Key Points:

- Contrary to the short-term correction scenario, Bitcoin advanced with bullish momentum and then entered a consolidation phase; the market is now evaluating liquidity between $71,000 and $72,000;

- On the 4-hour timeframe, as long as higher lows are maintained, the short-term structure remains bullish; however, price compression below resistance could precede the next sharp move;

- On the 1-hour timeframe, after sweeping buy-side liquidity and forming a Swing Failure pattern, there is a growing probability of a short-term move back toward sell-side liquidity;

- Fundamental data, including MVRV at 1.27 and the gap to the Realized Price around $55,000, continue to keep the risk of a further corrective phase active;

- The market’s next direction depends on a valid breakout above $72,000 to continue the uptrend or the loss of structural supports and a move toward the $55,000 region.

Contrary to the short-term correction scenario, Bitcoin has continued its movement with bullish momentum and then entered a consolidation phase. Current price behavior indicates that the market is assessing the available liquidity level.

On one hand, the absorption of buy-side liquidity at higher levels is possible, and on the other hand, in the event of capital flow weakness, the scenario of moving toward sell-side liquidity will be activated.

On-chain data simultaneously show signs of increasing risk for a deeper correction.

Bitcoin Analysis on the Four-Hour Timeframe (H4)

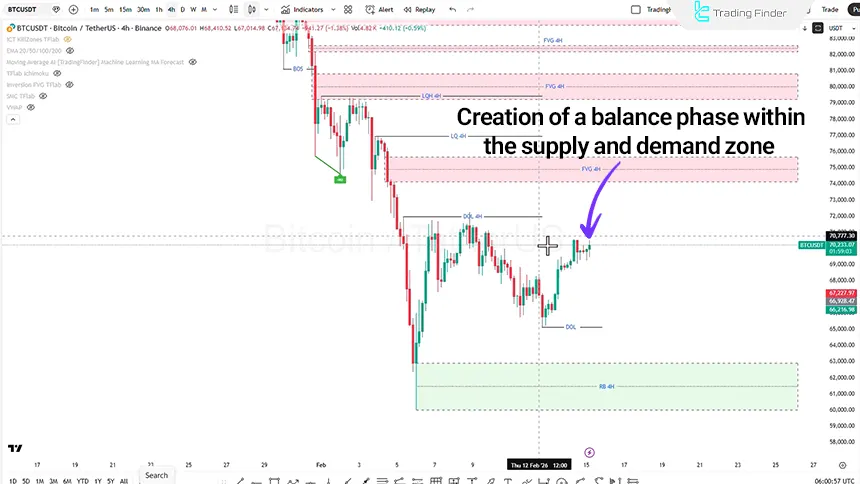

On the 4-hour timeframe, Bitcoin’s price behavior can be evaluated within a short-term bullish structure that, after a displacement move to the upside, has entered a compression phase.

This phase reflects a temporary balance between supply and demand zones and the market’s preparation for the next move.

However, the formation of a consolidation zone below the $71,000 to $72,000 levels indicates that the market is collecting orders and assessing liquidity depth within this range.

BTC Analysis on the 1-Hour Timeframe (H1)

On the 1-hour timeframe, after forming simultaneous structures, price initially moved upward and collected buy-side liquidity. This move was accompanied by bullish momentum but subsequently entered a price compression range.

Within this structure, the formation of a Swing Failure pattern and a price return to the pullback zone are observed; a zone that can be considered a potential trading area for a short position. In this scenario:

- Stop-loss can be placed behind the recent swing highs or the previous high;

- Price targets can be set at a 1:1, 1:2 risk-to-reward ratio or at the sell-side liquidity zone.

This structure indicates that after collecting buy-side liquidity, the market maintains the probability of a short-term move downward.

Bitcoin Fundamental Analysis on February 15, 2026

From a fundamental perspective, the convergence of on-chain data paints the picture of a market in a transitional phase. The profit and loss ratio indicator shows that the market has not yet entered a widespread Capitulation phase, and a significant portion of unrealized profits remains within the system; a factor that can keep the room for a further corrective phase open.

On the other hand, the MVRV indicator standing at 1.2745 suggests that there is still a meaningful distance from the historical value zone (MVRV -1).

At the same time, the proximity of price to the Realized Price line around $55,000 turns this level into an important psychological and structural boundary that could play a decisive role in the cycle shift.

Conclusion

Bitcoin is currently in a decision phase between absorbing buy-side liquidity or reversing to collect sell-side liquidity.

On-chain data, particularly the MVRV indicator and the Realized Price line, indicate that the probability of a further corrective phase still exists. However, the inflow of new liquidity and institutional capital could shift the current structure in favor of the bullish scenario.

The market’s ultimate direction will depend on price reaction to the $55,000 level on the downside and $72,000 on the upside.