- TradingFinder

- Forecast and Analysis

- Crude Oil Forecast and Analysis

Crude Oil Forecast & Analysis 2026; Price, News, Chart

Crude oil news today shapes immediate price behavior across WTI markets, driven by OPEC+ decisions, geopolitical risks, inventory data from the EIA, and shipping disruptions. These factors influence crude oil price forecast for today and set the tone for short term market analysis. Crude Oil technical analysis today evaluates trend strength, volatility shifts, and key price zones using tools such as moving averages, ATR, volume profiles, and breakout structures. This approach supports intraday signals, tactical trading ideas, and precise price prediction for fast moving sessions. Commodities Analysis & Forecasts for energy markets also rely on macro drivers such as global growth expectations, refinery demand, and currency dynamics. Brent crude oil forecast and analysis often diverge from WTI due to regional supply flows, refining margins, and European demand conditions. Crude oil price prediction this week and crude oil price forecast for next week are built around scenario based outlooks, options positioning, and inventory trends. These Analysis Reports combine probability models with expert opinion to assess continuation, consolidation, or reversal risks. All crude oil Forecasts & Analysis published by TradingFinder are completely free and integrate futures market data, macro indicators, and institutional insights. These free analysis reports deliver structured market analysis, verified signals, and data driven prediction frameworks without subscription requirements.

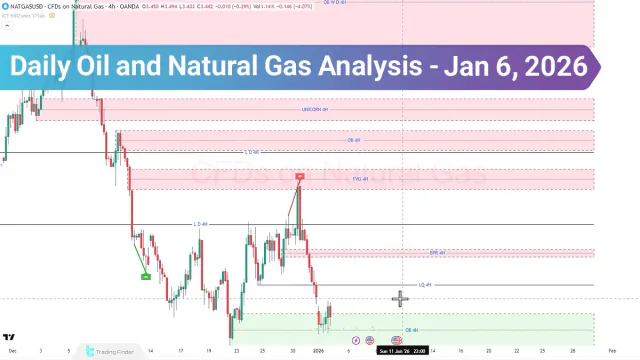

Oil and Natural Gas Analysis; Energy at Inflection Point, Breakdown or Aggressive Rebound?

Oil and Natural Gas Analysis on January 6, 2026 - Analysis of oil and gas trends based on price reaction to Order Block zones, FVG, and Consolidation