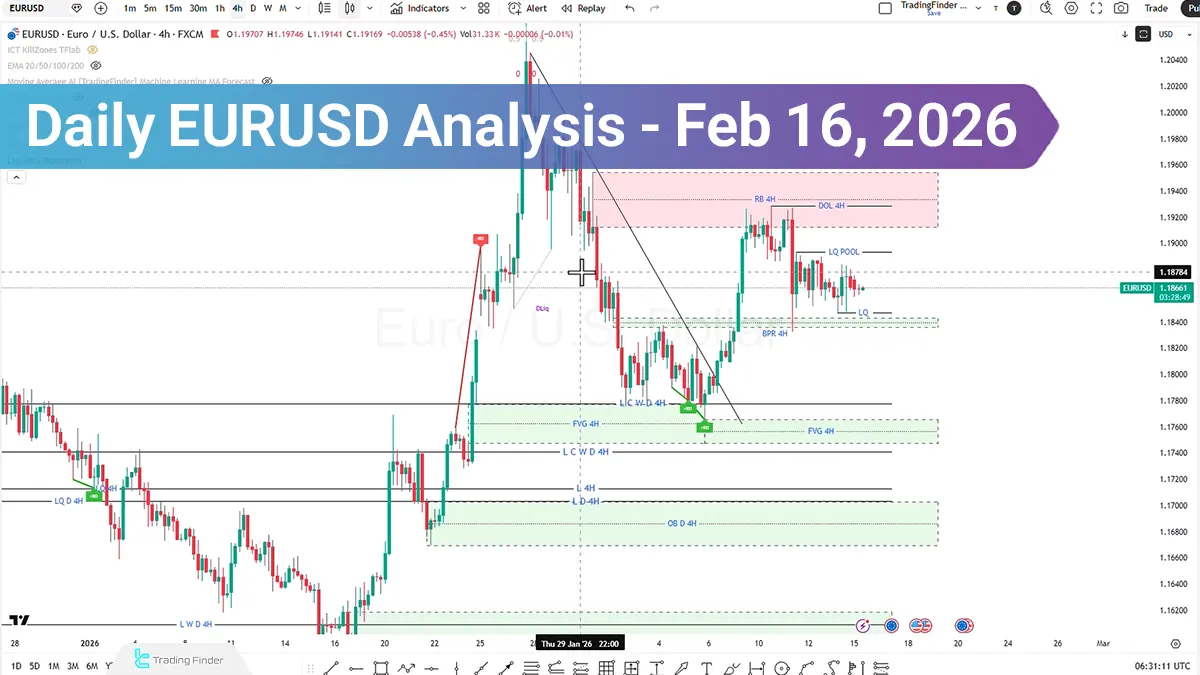

Daily Analysis of EURUSD on the 4-Hour (H4) Timeframe

On the 4-hour timeframe, after a bearish displacement move to the downside, price has reached the 4-hour BPR zone and reacted to it. The market has now entered a consolidation phase, creating the probability of the following scenarios:

First Scenario:

- Price makes a short-term correction to the downside;

- Collects sell-side liquidity;

- Reacts to the Balanced Price Range or the Rejection Block;

- Then moves in line with the prevailing bullish trend toward collecting buy-side liquidity.

Second Scenario:

- Price initially moves upward and collects buy-side liquidity;

- After reacting to the BPR zone, it returns downward;

- Collects sell-side liquidity as well and then enters a new impulsive phase.

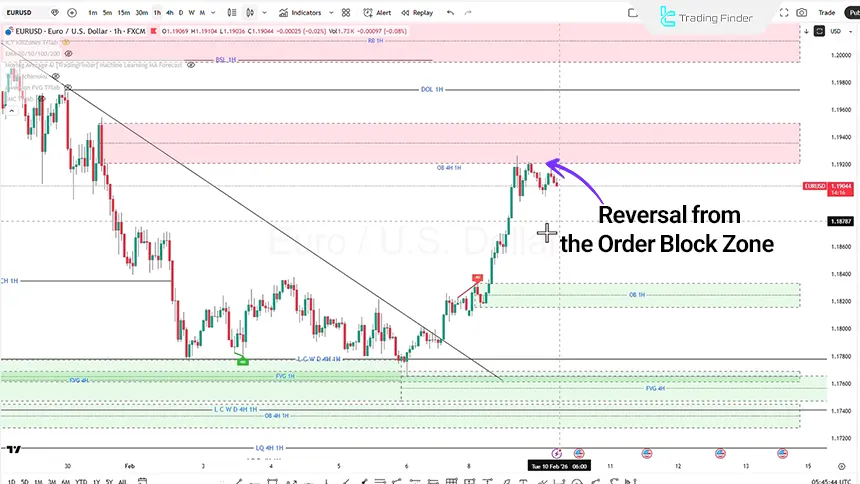

EURUSD Analysis on the 1-Hour (H1) Timeframe

On the 1-hour timeframe, Smart money and ICT-style traders, using liquidity detection tools, are able to identify zones of buy-side and sell-side liquidity concentration.

At present, price is moving toward the buy-side liquidity zone, and there is a possibility that this level will be collected. If, after this move, price returns back inside the range, it can be considered as a trading strategy.

Analysis of EURUSD on the 15-Minute (M15) Timeframe

On the 15-minute timeframe, an Accumulation move during the Asian session is observable. The main focus is on price behavior during the London and New York sessions; session-based behavioral scenarios are as follows:

- If price reacts to the 50% level of the bullish Order Block at the bottom of the consolidation range, there is potential for collecting London and New York session liquidity followed by an upward move;

- If during the London session price moves upward, collects buy-side liquidity, and then closes inside the consolidation range, this behavior may signal selling pressure and activate a sell scenario toward the swing low.

However, considering the overall market structure, long positions in line with the prevailing trend are more probable.

Conclusion

The overall structure of EURUSD remains inclined toward a bullish scenario. Weak momentum in the US Dollar Index (DXY) and the euro’s relative fundamental advantage support continued buying pressure.

Additionally, price behavior around BPR zones, Order Blocks, and reactions to two-sided liquidity will determine the market’s short-term direction.

If selling pressure in the US Dollar Index continues, the likelihood of reinforcing the bullish scenario in the EUR/USD pair increases, especially if price can maintain its structure above valid demand zones.