Forex brokers offer accounts with special features or advantages such as higher leverage or more tradable assets. These account types, categorized as professional (pro) accounts, appear by various names such as “Elite”, “Institutional”, etc. and have certain requirements for eligible traders.

The shortlist below contains the recommended choices for trading via a pro account.

| AVATRADE | |||

| FxGLORY | |||

| FxPro | |||

| 4 |  | HFM | ||

| 5 |  | Exness | ||

| 6 |  | BlackBull Markets | ||

| 7 |  | GLOBAL PRIME | ||

| 8 |  | FXTM |

Trustpilot Ratings and Reviews for Brokers

Users and traders can submit reviews and ratings for brokerages on “Trustpilot” platform. The table here ranks mentioned brokers based on these scores.

Broker Name | Trustpilot Rating | Number of Reviews |

AvaTrade | 11,877 | |

27,566 | ||

BlackBull Markets | 3,124 | |

HFM | 3,256 | |

414 | ||

FXGlory | 65 | |

FxPro | 813 | |

FXTM | 1,078 |

Minimum Spreads in Brokerages

Spreads are part of the trading costs when working with almost any broker. It is wise to choose one that has the lowest spreads among preferred choices.

Broker Name | Min. Spreads |

0 Pips | |

0 Pips | |

Axi | 0 Pips |

FXGlory | 0 Pips |

FxPro | 0 Pips |

FXTM | 0 Pips |

IG | 0.3 Pips |

Plus500 | 0.5 Pips |

Other Account Types and Leverage Limitations

The table in this section demonstrates the accounts together with leverage availability of each abovementioned broker in a certain order.

Broker Name | Account Types | Max. Leverage |

HFM | Cent, Zero, Pro, Premium | 1:2000 |

Standard, Premium, VIP, CIP | 1:3000 | |

BlackBull Markets | ECN Standard, ECN Prime, ECN Institutional | 1:500 |

Standard, Raw+, Elite | 1:500 | |

FXTM | Advantage, Stocks Advantage, Advantage Plus | 1:3000 |

Axi | Standard, Pro | 1:30 |

FP Markets | Standard, RAW | 1:500 |

Plus500 | Retail, Professional | 1:300 |

Tradable Instruments Amount in Select Brokers

Having access to a high number and variety of trading assets is an important advantage found in some brokers.

Broker Name | Number of Instruments |

BlackBull Markets | 26,000+ |

FP Markets | 10,000+ |

Plus500 | 2,800+ |

FxPro | 2,100+ |

1,250+ | |

Pepperstone | 1,200+ |

HFM | 1,000+ |

1,000+ |

Top 6 Pro Account Brokers in Detail

In the following sections, six of the recommended brokers will be reviewed briefly around their pros, cons, and trading conditions.

AvaTrade

Founded in 2006, AvaTrade has evolved into a multi-asset brokerage serving clients in over 150 countries. The broker operates under nine regulatory frameworks, including Central Bank of Ireland, ASIC, CySEC, FSCA, and ADGM, reinforcing its credibility for professional and high-volume traders.

For Pro Account holders, leverage can reach up to 1:400 (jurisdiction-dependent), while margin call and stop-out levels are set at 25% and 10%, respectively. Client funds are held in segregated accounts, and negative balance protection applies across regulated entities.

AvaTrade supports six base currencies (USD, EUR, GBP, CHF, JPY, AUD) and provides access to over 1,250 instruments, including Forex, commodities, indices, stocks, ETFs, bonds, and crypto CFDs. Execution is instant, and minimum order size starts from 0.01 lot. Furthermore, there is an AvaTrade rebate program available for fee discounts.

Professional traders can operate through MetaTrader 4, MetaTrader 5, WebTrader, mobile apps, and AvaOptions. With a $100 minimum deposit and multiple AvaTrade funding methods, the broker balances accessibility with institutional-grade infrastructure.

Table of Specifics

Account Types | Retail, Professional, Islamic, Demo |

Regulating Authorities | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, PayPal |

Maximum Leverage | 1:400 |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

AvaTrade Pros and Cons

AvaTrade’s strengths and limitations are outlined below, offering a balanced perspective for traders considering its Pro Account structure.

Pros | Cons |

Regulated across 9 jurisdictions | Pro status subject to eligibility criteria |

Negative balance protection across entities | Inactivity fees after prolonged dormancy |

Wide platform support including MT4/MT5 and AvaOptions | No PAMM account offering |

1,250+ tradable instruments across multiple asset classes | Bonuses restricted by jurisdiction |

Exness

Founded in 2008 by Petr Valov and Igor Lychagov, Exness has evolved into a global multi-asset broker with over 2,100 employees across nearly 100 countries. The company reports monthly trading volumes exceeding $4 trillion, positioning itself among the largest retail forex market makers worldwide.

Exness operates through multiple regulated entities, including Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Financial Sector Conduct Authority (FSCA), FSA Seychelles, CMA Kenya, FSC BVI, and CBCS. Client funds are segregated, and compensation schemes apply; up to £85,000 under FSCS and €20,000 under ICF.

For professional traders, the Pro Account offers spreads from 0.1 pips with zero commission, a $200 minimum deposit, and flexible leverage, which goes up to unlimited under eligibility conditions. Margin call levels start from 30%, with stop-out at 0%, supporting high-precision risk management strategies.

There is a cashback offer available. To reduce trading costs and increase your net profit, you may want to participate in the Exness rebate program, provided via TradingFinder.

Exness supports MT4, MT5, Exness Terminal (web), and Exness Trade (mobile), alongside algorithmic trading, VPS hosting, and copy trading. Over 200 instruments are available, including 96 forex pairs, stock CFDs, indices, commodities, and crypto CFDs, with execution models covering both Market and Instant Execution.

Note that similar to most other Forex brokers, to access all features and benefits, you should pass the Exness verification procedure.

Specifications and Parameters

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Maximum Leverage | Unlimited (Subject to account) |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Exness Pros and Cons

The following pros and cons summarize Exness’s strengths and limitations for traders evaluating Pro account conditions within the competitive landscape of professional forex brokerage services. These are essential to know before going through Exness registration.

Pros | Cons |

Multi-regulated (FCA, CySEC, FSCA, CMA, FSA, FSC, CBCS) | Educational resources less comprehensive than some competitors |

Pro Account spreads from 0.1 pips with no commission | Certain instruments unavailable in specific jurisdictions |

High leverage options, including unlimited (conditions apply) | Restricted in several countries |

Fast withdrawals with no deposit/withdrawal fees | REVIEWS.io rating lower than Trustpilot score |

BlackBull Markets

Founded in 2014 by Michael Walker and Selwyn Loekman, BlackBull Markets (Black Bull Group Limited) is a New Zealand-based multi-asset broker regulated by the Financial Markets Authority (FMA) and the Financial Services Authority (FSA). It provides access to over 26,000 instruments across six asset classes.

The broker offers three ECN-based accounts, including ECN Standard, ECN Prime, and ECN Institutional, featuring spreads from 0.0 pips and leverage up to 1:500. Institutional-grade pricing and Equinix NY4/LD5 infrastructure make its Pro-level environment suitable for high-volume and latency-sensitive strategies.

BlackBull supports MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, and BlackBull Invest. With nine base currencies and a $0 minimum deposit (except $20,000 for ECN Institutional), it accommodates both retail and professional traders seeking API trading, copy trading, and advanced order execution.

Client funds are held in segregated accounts with Tier-1 banking partners, and negative balance protection applies under both regulated entities.

The broker reports 24/7 multilingual support and maintains a strong reputation, reflected in a 4.8/5 Trustpilot rating from over 2,500 reviews. Note that you must pass BlackBull Markets verification to access all features.

Here’s a summary of the broker’s specifics.

Account Types | ECN Standard, ECN Prime, ECN Institutional |

Regulating Authorities | FSA, FMA |

Minimum Deposit | $0 |

Deposit Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Withdrawal Methods | Visa, MasterCard, Apple Pay, Google Pay, Bank Wire, Crypto, Neteller, Skrill, SEPA, FasaPay |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4, MT5, TradingView, cTrader, BlackBull CopyTrader, BlackBull Invest |

BlackBull Markets Pros and Cons

When evaluating BlackBull Markets for a Pro account setup, traders should balance its ultra-tight spreads, broad market range, and multi-platform integration against regional restrictions and institutional entry requirements.

Pros | Cons |

Spreads from 0.0 pips on ECN accounts | $20,000 minimum deposit for ECN Institutional |

26,000+ tradable instruments across 6 asset classes | Not available in the U.S. and several restricted regions |

Multi-platform support (MT4, MT5, TradingView, cTrader) | $5 flat withdrawal fee per transaction |

Tier-1 regulation (FMA) with segregated client funds | Offshore entity regulated under Tier-3 jurisdiction |

HFM

Founded in 2010, HFM (HF Markets) has grown into a multi-asset broker serving over 2,500,000 live accounts worldwide. With entities regulated by CySEC, FCA, DFSA, FSCA, and FSA Seychelles, it operates under a multi-jurisdictional compliance framework.

For Pro account traders, HFM offers floating spreads from 0.6 pips with zero commission on Forex pairs. Maximum leverage reaches 1:2000 under certain entities, while margin call and stop-out levels are set at 50% and 20%, respectively, supporting structured risk control.

Clients can trade CFDs across 1,000+ instruments, including Forex, indices, metals, commodities, stocks, ETFs, bonds, energies, and cryptocurrencies.

Platforms include MetaTrader 4, MetaTrader 5, and the proprietary HFM mobile app, with access to Autochartist, VPS services, and SMS market alerts. Also, an HFM copy trading feature is provided.

You can go to our HFM dashboard review to learn about the broker’s user interface. HFM supports deposits from $0 on selected accounts and offers base currencies such as USD, EUR, and USC.

Payment methods include bank wire, cards, e-wallets, and crypto (TRC20 & ERC20). Negative balance protection and segregated client funds apply across regulated entities.

Specifics and Parameters

Account Types | Cent, Zero, Pro, Premium |

Regulating Authorities | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Deposit | From $0.00 |

Deposit Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Withdrawal Methods | Wire transfer, E-payments, Credit/Debit cards, Crypto |

Maximum Leverage | 1:2000 |

Trading Platforms & Apps | MT4, MT5, Mobile App |

HFM Pros & Cons

Below, we outline HFM’s key advantages and limitations to help evaluate whether its Pro account structure aligns with professional trading requirements and capital management strategies.

Pros | Cons |

Multi-regulated across EU, UK, MENA, and Africa | Geo-restrictions in several jurisdictions |

Pro account with zero Forex commission | Limited proprietary platform ecosystem |

Maximum leverage up to 1:2000 (entity-dependent) | Inactivity fees after 6 months |

1,000+ tradable instruments across asset classes | Mixed feedback on customer support responsiveness |

Global Prime

Founded in 2010 in Australia by Jeremy Kinstlinger, Global Prime operates under the tier-1 oversight of Australian Securities and Investments Commission (ASIC) and the VFSC in Vanuatu. With 13+ years of market presence, the broker focuses on transparent pricing and institutional-grade execution for retail and professional traders.

Global Prime provides access to 150+ tradable instruments across Forex, Indices, Commodities, Crypto CFDs, Bonds, and 100+ US Share CFDs. Raw spreads start from 0.0 pips, with a $3.5 commission per side on the Raw account, while the Standard account offers commission-free trading from 0.9 pips.

It’s worth noting that you may participate in the Global Prime rebate program for reduced trading costs.

Client funds are held in segregated accounts with HSBC and National Australia Bank (NAB). Under ASIC regulation, leverage is capped at 1:30 for retail clients, while international clients under VFSC may access up to 1:500 leverage. A dedicated “Pro Trading” mode enables qualified Australian traders to unlock higher leverage tiers.

The broker supports MT4 across desktop, web, and mobile, with execution speeds from 10 milliseconds. Additional features include Autochartist signals, ZuluTrade integration, TradingView Premium promotions, 20+ payment methods, and zero deposit or withdrawal fees.

Features and Details

Account Types | Standard, Raw |

Regulating Authorities | VFSC, ASIC |

Minimum Deposit | From $0.00 |

Deposit Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, FasaPay, Perfect Money, Bank Wire, etc. |

Withdrawal Methods | Credit/Debit Cards, Crypto, PayPal, Neteller, Skrill, AstroPay, Perfect Money, Bank Wire |

Maximum Leverage | 1:500 |

Trading Platforms & Apps | MT4 |

Global Prime Pros & Cons

For traders evaluating Pro Account Forex Brokers, Global Prime combines regulatory depth, fast execution, and flexible leverage structures. Below is a balanced review of its main advantages and limitations.

Pros | Cons |

Regulated by ASIC (Tier-1 authority) | Only MT4 platform currently available |

Raw spreads from 0.0 pips with transparent commission model | No Islamic (swap-free) account |

Segregated funds with HSBC & NAB | Restricted access for clients from certain jurisdictions |

20+ fee-free deposit & withdrawal methods | No proprietary copy trading platform |

FXGlory

Founded in 2011 and headquartered in Saint Lucia, FXGlory operates as an international forex broker offering exceptionally high leverage of up to 1:3000. With a $1 minimum deposit and four account types, including Standard, Premium, VIP, and CIP, it targets traders seeking flexible capital requirements and scalable exposure.

FXGlory provides access to currencies, metals, and oil CFDs through MetaTrader 4 and MetaTrader 5, supporting Expert Advisors (EAs), one-click trading, and custom indicators. Micro-lot trading from 0.01 lot and swap-free accounts expand accessibility for both retail and Islamic traders. To learn more about the FXGlory trading platforms, go to the linked page.

Spreads vary by FXGlory account types, starting from 2.0 pips on Standard and narrowing to 0.1 pips on CIP accounts, with zero commission across all tiers. Execution models include both Market Execution and Instant Execution, while a 50% deposit bonus (capped at $2,000) enhances initial margin capacity.

Despite competitive leverage and bonus structures, FXGlory is not regulated by major authorities such as the FCA or CySEC.

It is registered in Saint Lucia but does not provide segregated funds, investor compensation schemes, or negative balance protection, which are factors that materially affect its risk profile. The table below summarizes the broker’s specifications.

Account Types | Standard, Premium, VIP, CIP |

Regulating Authorities | None |

Minimum Deposit | $1 |

Deposit Methods | Wire Transfer, Credit/Debit Card, PayPal, NETELLER, Payza, Skrill, OKPAY, Webmoney, Sticpay, Perfect Money, CryptoCurrency, Zelle |

Withdrawal Methods | Wire Transfer, Credit/Debit Card, PayPal, NETELLER, Payza, Skrill, OKPAY, Webmoney, Sticpay, Perfect Money, CryptoCurrency, Zelle |

Maximum Leverage | 1:3000 |

Trading Platforms & Apps | Metatrader 4, Metatrader 5 |

FXGlory Pros and Cons

FXGlory’s trading conditions emphasize high leverage, micro-lot flexibility, and commission-free pricing, while regulatory absence and withdrawal fee structures require careful evaluation. Below is a structured breakdown of its primary strengths and limitations.

Pros | Cons |

Extremely high leverage up to 1:3000 | No regulation by major financial authorities |

$1 minimum deposit for Standard account | No investor compensation fund or segregated funds |

Zero commission on all account types | Limited tradable instruments (Forex, metals, oil only) |

Spreads from 0.1 pips on CIP accounts | Relatively high withdrawal fees on certain methods |

How We Selected Each Broker in the Shortlist

Selecting the Best Pro Account Forex Brokers requires more than comparing spreads or leverage. At TradingFinder, our evaluation is built on a structured, data-driven framework designed to measure transparency, execution quality, and long-term broker reliability.

Traders entrust brokers with significant capital in Pro accounts, so our review process prioritizes security, cost efficiency, and institutional-grade trading conditions.

Our analysts apply a proprietary 19-metric review methodology covering core pillars such as Regulations and Licenses, Broker Summary, Account Types Variety, and Variety of Tradable Symbols.

We verify supervision by recognized authorities (e.g., FCA, ASIC, CySEC) and assess whether client funds are protected through segregation and compensation schemes. For Pro accounts, we closely examine raw spreads, commission structures, execution models (ECN/STP), and liquidity depth.

Cost transparency is evaluated through detailed analysis of Commissions and Fees, Deposits and Withdrawals, and inactivity policies. We test platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, measuring order execution speed, slippage behavior, and platform stability.

Our team also reviews account opening and KYC verification efficiency, copy trading infrastructure, and risk management tools.

Beyond trading conditions, we assess Customer Support responsiveness, Trustpilot Score credibility, global office presence, educational resources, scam alerts, and broker responses to user complaints. Each metric is weighted according to its real impact on trader performance.

This comprehensive methodology ensures that every broker listed in our Best Pro Account Forex Brokers ranking meets strict standards for regulation, execution quality, and overall trading experience.

What is a Pro Account?

A Pro account in forex trading is a broker account type designed for experienced traders who require tighter spreads, faster execution, and institutional-style pricing. Unlike standard accounts,

Pro accounts typically offer raw or near-raw spreads, often starting from 0.0-0.2 pips on major currency pairs like EUR/USD, with commissions either reduced or structured separately per lot.

Pro accounts are commonly associated with ECN (Electronic Communication Network) or advanced STP execution models. This means orders are routed directly to liquidity providers, reducing dealing desk intervention and improving pricing transparency.

As a result, Pro accounts are frequently used by scalpers, algorithmic traders, and high-volume participants who depend on low latency and minimal slippage.

Minimum deposit requirements for Pro accounts are generally higher than for standard accounts, often ranging from $200 to $1,000 or more, depending on the broker. Leverage levels vary based on regulatory jurisdiction (e.g., ESMA limits in the EU vs. higher leverage in offshore regions).

Many brokers provide access to platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, along with advanced order types and depth-of-market (DOM) functionality.

In practice, a Pro Account is structured to reduce trading costs per lot and optimize execution quality, making it suitable for traders who prioritize precision, scalability, and competitive pricing in the global forex market.

What are the Pros and Cons of Trading with a Pro Account?

A Pro account is structured for traders who require institutional-style pricing, tighter spreads, and faster execution. While it can significantly reduce trading costs for high-volume strategies, it often involves commission-based pricing and higher entry requirements.

Understanding the cost structure, execution model (ECN/STP), and capital thresholds is essential before choosing this account type.

Pros | Cons |

Tighter spreads on major currency pairs | Commission charged per traded lot |

Faster order execution speeds | Higher minimum deposit requirements |

Suitable for scalping and automated trading | More complex cost calculation |

Greater pricing transparency | Less beginner-friendly structure |

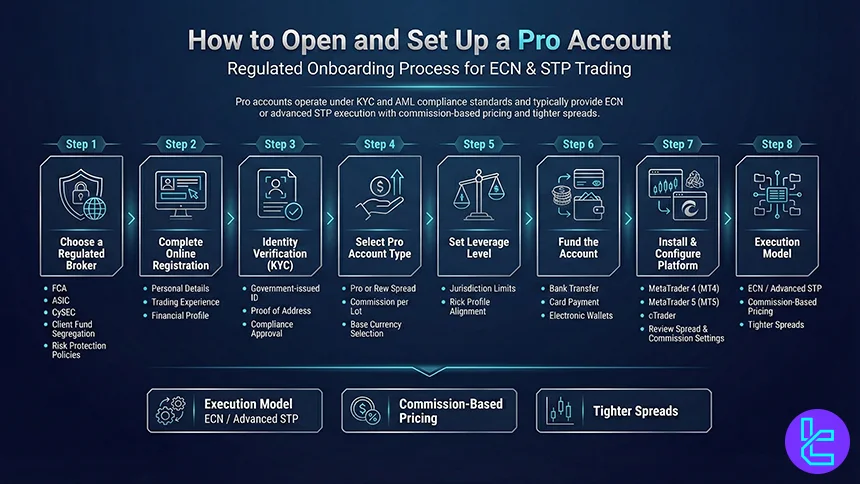

How Can I Open and Set Up a Pro Account?

Opening a Pro account involves a regulated onboarding process aligned with KYC and AML requirements. Since Pro accounts typically offer ECN or advanced STP execution with commission-based pricing and tighter spreads, brokers may apply stricter funding thresholds and verification standards compared to Standard accounts.

Here are the steps and instructions to a pro account setup.

- Choose a regulated broker: Confirm supervision under recognized authorities such as FCA, ASIC, or CySEC, and review client fund segregation and risk protection policies;

- Complete online registration: Submit personal details, trading background information, and financial profile as required by the broker;

- Verify identity (KYC): Upload a government-issued ID and proof of address to meet compliance standards;

- Select the Pro Account type: Choose the Pro or Raw Spread option, review commission per lot, and select your preferred base currency;

- Set leverage level: Select leverage within regulatory limits based on your jurisdiction and risk profile;

- Fund the account: Deposit the required minimum capital via bank transfer, card payment, or approved electronic wallets;

- Install and configure the trading platform: Access MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader, adjust trading settings, and review cost parameters before executing trades.

Do Pro Accounts Have Wide Spreads?

In most cases, Pro Accounts do not have wide spreads. They are specifically designed to offer tighter pricing compared to Standard accounts. Many brokers provide raw or near-raw spreads on Pro accounts, with minimum spreads often starting from 0.0 pips on major currency pairs such as EUR/USD during high-liquidity market sessions.

However, Pro accounts typically operate on a commission-based pricing model. Instead of widening the spread to include broker compensation, the broker charges a fixed commission per lot traded (for example, $3-$7 per standard lot per side, depending on the broker and jurisdiction).

As a result, traders must calculate the total trading cost, which includes both the spread and the commission.

Spread levels on Pro accounts can still fluctuate due to market conditions. During major news releases, low-liquidity sessions, or periods of high volatility, spreads may temporarily widen regardless of the account type. Liquidity depth, execution model (ECN or STP), and the broker’s liquidity providers also influence real-time pricing.

Overall, Pro accounts are structured to provide tighter average spreads and more competitive pricing, especially for high-volume traders, scalpers, and algorithmic strategies that rely on low transaction costs.

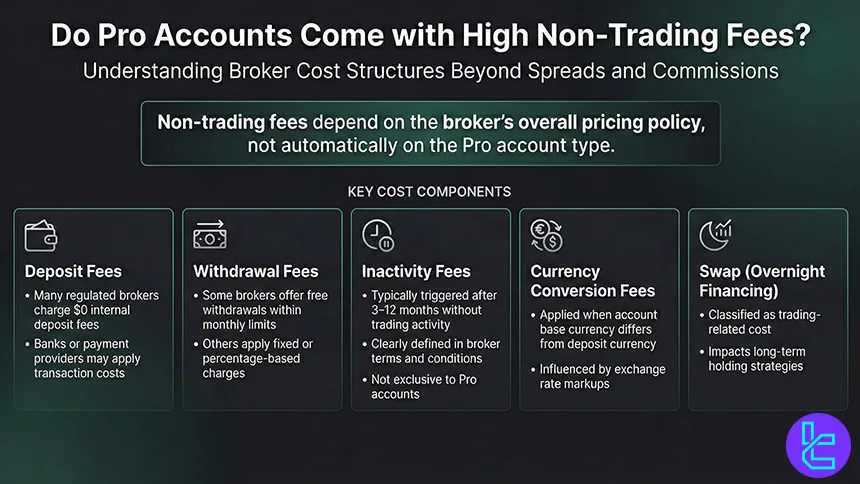

Do Pro Accounts Come with High Non-Trading Fees?

Pro Accounts generally do not automatically come with high non-trading fees, but the cost structure depends on the broker’s overall pricing policy rather than the account type itself. Non-trading fees typically include charges such as deposit and withdrawal fees, inactivity fees, currency conversion costs, and overnight financing (swap) adjustments.

Many regulated forex brokers do not charge internal deposit fees, although third-party payment providers or banks may apply transaction costs. Withdrawal fees vary: some brokers offer free withdrawals up to a certain limit per month, while others apply fixed or percentage-based charges depending on the method used.

Inactivity fees are more common and may apply if no trading activity occurs for a defined period, often ranging from 3 to 12 months. These fees are not exclusive to Pro accounts and are usually outlined clearly in the broker’s terms and conditions.

Currency conversion fees may also apply if the trading account base currency differs from the deposit currency. Additionally, overnight swap charges are considered trading-related costs rather than non-trading fees, though they can impact long-term holding strategies.

Overall, Pro accounts are primarily optimized for trading cost efficiency through tighter spreads and commissions, while non-trading fees depend largely on the broker’s broader operational policies.

Who Should Trade with Pro Accounts?

A Pro Account is primarily suited for experienced traders who require tighter spreads, transparent commission-based pricing, and faster execution speeds.

Because this account type is commonly structured around ECN or advanced STP execution models, it is designed for participants who actively manage risk and calculate total trading costs (spread + commission).

Pro accounts are generally appropriate for:

- High-volume traders: Those executing multiple standard lots per session benefit from lower average spreads and reduced cost per pip;

- Scalpers: Strategies targeting small price movements require minimal spread and low-latency execution;

- Algorithmic and EA users: Traders using automated systems on MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader often prefer raw pricing environments;

- Intraday and short-term traders: Reduced transaction costs improve risk-reward efficiency for frequent entries and exits;

- Professionals managing larger capital allocations: Traders with higher account balances who can meet minimum deposit requirements typically gain greater cost efficiency.

Conversely, Pro accounts may not be ideal for beginners or very low-volume traders. Since commissions are charged per lot, traders placing small or infrequent positions may not experience a meaningful cost advantage over Standard accounts.

In summary, Pro accounts are structured for disciplined, strategy-driven traders who prioritize execution quality, cost transparency, and scalability within the global forex market.

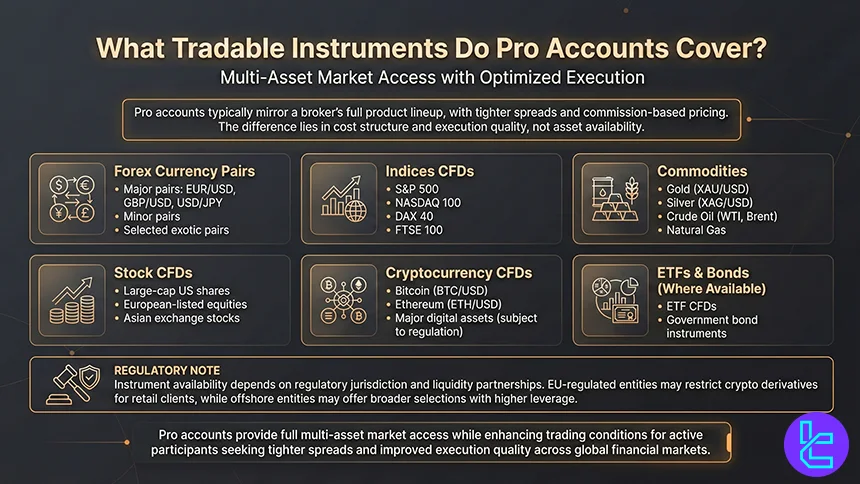

What Tradable Instruments Do Pro Accounts Cover?

Pro Accounts generally provide access to the same range of tradable instruments available under a broker’s broader product offering, but with tighter spreads and commission-based pricing. The difference lies in cost structure and execution quality rather than asset availability.

Most regulated forex brokers offering Pro accounts cover major global markets, including:

- Forex currency pairs: Major pairs (EUR/USD, GBP/USD, USD/JPY), minor pairs, and selected exotic pairs

- Indices CFDs: Popular benchmarks such as S&P 500, NASDAQ 100, DAX 40, and FTSE 100

- Commodities: Gold (XAU/USD), silver (XAG/USD), crude oil (WTI, Brent), and natural gas

- Stock CFDs: Shares of large-cap companies listed on US, European, and Asian exchanges

- Cryptocurrency CFDs: Bitcoin (BTC/USD), Ethereum (ETH/USD), and other major digital assets, depending on regulatory restrictions

- ETFs and bonds (where available): Select brokers also provide ETF CFDs and government bond instruments

Availability depends on the broker’s regulatory jurisdiction and liquidity partnerships. For example, EU-regulated entities may limit crypto derivatives for retail clients, while offshore branches may offer a broader selection with higher leverage.

In essence, Pro accounts typically mirror the broker’s full multi-asset lineup but optimize trading conditions for active and professional-style participants seeking lower spreads and improved execution across global financial markets.

Pro Accounts vs. Other Common Account Types

Pro accounts are generally positioned between retail-focused Standard accounts and commission-based ECN accounts.

While they operate in base currency denominations like Standard and ECN accounts, Pro accounts typically offer tighter spreads, optimized execution models (often STP or hybrid), and lower or zero commissions depending on the broker.

Compared to Cent accounts, which are structured for micro-capital exposure, Pro accounts target experienced traders seeking improved pricing conditions without always paying full ECN-style commissions. The table below outlines the structural, cost, and execution differences across these four common forex account types.

Parameters | Pro Account | Cent Account | Standard Account | ECN Account |

Balance Denomination | Base currency | Cents (e.g., $10 = 1,000 cents) | Base currency (USD, EUR, etc.) | Base currency |

Typical Minimum Deposit | $200 - $1,000+ | $0 - $50 | $50 - $200 | $100 - $500 |

Lot Size Structure | Standard lots with optimized execution | Micro lots (0.01) or smaller | Mini & standard lots (0.01-1.0) | Raw lot sizes with direct liquidity |

Spreads (Major Pairs) | 0.1 - 0.8 pips (floating) | 1.0 - 2.0+ pips (floating) | 0.8 - 1.5 pips (floating) | 0.0 - 0.3 pips (raw) |

Commission Model | Low or zero commission (broker-dependent) | Usually spread-only | Usually spread-only | Commission per lot ($3–$7 RT typical) |

Execution Model | STP / Hybrid | Market Maker / Hybrid | Market Maker / STP | True ECN / NDD |

Max Leverage (Offshore) | 1:200 - 1:500 | 1:500 - 1:2000+ | 1:500 - 1:1000 | 1:200 - 1:500 |

Max Leverage (Tier-1 Reg.) | 1:200 – 1:500 | 1:30 | 1:30 | 1:30 |

Instrument Availability | Full offering | Limited to core FX & CFDs | Full retail offering | Full offering with deeper liquidity |

Target Trader Profile | Experienced discretionary traders | Beginners, low-capital traders, EA testing | Retail traders | Scalpers, high-volume traders |

Typical Stop-Out Level | 20% - 30% | 20% - 50% | 20% - 50% | 20% - 30% |

Slippage Sensitivity | Lower | Moderate | Moderate | Lower (direct liquidity access) |

Conclusion

Pro accounts, usually offered by brokers regulated by top-tier financial supervisors, provide higher leverage and other benefits in exchange for reduced investor compensation protection.

Also, it has a higher initial deposit threshold and other requirements for the trader. AvaTrade, Exness, BlackBull Markets, and HFM are the best brokers you can find offering Pro accounts.

To learn about our approach when choosing recommended brokerages, visit our Forex methodology page.