Important Note: Based on the latest user reviews, the TradingFinder team considers A3 Trading a scam broker. Multiple reports of this broker freezing clients' funds and disabling withdrawals exist. We strongly advise traders to do their due diligence before using this broker's services.

A3 Trading offers CFD trading across 5 asset classes, including Forex and Crypto. The minimum deposit and the maximum leverage option are $200 and 1:200, respectively. The broker supports the Xcite trading platform.

A3 Trading; Company Information and Regulation [FSA]

A3 Trading was founded in 2021 in Nicosia, Cyprus. The broker provides online trading services to a global clientele. The website operates through two legal entities registered in different jurisdictions: Wanakena Ltd and Securcap Securities Limited.

The broker’s sole license was acquired through Securcap Securities Limited from the Seychelles Financial Services Authority (FSA). However, at the time of writing this A3 Trading review, the license was expired. It was valid till 10th February 2025.

The table below highlights A3 Trading’s company registration and regulatory details:

Parameter | A3 Trading (FSA Entity) |

Regulation | Seychelles FSA, license SD007 |

Regulation Tier | Tier-2 (offshore regulation) |

Country / Jurisdiction | Seychelles (Victoria) |

Investor Protection Fund | Not available under FSA |

Segregated Funds | Yes, client funds kept separate |

Negative Balance Protection | Yes, for retail clients |

Maximum Leverage | Up to 1:400 |

Client Eligibility | International clients outside strict EU/US zones |

A3 Trading Broker Specifications

The Forex broker offers access to online trading services for a minimum deposit of $200. Let’s take a brief look into A3 Trading's features.

Broker | A3 Trading |

Account Types | Real |

Regulating Authorities | FSA (Expired) |

Based Currencies | USD |

Minimum Deposit | $200 |

Deposit Methods | VISA, MasterCard, Maestro, JioMoney, Oxigen, Skrill, Neteller, EcoPayz, PaySafeCard, Paytm, Globe Pay, Google Pay, Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:200 |

Investment Options | None |

Trading Platforms & Apps | Xcite |

Markets | Currencies, Commodities, Cryptocurrencies, Stocks, Indices |

Spread | Variable based on the instrument |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Mobile Trading, CFDs |

Affiliate Program | Yes |

Bonus & Promotions | Risk-Free Trades |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Phone, WhatsApp, Ticket |

Customer Support Hours | N/A |

A3Trading Accounts

The company offers a single Real trading account type with the following features:

- Minimum Deposit: $200

- Leverage: Up to 1:200

- Trading Instruments: Forex, CFDs on stocks, indices, commodities, and cryptocurrencies

- Platform: Xcite

The lack of account variety may not cater to the different needs and experience levels of traders.

A3 Trading Pros & Cons

Given the regulatory concerns and user complaints, opening an account with A3 Trading carries significant risks. However, it has upsides too.

Pros | Cons |

Wide range of tradable assets | High entry barrier ($200) |

First protected positions feature | Expired license |

Mobile trading app | Lack of transparency in fees |

No commission trading | Not a standard or widely-used trading platform |

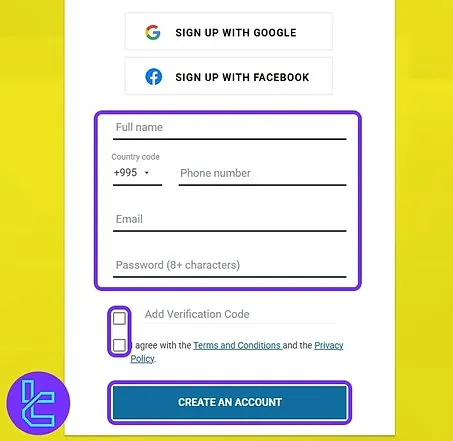

How to Open and Verify an Account?

Opening an account with A3 Trading is completed in four steps. The process begins on the official A3 Trading Registration page, where clients enter their personal details before moving to KYC verification.

Opening account on A3 Trading steps:

- Visit the A3Trading official website and click Open Account;

- Complete the registration form with personal details;

- Confirm your email or phone number (optional);

- Log in to the client dashboard to access your account.

#1 Visiting the A3Trading Website

The first step is to access the official A3Trading homepage. Once there, you need to click the Open Account button, which is clearly displayed on the landing page.

This action redirects you to the registration form where you begin the sign-up process.

#2 Filling Out the Registration Form

After clicking the sign-up button, you must enter personal information accurately. This includes your name, contact details, and a secure password. You can either register manually or use your Google and Facebook accounts for faster access.

Here's the simple 5 steps:

- Enter first and last name;

- Provide a valid email address;

- Add your mobile phone number;

- Create a secure password;

- Accept the terms and click Create Account.

#3 Logging into Your Dashboard

Once the form is submitted, A3Trading instantly creates your account. The login requires only your registered email and password, and from there you can access the dashboard.

This secure space is where you manage trades, deposits, and personal settings.

Follow these steps to make it complete:

- Use email and password to log in;

- Access the trading dashboard immediately;

- Explore account features and funding options.

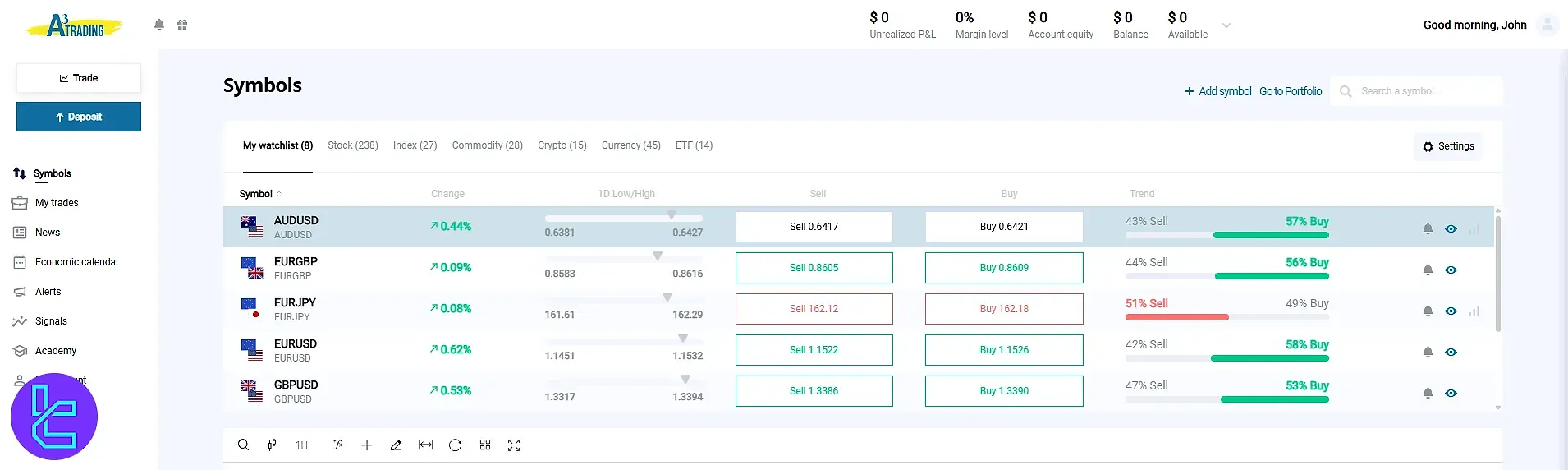

A3 Trading Broker Platforms

The broker has partnered with Tiebreak Solutions to provide access to the not well-known Xcite platform available across various devices, including:

- Xcite Android

- Xcite iOS

- Web Xcite

Fees and Commissions

Offering commission-free trading is one of the upsides in this A3 Trading review. The broker has a fixed spread structure. It also charges rollover or swap rates.

- Swap fee of 0.02% on CFDs (Indices, Currencies, Stocks, and Commodities)

- Swap fee of 0.1% on Crypto CFDs

- No commissions

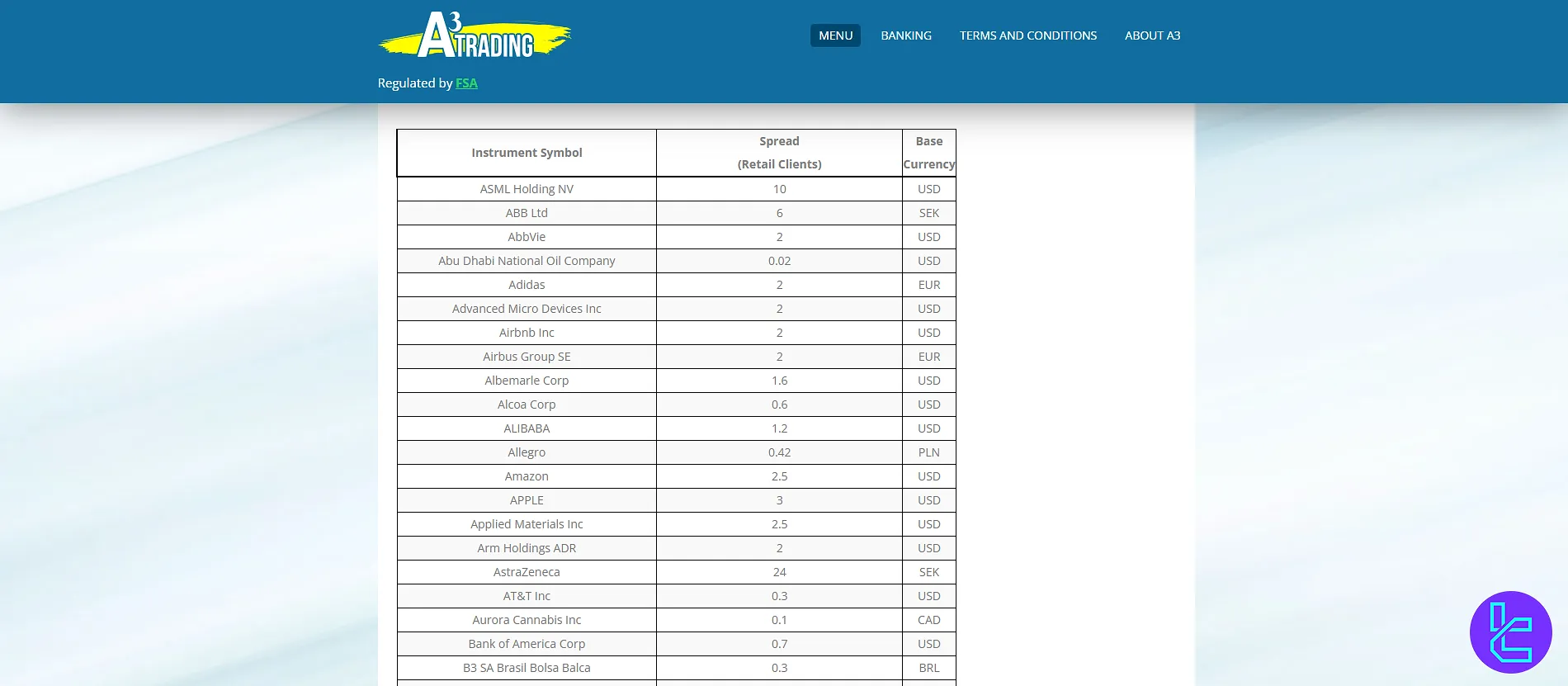

The table below provides the spread data on some of the most popular trading instruments:

Trading Instrument | Spread (pips) |

BRENT | 0.2 |

NGAS | 0.04 |

AUDCAD | 0.001 |

EURUSD | 0.0004 |

GBPUSD | 0.0004 |

DAX | 7.00 |

DOW | 35.00 |

Swap Fees

At A3 Trading, swap fees are charged for positions held overnight, reflecting the interest rate differential between currencies or assets. A3 Trading swap fees:

- Swap Long: Applied when holding buy trades overnight, which can either be a debit or credit depending on the instrument;

- Swap Short: Applied when holding sell trades overnight, also varying by currency and market conditions.

These swaps are automatically calculated daily and credited or debited to the trader’s account.

Non-Trading Fees

A3 Trading applies certain non-trading fees to cover administrative costs. Deposits are generally free, though third-party providers may impose charges. Withdrawals may incur standard payment processing fees depending on the method.

Importantly, an inactivity fee of $10 per month is deducted from accounts inactive for over 90 days. Refunds are offered for bank transfers above $1,000, while blockchain network fees for crypto payments are non-refundable.

Deposit and Withdrawal Methods

A3 Trading requires a minimum deposit of US$200 to open a real trading account. Clients may fund their accounts via credit/debit cards, bank transfers, and various e-wallets.

All deposit currencies are converted into the account’s base currency, which is USD. Withdrawal methods are more limited primarily bank transfer is confirmed.

Deposit Options

Here are verified deposit methods for A3 Trading with known limits and currencies.

The table below shows true deposit options for A3 Trading:

Option | Accepted Currencies | Min. Deposit |

Bank Transfer | USD, EUR, GBP, etc. | US$200 |

Credit / Debit Cards | USD, EUR, GBP | US$200 |

E-wallets (Neteller, Skrill) | USD, EUR, GBP etc. | US$200 |

Withdrawal Solutions

Verified withdrawal method(s) for A3 Trading based on public information are shown below. Some details (fees, processing times) are not fully disclosed.

The table below shows known withdrawal solutions for A3 Trading:

Withdrawal Solution | Processing Time | Withdrawal Fee |

Bank Transfer | (not publicly confirmed) | (not publicly confirmed) |

Does A3 Trading Offer Copy Trading or Growth Plans?

Based on available information, A3Trading does not offer copy trading or managed growth plans. The broker focuses on self-directed trading through its Xcite platforms.

Trading Instruments

A3 Trading gives its clients access to a broad selection of tradable assets, enabling both diversification and strategy flexibility.

Traders can choose from over 50 Forex pairs, including majors like EUR/USD and GBP/USD as well as minors and exotics.

The broker also supports global indices such as the S&P 500 and DE40, commodities like gold, silver, and crude oil, and a growing list of cryptocurrencies including Bitcoin and Ethereum.

All instruments are available via CFDs, allowing traders to use leverage up to 1:400 depending on the asset class. This mix positions A3 Trading competitively for both beginners and experienced traders seeking exposure across multiple markets.

The table below summarizes the asset classes offered by A3 Trading:

Asset Class | Type of Instruments | Number of Symbols | Max. Leverage | Competitor Average |

Forex | Major, Minor & Exotic Currency Pairs | 50+ Pairs | Up to 1:400 | 50–70 Pairs |

Indices | CFDs on Global Indices (S&P 500, DE40, EUR50) | Around 14 Indices | Up to 1:200 | 10–20 Indices |

Commodities | CFDs on Metals & Energies (Gold, Oil, Silver) | 15+ Instruments | Up to 1:200 | 10–20 Instruments |

Cryptocurrencies | CFDs on Bitcoin, Ethereum & Others | 10+ Coins | Up to 1:10 | 5–15 Coins |

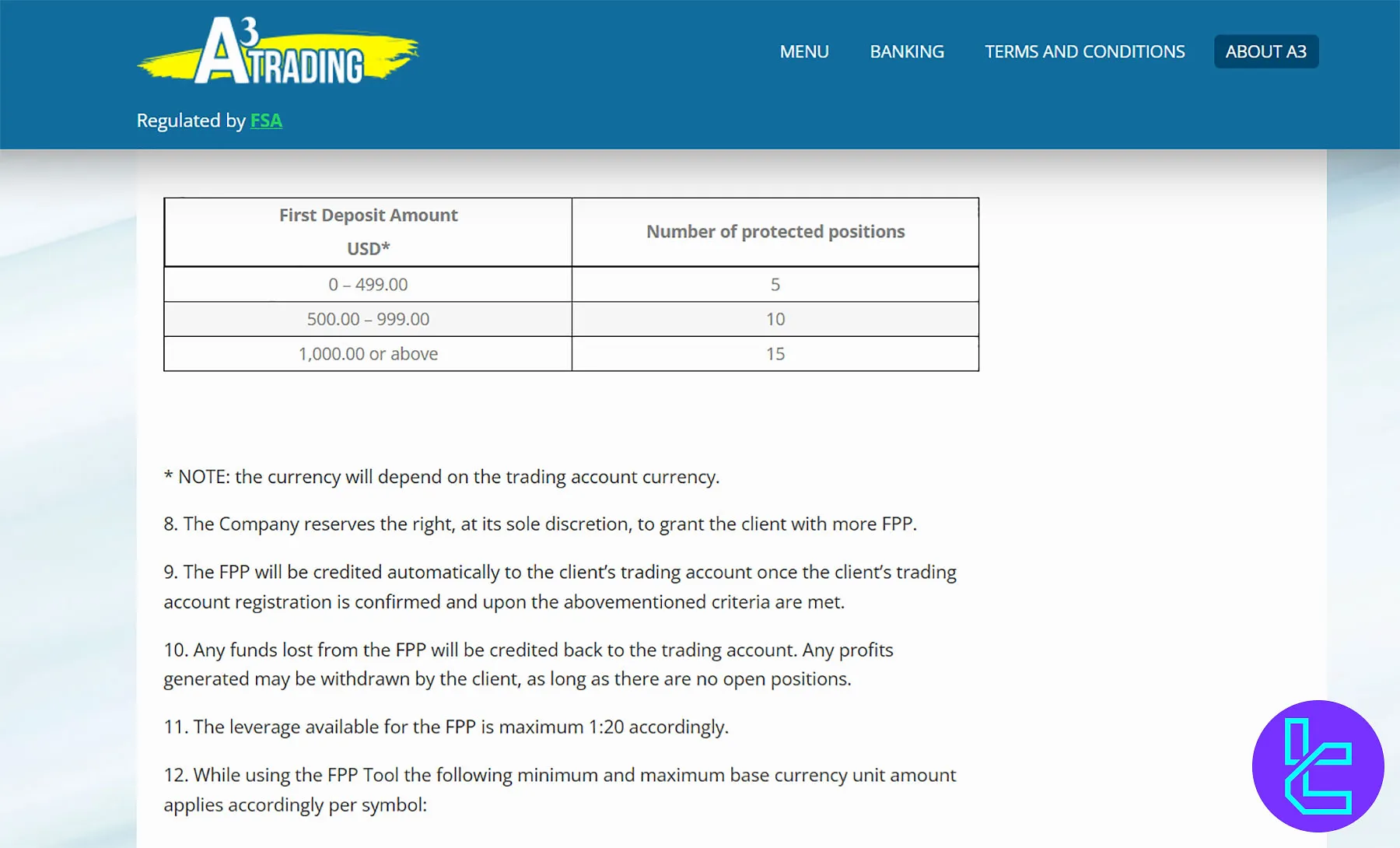

A3 Trading Promotional Offerings

The broker offers a “First Protected Positions” feature and a comprehensive affiliate program. Key points about the “First Protected Positions” tool:

- Available to new accounts with a minimum deposit of $200

- 5 risk-free positions for deposits between $200 to $499

- 10 risk-free positions for deposits between $500 to $999

- 15 risk-free positions for deposits above $1,000

Awards

As of the latest public records, A3 Trading has not received any major awards, recognitions, or industry honours from well-known financial or trading award bodies.

A3 Trading Broker Customer Support

The company provides various support channels, including email, call center, WhatsApp, and a ticket system.

customer.service.en@a3trading.com | |

Phone | +441519471242 |

WhatsApp Number | +447418350420 |

Ticket | Available on the Contact Us page |

Restricted Countries

A3 Trading doesn’t provide trading services in any jurisdictions where such services are not authorized. However, its website hasn’t disclosed any specific countries. It probably doesn’t accept clients from the United States, EEA, Iran, and North Korea.

Trust Scores

The A3 Trading Trustpilot profile is unclaimed. There are 11 comments, mostly negative, resulting in a poor score of 2.3 out of 5.

A3Trading Broker Educational Materials

The company offers a range of educational materials for traders of all levels, including:

- Trading for Beginners: Basic concepts of online trading

- Advanced Traders Course: In-depth market analysis techniques

- Video Lessons: Step-by-step tutorials on platform usage and market analysis techniques

Conclusion and Final Words

A3 Trading charges fixed spreads (e.g., 0.0004 for EURUSD) and a 0.02% rollover fee on CFDs, except for cryptocurrency CFDs, which incur a swap rate of 0.1%. The broker has a poor score of 2.3 out of 5 on Trustpilot.