AAFX verification is a mandatory 4-step process that enables users to access deposits and withdrawals. The process requires identity and residency authentication and allows traders to choose their account type (Fixed, ECN, or VIP).

Document approval time is not specified by the broker and should be monitored in the dashboard.

AAFX KYC Overview

After AAFX registration, account verification in the AAFX Forex broker is required to enable trading, deposits, and withdrawals.

AAFX broker verification steps:

- Access the "Verification" section;

- Submit a proof of identity (POI) document;

- Set up a trading account;

- Upload a proof of address (POA).

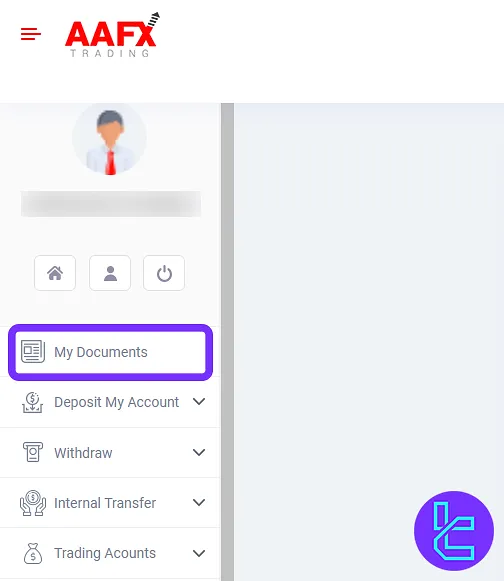

#1 Accessing the "Verification" Section

To start the KYC process, log into the AAFX dashboard and click on "My Documents".

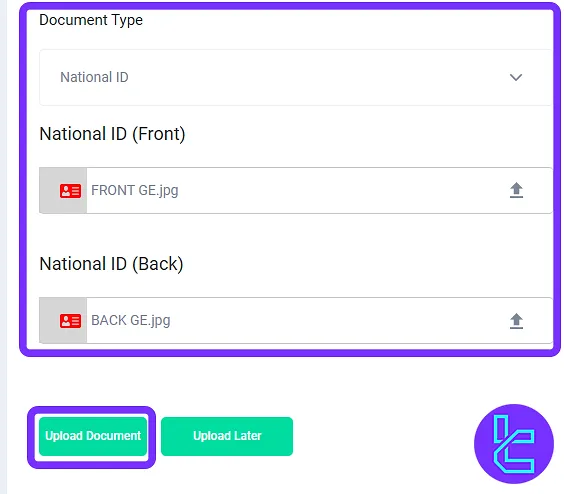

#2 Submitting an Identity Verification Document

Choose an identity document such as a national ID, passport, or driver’s license. Upload front and back images of the document.

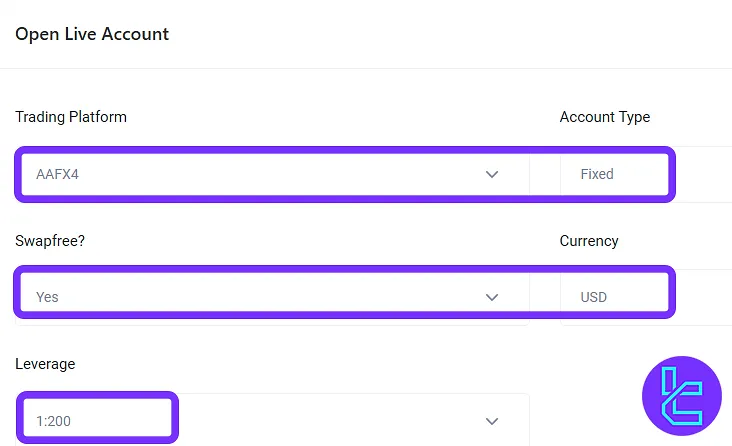

#3 Setting Up a Trading Account

Select a trading platform, account type, currency, and leverage according to preferences.

#4 Uploading a Residency Verification Document

Upload a bank statement or utility bill issued within the last 3 months to verify residency.

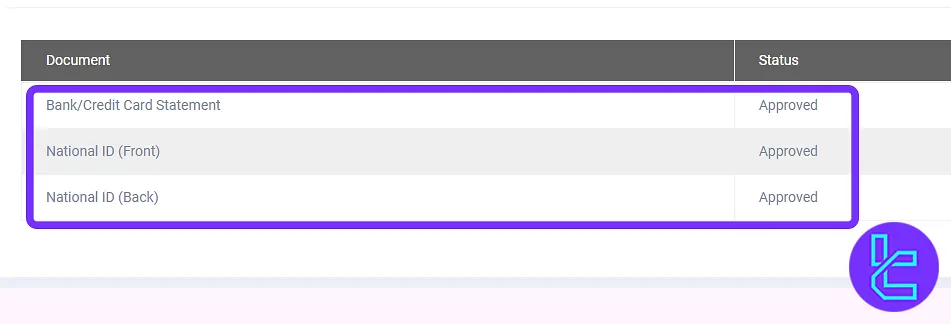

After submitting all documents, check the verification status in the "My Documents" section.

TF Expert Suggestion

The AAFX verification process takes less than 10 minutes to complete. Traders must provide Proof of Identity (ID card, passport, Driver’s license) and Proof of Address (bank statement or a utility bill) documents to become eligible for deposits and withdrawals.

Now that your account is verification is complete, explore AAFX deposit and withdrawal options on the AAFX tutorial page and start trading.