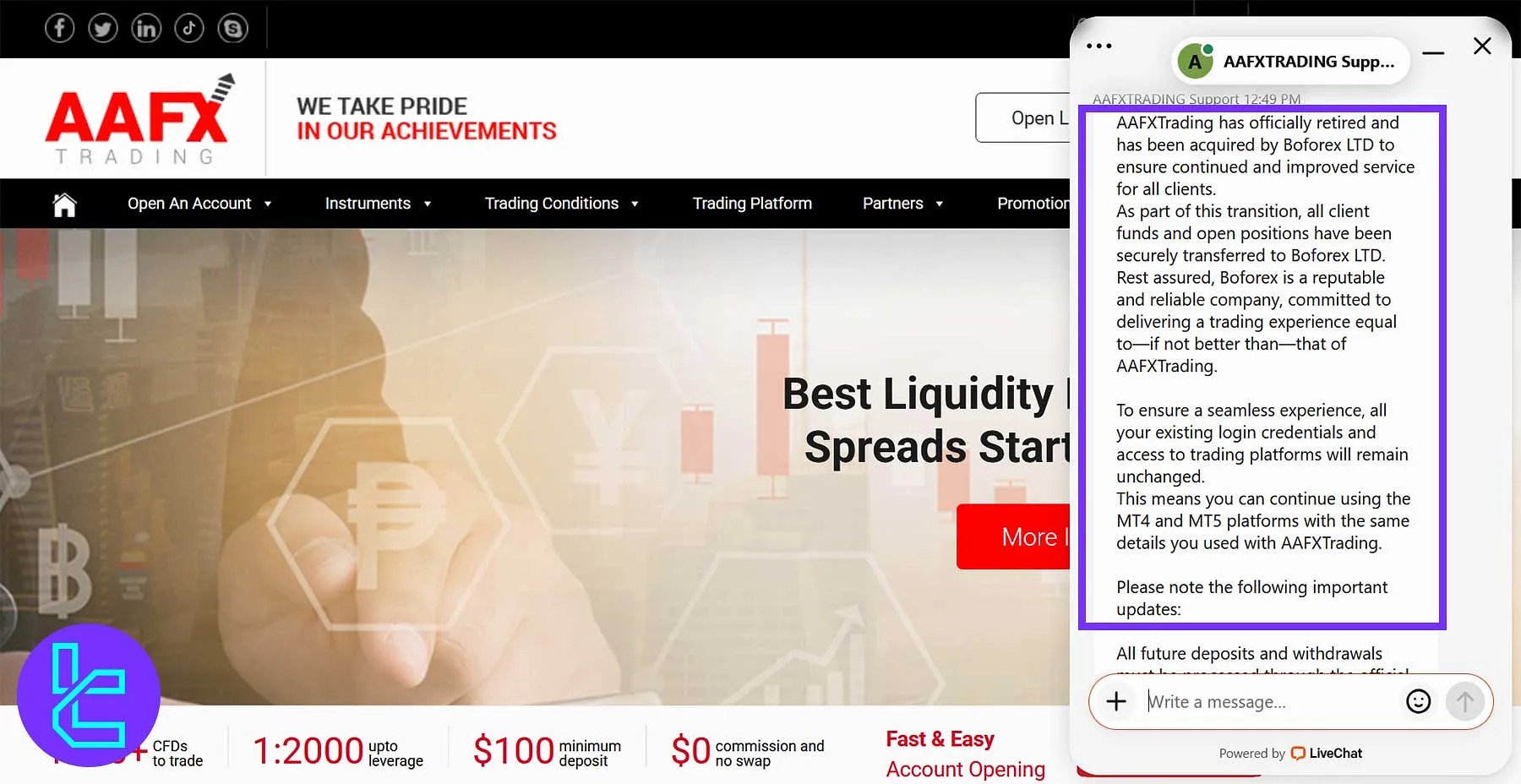

AAFX Trading has officially retired and been fully acquired by Boforex LTD, marking a new chapter for its global clients.

All client funds and active trading positions have been securely migrated to Boforex. The acquisition aims to ensure uninterrupted, enhanced, and transparent trading services for all former AAFX users.

As part of the transition, traders can continue accessing their MT4 and MT5 accounts using the same login credentials.

Future deposits and withdrawals must now be completed via the Boforex LTD official website. Android users are required to install the Boforex mobile app, while desktop terminals remain unchanged.

AAFX is a dominant Forex broker offering over 1000 tradable instruments to clients in 150 countries. This broker has 3 main account types, including Fixed, ECN, and VIP accounts with spreads as low as 0.4 pips.

AAFX has numerous bonuses such as a 35% welcome bonus, a redeposit bonus, and an iPhone/iPad promotion.

AAFX Company Information & Regulations

AAFX Trading Company Ltd has quickly become one of the world's fastest-growing Forex and CFD providers. The company offers foreign exchange and CFD trading on multiple platforms.

Here are some key points about the AAFX broker:

- Market leader in customer service, offering products and services in over 20 languages

- Won the best broker of Asia in 2013

- Regulated by FSA and Mwali

- Incorporated in Saint Vincent and the Grenadines (Registration number: 22916 IBC)

- Compliant with international legislation and regulatory standards

AAFX Trading places a strong emphasis on fund safety, prompt customer support, and providing industry-leading trader tools.

This commitment to excellence has established AAFX as a trusted and reliable platform for global forex and CFD trading.

AAFX Broker Summary of Specifications

Let's take a closer look at what makes AAFX Trading stand out in the crowded forex broker market.

Broker | AAFX |

Account Types | Fixed, ECN, VIP |

Regulating Authorities | FSA, Mwali |

Based Currencies | USD, GBP, EUR |

Minimum Deposit | $100 |

Deposit Methods | Bitcoin, Webmoney, Fasapay, Skrill, Neteller |

Withdrawal Methods | Bitcoin, Webmoney, Fasapay, Skrill, Neteller |

Minimum Order | 0.01 |

Maximum Leverage | 1:2000 |

Investment Options | No |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, AAFX platform |

Markets | Forex, CFDs, indices, commodities, stocks, cryptocurrencies, Energies, Precious Metals |

Spread | From 0.4 pips |

Commission | No |

Orders Execution | Market execution |

Margin Call/Stop Out | 50%/20% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | Welcome Bonus, redeposit bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, phone, live chat |

Customer Support Hours | 24/5 |

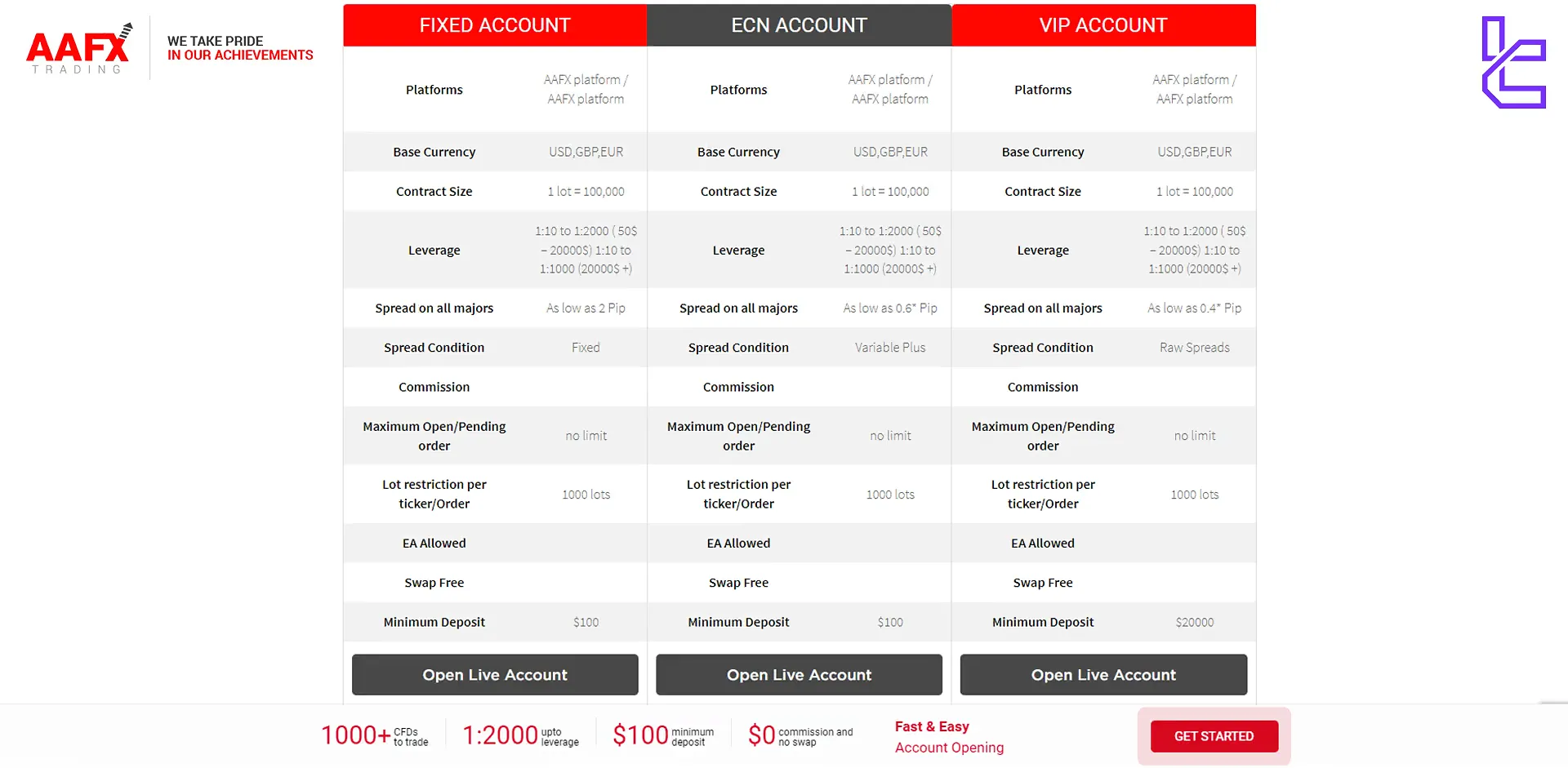

AAFX Broker Account Types

AAFX Trading offers several account types to suit different trading styles and preferences:

Fixed account

This account is perfect for traders who want to have fixed Spreads on their traders. Let’s see some of the key features of this account type:

- Fixed spreads starting from 2 pips

- Leverage up to 1:2000

- No commissions

- Minimum deposit: $100

ECN Account

This account suits traders who want to trade various instruments with low variable spread and no commission. Here are some of the key features of this account type:

- Variable spreads starting from 0.6 pips

- Leverage up to 1:2000

- No commissions

- Minimum deposit: $100

VIP Account

AAFX VIP account is best for high-volume traders. This account enables traders to buy and sell with a maximum Leverage of 1:2000. Some it’s key features include:

- Tightest spreads starting from 0.4 pips

- Leverage up to 1:2000

- No commissions

- Minimum deposit: $20,000

AAFX Islamic Account

AAFXTrading offers fully compliant Islamic (swap-free) accounts across all account types [including Fixed, ECN, and VIP], ensuring that no overnight interest (riba) is charged on open positions.

These accounts maintain the same trading conditions, spreads, and execution speeds as regular accounts and are available on both MT4 and MT5 platforms.

Traders simply need to request swap-free status during account registration or through support.

This makes AAFX a suitable option for Muslim traders seeking to align their trading activity with Shariah principles.

Pros and Cons of AAFX Broker

Let's weigh the pros and cons of trading with AAFX:

Advantages | Disadvantages |

High leverage up to 1:2000 | Not regulated by top-tier authorities |

Wide variety of bonuses | Doesn’t support popular trading platforms |

Competitive spreads | Mixed online reviews |

Fixed spread account type |

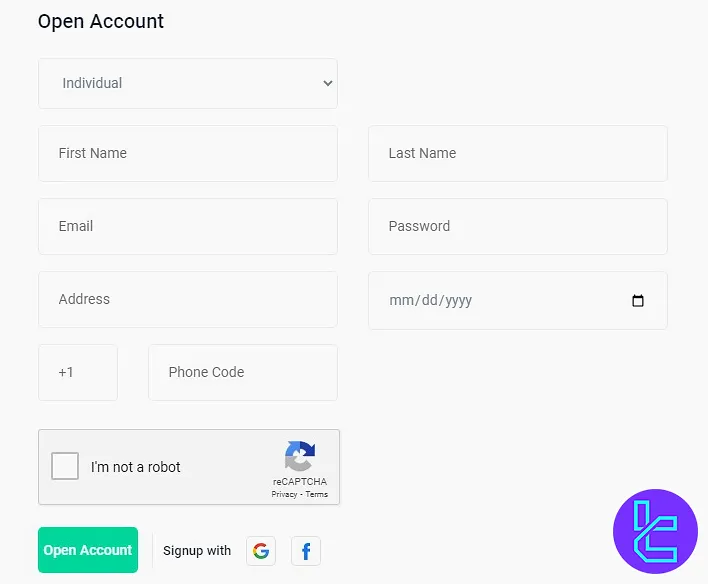

AAFX Sign-Up & Verification Guide

Getting started with AAFX is a straightforward process. Here's a step-by-step AAFX registration guide:

#1 Access the AAFX Website and Signup Section

Search for AAFX broker on your favorite browser and access the official website. Once there, click on the "Open Live Account" button.

#2 Fill Out the Personal Details Form

Choose an individual account type and enter your full name, email, password, phone number, date of birth, and residential address.

Submission will instantly create your live account and open access to the trading dashboard.

After finalizing the registration process, traders must provide the necessary documents to complete the AAFX verification as well. Accepted documents include:

- Proof of Identity: National ID, passport, driver's license

- Proof of Address: Utility bill or bank statement

AAFX Broker Trading Platforms

AAFXTrading provides access to MetaTrader 4 and MetaTrader 5, the most widely used trading platforms in the Forex industry.

These platforms are available on desktop, web, and mobile devices (iOS & Android), and support the full range of trading strategies.

Key platform features include:

- One-click trading and trading directly from charts

- Support for scalping, hedging, and Expert Advisors (EAs)

- Over 30 built-in technical indicators and multiple chart types

- Swap-free account support

- Real-time news, alerts, and push notifications

- Full synchronization across desktop, tablet, and mobile versions

- Copy trading functionality built-in

These powerful platforms are backed by AAFX’s rapid execution engine and zero-commission trading model, providing a seamless experience for both beginners and advanced traders.

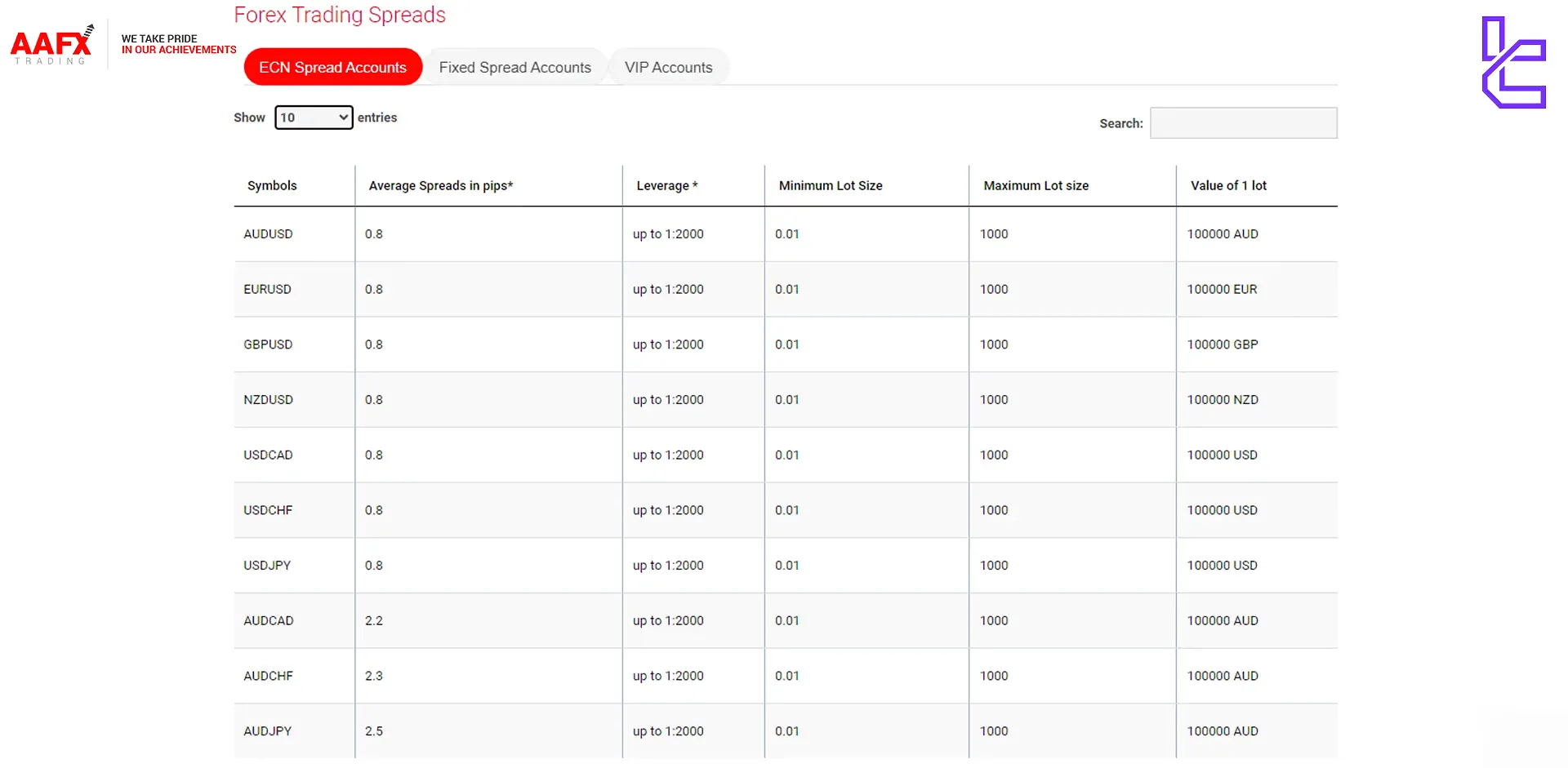

AAFX Broker Spreads and Commissions

AAFX Trading offers competitive spreads and a commission-free trading environment:

Account type | Spread |

Fixed | Spreads from 2 pips on major pairs |

ECN | Variable spreads from 0.6 pips |

VIP | Tightest spreads from 0.4 pips |

No commissions are charged on any of the account types, making AAFX an attractive option for cost-conscious traders.

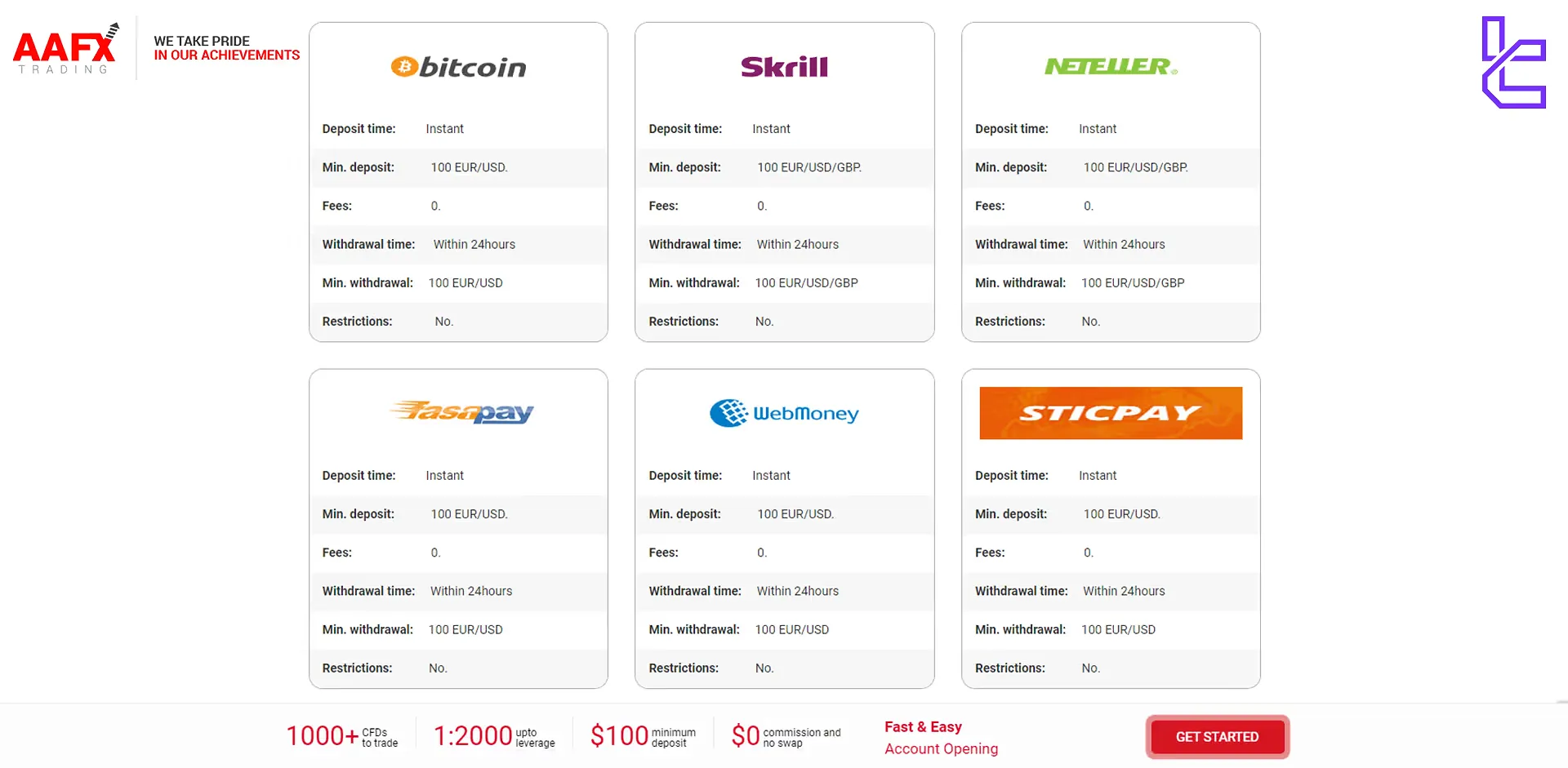

AAFX Deposit and Withdrawal Methods

it’s time to go through deposit and withdrawal methods in our AAFX broker review. This broker provides a range of convenient deposit and withdrawal options:

Method | Minimum deposit | Withdraw time |

Bitcoin | 100 EUR/USD | Within 24hours |

Skrill | 100 EUR/USD | Within 24hours |

Netteller | 100 EUR/USD | Within 24hours |

Fasapay | 100 EUR/USD | Within 24hours |

Webmoney | 100 EUR/USD | Within 24hours |

Stickpay | 100 EUR/USD | Within 24hours |

AAFX covers all deposit and withdrawal fees for payments. However, this broker doesn’t offer credit or debit deposits and withdrawals, which could be a major downside for many traders.

Deposit Options

Below is a table listing AAFX’s common deposit channels and typical minimums:

Option | Accepted Currencies | Min. Deposit |

Bank Wire (SWIFT) | USD, EUR, GBP, others | $100 |

Visa / Mastercard | USD, EUR, GBP | $100 |

Skrill | USD, EUR, GBP | $100 |

Neteller | USD, EUR, GBP | $100 |

Bitcoin / USDT (ERC-20 / TRC-20) | BTC, USDT | $100 |

FasaPay / WebMoney / Other e-wallets | Local currencies where supported | $100 |

Withdrawal Solutions

Below is a table summarising typical AAFX withdrawal routes, timings and fees:

Withdrawal Solution | Processing Time | Withdrawal Fee |

Bank Wire (SWIFT) | 2–7 business days (bank-dependent) | Possible intermediary fees; broker may not charge |

Visa / Mastercard refunds | 1–5 business days | Often no broker fee (may be card issuer fees) |

Skrill | Same business day / 24 hours | No broker fee (AAFX covers Skrill fees in some promos) |

Neteller | Same business day / 24 hours | No broker fee |

Cryptocurrency (BTC, USDT) | Same business day / within 24 hours | No broker fee |

FasaPay / WebMoney | Same business day | No broker fee |

Right now, AAFX broker has 6 different withdrawal methods, but they may add more in the future.

AAFX Copy Trading & Investment Options

Unfortunately, AAFX doesn't offer copy trading services for beginner traders. Users who are looking for this option must look for alternative options.

Tradable Markets & Symbols on AAFX

AAFX provides access to a multi-asset portfolio that includes forex pairs, global equities, commodities, indices, and cryptocurrencies.

Traders can speculate on 50+ forex pairs ranging from majors like EUR/USD to exotics, while more than 200 global shares from US and Asian markets are available via CFDs.

Commodities trading covers gold, silver, and crude oil, and indices include popular benchmarks such as US30, UK100, and DE40.

In addition, AAFX has integrated crypto trading with Bitcoin, Ethereum, and Ripple CFDs, offering leverage up to 1:2000 on forex and 1:5 on cryptocurrencies.

AAFX tradable asset classes and their key details:

Category | Type of Instruments | Number of Symbols | Max. Leverage | Competitor Average |

Forex | Majors, Minors & Exotics | 50+ pairs | Up to 1:2000 | 50–70 pairs |

Shares | CFDs on Global Stocks (US, HK, etc.) | 200+ | Up to 1:20 | 800–1200 |

Commodities | Metals (Gold, Silver), Energies (Crude, Natural Gas) | ~15 | Up to 1:100 | 10–20 |

Indices | Global Indices (US30, UK100, DE40, JP225) | ~14 | Up to 1:100 | 10–20 |

Cryptocurrencies | CFDs on BTC, ETH, XRP | 5+ | Up to 1:5 | 5–10 |

Trading hours, minimum/maximum lot sizes, and leverage details are clearly specified for each instrument, allowing traders to decide based on their trading strategy and risk appetite.

AAFX Broker Bonuses and Promotions

AAFX offers attractive bonuses to both new and existing clients:

Welcome Bonus

- Minimum deposit: $500

- 35% bonus on first deposit

- Send a bonus request through email or live chat

In order to receive this bonus, traders need to follow these simple steps:

- Create an account in AAFX broker;

- Read the terms and conditions;

- Deposit at least $500;

- Submit a request to recieve your bonus through live chat or email support.

Redeposit Bonus

- 25% bonus on deposits of $500 or more

- 30% bonus on deposits of $1000 or more

- Can be claimed up to two times

- Traders can’t withdraw bonuses

iPhone and iPad promotion

Meet these qualifying factors to have a chance at winning an iPhone 6S or iPad pro

Initial Single Deposit | Round Turn Lot Traded |

From $10,000 – $24,999 | 250 lots |

$25,000 – $49,999 | 500 lots |

Over $50,000 | 1,000 lots |

AAFX Broker Support

AAFX Trading prides itself on providing excellent customer service:

Support channel | Detail |

Live chat | Available 24/5 |

Phone support | +16783940676 |

Email support | support@aafxtrading.com |

AAFX Broker Restricted Countries

AAFX Trading does not provide services to residents of certain countries, including:

- Japan

- Australia

- Brazil

- Tahiti

- North Mariana Islands

- Guinea-Bissau

- Turkey

- USA

- Iraq

- Libya

- South Sudan

This list is not exhaustive, and AAFX reserves the right to refuse service to anyone for any reason.

Traders should check the broker's terms and conditions or contact customer support to confirm their eligibility.

AAFX Broker Trust Scores & Reviews

AAFX Trading has received mixed reviews from traders on reliable review websites.

Source | Score | Links |

Trustpilot | 3.6 | https://www.trustpilot.com/review/aafxtrading.com |

Reviews.io | 4.2 | AAFX score on reviews.io |

ForexPeaceArmy | Scam |

It’s essential to recognize that personal experiences may differ, so prospective clients are encouraged to do extensive research before setting up an account.

AAFX Broker Education

AAFX Trading provides a comprehensive education center for traders of all levels:

- Educational videos

- E-books on forex trading

- Research reports

- Trading tools (calculators, converters, economic calendar)

- Regular market analysis and updates

These resources cover topics from forex basics to advanced Technical Analysis and fundamental analysis.

AAFX Comparison with Other Forex Brokers

The table below helps you identify the pros and cons of AAFX services compared to other Forex brokers.

Parameters | AAFX Broker | |||

Regulation | FSA, Mwali | FCA, FSCA, CySEC, SCB | CySEC, DFSA, FCA, FSCA, FSA | FSA, CySEC, ASIC |

Minimum Spread | 0.4 Pips | 0.0 Pips | 0.0 Pips | 0.0 pips |

Commission | No | From $3 | No commission for Forex pairs (except in Zero accounts) | Average $1.5 |

Minimum Deposit | $100 | $100 | $0 | $200 |

Maximum Leverage | 1:2000 | 1:500 | 1:2000 | 1:500 |

Trading Platforms | MetaTrader 4, MetaTrader 5, AAFX Platform | MetaTrade 4, MetaTrade 5, Mobile App, cTrader, Web Trader | MetaTrade 4, MetaTrade 5, Mobile App | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Fixed, ECN, VIP | Standard, Pro, Raw+, Elite | Cent, Zero, Pro, Premium | Standard, Raw Spread |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1000+ | 2100+ | 500+ | 2200+ |

Trade Execution | Market | Market | Market, Instant | Market |

TradingFinder Expert Suggestion

AAFX offers intriguing offers such as a $100 minimum deposit, no trading commissions, various leverage options (up to 1:2000), and 6 fee-freefee-free deposit methods.

However, its lack of proper regulation by tier-1 authorities, such as FCA, CySEC, and CFTC, restricts it from reaching its full potential.