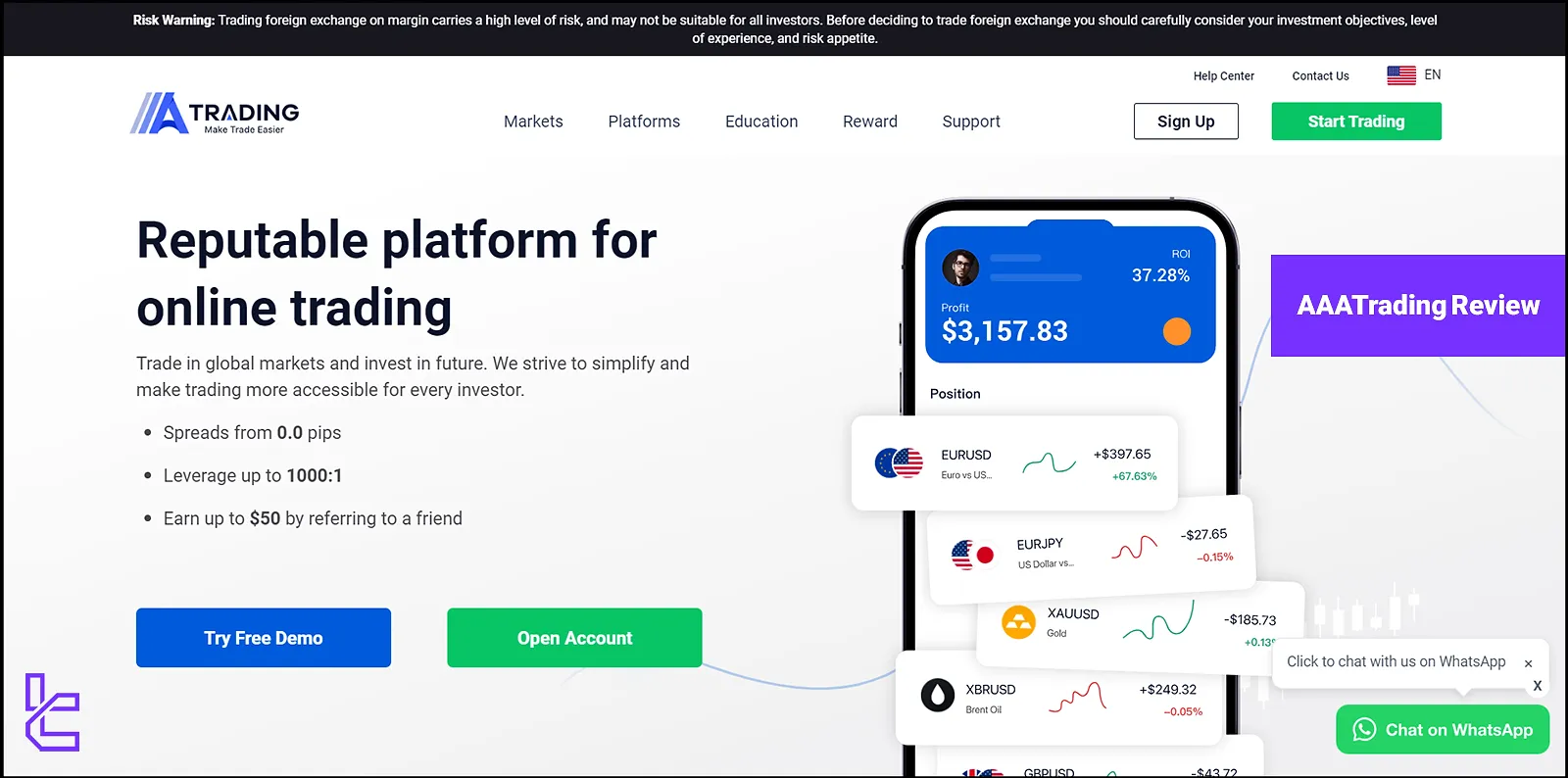

AAATrading has partnered with HSBC, Goldman Sachs, and Citibank liquidity providers to offer tight spreads from 0.0 pips and commission-free Stock trading for a minimum deposit of $25.

Traders can execute trades on MetaTrader 5, browser-based Web Terminal, and AAA Trading mobile app, with 75+ built-in indicators, one-click order entry, price alerts, market sentiment, and daily analysis.

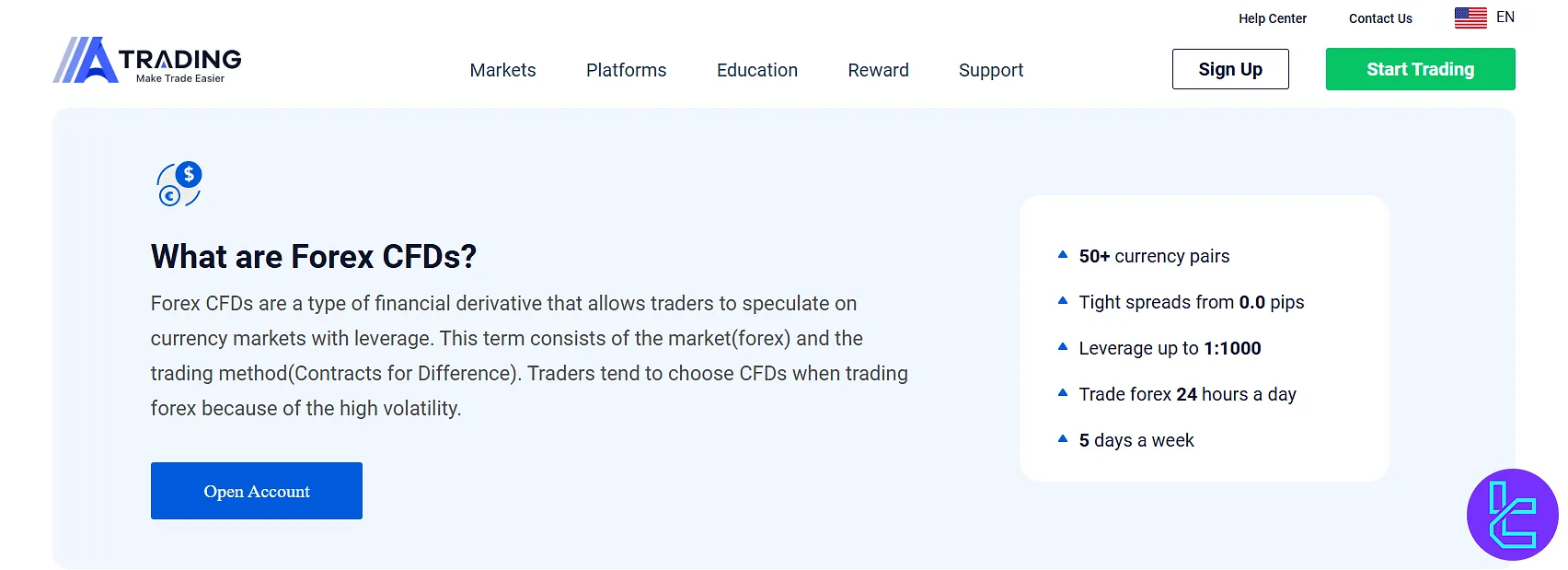

Tradable markets span 50+ FX pairs (e.g., EURUSD, GBPUSD, USDJPY), indices such as NAS100, AUS200, EU50, JPN225, metals/energies like Gold, Silver, Brent Oil, and crypto-CFDs on BTC, ETH, XRP, BCH.

The maximum for various instruments include: up to 1:1000 for Forex and commodities, up to 1:50 on indices, and up to 1:20 for stocks.

AAATrading Company Information & Regulation Status

AAATrading is a FinTech company that uses the liquidity providers like:

- P.Morgan

- HSBC

- Goldman Sachs

- and Citibank

This Forex broker is regulated by the SCB financial entity in Bahamas which isn’t a tier-1 regulating authority and has limited oversight on the companies’ activities.

The table below summarizes the regulation and company structure of AAATrading:

Parameter / Branches / Entity | AAA Trading Limited |

Regulation | Securities Commission of The Bahamas (SCB) |

Regulation Tier | 2 |

Country / Jurisdiction | The Bahamas |

Investor Protection Fund | No |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | Up to 1:1000 |

Client Eligibility | Global |

AAATrading Broker Summary of Specifics

Here's a concise summary of AAATrading's key specifics:

Broker | AAATrading |

Account Types | VIP, Standard, Demo |

Regulating Authorities | CySec |

Based Currencies | USD |

Minimum Deposit | $25 |

Deposit Methods | Credit/Debit Cards, Crypto, Neteller, Skrill |

Withdrawal Methods | Bank Transfer, Credit/Debit Cards, Neteller, Skrill |

Minimum Order | 0.01 |

Maximum Leverage | 1:1000 |

Investment Options | No |

Trading Platforms & Apps | MT5, WebTrader, AAATrading App |

Markets | Forex, commodities, Indices, Stock |

Spread | From 0.0 |

Commission | From $0 |

Orders Execution | Market |

Margin Call/Stop Out | 70/50% |

Trading Features | API, Signal Trading |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Phone, Call back, Email, WhatsApp |

Customer Support Hours | 24/5 |

This comprehensive offering positions AAATrading as a versatile broker capable of meeting the needs of both beginners and seasoned traders alike.

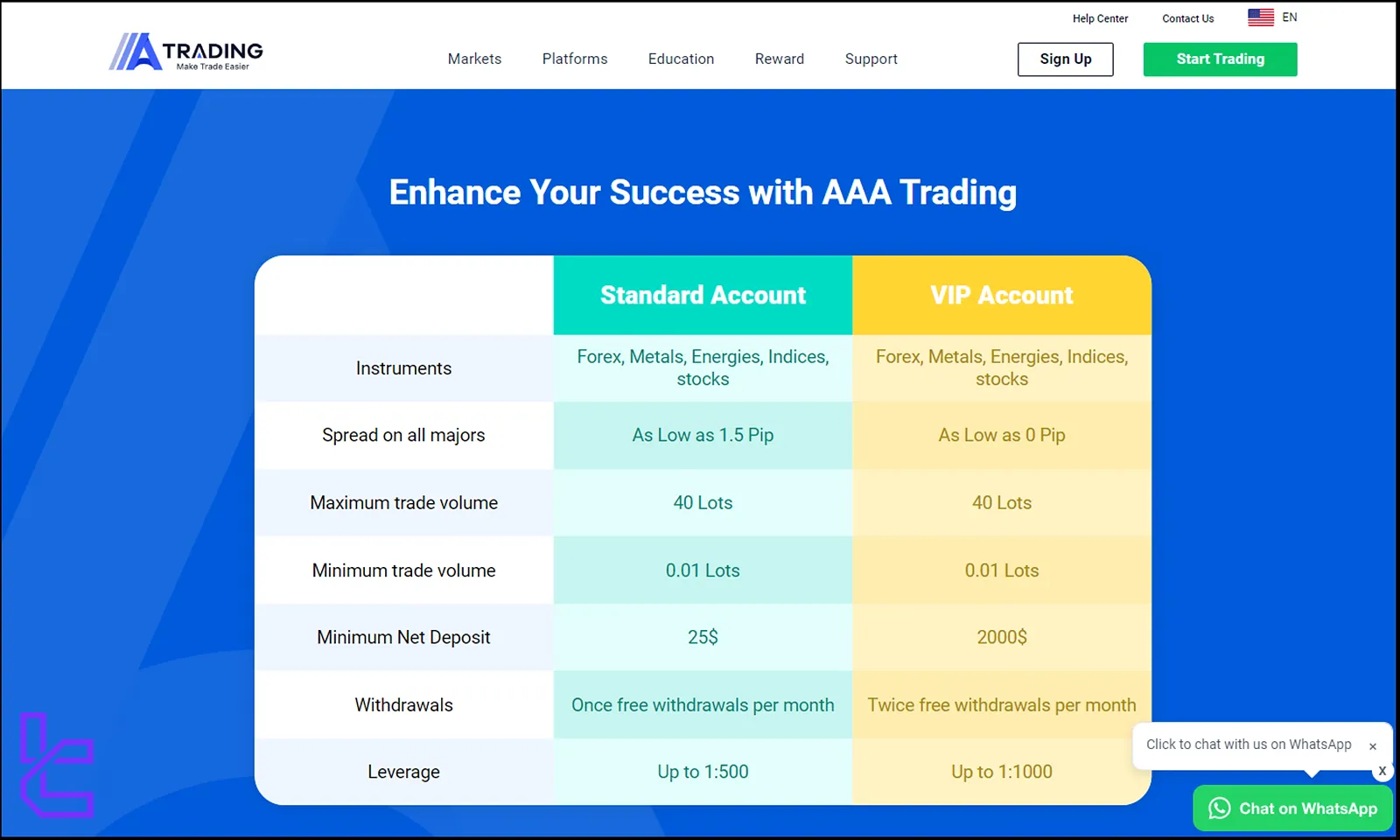

AAATrading Types of Accounts

AAATrading provides traders with three account types designed to accommodate different experience levels and capital sizes:

Standard Account

The standard account is perfect for beginner traders looking for an easy entry point to Forex trading. Key features of AAATrading Standard account:

- Minimum deposit: $5

- Leverage: up to 1:500

- Commission: From $2.5

- Spreads from 1.5 pips

VIP Account

Perfect for more experienced traders looking to benefit from low trading costs. Key points about AAATrading VIP accounts:

- Minimum deposit: $2,000

- Leverage: up to 1:1000

- Raw spreads from 0.0 pips

- Lower commissions (as low as $2.5 or $0 on stock CFDs)

- Designed for high-volume and professional traders

Demo Account

If you are a beginner, the AAATrading demo account is exactly what you need.

- Free and unlimited practice environment

- Trades mirror live market conditions

- Ideal for testing strategies risk-free

All live accounts are USD-denominated and allow micro-lot trading (from 0.01 lots). However, AAATrading does not clearly advertise the availability of Islamic (swap-free) accounts.

AAATrading Advantages and Disadvantages

AAATrading offers a compelling package for forex and CFD traders, but like any broker, it comes with its own set of pros and cons.

Here's a balanced overview of the advantages and disadvantages of trading with AAATrading:

Advantages | Disadvantages |

High leverage offerings | Lack of support for crypto trading |

Wide range of trading instruments | Limited trading platforms |

spreads from 0.0 pips | - |

While AAATrading provides attractive features for active traders, it's crucial for potential clients to carefully evaluate these factors in light of their personal trading goals and risk tolerance.

AAATrading Signup and Verification

Traders must complete the AAATrading registration process to gain access to their trading dashboard. The account opening process is as follows:

#1 Access the Registration Portal

Navigate to the official AAA Trading website and select "Sign Up" or "Open an Account". This will redirect you to the onboarding interface.

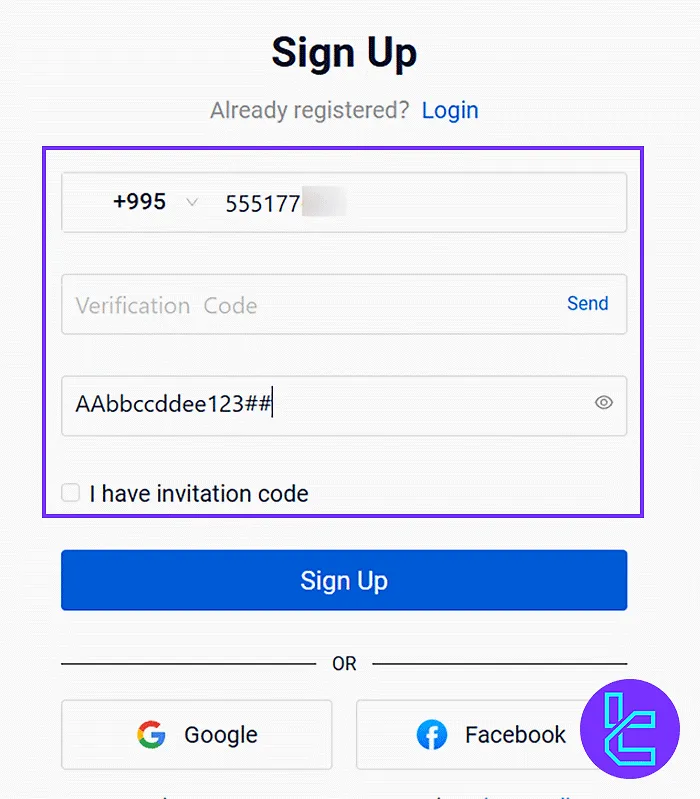

#2 Submit Personal Login Details

Provide a valid mobile number and create a strong password. If applicable, enter any invitation code.

Request the verification code via SMS, enter it, then proceed by selecting “Sign Up” and “Open Live Account”.

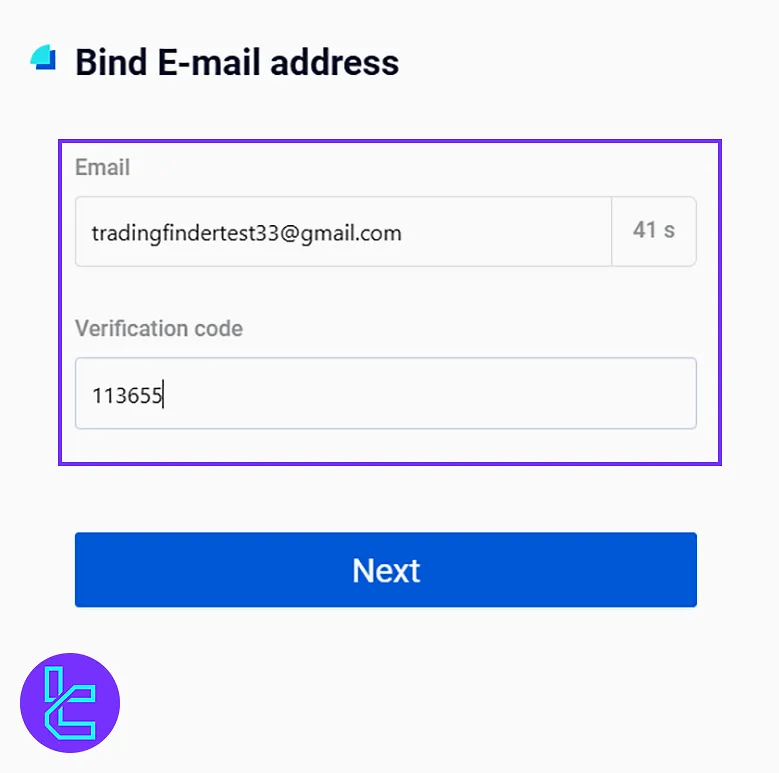

#3 Email Confirmation

Enter your email address, trigger the verification process, and input the 6-digit code received in your inbox. Finalize your signup by clicking “Next”.

To increase trading account security, traders must complete the AAATrading verification by uploading proof of address (bank statement or utility bill) and proof of identity (ID card, driver's license, or passport) documents.

AAATrading Trading Platforms

AAATrading supports a trio of trading platforms designed to meet the needs of both desktop and mobile users:

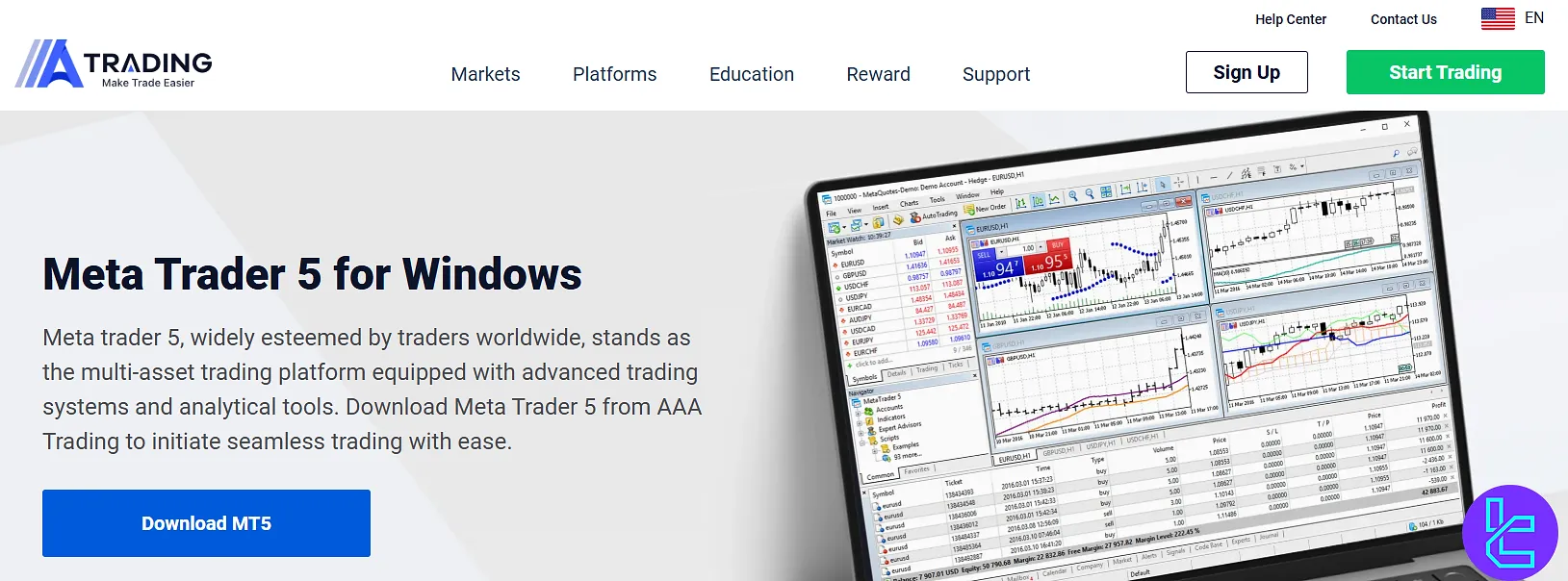

MetaTrader 5 (MT5)

The industry-standard terminal with advanced charting, multiple order types, algorithmic trading (EAs), and access to all asset classes.

WebTrader

A browser-based platform with no installation required. It delivers fast execution and real-time market data across all major devices.

AAATrading Mobile App

Available on iOS and Android, the mobile app allows traders to manage positions, view live charts, and place trades on the go with full market access.

Together, these platforms ensure that clients can trade effectively regardless of their location or device preference.

AAATrading Spread and Commission Structures

AAATrading offers competitive pricing structures designed to cater to different trading styles and volumes:

Account | Spreads (pips) | Commissions |

Standard | 1.5 | From $2.5 ($0 for Stock) |

VIP | 0 | From $2.5 ($0 for Stock) |

AAATrading's pricing model aims to provide traders with cost-effective access to global markets, enabling them to maximize their trading potential while minimizing transaction costs.

AAATrading Swap Fees

AAATrading applies variable overnight financing (swap) charges across major Forex pairs, reflecting interest rate differentials between currencies. Below are the indicative swap values per lot:

- AUDUSD: Long -4.095 pts | Short 0.828 pts

- EURUSD: Long -12.887 pts | Short 6.737 pts

- GBPUSD: Long -10.119 pts | Short 4.207 pts

- NZDUSD: Long -3.74 pts | Short 0.445 pts

- USDCAD: Long -2.333 pts | Short -9.277 pts

- USDCHF: Long 6.441 pts | Short -12.686 pts

- USDJPY: Long 7.361 pts | Short -13.773 pts

These swap rates are quoted in points and vary according to liquidity conditions, market volatility, and central-bank interest rate policies.

Positive swap values indicate potential credit to the trader’s account, while negative values represent overnight charges for maintaining open positions.

AAATrading Non-Trading Fees

AAATrading states it does not charge internal fees for deposits; however, intermediary/banking provider fees may apply and are the client’s responsibility.

Traders must also pay a 2% fee for Skrill and a 1% fee for Neteller withdrawals.

In addition, if an account is inactive for a full calendar year, the firm may charge an annual account maintenance fee of USD 15 (or currency equivalent).

AAATrading Deposit & Withdrawal Methods

AAATrading provides a diverse range of payment options to ensure convenient deposits and withdrawals for traders worldwide:

Deposit | Withdrawal |

Master Card | Master Card |

Visa | Visa |

Neteller | Neteller |

Skrill | Skrill |

Crypto | Bank Transfer |

Key points:

- No internal fees charged by AAATrading for deposits or withdrawals;

- Most methods offer instant processing, except bank transfers;

- Withdrawals are typically processed within 24 hours.

AAATrading emphasizes the security and efficiency of its payment systems, allowing traders to manage their funds with ease and confidence.

Deposit Options

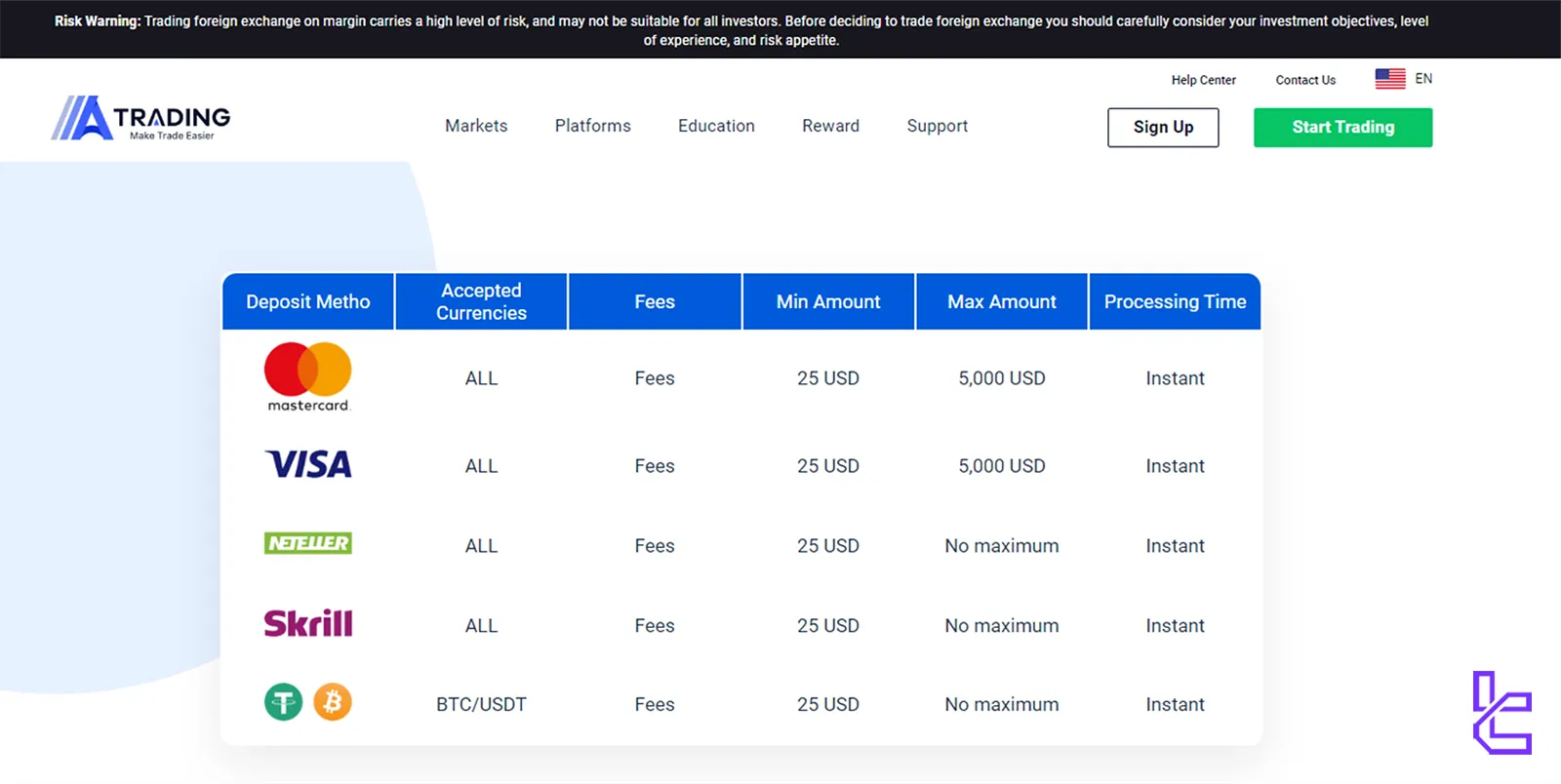

AAATrading supports card, e-wallet, and crypto funding from the Client Portal. The AAATrading lists Mastercard, Visa, Neteller, Skrill, and BTC/USDT with a minimum of 25 USD and instant processing.

The table below lists AAATrading deposit methods and minimums:

Option | Accepted Currencies | Min. Deposit |

Mastercard | ALL | $25 |

Visa | ALL | $25 |

Neteller | ALL | $25 |

Skrill | ALL | $25 |

BTC/USDT | BTC, USDT | $25 |

Withdrawal Solutions

Withdrawals are requested in the Client Portal. The AAATrading shows methods matching deposits (cards, e-wallets, BTC/USDT) and reiterates no internal withdrawal fees (third-party charges may apply). Also it specifies e-wallet fees, Neteller is 2% and Skrill is 1%.

The table below summarizes AAATrading withdrawal options, fees, and timing policy:

Withdrawal Solution | Processing Time | Withdrawal Fee |

Mastercard | Instant or within 24 hours | No internal fee; provider fees may apply |

Visa | Instant or within 24 hours | No internal fee; provider fees may apply |

Neteller | Instant or within 24 hours | 2% |

Skrill | Instant or within 24 hours | 1% |

Copy Trading & Investment Options Offered on AAATrading

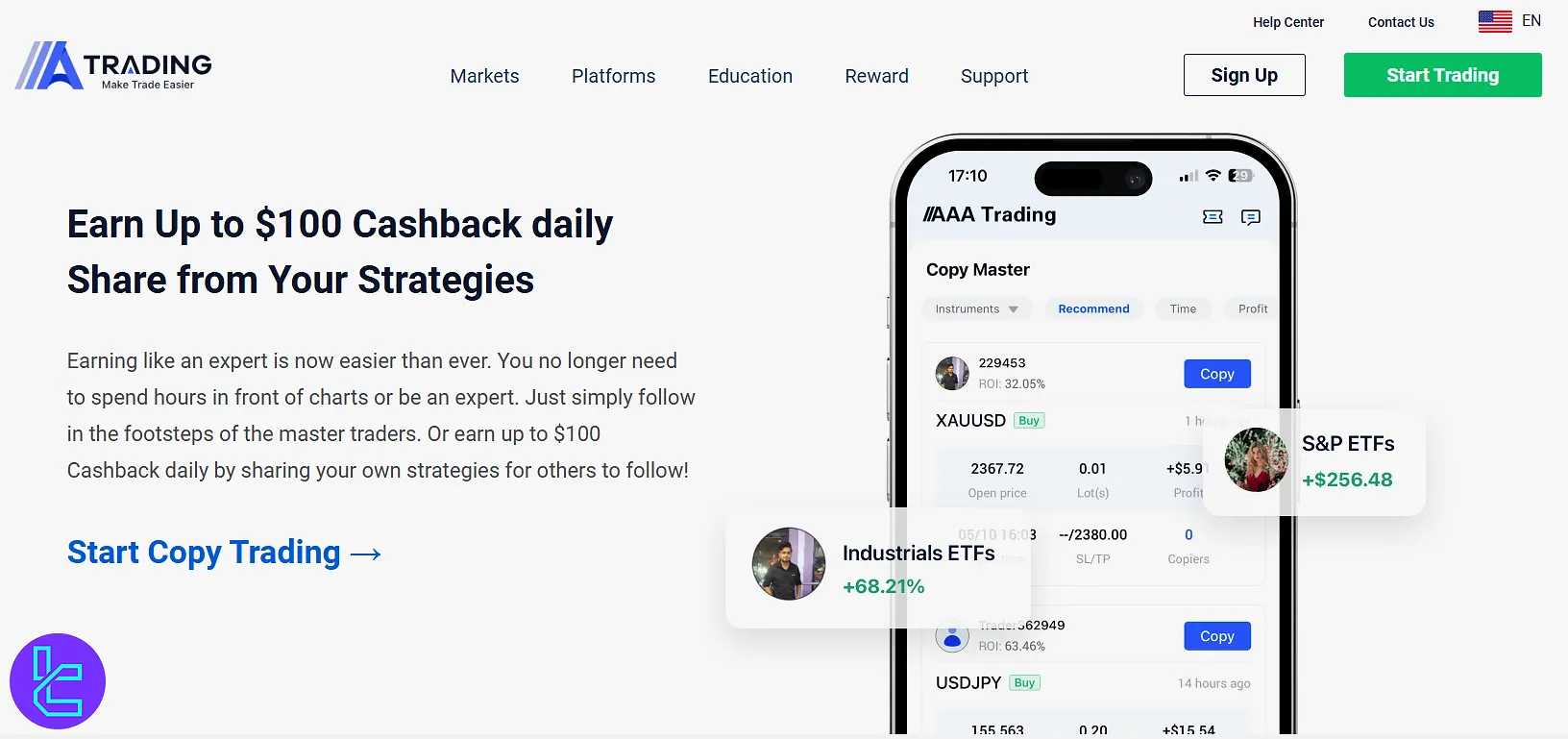

AAATrading offers copy trading services, allowing less experienced traders to automatically replicate the trades of successful investors.

This feature provides an opportunity to learn from seasoned traders and potentially profit from their expertise. Key aspects of AAATrading's copy trading:

- Ability to follow and copy multiple traders;

- Real-time trade execution;

- Performance analytics for signal providers;

- Option to become a signal provider and earn additional income.

However, it's important to note that AAATrading does not offer PAMM accounts, which are a different form of social trading where investors pool their funds under a master account managed by a professional trader.

Available Markets & Instruments

AAATrading offers multi-asset CFDs across Forex, Stocks, Commodities (Metals & Energies), Indices, and Crypto.

AAATrading states Forex 50+ pairs with leverage up to 1:1000, Stocks up to 1:20, Commodities up to 1:1000, Indices up to 1:50, and Crypto up to 1:20.

The table summarizes asset classes, number of symbols, competitor ranges, and max leverage:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, Minor & Exotic FX pairs | 50+ | 50–70 | Up to 1:1000 |

Stocks | CFDs on global shares (e.g., Apple, Microsoft, Amazon, Tesla) | 22+ | 800–1200 | Up to 1:20 |

Commodities (Metals & Energies) | Gold, Silver, Brent, WTI, Natural Gas | 5+ | 10–20 | Up to 1:1000 |

Indices | Global indices (AUS200, EU50, FRA40, HK50, JPN225, NAS100, SP500, UK100, US30) | 9+ | 10–20 | Up to 1:50 |

Cryptocurrencies | BTC, ETH, XRP, BCH (and more) | 4+ | 20–100 | Up to 1:20 |

AAATrading Bonuses and Promotions

AAATrading offers attractive bonuses and promotions to new and existing clients:

- $20 no-deposit welcome Bonus;

- $50 of Account opening cashback;

- $10 loss insurance;

- $1600 first deposit bonus.

- $50 referral bonus per referred friend.

AAATrading's bonus structure is designed to attract new traders and reward loyal clients, enhancing the overall trading experience on their platform.

AAATrading Broker Support Channels

AAATrading prioritizes customer support, offering multiple channels for traders to seek assistance:

- WhatsApp Support: +44 7375844463;

- Phone: +44 2033072622;

- Email: support@aaatrading.net;

- Callback Service.

AAATrading's multi-channel support system aims to provide timely and effective assistance to traders, building trust with clients.

AAATrading Broker List of Restricted Countries

Many regulated brokers have restrictions on providing services to certain countries due to regulatory requirements and compliance policies.

While the specific list of restricted countries was not found on the main page, we reached a list in the Preventing Money Laundering section claiming that the broker does not accept POI documents from the following countries:

- American Samoa

- Baker Island

- Guam

- Howland Island

- Jarvis Island

- Johnston Atoll

- Kingman Reef

- Marshall Islands

- Midway Islands

- Navassa Island

- Northern Mariana Islands

- Palmyra Atoll

- Puerto Rico

- United States Minor Outlying Islands

- United States of America

- United States Virgin Islands

- Vatican City

- Wake Island

It's crucial for potential clients to check the most up-to-date information on country restrictions directly with AAATrading or consult their legal documentation.

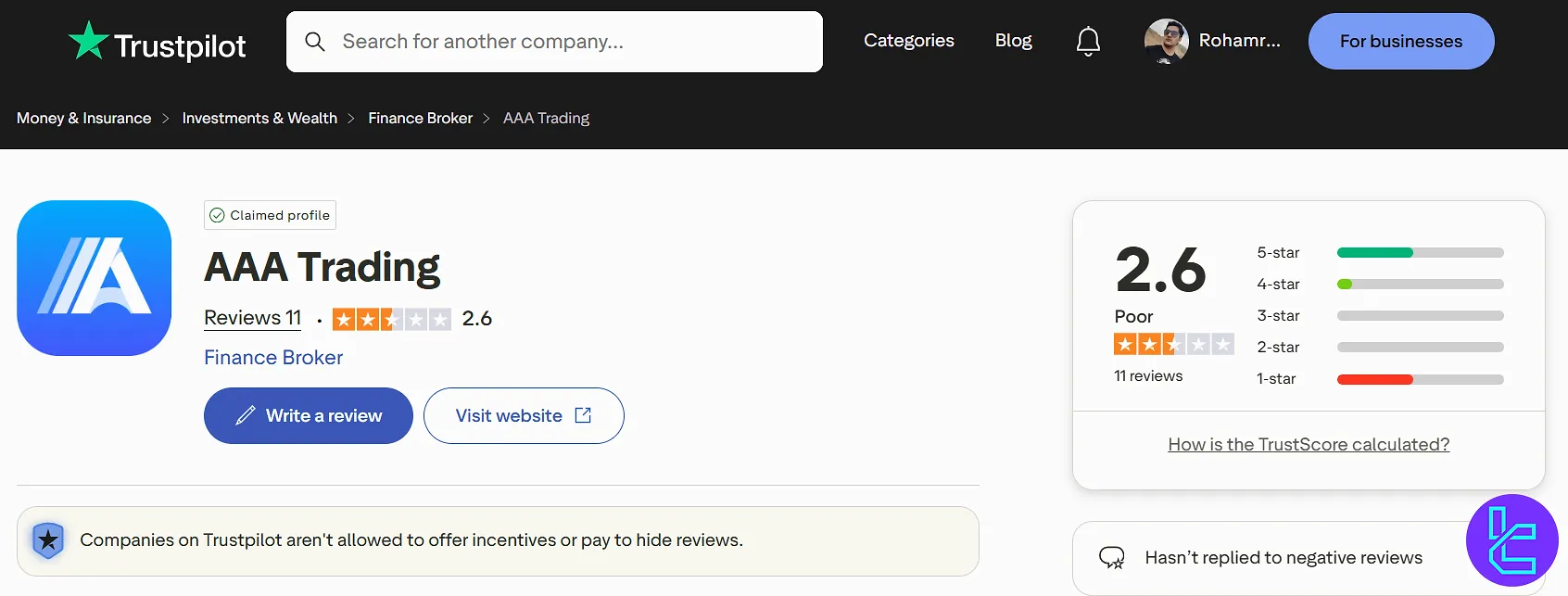

AAATrading Trust Scores & Reviews

AAATrading has received mixed reviews from traders, with an overall Trustpilot rating of 2.6 out of 5 based on over 100 reviews. This score indicates a generally positive sentiment but with room for improvement.

Positive aspects | Areas of concern |

Diverse range of tradable assets | Withdrawal bugs |

Low fees | Inability for big withdrawals |

Safe environment | fake signal claims |

Easy to use app | - |

It's important to note that individual experiences may vary, and potential traders should conduct thorough research and consider multiple sources of information before making a decision.

Education on AAATrading

AAATrading broker offers comprehensive educational resources to support traders at all levels:

Category | Topics |

Learn | Glossary & Terms, Spreads, Swap Rates, Margin and Leverage, Trading Hours Video, Tutorials |

Research | Market Overview, News, Daily Analysis, Market Sentiment |

AAATrading's educational offerings aim to empower traders with the knowledge and skills necessary for successful trading in the dynamic financial markets.

AAATrading Comparison with Other Brokers

To better understand the pros and cons of trading with AAATrading compared to other Forex brokers, you can check out the table below:

Parameters | AAATrading Broker | |||

Regulation | CySec | ASIC, FSC, DFSA, CySEC | CySEC, DFSA, FCA, FSCA, FSA | FSA, CySEC, ASIC |

Minimum Spread | 0.0 Pips | 0.6 Pips | 0.0 Pips | 0.0 pips |

Commission | $0 | $0 (Except On Shares Account) | No commission for Forex pairs (except in Zero accounts) | Average $1.5 |

Minimum Deposit | $25 | $5 | $0 | $200 |

Maximum Leverage | 1:1000 | 1:1000 | 1:2000 | 1:500 |

Trading Platforms | MetaTrader 5, WebTrader, AAATrading App | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrade 4, MetaTrade 5, Mobile App | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | VIP, Standard, Demo | Micro, Standard, Ultra Low, Shares | Cent, Zero, Pro, Premium | Standard, Raw Spread |

Islamic Account | Not Specified | Yes | Yes | Yes |

Number of Tradable Assets | 170+ | 1400+ | 500+ | 2200+ |

Trade Execution | Market | Market, Instant | Market, Instant | Market |

Conclusion and Final Words

AAATrading provides access to 4 asset classes with leverage options of up to 1:1000 for a minimum deposit of $2000 through its VIP account.

The broker offers a $50 commission per client toaffiliates, and accepts Crypto, Skrill, and Neteller payments. It has a TrustPilot score of 2.6, and doesn't accept US clients.