Key Points:

- Ethereum is positioned within the 4-hour Order Block; a close above $2157 activates the bullish scenario toward $2208, while losing the $2031 level will strengthen the corrective path;

- BNB, after reacting to the $400 Order Block and forming a Pin Bar, is at a decision point; the type of candle close will determine the next direction;

- In the 1-hour timeframe of BNB, negative CVD divergence and a consolidation phase indicate that the market is accumulating or distributing liquidity ahead of the next move;

- In both assets, the entry of effective momentum and volume is the main condition for exiting the equilibrium phase and activating either the bullish or bearish scenario.

On February 15, 2026, both Ethereum and Binance Coin are positioned in key liquidity and Order Block zones. Ethereum, after entering the 4-hour Order Block range, is on the verge of structural determination between the $2157 and $2031 levels.

Binance Coin, following a bullish displacement move and reaction to the $400 zone, is in a condition where the candle close can define the short-term direction.

In both assets, the behavior of buy-side and sell-side liquidity plays a decisive role in the upcoming scenarios.

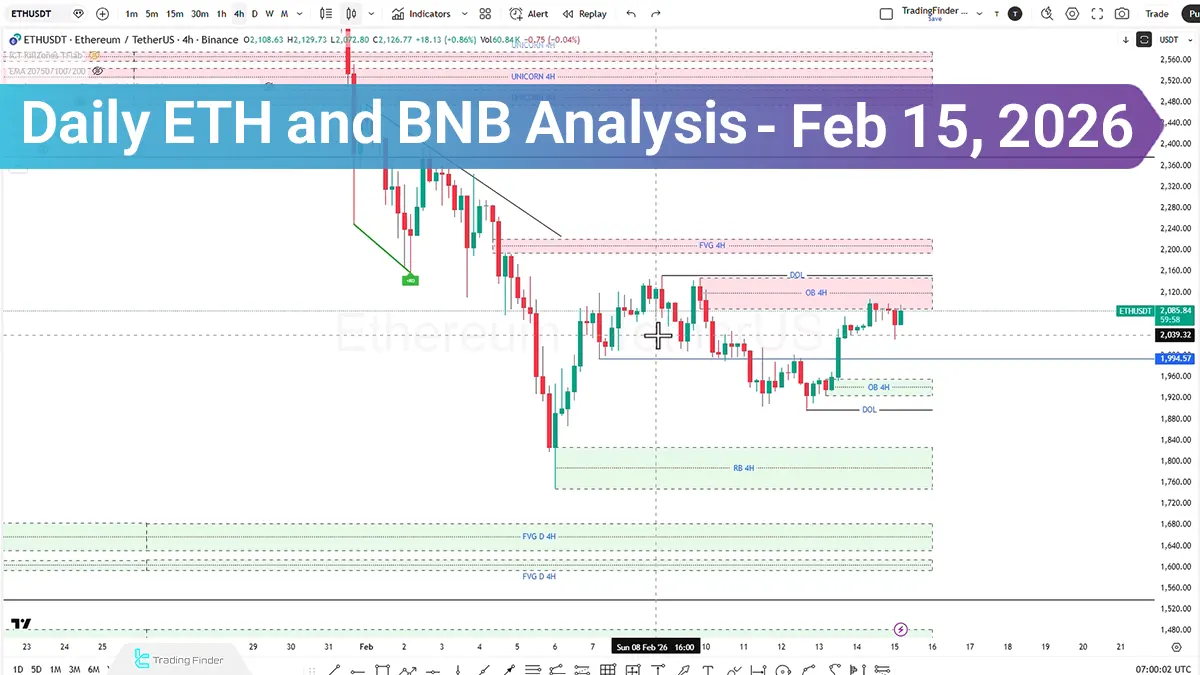

ETH Analysis in the 4-Hour Timeframe (H4)

Ethereum has entered the 4-hour Order Block with bullish momentum and is currently positioned in a sensitive liquidity zone. Within this range, a Liquidity Draw level is also present, which may act as a price magnet; the potential scenarios are as follows:

Bullish Scenario:

- If liquidity increases and effective demand enters the market, price may move upward to absorb buy-side liquidity;

- The activation condition for this scenario is a close above the $2157 level;

- If stabilization occurs above this level, a move toward the $2208 range becomes likely;

- However, upon reaching $2208, the possibility of a bearish reaction from this zone remains.

Bearish Scenario:

- If sufficient liquidity is absent and buying pressure declines, price may face selling pressure after collecting buy-side liquidity;

- In this case, the target of the move could be the collection of sell-side liquidity;

- On the bearish path, a Unicorn zone and a highly significant level are positioned, which may identify potential weakness in the downtrend and a possible market reaction.

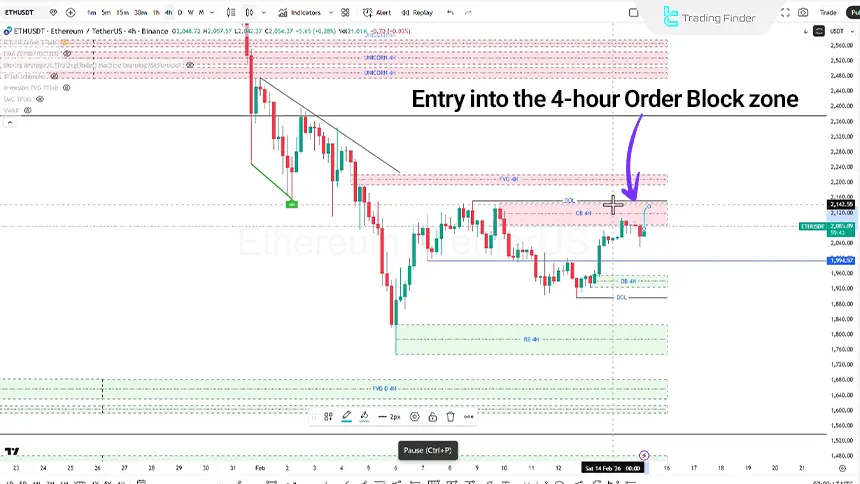

ETH Analysis in the 1-Hour Timeframe (H1)

In the 1-hour timeframe, after a compression phase and the simultaneous formation of buy-side and sell-side liquidity, price moved upward and collected buy-side liquidity.

This move led to a reaction to the 4-hour Order Block zone as well as the 1-hour area.

If price closes below the $2031 level and below the Doji candle range, the probability of testing lower levels increases.

Conversely, increasing buying pressure could activate a continuation of the bullish trend and targeting of higher levels.

Binance Coin (BNB) Analysis in the 4-Hour Timeframe (H4)

After a bullish displacement move, Binance Coin collected buy-side liquidity and reacted to the $400 Order Block zone. In this timeframe, two bullish and bearish scenarios can be examined:

- Bearish scenario: If a close occurs within the shadow of the Pin Bar candle, the probability of increased selling pressure and movement toward lower levels rises;

- Bullish scenario: If a close forms above the high of the Pin Bar candle, a renewed upward move and another collection of buy-side liquidity become likely.

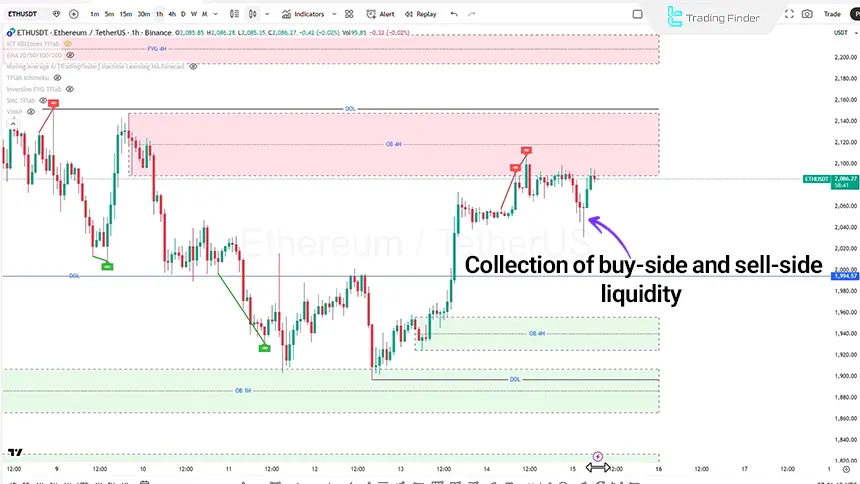

BNBUSDT Analysis in the 1-Hour Timeframe (H1)

In the 1-hour timeframe of Binance Coin, after the identification of negative divergence by the CVD Divergence indicator, the market entered a consolidation phase, while liquidity simultaneously formed on both sides of the market.

Price, through a bullish move, collected buy-side liquidity and then closed within a defined range.

Structurally, this behavior can be evaluated similarly to the Ryan Soldier strategy pattern, where upside liquidity is first collected and the market then enters an equilibrium phase within a decision zone.

At present, the market lacks sufficient momentum for a strong directional move and is primarily accumulating or distributing new liquidity.

Conclusion

Both Ethereum and Binance Coin are positioned in sensitive market structure and liquidity zones. In Ethereum, the $2157 and $2031 levels represent key scenario-defining boundaries, and the type of close relative to these levels will determine the short-term path.

In Binance Coin, the reaction to the $400 Order Block and price behavior relative to the Pin Bar Candlestick are highly significant. Under current conditions, the market is less directional and more engaged in liquidity accumulation and distribution, and the activation of either scenario depends on the entry of effective momentum and volume on one side of the market.