Key Points:

- USD/CAD entered a bearish phase after pulling back to the 4-hour support and swept sell-side liquidity; the overall structure remains tilted to the downside;

- Before continuing the decline, there is a possibility of drawing buy-side liquidity and a corrective rise toward the 4-hour order block area;

- On the 1-hour timeframe, the dominance of bearish candles and weak bullish momentum indicate sellers’ advantage; the reaction to the FVG will determine the next move;

- Weakness in the U.S. Dollar Index could maintain downward pressure on USD/CAD and reinforce the continuation scenario;

- The release of CPI data on Tuesday is a potential catalyst for high volatility and may activate either the corrective bullish scenario or the continuation of the decline.

In recent trading sessions, the U.S. Dollar to Canadian Dollar (USD/CAD) pair entered a bearish phase after pulling back to a support level on the 4-hour timeframe and successfully collected sell-side liquidity.

The current market structure indicates that despite the overall bearish bias, there is a possibility of collecting buy-side liquidity (Buy Side Liquidity) before the continuation of the decline.

At the same time, weakness in the U.S. Dollar Index (DXY) and the release of Consumer Price Index (CPI) data on Tuesday could generate meaningful volatility in the market.

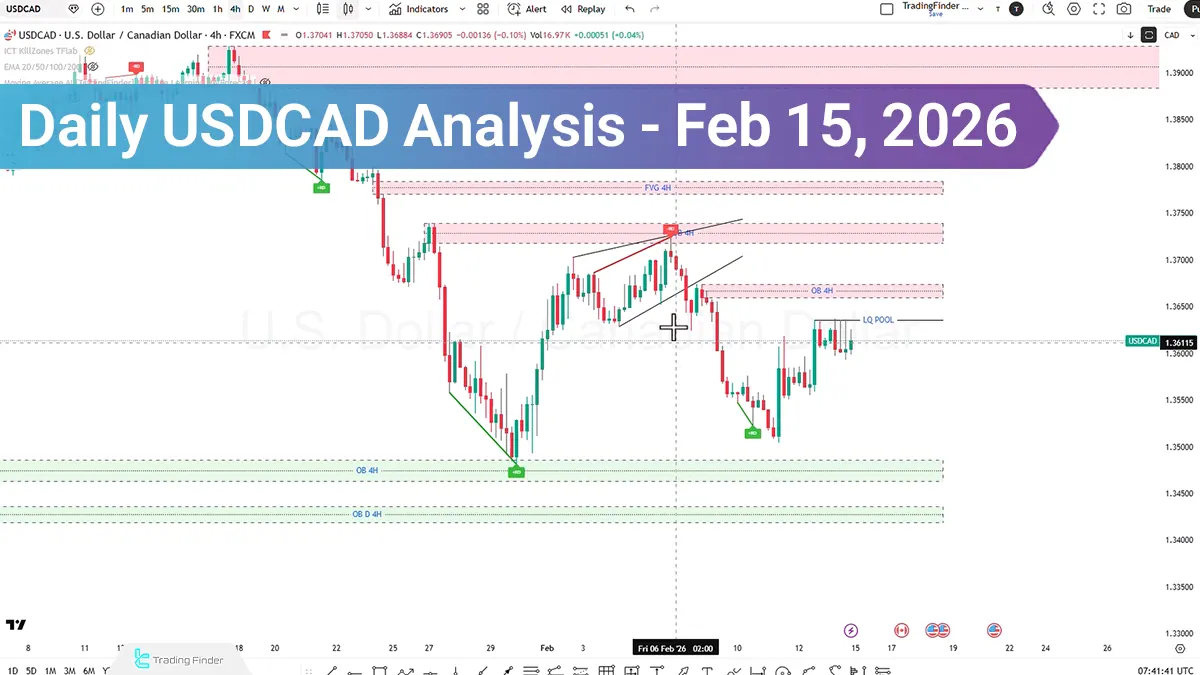

USDCAD Analysis on the Four-Hour Timeframe (H4)

On the four-hour chart, price moved in line with the previous scenario and entered a bearish move after pulling back to the support level, collecting sell-side liquidity.

This behavior indicates the activation of pending orders below previous lows and the partial release of selling pressure. Two scenarios can be defined for Monday:

First Scenario: Continuation of Selling Pressure

- Price may continue moving downward;

- Enter the fair value gap area;

- After collecting sell-side liquidity again, face a bullish displacement move;

- Move upward and target buy-side liquidity;

- Enter the 4-hour order block

In this scenario, the bullish move may merely serve as a correction to complete liquidity engineering rather than necessarily signaling a trend reversal.

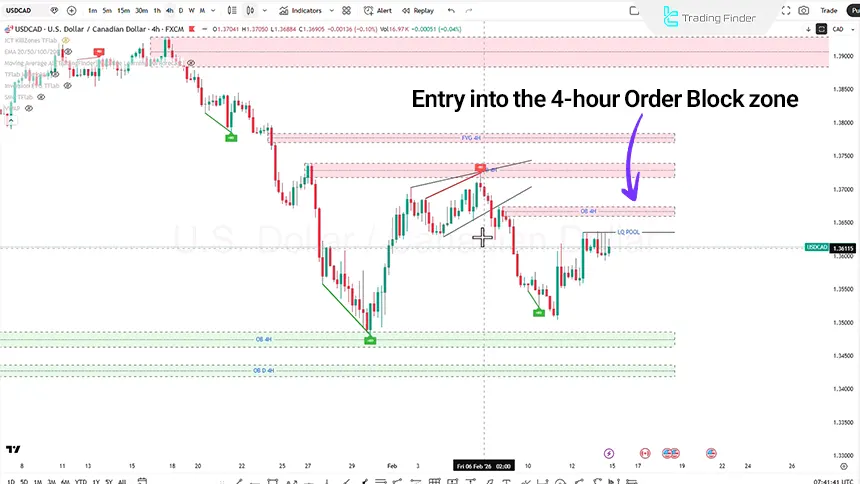

Second Scenario: Bullish Momentum at the Start of the Week

- Initially collects buy-side liquidity;

- Enters the 4-hour order block area;

- If weakness in the bullish move is observed, selling opportunities can be considered.

This scenario is based on a price reaction from the supply zone and the continuation of the dominant bearish structure.

USDCAD Analysis on the 1-Hour Timeframe (H1)

On the one-hour timeframe, price is in a consolidation phase, and after sweeping stop liquidity, the market experienced a bullish move.

During the final trading hours, the dominance of bearish candles also confirms a relative increase in selling pressure. If this pressure intensifies, the probability of price entering the fair value gap or order block area increases.

On the other hand, if signs of a market structure shift or CISD are observed in these areas, a potential long position scenario toward the order block zone can be considered.

USDCAD Analysis on the 15-Minute Timeframe (M15)

On the 15-minute timeframe, although the overall trend in the higher structure is assessed as bearish, candlestick behavior shows that:

- Bearish candles are accompanied by stronger momentum compared to bullish candles;

- This indicates the relative short-term advantage of sellers.

Accordingly, the overall market outlook for USD/CAD is bearish. However, before the primary bearish move begins, there is a possibility of collecting buy-side liquidity; a move that may appear as a temporary rise and then pave the way for the continuation of the decline.

U.S. Dollar Index (DXY) Analysis

The review of the U.S. Dollar Index (DXY) shows that, as anticipated, the index has weakened and shows signs of fading bullish momentum. If the downward trend in the Dollar Index continues:

- The probability of strengthening opposing currencies increases;

- Downward pressure on USD/CAD may be maintained;

- And the market may move toward lower targets.

The weakening of DXY, as an intermarket variable, can play a significant role in sustaining the bearish USD/CAD scenario.

Conclusion

The dominant structure in the U.S. Dollar to Canadian Dollar pair remains bearish; however, before continuing the decline, the market may collect buy-side liquidity.

Weakness in the U.S. Dollar Index (DXY) reinforces this scenario; however, the primary focus under current conditions is on price behavior within the order block area, reaction to the Fair Value Gap, and the quality of momentum in upcoming moves.